Investment Thesis: I rate Korn Ferry as a Hold at this time.

Korn Ferry (NYSE:KFY) is a global organizational consulting firm that serves clients in over 50 countries.

The stock has seen substantial growth recently – up by over 35% over the course of the year.

TradingView.com

The purpose of this article is to determine whether Korn Ferry has the capacity to see further upside from here.

Performance

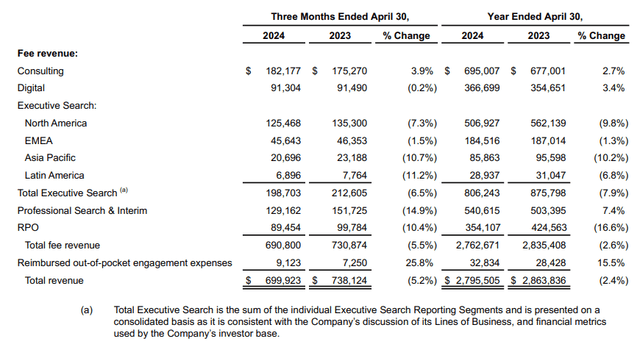

When looking at the most recent earnings results for Korn Ferry (as released on June 13, 2024), we can see that total revenue was down by 5.2% on a three-month ended basis as compared to the prior year quarter. However, the Consulting segment was the only segment that demonstrated growth at 3.9%.

Korn Ferry Press Release: Fourth Quarter and Full Year FY’24 Results of Operations

Adjusted diluted earnings per share was up to $1.26 from $1.01 in the prior year quarter. On a year ended basis, adjusted diluted earnings per share was down from $4.94 to $4.28.

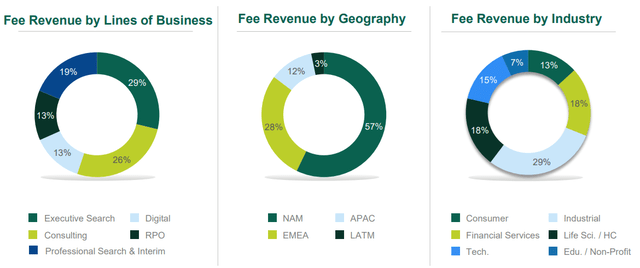

Additionally, when looking at fee revenue by lines of business, we can see that Executive Search is currently the largest by fee revenue, followed by consulting.

Korn Ferry: FY’24 Q4 Earnings Call Presentation

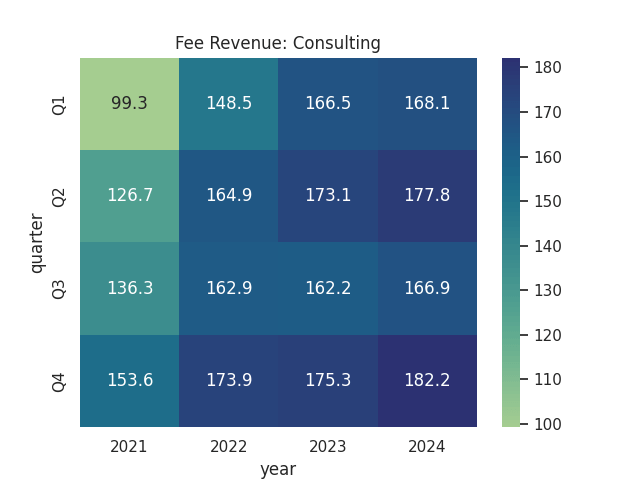

When we examine this trend in more detail, we can see that the Consulting segment has been showing growth – with each quarter of this year having shown growth in fee revenue as compared to the prior year quarter.

Fee Revenue by Quarter: Consulting segment

Figures sourced from historical Korn Ferry quarterly press releases. Heatmap generated by author.

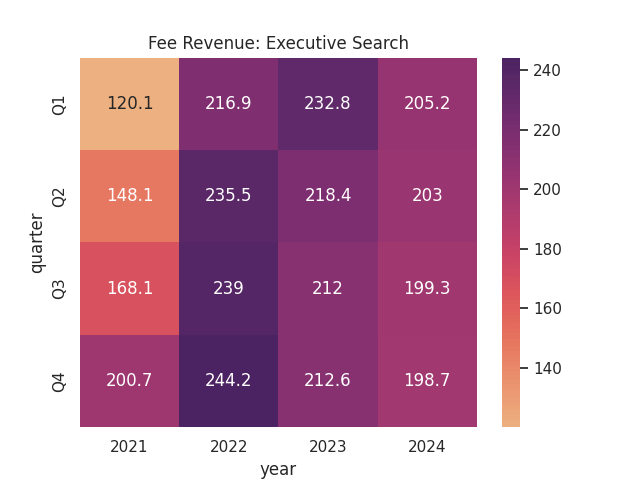

In contrast, we can see that the Executive Search segment has shown the opposite trend – with fee revenue by quarter in 2024 down from that of the previous year.

Fee Revenue: Executive Search segment

Figures sourced from historical Korn Ferry quarterly press releases. Heatmap generated by author.

