Stocks can go through periods of underperformance for one reason or another, and a common refrain among investors may be to ask “what does the market know that I don’t?”

Having been in the investment game for quite some time, I would say that more often than not, so long as you do your due diligence, the market doesn’t know any more than you do.

Sometimes, an individual company or sector may simply be out of favor with big institutional firms, which often adopt a herd mentality and can “window dress” results to make quarterly statements look good for their investors.

This can result in outsized buying opportunities for value investors, and brings me to Genuine Parts (NYSE:GPC), which I last covered in April on the strength of its distribution platform and attractive valuation.

It appears that the market hasn’t agreed with my thesis as of yet, as the share price has fallen by 12% since then, underperforming the 8% rise in the S&P 500 (SPY) over the same timeframe. In this article, I discuss why this presents a great opportunity for dividend value investors, so let’s get started!

Why GPC?

Genuine Parts has been in existence for 96 years, since when the automotive industry was just getting started. Today, it’s best known for the NAPA automotive parts retail brand, serving both individual and professional automotive technicians with a network of over 10,000 stores across 17 countries. GPC is also a dividend aristocrat with 67 years of dividend raises.

GPC stock hasn’t been a great performer over the past 12 months, with the stock having declined by 21% over this timeframe. One would think that the business were falling off the rails based on this metric alone, but that’s simply not the case.

GPC Stock (Seeking Alpha)

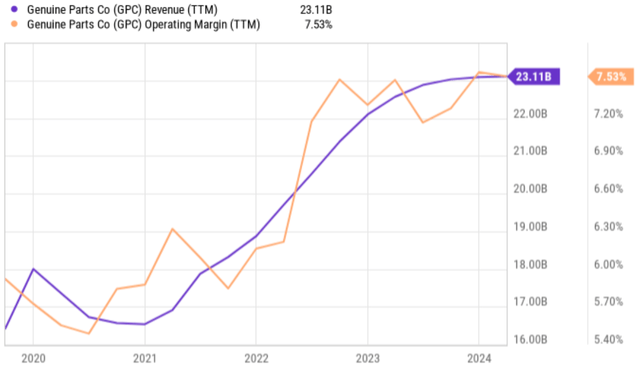

As shown below, GPC has grown its revenue rather consistently over the past 5 years from $16.5 billion to $23.1 billion. Moreover, it’s also seen higher profitability, with operating margin rising from 6% to 7.5% over the same timeframe. This was supported by GPC’s continued leverage of its operating scale to efficiently serve customers.

YCharts

GPC’s revenue of $5.8 billion in Q1 2024 was virtually flat on a YoY basis, rising by just 0.3%. However, segment margin improved by 30 basis points YoY to 9.4%, driven by cost discipline at the Motion segment (a distributor of industrial parts) and improved profitability in the U.S. Auto business. The improved margin profile translated into better bottom-line growth than the top-line, with adjusted EPS rising by 3.7% YoY during the first quarter.

Management recently raised full-year EPS guidance to $9.88 at the midpoint of range, up from $9.80 previously. This is based on growth expectations for the automotive segment along with a continuation of the favorable margins that it’s seen so far this year. Its free cash flow is expected to land at $900 million this year, which more than covers $500 million worth of planned capital expenditures.

GPC’s capital investments may pay off in the near to medium term, as this includes a partnership with Google (GOOG) to enhance its online search catalog, thereby removing friction and improving the customer experience. In addition, GPC’s FCF enables it to continue to make strategic acquisitions of its NAPA stores from independent owners. GPC is ramping up on this effort, with 45 stores acquired during the last reported quarter, up from 33 stores in Q4 2023, and 16 stores in Q1 2023.

Importantly, GPC maintains a strong balance sheet with a BBB investment grade credit rating, and a safe 1.8x net debt to EBITDA ratio, sitting well below its internal target of 2.5x.

This lends support to the 3.1% dividend yield, which is well covered by a 41% payout ratio. It also comes with a 5.6% 5-year dividend CAGR and as mentioned earlier, 67 years of consecutive growth.

Risks to GPC include vehicle electrification, which may reduce demand for its automotive products and a slowdown in the economy may result in weakness in Motion segment.

It’s worth noting, however, that GPC is more diversified compared to peers like Autozone (AZO) and O’Reilly Automotive (ORLY) due to its Industrial exposure through Motion. Moreover, the increase in average age of vehicles by 2 months to 12.6 years this year bodes well for GPC’s NAPA replacement parts, and slowdown in EV sales along with increased adoption of hybrid vehicles also bodes well for GPC.

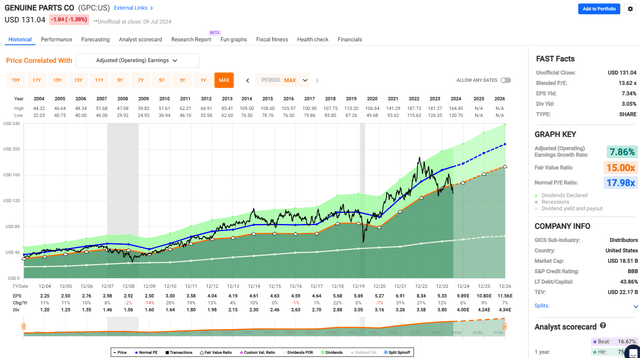

Lastly, I continue to see value in GPC at the current price of $131 with forward PE of 13.2, sitting far below its historical PE of 18.0, as shown below.

FAST Graphs

Sell side analysts who follow the company estimate 6-8% annual EPS growth over the next 2 years, which I believe is reasonable considering GPC’s margin growth this year and tailwinds stemming from the aforementioned strategy of acquiring stores and rise in average vehicle age. With a 3.1% dividend yield, around 7% annual EPS growth and potential for a reversion to mean valuation, GPC could provide investors with above average returns.

Investor Takeaway

Genuine Parts Company, known for its NAPA automotive parts brand, presents a good buy-the-drop opportunity for dividend value investors. It’s consistently grown revenue and profitability over the past five years, boasting a strong balance sheet, a 3.1% dividend yield, and 67 consecutive years of dividend growth.

Recently, it’s seeing improved segment margins and increased EPS guidance, supported by strategic store acquisitions and industry tailwinds. GPC’s diversified operations, favorable market conditions, and undervaluation relative to historical P/E ratios suggest potential market-beating returns for patient investors.

Read the full article here