It’s becoming obvious that the U.S. is going to need to generate substantially more power than it is today. Southern Company (NYSE:SO) is well positioned to answer the challenge.

The Buy Thesis

Southern Company is trading at a reasonably cheap valuation that does not account for its future growth rate. Specifically, I think the market is missing three key aspects:

- Current mix of energy production facilitates cheap cost per MW on new builds

- 9.5 GW capacity pipeline is well-supported by demand

- Guided growth rate of 5%-7% is conservative

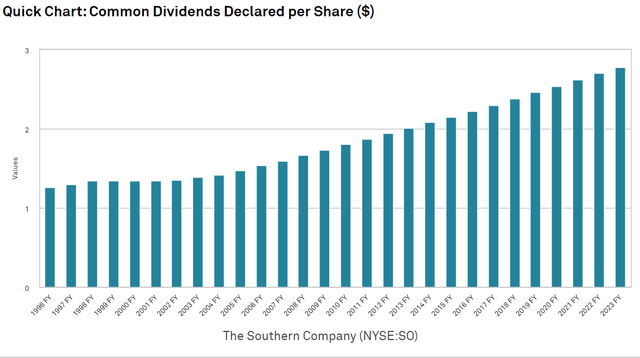

In combination, I think these will allow SO to extend and accelerate its long streak of dividend growth and in turn generate an above market total return for shareholders.

Energy production mix and expertise à efficient developments

Southern Company is well positioned to supply America’s growing need for energy. Its advantage lies in its ability to adapt to whatever the best mix of power production ends up being, with proven capability in a wide variety of power generation.

The “best” source of incremental energy production is a hotly debated topic with large numbers of people advocating for solar, natural gas, wind, nuclear and even hydroelectric. It’s true that each of these has some unique advantages over the other forms, but I think it’s important to recognize that the best energy for the future remains an unknown.

Energy production is a complex problem in which the engineering aspect alone is quite challenging, with leading experts showing a wide variety of opinions. Add on top of that the regulatory, political, and financial layers, and it approaches enigmatic difficulty.

Thus, while energy demand is a powerful driver and a fruitful place for investment, I think it must be approached with a certain humility – a recognition that we do not know what the energy production landscape of 20 years in the future will look like.

In the face of this uncertainty, Southern Company stands out as being able to pivot to whatever works the best given a wide range of potential scenarios. This flexibility comes from two advantages:

- A deep understanding of the execution of a wider array of power generation

- SO’s current mix of power generation sets up for low-cost incremental generation

I think most utilities fully understand how to implement solar and natural gas. SO’s advantage is in nuclear. While a few other utilities also have some nuclear production, SO is the only one who has had success getting through regulatory difficulties to actually build new nuclear. Their new plant, Vogtle Unit 3 began operating on 7/31/23 and Vogtle Unit 4 commenced operation on 4/29/24, making these the first new nuclear facilities in the U.S. in decades.

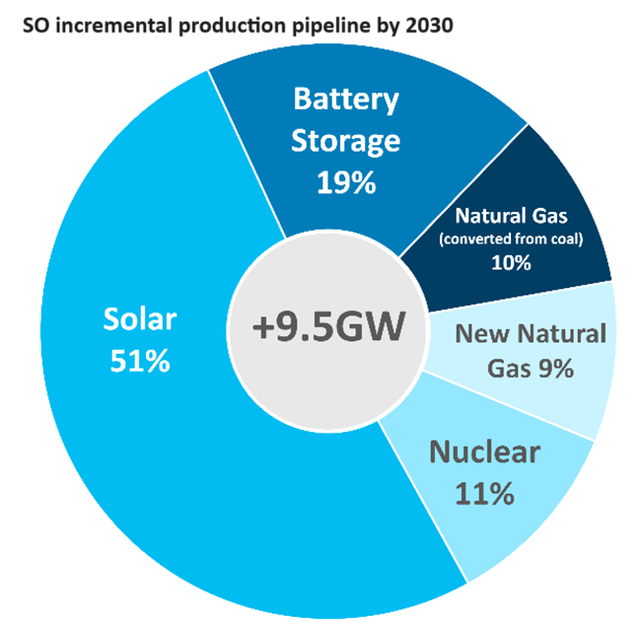

This new nuclear production, in combination with an emphasis on peaker plants (those designed to operate while other forms of power are not producing) sets SO up to build 9.5GW of incremental capacity at particularly low cost.

