Investment Thesis

I wanted to take a look at Verisk’s (NASDAQ:VRSK) financials to see if the company’s high PE ratio is justified. The company is not overleveraged, but the current ratio and deteriorating margins make me cautious. Furthermore, the company´s revenue growth is not of a company that would have a 40x PE ratio, and even with more optimistic numbers than what I usually do for the DCF modeling, the company is still very overvalued and it would not be a good time to start a position right now as risk/reward is not enticing and starting a position at this point would be a gamble in my opinion, and that is not my style.

Briefly on the Company

Verisk provides data analytics solutions to the insurance markets in the US. It collects vast amounts of data from public sources, and property reports, and analyses it. Once all the data necessary is gathered, the company goes in-depth and tries to see how likely something bad is going to happen, like a house fire or a car crash.

Financials

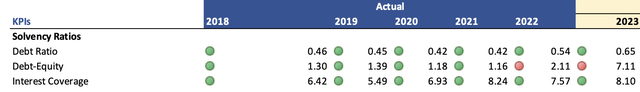

As of Q3 ´23, the company had around $416m in cash and equivalents, against $2.8B in long-term debt. Many people tend to avoid companies with excess leverage, but they may be missing out on some potentially great long-term investments. To see if the company in question is smartly using leverage, there are a few metrics I like to look at to see if the debt is manageable. These are debt-to-assets, debt-to-equity, and interest coverage ratios. I’m looking for less than 0.6 on the D/A ratio, less than 1.5 on the D/E ratio, and over 5x on the interest coverage ratio. As of FY22, there were no serious issues here, except for D/E which was just over 2. As of Q3 ´23, D/E has worsened to around 7, D/A to around 0.65, which is not a big deal, and the interest coverage ratio improved to around 8x. I don’t think the high D/E is an issue, especially when looking at the other two metrics that are within my acceptable ranges. The increase in the ratio was due to the company repurchasing shares, so the company is at no risk of insolvency since it can easily cover its annual interest expenses and it is not overleveraged relative to its assets.

Solvency Ratios (Author)

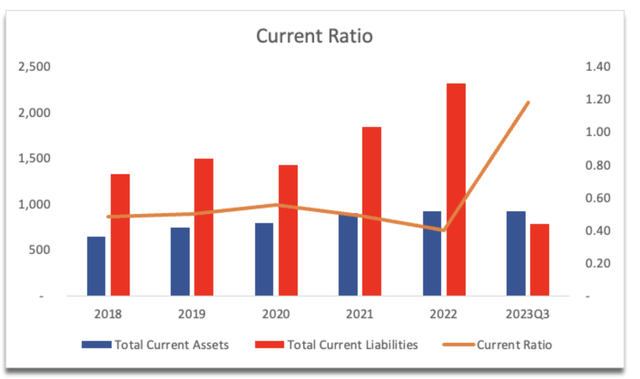

The company´s current ratio has massively improved due to very little short-term debt outstanding as of Q3 ´23. I expect this to deteriorate in the future when more of the debt is due to be paid, however, as of right now, the company has no liquidity issues, but I am more cautious going forward. I would like to see the company consistently reach at least 1.0, but because of this, I will be adding a bit more margin of safety to my calculations in the later section.

Current Ratio (Author)

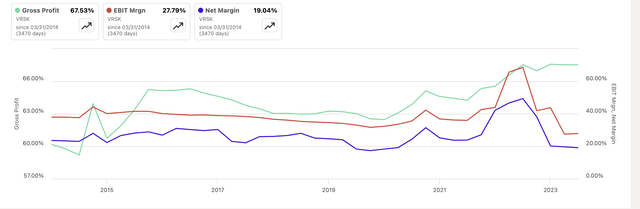

Going next on to the company’s efficiency and profitability, in terms of the company´s margins, these have retreated from the highs in Q3 ´22, all but gross margins, which stayed relatively stable. The change can be attributed to the loss on discontinued operations, so I would expect the margins to come back up in the next few quarters.

Margins (Seeking Alpha)

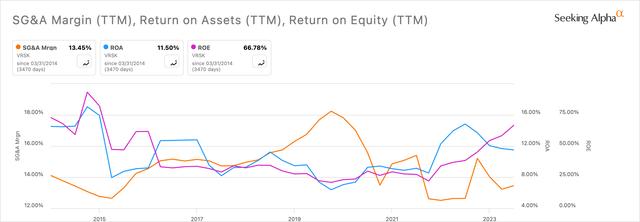

VRSK’s ROA and ROE have been recovering from the lows of FY19, and even then, the returns were decent. A lot of the improvements can be attributed to the company becoming more efficient, as SG&A and Cost of Revenues peaked at the end of FY19 and started to come down considerably over the next couple of years. Total operating expenses went from around 36% of total revenue to around 25% as of FY22, so we can see quite a big improvement. COGS improved by around 400bps during the same period.

