Investment Thesis

Ford Motors (NYSE:F) is transitioning to EVs, which drew a lot of criticism in how the company is handling this transition. I wanted to take a look at the company’s financial situation and give some comments on the outlook regarding the transition. I believe that the company will continue to suffer in the short run, however, the financial situation isn’t particularly bad, with sales starting to pick up aggressively, which gives me some indication that the next stage of growth is well on its way. Therefore, I am assigning the company a buy rating for the long-term hold.

Financials

As of Q3 ’23, Ford had around $41B in cash and marketable securities against around $94B in long-term debt. This debt is made up of your usual debt like convertible notes and other unsecured debt financing, which was around $19B, while the rest of it belongs to the Ford Credit segment of the company that takes care of financing business of consumers and non-consumers. The majority of it is consumer-facing debt of about $75B. It is a lot of debt; however, I am going to focus on the debt that directly affects the automotive manufacturing side of the company, which is the $19B. There are a few metrics I like to look at to see whether the company is in trouble in terms of leverage. Many investors tend to avoid companies with excessive leverage because of the risks it carries, however, if we dig deeper, we can see that most of that debt is not directly going to affect Ford Motors itself. Sure, reputational risks posed by customers defaulting on their obligations, but it’s not a major issue in my opinion. So, let’s look at some metrics and the $19B in LT debt that is relevant to the automotive side.

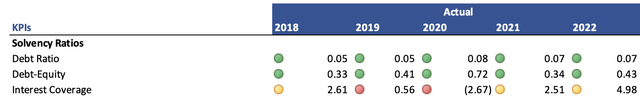

If we look at all of the debt the company has on its balance sheet, which is the short-term debt and long-term debt, Ford’s debt-to-assets ratio is still rather decent. It is hovering around 0.3 over the years, which is below my threshold of 0.6, so that’s good. Looking at the debt-to-equity ratio, it is also well within my threshold of 1.5. It’s stood at around .43 as of the latest quarter, so it’s well within the range. Lastly, I like to look at the interest coverage ratio. Ford doesn’t separate interest expenses for Ford Credit and lumps it in with the operating expenses. As of the latest quarter, the interest coverage ratio stood at around 6, which is a good improvement over the previous years. For reference, many analysts consider a coverage ratio of 2 to be healthy, but I think it’s a little too close for comfort and I usually look for companies that can cover annual interest expense at least 5 times with the operating income, so Ford passes on this too. So, it looks like the company is not at any risk of insolvency as it passed all three metrics.

Solvency Ratios of Ford (Author)

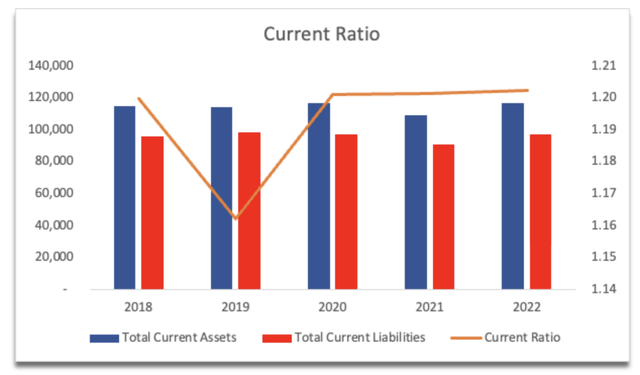

The company’s current ratio is also good enough and should have no problem paying off its short-term obligations as long as it stays above 1. I would prefer to see the ratio to be around 1.5-2.0, however, anything over 1 is good enough in many cases, therefore, Ford has no liquidity problems. As of the latest quarter, it stood at around 1.2 still.

Current Ratio (Author)

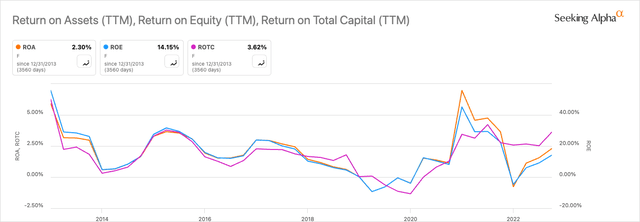

In terms of efficiency and profitability, the company’s ROA and ROE have been quite volatile due to the company’s bottom-line performance over the last 5 years. I don’t like seeing such volatility and would prefer a stable picture of efficiency, however, a positive to note here is that it has started to recover in the most recent quarter, which I don’t know how long it’ll last. The company’s ROTC has also been recovering, although quite small. I usually look for at least 10% here, but the low ROTC may be sector-wide.

