The S&P 500 Index (SP500) has outperformed most major markets over the past decade, defying many skeptics and, in many cases, even surprising those who were already bullish. Case in point, many analysts revamped their targets early in the year after the strong performance at the start of the year. Still, prices have been outrunning fundamentals for some time, and this is not sustainable. Valuations tend to be mean-reversing, and only revenue and profit growth results in real value creation.

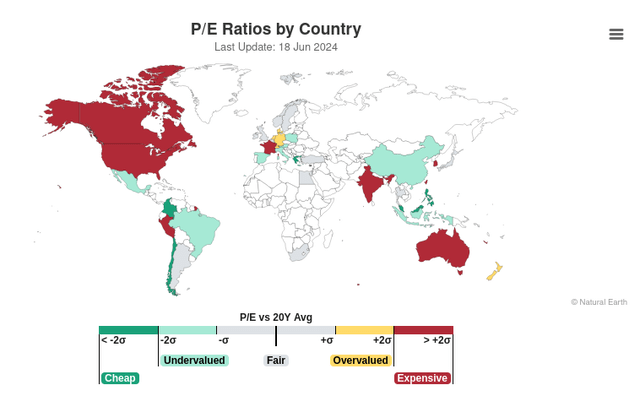

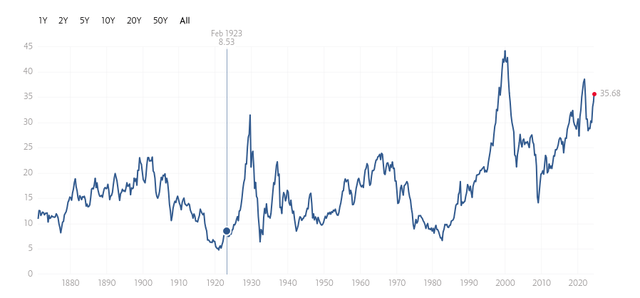

According to bulls, the economy is growing, lower interest rates are on the horizon, and artificial intelligence will significantly increase productivity. However, we should not forget that when it comes to investing, one of the most dangerous phrases is, “this time is different”. If we forget about AI, rate cuts, and other financial noise, the reality is that the market in the U.S. is quite expensive. According to World PE Ratio, the U.S. P/E multiple is more than two standard deviations above its 20-year average. Other similarly expensive markets include Canada (EWC), France (EWQ), India (INDY), South Korea (EWY), and Australia (EWA). It is not just the current P/E ratio of the S&P 500 index that is elevated, but also its cyclically adjusted PE ratio (CAPE). In fact, the CAPE, also known as Shiller PE ratio, has been shown to be a good predictor of 10-year forward returns. Based on the current value being close to 35x, it is likely that average returns over the coming decade will be less than 5%. This is consistent with Vanguard’s published forecast in May of this year, which estimates 10-year annualized nominal return for U.S. large-cap companies will be in the range of 3.1% to 5.1%

World PE Ratio

Running on Fumes

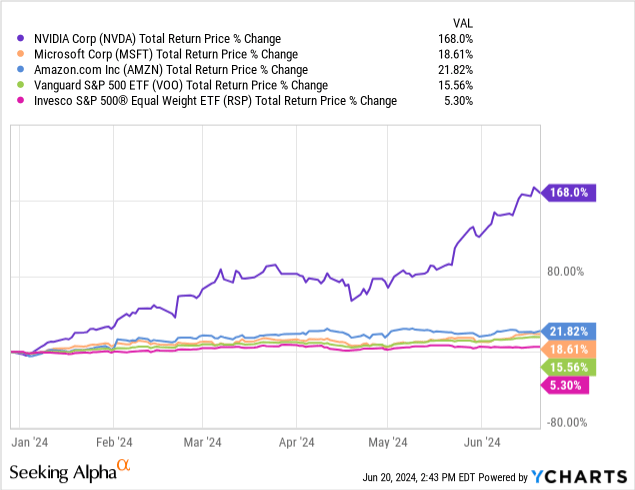

While the S&P 500 index has broken new record highs multiple times this year, it increasingly looks like it is running on fumes. By this, we mean that the rally is increasingly dependent on the rise of a few stocks like NVIDIA (NVDA), Microsoft (MSFT), and Amazon (AMZN) that continue to attract investors excited by the promise of artificial intelligence, while an increasing number of companies and sectors are falling as it becomes clear that the economy and consumers are getting weaker. This is reflected in the significant difference between the S&P 500 index, which in market-cap weighted, and the Invesco S&P 500 Equal Weight ETF (RSP), which has only delivered about one third the performance of the regular index.