Solar has three main advantages right now:

- Improved technology makes it low cost per MW capacity

- Subsidies, tax credits and other aid presently available make solar even more affordable

- Companies like Microsoft are demanding carbon-free power, making solar a go-to for incremental data center electricity demand

Most, if not all utilities, can benefit from these. However, it’s the downside of solar where SO has an advantage: Intermittent production.

As you already know, solar panels give about 6–8 hours of great production each day and maybe another few hours of mediocre production, but they really struggle to supply power the rest of the day. Batteries are one potential solution, but at this point in time, batteries are quite expensive, which somewhat ruins the otherwise advantageous cost per MW capacity.

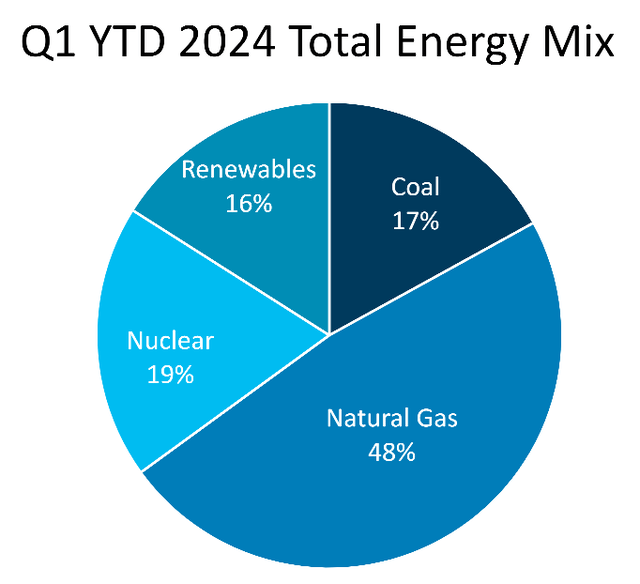

Intermittent production is not a problem for SO. Its production as of 1Q24 was 84% continuous in nature.

SO

With the recent additions of the Vogtle nuclear expansion, it has even more continuous production at its disposal which will allow it to add a substantial amount of incremental solar production at very low cost while only having to build a small amount of batteries and still provide continuous power. By 2030, SO intends to add nearly 5GW of solar capacity.

SO

Over time, it’s replacing its soon-to-be decommissioned coal plants with natural gas peaker plants. These peaker plants only operate a small portion of the day to cover time periods in which solar is not producing.

With so much continuous power available to SO, it can build incremental solar at a very low cost per MW. Being a low-cost provider is particularly important in Georgia (where SO operates) because of the Georgia Territorial Electric Service Act of 1973 which allows large-scale customers to choose their electric supplier.

As new data centers are built, I think SO will win a disproportionate market share as their nuclear and peaker plants provide continuous backup power while the new solar provides the bulk power at a cheap cost. This feeds into SO’s oversized 9.5GW pipeline.

SO has enough incremental demand load to support massive new production

With the growing need for energy, Southern Company has identified incremental load supportive of 9.5 GW of new production capacity by 2030. It’s coming from existing data centers, new data centers, population growth and manufacturing growth.

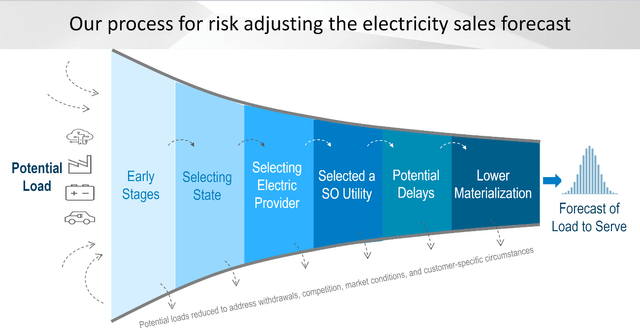

As a regulated utility, all this capex has to be approved to be added to their rate base. Given that electricity demand has been largely flat for the past decade or so, there’s some skepticism among regulators that the incremental load is actually that large.

Specifically, regulators are worried about expansion plans of data centers being greater than implementation. Let’s say, for example, that 100 data centers are in some phase of planning in a given area, but perhaps only 70 of them actually get built. If utilities were to build capacity to serve the full 100, there would not be enough incremental revenue from just the 70 to support the cost of all that capacity, which would raise rates for existing customers.

