The SPDR S&P Retail ETF (NYSEARCA:XRT) offers targeted exposure to the leading U.S. retailers. The fund does a good job of capturing the high-level trends in consumer spending.

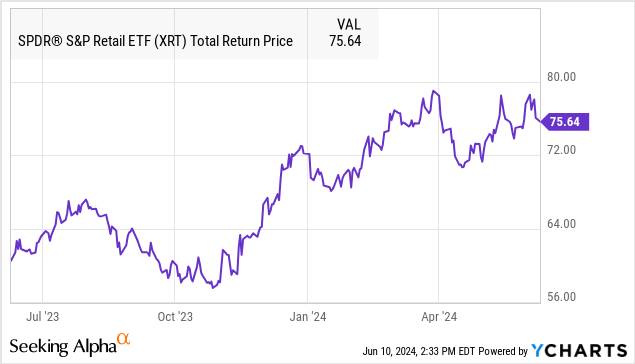

This segment has gained momentum over the past year amid the resiliency of the U.S. economy, moving past the more difficult period between 2022 and 2023 defined by rising interest rates and elevated inflation. Indeed, XRT has returned more than 25% over the past year, benefiting alongside the improved sentiment in the broader stock market.

As we approach the second half of the year, it’s fair to question whether the recent momentum can continue. We’re seeing mixed signals from key retailers, adding a layer of caution to the outlook. We’ll attempt to dissect the themes at play and our view on where XRT is headed next.

What is the XRT ETF?

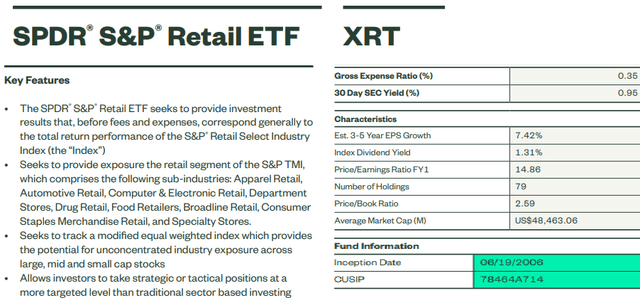

The XRT ETF is intended to passively track the “S&P Retail Select Industry Index” covering the following sub-industries: Apparel, Automotive, Computer & Electronic, Department Stores, Pharmacies, Food Retailers, Broadline Retail, Consumer Staples Merchandise, and Specialty Stores.

The term retail has a broad definition with the notable exception here in that the fund does not include home-improvement or furniture retailers as that segment follows more of the trends in the housing market than consumer spending.

source: State Street

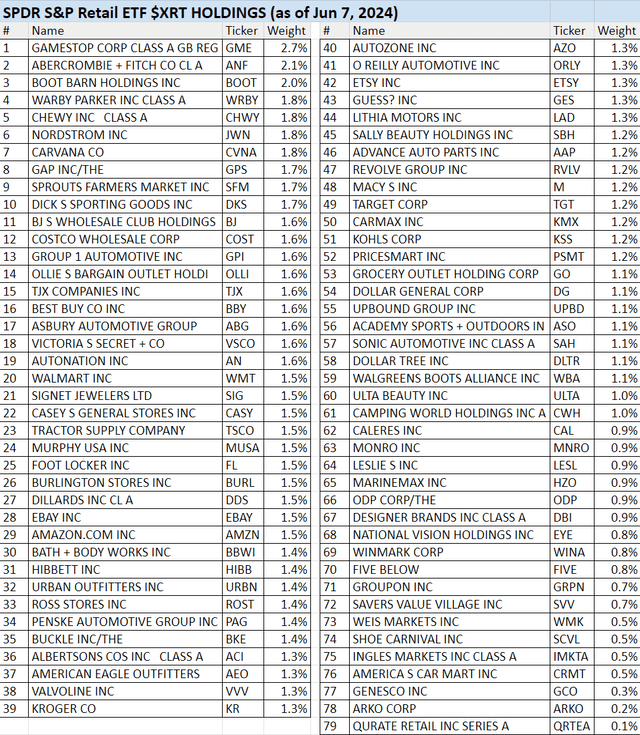

What’s interesting about the XRT is that the fund utilizes a modified equal-weighting approach across all its 79 holdings.

This means that smaller specialty retailers like Foot Locker (FL), Gap (GPS), or even vehicle dealerships such as AutoNation (AN) have a similar contribution to the overall portfolio as mega-cap names such as Amazon (AMZN), and Walmart (WMT).

This dynamic is important as it makes XRT a potential portfolio diversifier in contrast to a market-cap-weighted strategy that would be dominated by top holdings in AMZN or Costco Wholesale Corp. (COST).