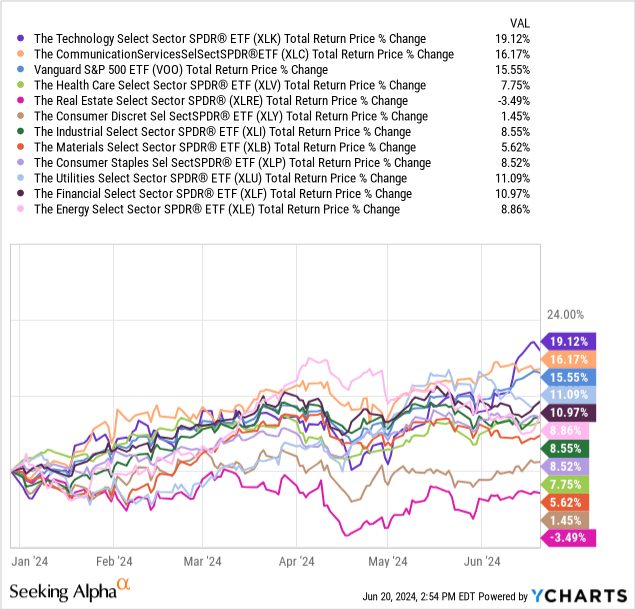

Similarly, we do a sector comparison, and it becomes clear that the S&P 500 index has increasingly depended on the technology sector (XLK), and the communication services sector (XLC) which includes companies like Alphabet (GOOGL) and Meta (META), to keep rising. The real estate sector (XLRE) is actually down year to date on a total return basis, and perhaps more importantly, the consumer discretionary sector which has historically been the “canary in the coal mine” with respect to the economy’s health, has significantly underperformed the market with a year-to-date total return of less than 2%.

Buckling Consumer

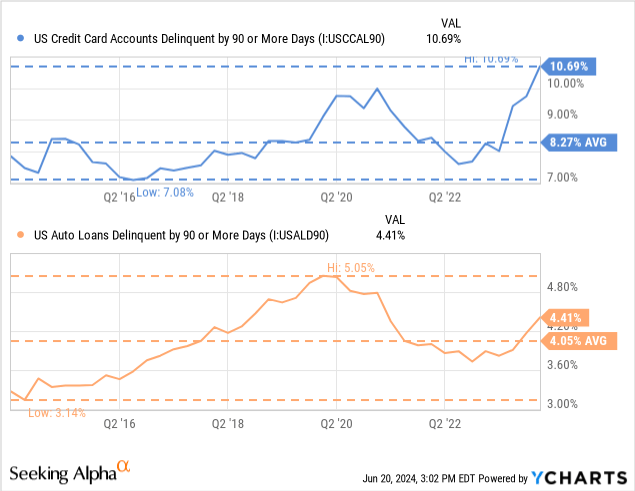

The problem is not only high valuations, but also increasing signs that the U.S. consumer and hence the economy are at risk of entering a recession. For example, the percentage of credit cards delinquent by 90 or more days is now higher than it was during the worst part of the pandemic. Auto loans have not exceeded the pandemic levels, but are also clearly in an uptrend and significantly above the ten-year average.

