Investment Thesis

Lifeway Foods (NASDAQ:LWAY) sells kefir, a milk-based drink that is trending thanks to its beneficial properties for intestinal health. And not only that, but the company only generated 2% of its revenue outside the U.S. during full year 2023, so the opportunity for international growth with the support of Danone, which owns 24% of the company, makes Lifeway a very appealing investment idea.

Sales distributed outside the United States represented approximately 2% of net sales for the year ended 2023.

Lifeway Foods 10-K 2023

The Growth Trend Behind

Lifeway is dedicated to the production of fermented dairy products, with kefir being its star product. I understand that this may be a new product for you since it is not the most commonly consumed. Basically, kefir is a fermented milk-based drink considered beneficial for health thanks to its high content of probiotics, which are beneficial for intestinal health. Then, we can notice the type of consumer this product is aimed at: Health enthusiasts.

In addition to kefir, and taking advantage of its infrastructure and production capacity, Lifeway also produces other fermented dairy products, such as probiotic yogurts, cottage cheese, among others. These products are distributed in different flavors, making them more friendly for new consumers.

Lifeway Webpage

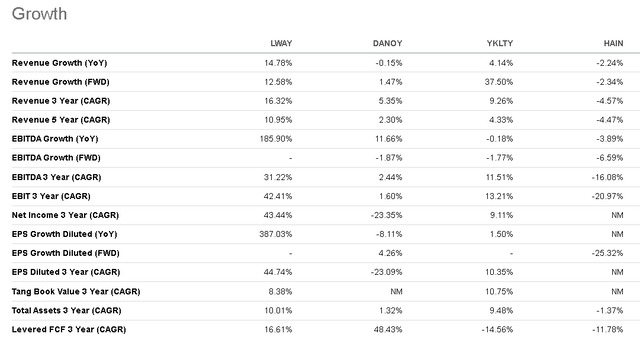

In recent years, the company has seen considerably more growth than other larger scale nearby competitors such as Danone (OTCQX:DANOY) or Yakult (OTCPK:YKLTY). This is a good sign, as it means that the company is growing more than the leaders, therefore stealing market share and carving out a place for itself in the industry.

Seeking Alpha

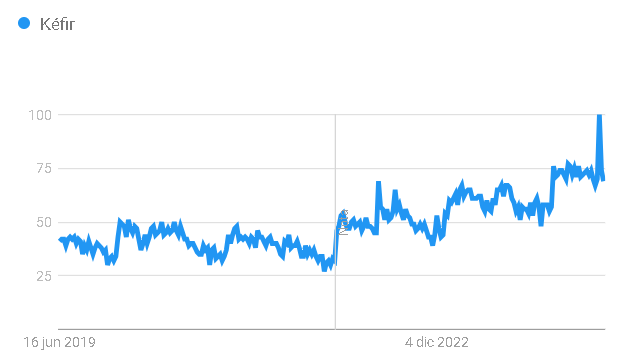

This growth is supported by the trend of health consciousness, seen especially in developed countries. If we look at the searches of the last 5 years on Google Trends we can see a growing interest in kefir in the United States, which ends up being beneficial for a company as focused on this niche as Lifeway.

Google Trends

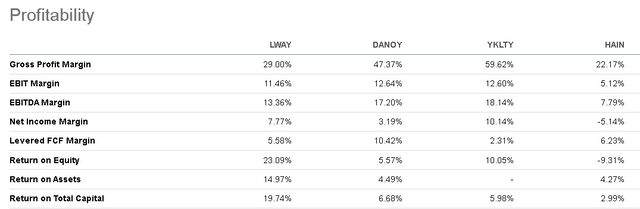

In terms of profitability, it is remarkable that despite having a lower gross margin than Danone and Yakult, its net margin is so high, with a notable return on capital. This is good because it means that the company has a very profitable business, but it also has certain risks, since a profitable business attracts competitors like honey attracts bees.

