Investment Thesis

Match Group, Inc. (NASDAQ:MTCH) is a stock that I recommend buying into right now. I recommended this stock to offer diversification and protection from high-beta stocks in my portfolio.

The business is priced at less than 10x this year’s clean free cash flow, or FCF. The business does carry $3 billion of net debt, but given that Match is making more than $1 billion of free cash flow per year, this balance sheet is in no way restrictive.

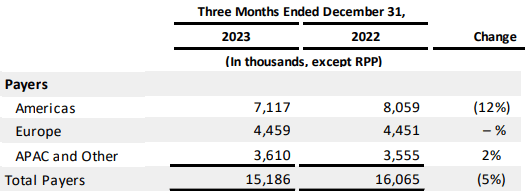

While the investment thesis isn’t blemish-free, as its number of highly coveted Americas payers were down 12% y/y in Q4 2023, I believe that at 10x free cash flow, many less-than-perfect considerations can be forgiven.

On top of that, recent news of activist investor Elliot Management being instrumental in the assignment of two Board seats bodes well for all shareholders. Elliot is not perfect, but given this stock’s valuation, together with Elliot’s better-than-average track record, I’m inclined to believe that Elliot is right on this stock.

Furthermore, Match Group reaffirms its intention to return more than 50% of its free cash flows back to shareholders. This implies that more than 5% of its market cap will return to shareholders, thereby, together with some growth in bottom line profitability, driving my return in this stock towards a $60 price target by the summer of 2025.

Rapid Recap

Back in January, in a bullish analysis, I said,

I make the case that MTCH is priced at 10x this year’s free cash flows. And that a business growing by 10% CAGR should not be valued at 10x free cash flow.

Therefore, this stock offers investors a compelling risk-reward.

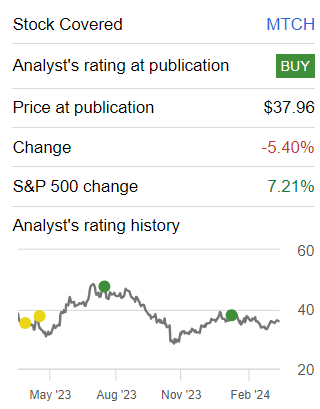

Author’s work on MTCH

Since I penned those words, Match has underperformed the S&P 500 Index (SP500). Nevertheless, not only do I stand by my thesis, but also I’ve put my money where my mouth is and bought shares in MTCH. Here’s why.

Match’s Near-Term Prospects

Match Group operates a range of online dating platforms, including Tinder, Match.com, and OkCupid, facilitating the creation of profiles for paying users to connect and potentially meet romantic partners.

The company provides technology for people to connect, chat, and arrange real-life meetings through online platforms.

Elliott Investment Management acquired about 10% of Match Group in January, eager to see a strong increase in Match’s share price. Recall, Elliott’s playbook, is known for enhancing free cash flow margins and increasing shareholder value in companies they take a stake in, for instance, Salesforce (CRM) or Peabody (BTU) or Twitter.

This type of turnaround effort doesn’t happen overnight, but they are eager to get a return on their capital, by stabilizing operations.

MTCH Q4 2023

Nevertheless, the fact that Match’s Americas payers are down 12% y/y shows that the attrition from the post-covid period is still being felt. At some point, these figures will stabilize, but the fact that Americas was down 9% y/y in Q3 2023 and down 6% y/y in Q2 2023, shows that Match’s Payers in Americas are accelerating, rather than stabilizing.

Match’s Americas is a figure that I’ll be watching closely in the next few quarters. Because I believe that Match can only rely on pricing power to stabilize its revenue growth rates only to a certain extent. At some point, Match must stabilize this figure, or else, I’ll recommend we exit our position.

To repeat, I’m very much bullish on Match and recommend buying into the stock right now. But if in the coming quarters, its Americas figures were down 15% for two consecutive quarters, I would then, recommend exiting this stock.

