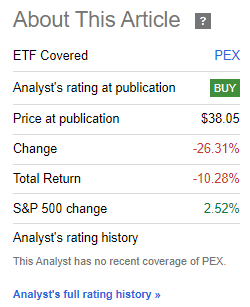

I last covered the ProShares Global Listed Private Equity ETF (BATS: PEX) in late 2021. In that article, I argued that PEX’s high yield and private equity investments made the fund a buy, and one which could help diversify an investor’s portfolio.

Since that article, PEX has performed worse than expected, and significantly underperformed the S&P 500. There were significant dividend cuts in 2022 too, although these have since been reversed.

PEX Previous Article

Recent losses have caused PEX’s assets under management to drop to $8M, which puts the fund at risk of closure, and means low volume and wide spreads. Although the fund has its merits, I find these issues to be deal-breakers. As such, I would not be investing in the fund at the present time.

PEX – Overview

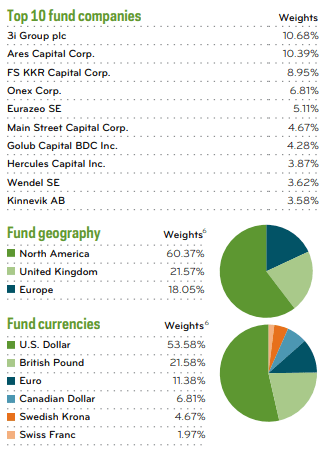

PEX is an index ETF, tracking the LPX Direct Listed Private Equity Index. It is a simple index, which includes the thirty largest private equity companies. Companies must invest at least 80% of their assets in private equity investments, including debt and equity, to be included in the index.

The typical PEX holding is a publicly-traded company which invests in private companies.

As an example, KKR (KKR), the fund’s third largest holding, holds a portfolio of dozens of companies, including Bytedance, the developers of TikTok. KKR is a public company: shares trade in the NYSE, and investors can easily buy these through their broker. Bytedance is a private company: a couple of big investors and employees own the company, and outsiders can’t easily buy shares.

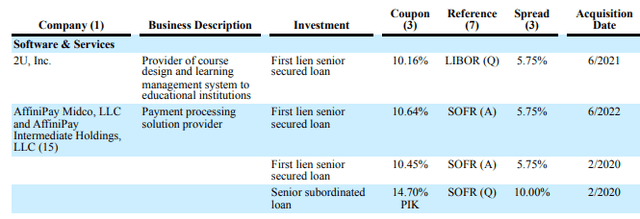

As another example, Ares Capital (ARCC), the fund’s second largest holding, holds a diversified portfolio of (private) corporate loans. Ares is publicly traded, the companies which issued the fund’s loan portfolio are not:

ARES

A quick look at the fund’s portfolio.

PEX

PEX – Benefits

Portfolio Diversification

PEX provides investors with indirect exposure to hundreds, perhaps thousands, of private companies / private equity investments. The vast majority of these are closed to the public, and only open to select high-net-worth individuals and company employees. Retail investors can’t easily invest in Bytedance, but they can invest in KKR, which does invest in Bytedance. Exposure to these companies would help diversify an investor’s portfolio, somewhat reducing risk and volatility.