Seeking Alpha

Danone’s Support

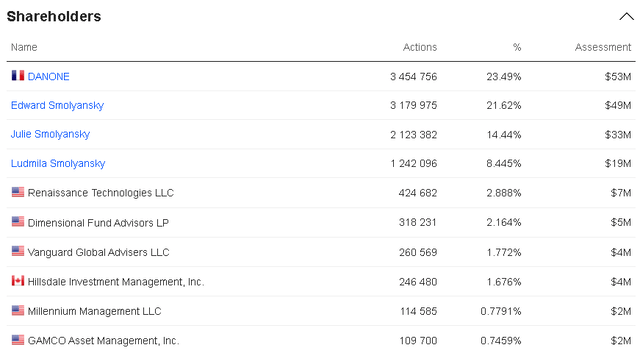

A curious fact and very relevant to the thesis is the fact that Danone owns almost a quarter of the company. This has positive and negative implications.

- The good: Being a majority shareholder, Danone has interest in helping Lifeway continue to grow, since if LWAY stock does well, Danone continues to rise to its 12-bagger yield, since Lifeway’s first 20% stake was purchased in 1999 for about $1 per share.

This creates a symbiotic relationship between both parties and has been the key to the success of companies such as Monster with Coca-Cola or Celsius with Pepsi. By having such a large brand behind them, they can integrate their products into a larger, more efficient supply chain, increasing scale and growth.

Lifeway Ownership (Marketscreener)

- The bad: Unlike the relationship between Celsius and Pepsi, Lifeway is a tiny fraction of the size of Danone. With a current EV of $170 million, Lifeway could be acquired without batting an eyelid by a Danone that has almost $7 billion in cash on its balance sheet.

An always-probable acquisition could reduce our downside, since if the shares start to do poorly and the valuation is attractive, Danone could decide to buy, surely, at a premium in the valuation.

- The ugly: But there’s always an even worse case. If the stock does poorly and Danone decides to buy at an insufficient premium, we could have a permanent loss even though the company’s future is good (assuming Danone buys Lifeway at a price lower than our purchase price). This could be possible given that two family members, Edward and Ludmila Smolyansky, whose ownership amounts to 30% of the company, have on several occasions tried to sell Lifeway, sending a bad signal that they’re not interested in the company’s growth in the future.

Valuation

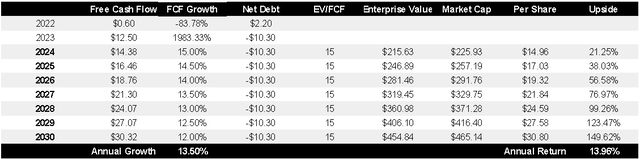

To value the company, I’m going to project its free cash flow over the next 7 years and apply an EV/FCF valuation multiple to estimate a potential upside. In this case, the company has no net debt on the balance sheet, so this is another positive point that will be reflected in the enterprise value. Over the last five years, the company has managed to grow its free cash flow 25% annually, so my estimate of 13.5% annually seems achievable.

Danone and Yakult typically trade at 12 times cash flow, but considering Lifeway’s rapid growth, a multiple of 15 seems fair to me. With these conservative estimates, we could expect a 14% compounded annual return if purchased at the current price of $12, so I’d be happy to buy in the entire range of $12s and if it drops further, it would seem like an even clearer buy to me.

This is because the chances of growth being greater are more likely than growth falling short. In fact, in the first quarter of 2024 the company reported growth of 18% YoY thanks to growth in volume, thus adding 18 consecutive quarters of growth, making clear the bright future that the company seems to be having.

Valuation Model (Author’s Compilation)

The Bottom Line

In my opinion, it seems to be clear that Lifeway’s product is taking advantage of an underlying trend that will generate more demand in the future. With the possibility of international expansion (98% of revenue comes from the US) and the support of Danone, the company should enjoy several years of growth.

Added to a fair valuation and a CEO with a high level of skin in the game, for me, it is currently a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here