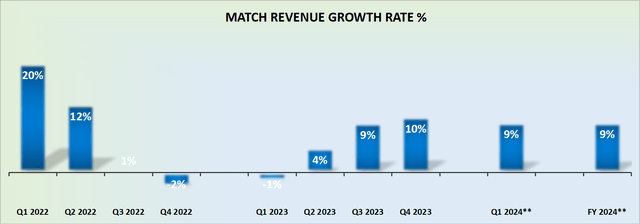

Revenue Growth Rates Of 9% CAGR

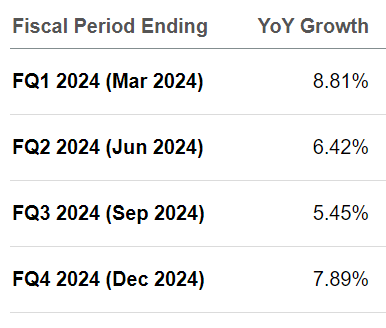

MTCH revenue growth rates

The guidance for the year ahead points to a 9% CAGR at the high end. I recognize that management is probably striving to be conservative with its guidance, and will in most likelihood reach 10% CAGR when 2024 is done and dusted, but I’m extremely conservative with my estimates, so I had hoped to see 10% CAGR.

SA Premium

As already discussed, the guidance for Q1 2024 is less enticing than many had expected. But I didn’t base my investment thesis on Match on its resumption to growth. I was seriously focused on its very strong free cash flows, which we discuss next.

MTCH Group — Less than 10x Free Cash Flow

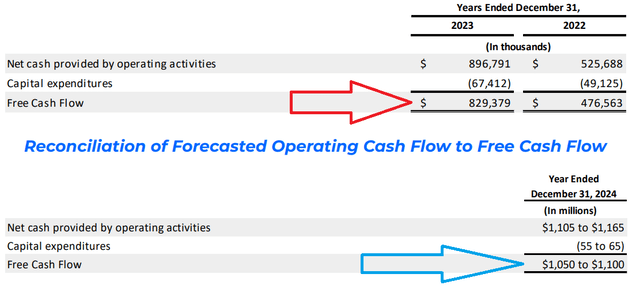

I can summarize my investment thesis for Match down to one graphic.

MTCH Q4 2023

What you see in the red arrow is the amount of free cash flow that Match made in 2023. And the blue arrow is the estimate of free cash flow that Match will make in 2024.

MTCH Q4 2023

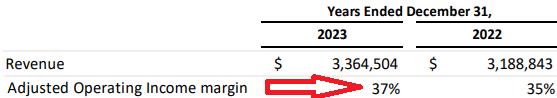

As a reference point, Match estimates that in 2024, its non-GAAP adjusted operating income margin will be at least 36%. Hopefully, this will reach 37% when the year is completed.

This would translate into $1.35 billion of thereabouts, approximately a 7% y/y increase from 2023. While on the surface, this doesn’t appear super interesting and exciting, my argument here is to show that Match’s strong free cash flow is not being driven squeezing of working capital. This is a strong and sustainable $1.1 billion free cash flow that Match is on a path to deliver in 2024.

And on top of that, Match states that it will return approximately 5% of its market cap as share repurchases this year.

In summary, there’s some growth on the topline and bottom line of about 7% to 9% y/y, plus about 5% coming via buybacks. I believe that once Match is able to convince investors that its revenue growth rates are no longer decelerating quarter after quarter as it did in H1 2023, and that its business is now stable, it won’t remain priced at 10x free cash flow. I fully suspect that investors will be more than willing to pay at least 15x forward free cash, meaning that Match should be valued at close to $60 per share (including buybacks) by summer 2025.

The Bottom Line

In summary, I see Match Group as an enticing investment opportunity. Although the decline in paying users in the Americas does raise some concerns, Match Group, Inc. stock’s valuation at less than 10x free cash flow presents an appealing entry point for me.

The company’s commitment to distributing over 50% of free cash flows to shareholders, along with a projected $1.1 billion free cash flow for 2024, positions Match for strong capital returns. With expectations of 7-9% year-over-year growth in both revenue and bottom line, alongside a 5% boost from share repurchases, my outlook is bullish.

As Match stabilizes its revenue growth and showcases business stability, I anticipate the possibility of a re-rating to at least 15x forward free cash flow by the summer of 2025, supporting a target valuation of nearly $60 per share. This makes Match an appealing investment opportunity in my view.

Read the full article here