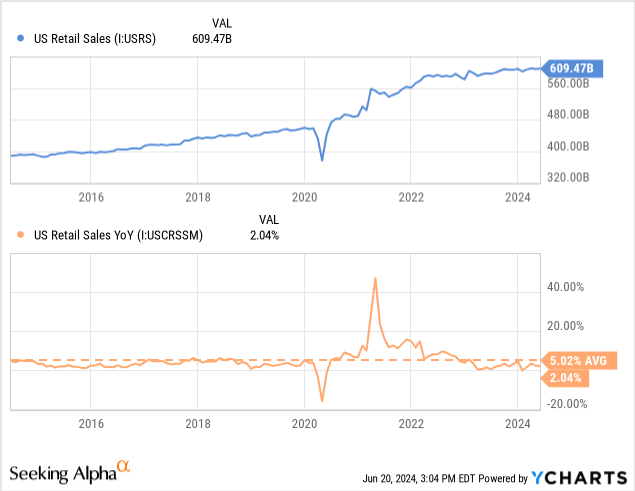

At the same time, retail sales are stagnating, recently growing by only 2% year-over-year, which means they actually declined in real terms after factoring inflation. For reference, the ten-year average has been around 5%.

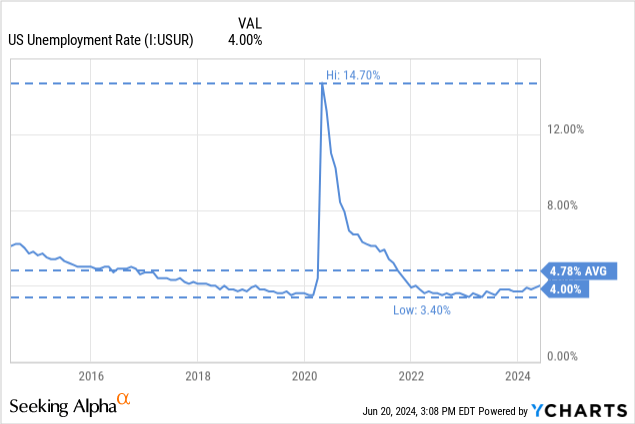

Even more worrying, unemployment is trending higher and very close to triggering the “Sahm Rule”. The rule developed by economist Claudia Sahm says that if there is more than a 0.5 difference between the three-month unemployment rate average and its 12-month low, a recession is very likely to occur. This heuristic has worked for every recession dating back to 1948. Sahm told CNBC that she thought Powell and his colleagues “are playing with fire” and that “the bad outcomes here could be pretty bad.”

Record Retail Investor Exposure

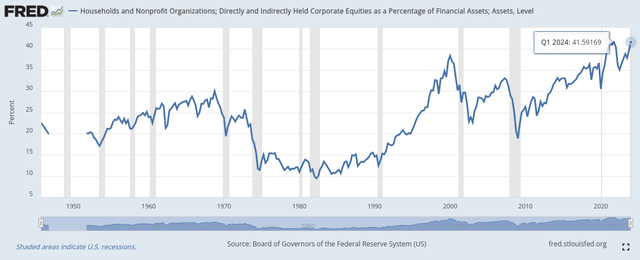

Another headwind for the U.S. stock market is that retail investors and non-profit organizations already have a near record-high percentage of their assets in corporate equities.

In the first quarter of 2024 this reached 41.59%, basically tied with the percentage held in Q4 of 2021, and slightly above the 38.38% reached in Q1 of the year 2000.

Board of Governors of the Federal Reserve System (US)

Is This Time Different?

When valuations become this extreme, there is usually some narrative behind creating the necessary excitement. During the dot-com bubble it was “the new economy”, with the Internet expected to generate enormous wealth, and basically change the rules of economics. While some companies did benefit enormously from the growth of the Internet economy, some of the biggest winners were not part of the public markets at the time. For example, Alphabet went public in 2004, and Meta in 2012. One company that was public at the time, and many investors saw as an obvious beneficiary of the Internet, was Cisco Systems (CSCO). It was a “picks-and-shovels” play, similar to how investors see NVIDIA benefiting from AI. While the company has indeed seen its revenue and profits grow, its share price is still below the record-high it reached during the dot-com bubble.

