Shares of Juniper Networks (NYSE:JNPR) have been a solid performer over the past year, thanks to Hewlett Packard Enterprise’s (HPE) announced acquisition of the company for $40 in cash. Shares today are about 3% below levels reached immediately after the deal was announced. They have about 8.6% upside to the $40 deal price at their current trading level, given ongoing scrutiny of the deal from regulators. To determine whether investors should hold shares for the remaining upside, we need to consider the odds of a deal and where Juniper’s standalone fundamentals would leave shares trading absent a deal.

Seeking Alpha

Will the Deal Close?

Given its pending acquisition, Juniper has ceased providing financial guidance or conducting earnings calls, as is common. In its first quarter earnings release, Juniper said it anticipates closing its deal in late 2024 or early 2025. In the event HPE cannot secure regulatory approval, it would pay Juniper a termination fee of $815 million. There have been a series of regulatory actions, which point to the deal getting some scrutiny. I view these as consistent with a deal of this size.

In May, the Department of Justice submitted a second request for information, suggesting that the deal is receiving meaningful antitrust scrutiny. The United Kingdom has also opened an initial investigation into the deal, and by mid-August, we will know if it decides to pursue an investigation more vigorously. By August 1st, the European Union will need to determine if an in-depth review is needed or if it can approve the deal outright. Given increased scrutiny in the US & UK, I would expect Europe to investigate the deal fully.

Critically, it does not appear China will need to approve the deal. Given the fraught geopolitical tensions, there would be a nonzero risk China blocks the deal given American companies are involved, irrespective of antitrust concerns, as QUALCOMM (QCOM) learned this in its failed effort to acquire NXP (NXPI) several years ago.

I view US & EU regulators as the most critical decision makers. Last year, we did see the UK hold out the longest before approving Microsoft’s (MSFT) Activision purchase, but ultimately, it is unlikely to single-handedly go against its major allies and trading partners and block a deal that is otherwise approved.

Given Juniper offers ancillary products and is not a direct competitor to HPE’s offerings, HPE does not anticipate a major antitrust hurdle. Considering HPE’s current market cap and debt load, the combined company will only have an enterprise value of about $50 billion. That is roughly a quarter of the size of IBM (IBM), 30% of Cisco Systems (CSCO), and a fraction of the multi-trillion “Big Tech” companies that have come to dominate much of our lives and our equity market. Indeed, allowing HPE to bulk up somewhat may actually help it compete better against larger players and increase competition.

I view a deal as likelier to close than not, given the size and the fact that JNPR’s networking and cloud service offerings are largely complementary to HPE’s own products. It will also continue to have smaller market share than firms like Cisco and larger cloud players, like Oracle (ORCL), which should mitigate antitrust concerns. Even with the current DOJ, I expect US approval. It is possible that if Donald Trump wins the election, turnover in the DOJ could delay approval, but I would not expect his Administration to take a harsher line on antitrust than the Biden Administration.

As such, I would classify completion of this acquisition as “likelier than not,” though not a total certainty. I would also expect it to close towards the end of Q1 2025, or towards the end of Juniper’s anticipated close timeline, given regulatory review. I view the deal as a likelihood to be about 80%, but in my fair value analysis below, I do show returns from 50-90% probabilities for investors with different views.

Juniper’s Stand-Alone Value

Now, we know investors receive $40 if the acquisition closes. The question is what Juniper would be worth if the deal is blocked. I see some downside, and recent results were not encouraging. In the company’s first quarter, revenue fell by 16% to $1.15 billion. Non-GAAP EPS was $0.29 as net income fell by 38% to $97 million.

Product revenue fell from $913 million to $652 million. Service revenue rose by 8.3% to $497 million. This shift is somewhat positive because while product gross margins are about 50%, service gross margins are over 71%. Still, the magnitude of the product decline is significant. Management sees macro headwinds weighing on customers, while other customers are working through last year’s deliveries before needing to place new orders. It is seeing growth in cloud offerings, with Mist up double-digits.

Juniper’s product side is suffering from a “bullwhip effect.” COVID supply chains delayed deliveries, and given the growth in network usage as work went remote, there was a surge in demand. JNPR was finally able to fulfill those orders through last year, but with that demand met, there is now limited need for new product. Service provider revenue was particularly hard hit by this phenomenon and fell by 31% to $382 million. Its service business continues to grow, but product is likely to be a headwind for several quarters.

I was particularly encouraged by the fact that service costs fell by $1.6 million even as revenue rose by $38 million, which speaks to the scalability and tremendous margins of this business line. Unfortunately, given the scale of the product demand drop, adjusted operating margins fell to 10.6% from 14.8%. Even with lower revenue, sales and marketing rose just under 1% to $305 million, and R&D rose 4% to $297 million.