Efficiency and Profitability (Seeking Alpha)

If we look at some of the competitors (as suggested by SA) we can see that the company’s return on total capital, which measures how efficiently the total capital is employed, VRSK is somewhere in the middle, which is not a bad thing. It means that the company still does have some competitive advantage, and the management is doing a decent job at allocating capital to profitable projects.

ROTC vs Comp (Seeking Alpha)

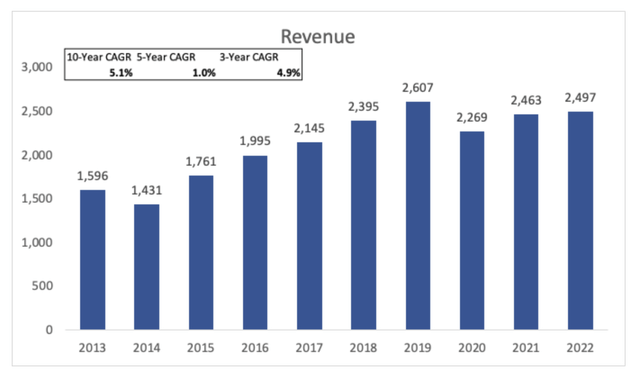

In terms of revenue growth, the company has not been known as a high grower, however, I like the consistency it has. Over the last decade, the company achieved around 5% CAGR, and its 3-year CAGR has been the same after the company’s revenue growth recovered post-pandemic. Although the company is not very exciting in this area and may not attract many investors who are looking for an amazing top-line expansion, that is not a deal breaker for me. As long as the company can become more profitable and efficient by improving its margins, the value of the company will certainly improve.

Revenue Growth (Author)

Overall, the company seems to be in a decent position, however, I would like to see a lot more improvements in those deteriorated margins as that is quite a bit of drop off since a year ago. The company is not overleveraged, so I am not worried about it, however, I would like to see improvement in the current ratio also. As long as those issues are still present, I will be adding a bit more margin of safety to take on those risks.

Valuation

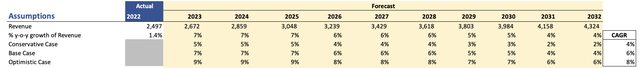

I will be breaking my rules here. I usually approach my valuations with a conservative mindset, however, I wanted to give the company a chance as you’ll see later on. For the revenue assumptions, I went with a bit more optimistic, yet realistic outcome for my base case scenario. I went with around 6% CAGR over the next decade. I also went ahead and added two other scenarios so I could get a range of possible outcomes. Below are those assumptions and their respective CAGRs.

Revenue Assumptions (Author)

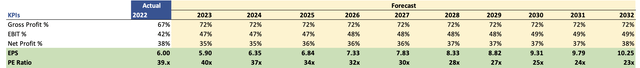

For margins and EPS, I also went a little more optimistic than its GAAP metrics, but even then, the company is trading at a 40x forward PE in FY23. Below are those assumptions as compared to the company’s FY22.

Margin and EPS assumptions (Author)

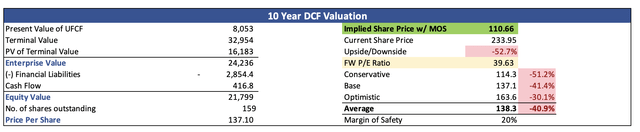

I usually go lower than estimates to give myself a little more margin of safety. As you can see, I didn’t go with more conservative numbers, which means there is very little margin for error. For the DCF model, I also decided to go with the company’s WACC of around 7.4% and a 2.5% terminal growth rate. I will be adding a 20% margin of safety to the intrinsic value calculation on top of these estimates as a last measure of safety. With that said, Verisk’s intrinsic value is around $110 a share, which means the company is too overpriced for me, and the risk/reward is not ideal.

Intrinsic Value (Author)

Closing Comments

As you can see the company’s high PE ratio is not justified in my opinion. The company’s top-line growth is lackluster, while the margins have just deteriorated over time, so I don’t see how the company could be trading at such a high multiple. There is not much to like here in terms of the company’s financials, and the growth that the company exhibits is not the growth of a company that should be trading at a 40x PE ratio.

This one will be going to my lists of setting a price alert at a much lower PT and forgetting about it until something changes, either the company’s earnings start to grow at an impressive pace, or the share price plummets closer to the above PT. Therefore, I assign the company a hold rating until either of the two happens.

Read the full article here