Given the extensive portfolio, with the average stock representing less than 1.5% of the overall exposure, no single name will dominate the performance.

source: State Street (table by author)

XRT Performance

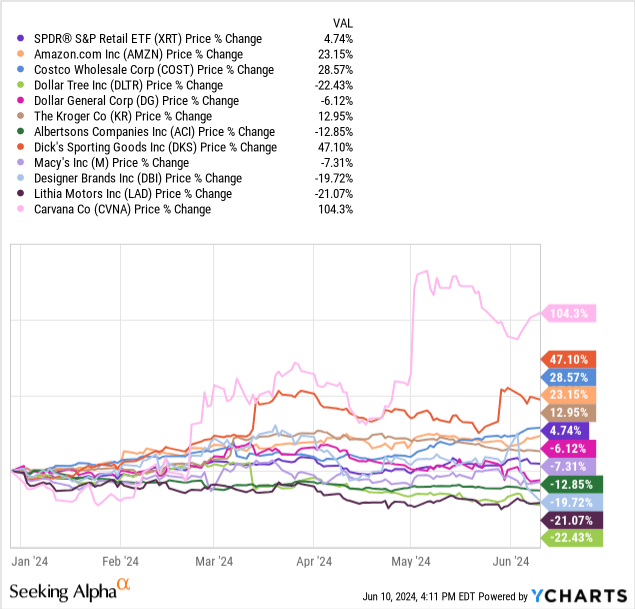

We mentioned the mixed signals from leading retailers. That theme is evident when we look at the recent stock price performance, with a wide divergence among winners and losers to start 2024.

Carvana (CVNA) stands out as an outperformer, with shares more than doubling year-to-date. On the other hand, its peer group with names like Lithia Motors (LAD) or Penske Automotive Group (PAG) have fared worse with a decline in 2024.

Grocery chain Kroger (KR) has a positive gain this year, while shares from its competitor in Albertsons Companies (ACI) are down. Discount stores such as Dollar Tree (DLTR) and Dollar General (DG) have generally lagged.

The understanding is that while the entire industry faces similar macro conditions impacting growth and demand, company-specific fundamentals play a key role in driving each stock’s performance. Naturally, the XRT ETF ends up as the average from this group.

Several comments from management teams during the Q1 earnings seasons describe the mixed trends companies are facing.

- Target (TGT) noted consumer “discretionary softness” in explaining its Q1 comparable sales weakness.

- Shares of Walmart are benefiting from an apparent influx of bargain-hunting high-income shoppers.

- Abercrombie & Fitch (ANF) is trading at an all-time high following record results and an upbeat outlook.

- Dillard’s (DDS) pointed to a “challenging” sales environment in explaining its sales decline last quarter.

These types of conflicting reports highlight the difficulty in forecasting the industry, particularly among volatile macro conditions.

What’s Next For XRT?

With the stock market as measured by the S&P 500 Index (SP500) at an all-time high, there’s a sense of optimism toward the forward economic outlook.

The bullish case for retailers is that a resilient labor market represents a tailwind for consumer spending, while a path for the Fed to cut interest rates into 2025 could lead to the start of a new credit growth cycle. Companies have made efforts to streamline operations in support of margins as a response to inflationary cost pressures in recent years. A scenario where demand from shoppers sees a new round of momentum could be a powerful driver for higher earnings.

On the other hand, that same rosy outlook is far from certain. Recent data including a stronger-than-expected jobs report for May along with stubbornly high inflation above 3% has pushed back on any timetable for those long-awaited Fed rate cuts.

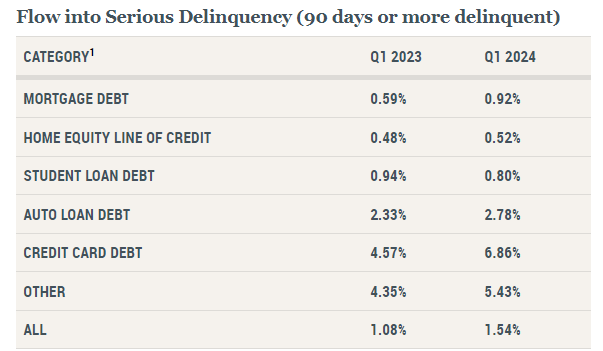

Other indicators such as climbing consumer credit delinquency rates could point to what remains more fragile conditions. According to the Federal Reserve Bank of New York Household Credit and Debt report for Q1 2024, delinquencies have climbed across major credit categories like credit card debt, and auto loans to start the year. Further weakness here could pose a threat to retailers on the demand side.

source: New York Fed

Final Thoughts

We rate XRT as a hold, balancing the proven ability of leading stocks in the group to navigate potential macro headwinds against the more complicated outlook.

The next several months of economic indicators including trends for inflation, the labor market, and retail sales will be critical to set the tone for the industry into 2025. On the upside, confidence that the Fed has room to cut rates while consumer spending remains strong could jump-start a new round of positive industry sentiment.

Read the full article here