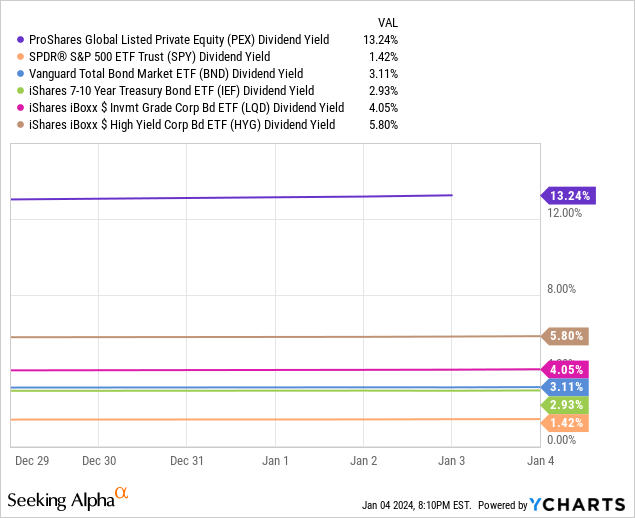

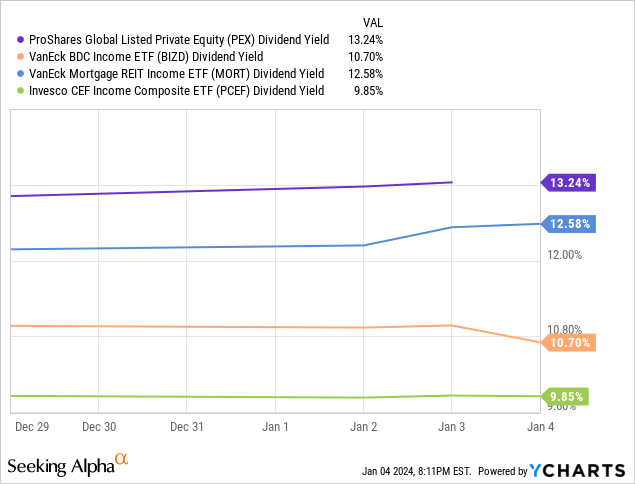

Strong 13.2% Yield

PEX currently yields 13.2%. It is an incredibly high figure on an absolute basis, and much higher than that of most asset classes, including bonds and equities.

Data by YCharts

It is also somewhat higher than some of the highest-yielding niche income asset classes, including BDCs, mREITs, and most CEFs.

Data by YCharts

PEX’s dividends are partly covered from the underlying income generated by private company debt. Ares Capital loaned money to several companies, these loans generate interest, and the interest is paid to investors as dividends.

PEX’s dividends partly come from the returns / deal-flow from private equity. KKR’s Bytedance investment should be sold in the coming years, and investors should receive some of the proceeds as dividends.

Both sources of dividends are somewhat sustainable, although obviously the equity portions are riskier, and more volatile.

Although PEX does provide investors with two important benefits, risks and downsides seem more impactful. Let’s have a look at these.

PEX – Risks and Downsides

Risky, Volatile Holdings

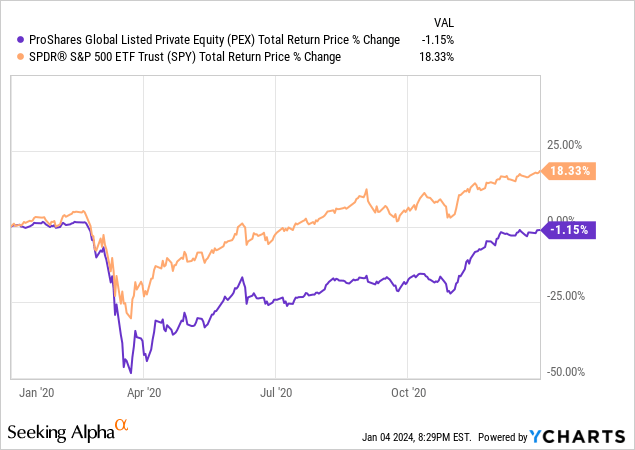

PEX’s underlying holdings are riskier than most. Expect significant losses and underperformance during downturns and recessions, as was the case in 2020.

Data by YCharts

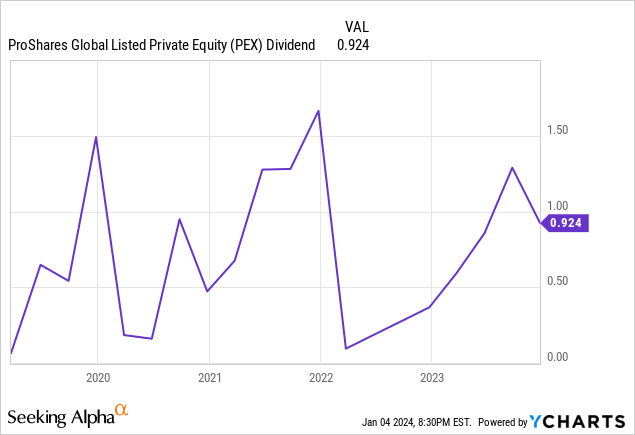

Dividends are quite volatile too, and saw massive drops in early 2020, the pandemic, and early 2022, when the Fed started to hike rates.

Data by YCharts

PEX’s risk and volatility is due to several factors.

