Elevator Pitch

I have a Hold rating assigned to Tencent Music Entertainment Group (NYSE:TME) [1698:HK]. My earlier August 18, 2023, update drew attention to TME’s Q2 2023 financial results and its Q3 2023 management guidance.

In this latest article, I write about the growth potential of TME’s online music services business and the company’s shareholder capital return. On the positive side of things, my view of the growth potential of Tencent Music Entertainment’s online services business is favorable. On the negative side of things, TME’s shareholder capital return isn’t as appealing as that of its larger Chinese technology or internet peers. Taking into account these factors, my decision is to stick with a Hold rating for TME.

Online Music Services Business Has A Long Growth Runway

At the beginning of this year, TME issued a press release revealing that the company has renewed its “multi-year strategic licensing agreement” with Universal Music Group (OTCPK:UMGNF) (OTCPK:UNVGY) which gives it “access to UMG’s music catalogue.” This recent disclosure brings Tencent Music Entertainment’s online music services business into the spotlight.

In its investor presentation slides, Tencent Music Entertainment highlighted that it owns and operates four of Mainland China’s five most popular music apps in terms of monthly active users. Credit ratings agency Fitch Ratings also referred to TME as the biggest player in the Chinese paid music market with respect to sales in its reports. Tencent Music Entertainment attributed the company’s market leadership to its large music library comprised of “150mm+ music and audio tracks” that has been built with the support of “domestic and international music label partners” such as Universal Music Group in its investor presentation.

I previously noted in my March 8, 2021 initiation article for TME that “Tencent Music Entertainment’s licensing agreements with leading music labels are only made possible, because of its (and the company’s parent) strategic interests in these companies.” For example, a January 3, 2024 Billboard news article mentioned that Tencent Holdings (OTCPK:TCEHY) (OTCPK:TCTZF), TME’s parent, “leads Concerto Partners, a consortium that owns a combined 19.92% stake in UMG (Universal Music Group).”

As such, it is reasonable to assume that Tencent Music Entertainment can maintain its competitive advantage relating to its vast music collection going forward, thanks to the strategic stakes in the major music labels.

Looking forward, TME’s online music services business boasts significant growth potential.

At Morgan Stanley’s (MS) 22nd Annual Asia Pacific Summit in mid-November last year, Tencent Music Entertainment mentioned that the company’s number of online music paying users could potentially increase to 150 million and 200 million, respectively for the “medium term” and “longer term”, respectively. TME’s management comments at the MS Asia Pacific Summit were taken from Morgan Stanley’s December 4, 2023, research report (not publicly available) titled “China Internet 2024 Outlook – Another Year of Alpha.”

As a comparison, the paying user base for the company’s online music services business in the third quarter of 2023 was 103 million as disclosed in its investor presentation slides. In other words, Tencent Music Entertainment sees its paying subscribers doubling in the long run.

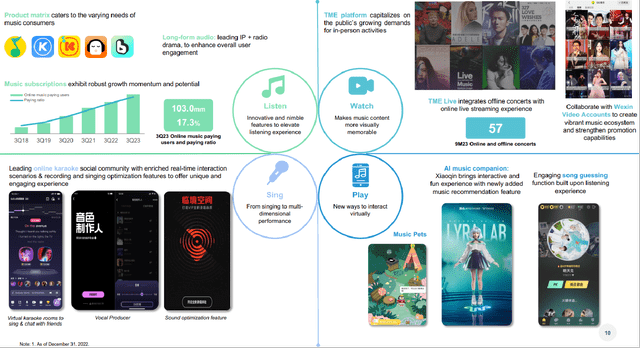

The Online Music Services Platform’s Key Features Keep Users Engaged And Increase Their Willingness To Become Paying Subscribers

TME’s Investor Presentation

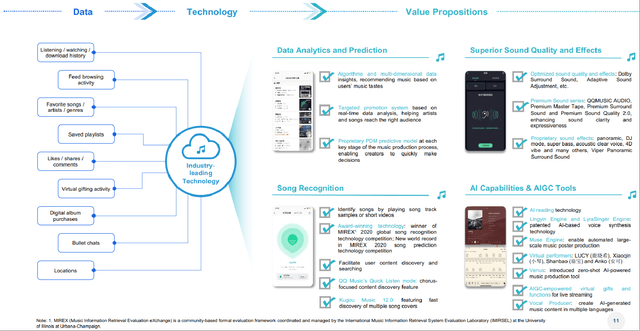

The Online Music Services Platform Leverages On Technology To Attract New Paying Users

TME Investor Presentation

TME stressed at its Q3 2023 earnings briefing that “interactive product features” and its “efforts to expand the application of AI technologies”, as highlighted in the charts presented above, have helped to grow its number of online music paying users. This is reflected in Tencent Music Entertainment’s most recent operating metrics, as the company’s paying user base and average revenue per paying user expanded by +21% YoY and +17% YoY, respectively in the third quarter of last year.

In a nutshell, Tencent Music Entertainment boasts a moat in the form of a large music library, and there are opportunities for TME to expand its paying subscriber base by capitalizing on AI-related technologies and attractive product features.

TME’s Shareholder Capital Return Isn’t That Attractive

Shareholder capital return is becoming an increasingly important investment criterion for investors seeking out potential investment candidates in the China internet or technology sector. A December 31, 2023, Wall Street Journal article noted that “cash-rich (Chinese) tech giants are helping their (investment) cases with dividends and stock buybacks” as most of these listed Chinese technology companies are now viewed by investors as “value stocks” rather than growth plays.

In that respect, Tencent Music Entertainment doesn’t seem to be an appealing investment opportunity if one judges the Chinese internet businesses on their respective shareholder capital returns.

With regards to dividends, TME has never paid a single dividend since its public listing in 2018, and the company isn’t expected to distribute dividends anytime soon based on consensus financial projections sourced from S&P Capital IQ. In contrast, Alibaba (BABA) revealed its “first annual dividend distribution” in the company’s Q3 2023 earnings press release issued on November 16. On the other hand, Tencent distributed its stake in Chinese food delivery giant Meituan (OTCPK:MPNGF) (OTCPK:MPNGY) to its shareholders as a special dividend in March 2023 worth around HK$134 billion or $17 billion at the point of distribution; this is equivalent to a special dividend yield of about 5%. Separately, NetEase (NTES) offers a reasonably decent consensus forward next twelve months’ dividend yield of 2% as per S&P Capital IQ data.

In terms of share buybacks, Tencent Music Entertainment has spent a total of $103 million repurchasing its own shares in the first nine months of 2023. This implies that TME’s annualized 2023 share buyback yield was below 1%, or 0.9% to be exact. As a comparison, Alibaba and Tencent Holdings allocated $9.5 billion and $6.2 billion of excess capital to share repurchases, respectively in the prior year. This translates into relatively superior share buyback yields of approximately 2% and 5% for Tencent Holdings and Alibaba, respectively in 2023.

Concluding Thoughts

TME’s shares are rated as a Hold. I have considered the attractiveness of its shareholder capital return and the music business’ growth prospects in maintaining my Hold rating for Tencent Music Entertainment.

Read the full article here