This time it is artificial intelligence that has investors excited, and which serves as a justification for extreme valuations. While it is true that AI could have a similar level of impact to the Internet with respect to how we live and work, there are few examples of companies making significant profits from it. Other than the semiconductor sector (SOXX), cloud operators like Amazon and Microsoft, and NVIDIA in particular, most companies do not seem to be really experiencing a significant economic benefit. If anything, some companies are rolling back their AI initiatives. A recent example is McDonald’s (MCD) ending its AI drive through trial after underwhelming results. While AI might indeed change the world, investors appear to be over their skis.

Valuation

The Cyclically Adjusted PE Ratio (CAPE Ratio), also known as the Shiller PE Ratio, for the S&P 500 index is currently about 35x. When starting from such elevated valuations, stocks have tended to deliver returns below 5% over the subsequent ten years. It is important to note that valuation levels have been shown to have strong predictive power for ten-year periods, but being poor predictors of returns over the next twelve months. In other words, during short periods of time, expensive stocks can get even more expensive, but eventually the market tends to reflect the real economic fundamentals.

multpl.com

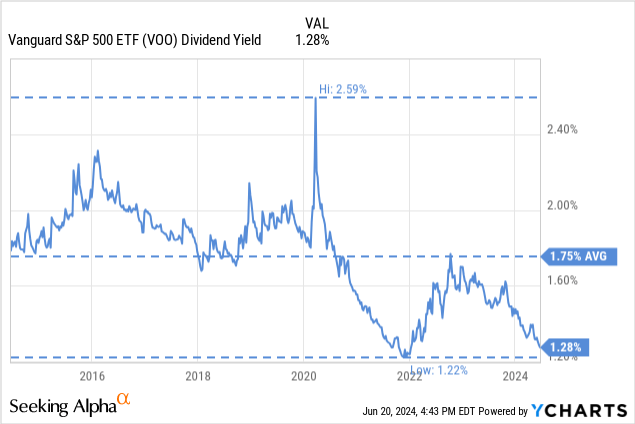

Another indicator that is flashing overvaluation warnings is the extremely low dividend yield on offer by the S&P 500 index. The current 1.28% is close to a ten-year low, and significantly below the 1.75% ten-year average.

Risks

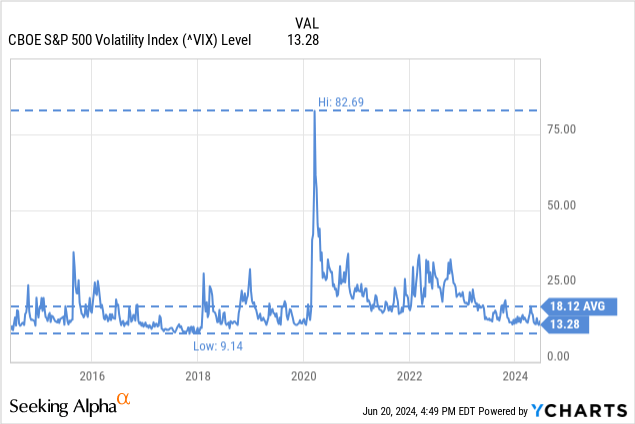

Despite clear signs of economic weakness, recession indicators such as the yield curve and Sahm’s rule flashing warnings, and geopolitical risks, investors remain complacent.

This can be seen with volatility levels significantly below average, and valuations near record highs. As a result, we believe risks currently outweigh rewards for investors in the S&P 500 index through ETFs such as the popular Vanguard S&P 500 ETF (VOO), the SPDR S&P 500 ETF Trust (SPY), and the iShares Core S&P 500 ETF (IVV). There is also risk trying to benefit from a short position in these ETFs, as an expensive market can become even more so.

Conclusion

The S&P 500 index currently has a very elevated valuation despite the U.S. economy showing clear signs that it is slowing down, and that consumers are experiencing significant stress. Investors are more focused on AI dreams, than the realities of rising credit card and auto loan delinquencies, declining retail sales, and increasing unemployment. In summary, we see an unattractive risk/reward for the S&P 500 index, and believe that investors are likely to be disappointed with the returns the index will deliver over the coming ten years.

Read the full article here