In this regard, while Korn Ferry’s Consulting business is currently the second-highest in terms of fee revenue across all segments – the current growth trajectory could mean that we see the Consulting segment eventually become the largest by revenue for Korn Ferry.

From a balance sheet standpoint, we can see that Korn Ferry’s quick ratio (calculated as cash and cash equivalents plus marketable securities plus receivables due from clients all over total current liabilities) remains above 1 and has seen an increase from that of the prior year quarter – indicating that the company has sufficient liquid assets to meet its current liabilities.

| Apr 2023 | Apr 2024 | |

| Cash and cash equivalents | 844,024 | 941,005 |

| Marketable securities | 44,837 | 42,742 |

| Receivables due from clients | 569,601 | 541,014 |

| Total current liabilities | 976,260 | 934,519 |

| Quick ratio | 1.49 | 1.63 |

Source: Figures sourced from Korn Ferry: Fourth Quarter and Full Year Highlights Earnings Release. Quick ratio calculated by author.

To summarise the most recent quarter, we have seen that while revenue growth as a whole came under pressure – that of the Consulting segment continued to see growth.

Looking Forward and Risks

In terms of potential growth prospects for Korn Ferry going forward, my view is that while the growth we have been seeing across the Consulting segment of the business is encouraging – the Executive Search segment also needs to ultimately see a rebound to drive net revenue higher from here.

According to Korn Ferry, the decline in Executive Search revenue was due to a decline in the number of Executive Search engagements billed – attributed to adverse economic conditions. The company was recently ranked by Forbes magazine as the top executive recruiting firm in the United States – having received such a ranking in seven out of the last eight years.

From this standpoint, I take the view that the company does have the capacity to bolster its fee revenue for Executive Search provided we see a significant rebound in labour demand from here.

According to Reuters, job openings in the United States are currently at a three-year low with the number of people quitting their jobs also having fallen. Moreover, companies are making an effort to address staff shortages through prioritising the retention of existing workers over hiring new ones.

Such trends are placing downward pressure on Executive Search revenues, as demand for such services has understandably been slowing in the face of a cooler labour market. With the Federal Reserve waiting for further clarification that inflation is indeed cooling before choosing to cut interest rates, it could be some time before we see companies take a more active approach to expanding headcount once again.

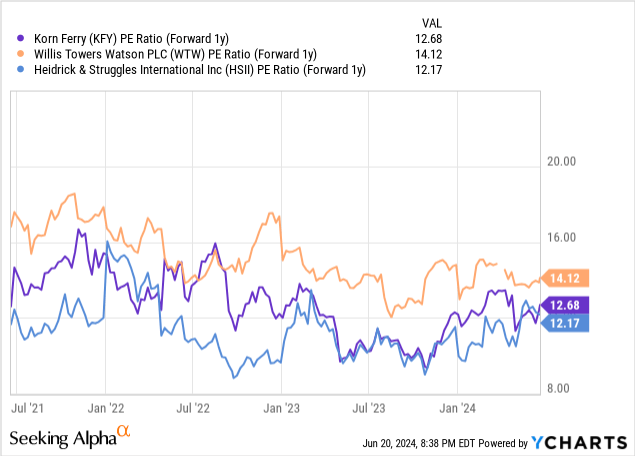

When looking at the forward P/E ratio for Korn Ferry and peers Willis Towers Watson (WTW) and Heidrick & Struggles International (HSII), we see that Korn Ferry is trading at a similar ratio.

ycharts.com

In this regard, I take the view that the stock is fairly valued as compared to its peers.

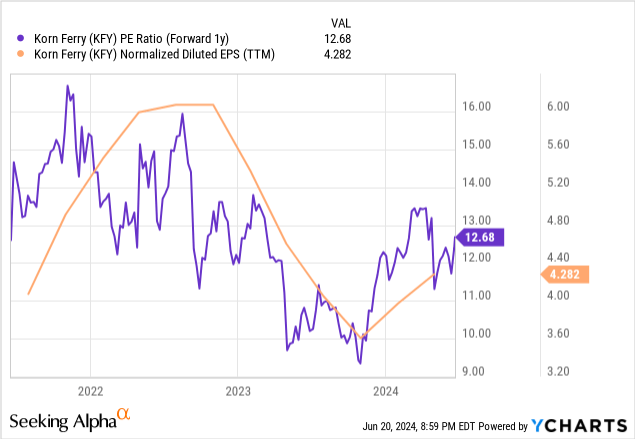

With that being said, we can see that earnings per share (on a normalised diluted basis) has declined as compared to last year, while the P/E ratio is trading at similar levels to that seen during this period.

ycharts.com

In my view, this is also an indication that the stock is trading at fair value, and we would need to see a significant rebound in earnings going forward to justify upside in the stock.

Conclusion

To conclude, Korn Ferry has seen an overall decline in fee revenues in spite of growth across the Consulting segment. In my view, fee revenues across the Executive Search segment needs to rise before the stock can see further upside from here. I rate Korn Ferry as a Hold at this time.

Read the full article here