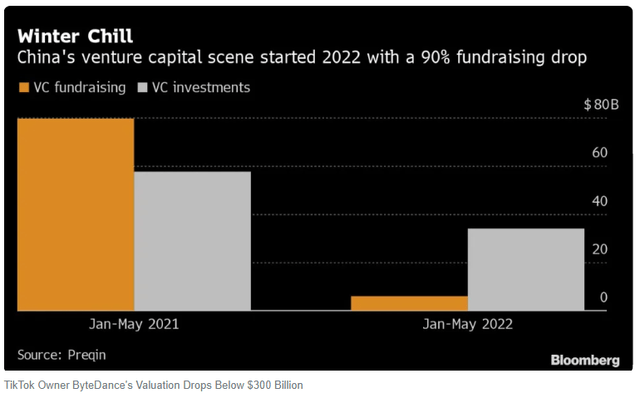

Private equity deal-flow is one such factor. KKR earns money from buying and selling stakes of companies. If opportunities for doing so dry up, the fund will not generate revenues or earnings. When economic conditions worsen the market freezes, deal-flow stops, and companies like KKR stagnate. As an example, Chinese venture capital investment dropped 90% in 2022:

Bloomberg

Chinese venture capital freezing means KKR can’t sell its Bytedance stake, nor make new ones in other companies.

There is quite a bit of volatility in private equity debt investments too, especially when economic conditions worsen and defaults increase.

Notwithstanding the above, PEX’s volatility seems higher than expected. PEX’s underlying holdings also invest quite heavily in private equity debt, which shouldn’t be significantly riskier than public equities. Their dividends are definitely not, including those of KKR and Ares Capital. Some of the fund’s dividend volatility might simply be normal ETF dividend volatility too.

In any case, PEX is a relatively risky fund, a significant negative for the fund and its shareholders.

Private Equity Valuations

PEX’s underlying holdings focus on private equity investments, and there is some controversy about valuations in this sector.

Valuations for public companies are simple. Apple’s (AAPL) shares are worth what the market says they are worth, company financials are audited by third-party accountants, and the SEC makes sure proper procedures are being followed (or at least tries to).

Valuations for private companies are more complicated. Bytedance’s shares are not publicly traded, so detailed, up-to-date information about prices is not readily available. Prices are generally calculated by private equity companies, and although there are procedures for doing so, companies have a lot of leeway. Reporting requirements are less stringent too.

Some investors have accused private equity companies of volatility laundering, fudging prices and valuations so as to (somewhat) reduce reported losses during bear markets. I fear that this is a possibility for some private equity companies, and so am somewhat apprehensive about investing in these. Investing in PEX means indirectly investing in private equity companies, so I am concerned about PEX as well.

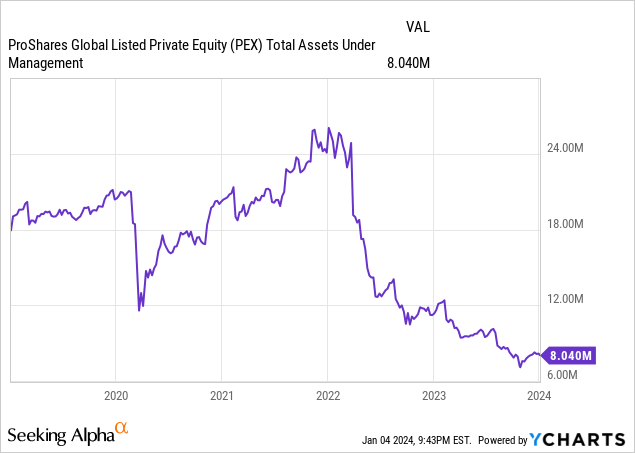

Declining AUMs

PEX’s assets under management have declined these past few years, reaching a measly $8M today. AUMs are low enough that a fund closure seems somewhat likely, especially considering the fact that assets are declining.

Data by YCharts

Tiny funds tend to be illiquid, with PEX having a volume of just 708 shares. Illiquid funds tend to have wide bid / ask spreads, although this does not seem to be the case for PEX right now.

Illiquid funds are somewhat risky, insofar as investors might have issues entering and exiting a position. The fund closing down is also a risk, although investors would receive their money back if this were to occur, which should only be an inconvenience.

Although the issues above are not significant negatives, I do find them to be deal-breakers. Most funds do not have these issues, and PEX is simply not all that strong to warrant an exception.

Conclusion

PEX focuses on companies with significant private equity investments. Although the fund has its merits, its low assets under management and illiquidity are significant negatives. As such, I would not be investing in the fund at the present time.

Read the full article here