Frankly, the company is not showing too much cost discipline given this drop in revenue. I would also note that inventories rose by $6 million to $958 million, a concerning sign that demand slowed even more than the company expected. I suspect JNPR management is holding off on taking significant cost action, given the pending acquisition, which is a reason why HPE sees scope for several hundred million in synergies.

If the deal falls through, we would likely need to see a significant cost-cutting effort, as these product cycles could take some time to normalize. Moreover, as we have seen in other technology earnings reports like Salesforce (CRM), tech budgets may be reallocating away from legacy products and towards AI, and this cannibalization could further slow JNPR’s recovery.

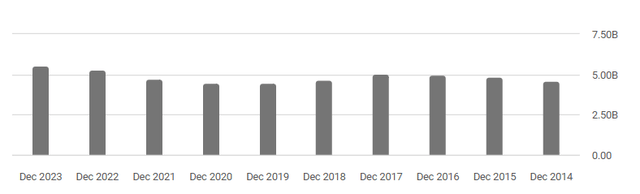

It is also worth keeping in mind that JNPR has not been much of a growth company for some time. As you can see below from Seeking Alpha’s financial dashboard, this company has not really grown over the past decade. Revenue last year rose as it fulfilled orders, but we are likely to end this year back below $5 billion, similar to levels 10 years ago. With major telecom firms also facing large debt loads, I expect service provider revenue to remain slow as significant cap-ex expansions are unlikely.

Seeking Alpha

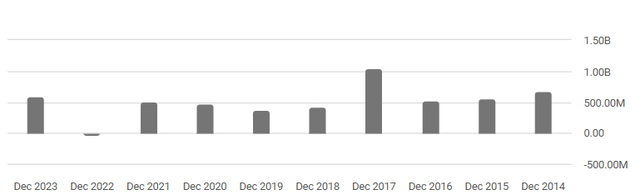

Free cash flow growth has been similarly muted at about $500 million per year, with large variation from that, largely driven by working capital movements.

Seeking Alpha

Now, on the positive side, JNPR has a strong balance sheet with about $1.25 billion of cash and $1.6 billion of debt. With the $815 million it also receives if the deal collapse, JNPR will have a net cash position. This comfortably protects its 2.4% dividend yield. While share repurchases are suspended pending the HPE acquisition, they would likely resume immediately after a failed deal.

In Q1, JNPR generated $190 million of free cash flow, excluding working capital. Now, $80 million of this was share-based compensation. I view this as a cash-like expense, as it just dilutes shareholders. True “free cash flow” is running about $440 million. As a standalone entity, I would expect it to cut costs, and even with muted product sales, it likely is a $~600 million free cash flow business after significant reductions in SG&A.

Conclusion

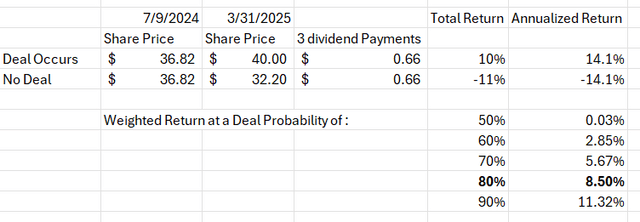

Below, I value JNPR across the two scenarios. Given its slow growth, I value JNPR at a 6% free cash flow yield and added a ~$400 million net cash position, resulting in a standalone value of $32.20. By 3/31/25 next year, investors will also receive 3 dividend payments. Essentially, I see about 14% of annualized upside if the deal closes and 14% of downside if the deal collapses. At an 80% deal probability, investors have a probabilistic annualized return of 8.5%

my own calculation

Now, this 8.5% return would be relatively uncorrelated to overall market performance, as it is strictly tied to regulatory approval, and the $40 is paid in cash not in HPE stock. I have generally viewed ~8% as a market-like return, meriting a “hold” recommendation, with 10+% meriting a buy. At my 80% deal probability, JNPR is squarely a “hold,” and investors need to view the deal closing as closer to a 90% probability to merit buying here. Now, these returns are fairly sensitive, if shares traded down to just $36.44, the weighted return would be my 10% buy threshold.

Right now, the market appears to be pricing in a ~80% chance of the deal closing, and this strikes me as about right. As such, I do not feel JNPR is a compelling merger arbitrage buy, given its weak standalone fundamentals. By the same token, there is no need to sell shares either. I view shares as a “hold.” While I do believe investors are most likely to receive the $40, the risk if the deal falls apart keeps me from rating JNPR a buy. If we saw shares trade down to $36, on further regulatory headlines, I would consider buying, but closer to $37, I see no rush to buy.

Read the full article here