Regulators are there to keep customer costs low while providing utilities with enough ROE to be stable and able to provide needed capacity. Given regulatory concerns about potential future load estimates, SO has developed a fairly rigorous process for estimating future load, in which they whittle down from initial demand requests to those more likely to actually happen. Here’s their illustration of the process, and for those interested, they discuss it in quite a bit of detail on the 1Q24 earnings call.

SO

Since the public is not privy to information on outstanding bids, the 9.5GW of incremental capacity SO is calling for does require some degree of trusting them.

I don’t like to blindly trust companies, but in this case, I’m inclined to think their estimates are conservative for two reasons:

- Surging electricity demand is a well-known event and SO’s service areas have strong data center, industrial, and job growth. Thus, we know the demand is at least somewhat high.

- Reputation: SO has 77 years of uninterrupted dividends with continuous annual growth for more than 20 years. That does not happen at companies that overpromise and underdeliver.

S&P Global Market Intelligence

They say their load estimates are on the conservative side, and I believe them.

Guided growth looks a bit sandbagged

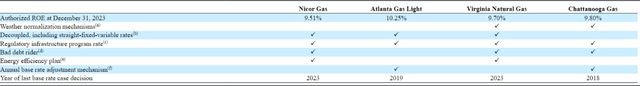

Southern Company has some fairly high allowed ROEs on both its natural gas and electric operations. Its gas ROEs range from 9.51% to 10.25%.

10-K

Per the 10-K filing, its electric ROE is set at 10.5%.

“Under the 2022 ARP, Georgia Power’s retail ROE is set at 10.50% and its equity ratio is set at 56%”

That’s a healthy spread over cost of capital, making any incremental rate base expanding capex significantly accretive to earnings per share.

With the magnitude of capex on the horizon and large spreads, I think growth will come in well above the guided 5%-7%.

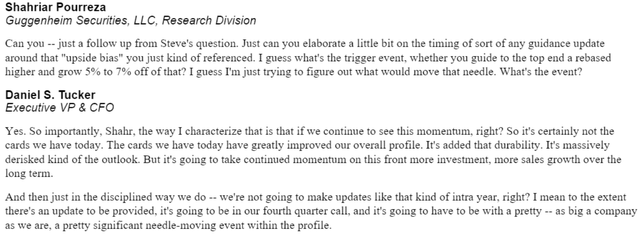

Guidance was issued early in the year, and at that point in time the boom in electricity demand was still somewhat speculative in nature. Today, demand is more concrete, and I believe the guidance issued at the start of the year is now likely a bit too low. On the 1Q24 conference call, management acknowledged that there’s an “upside bias” relative to the guide.

earnings call

As a matter of policy, guidance is only updated once a year. This sort of pacing of guidance seems to be quite prevalent among utilities. I suppose the less frequent updates make sense in an industry that has been sleepy for the last 20 years, but maybe with change becoming more rapid in electricity demand, more frequent guidance could be considered.

Valuation

Southern Company is trading at 18.8X forward earnings and 11.87X forward EBITDA. These metrics are slightly above median for electric utilities.

On a relative to sector basis, I think this pricing is correct. The modest premium is warranted by the following attributes:

- At $153B enterprise value it is of greater size which tends to trade at a premium.

- Nuclear power tends to (and I think should) trade at a higher multiple than other types due to the aforementioned synergy with non-continuous energy sources.

- Larger than average capex pipeline.

Relative to the broader market, I think SO is opportunistically priced. I see forward expected returns in the low double digits, which, generally speaking, would beat the S&P.

As discussed earlier, I think SO will come in at the high end or above its 5%-7% guidance. Add in its growing 3.7% dividend, and total returns at a flat multiple would be just over 10%.

Risks to watch out for

- Operational risk at Vogtle: It could be wise to verify that power output is coming in at the expected level and that there are no operational snags. Data for this should be available in the next 10-Q.

- Regulatory risk: As rate cases come in, look to see that allotted ROEs are flat or up.

- Capital spending cycle: Spending on digital infrastructure like data centers tends to come in waves. Current consensus is that the buildout is in the early innings, but that could change. If spending slows, it would slow the growth rate of SO.

Read the full article here