Efficiency and Profitability (Seeking Alpha)

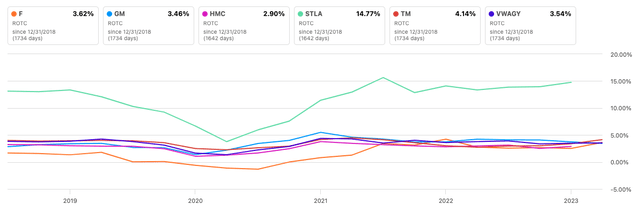

If we look at the company’s peers, we can see that the company’s ROTC is around in the middle of the competition, which means that it does look like it’s sector-wide (except for Stellantis (STLA)).

ROTC vs Competition (Seeking Alpha)

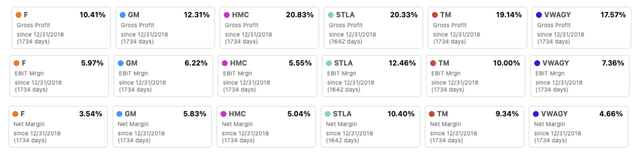

In terms of margins, compared to the competition, Ford is at or close to the bottom in all three. They do seem to be recovering slightly but the transition into EVs is going to pose some short-term pains.

Margins vs Competition (Seeking Alpha)

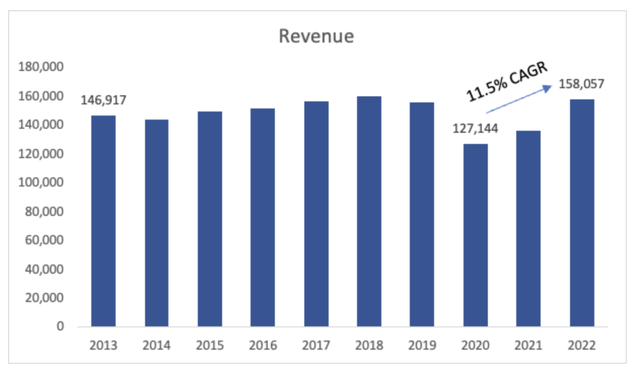

Ford’s revenues went nowhere in the last decade, which is not ideal I have to say, coupled with relatively low margins, it paints a bad picture of the company’s potential. If we look at the last 3 years of performance, the company managed to achieve around 11.5% CAGR. Does that mean its revenue growth has been revitalized? Hard to tell, however, analysts are predicting around 12% growth for FY23. Any predictions after that are just guesses, so I wouldn’t take anything to heart.

Revenue Growth (Author)

Overall, Ford’s financials aren’t the worst, but they do leave a lot to be desired. The redeeming and hopeful part of them is that the metrics are coming up in recent years, which may or may not become the new norm, and the revenues seem to be getting revitalized, however, it is too early to tell if the company has some sort of catalysts that will continue to play a huge roll in the company’s top-line growth, however, as you will see in the next section, the numbers are quite positive and good potential catalysts for better growth going forward.

Comments on the Outlook and Risks

I see many people on here saying that the company’s transition to EVs is going to be the demise of the company and that the trucks aren’t selling, especially when the company reported a 46% decline in sales of the F-150 Lightning pickups in Q3. Many bears said this was the end, as the demand for the vehicle slowed down massively. Fast forward to January ’24, the company released the numbers for domestic Q4 in which it showed that the company retained its top-selling status in the US and led across all gas, hybrid, and EVs. The company sold around 26k units across its EV offerings, with the F-150 up 74% for the quarter while Mustang Mach-E sales were solid also.

I like that the company did not jump straight into fully EVs as hybrid cars have still outsold the EV units and were up 55%. The gapping will be beneficial for the company until it fully transitions into EV space.

Contenders

There are some formidable opponents in the space of EV trucks. The Silverado (GM), which is Ford’s long-standing rival in the gas-powered truck market, will be released in the first half of ’24. It looks very promising; however, I am having a hard time believing that people will switch to a Silverado when they already own an F-150.

I also don’t think the Cybertruck (TSLA) will nab customers from Ford when it releases, as I believe the people who will be buying the Cybertruck are not the same as the people who own an F-150.

Another formidable opponent is Rivian (RIVN). It is stylish, but a newcomer. It outperformed the F-150 Lightning series during the third quarter, however, looking at the latest release, Ford outsold RIVN this quarter.

I think the big determinant will end up being the price. All the above-mentioned competitors of the Ford F-150 EV are much more expensive. Furthermore, the F-150 is already available for purchase, whereas a couple of the competitors are still yet to be released.

Margins Will continue to suffer

The transition is going to be painful; we can already see that by how the margins have deteriorated over the last while. I believe these are going to be short-term pains, after which the company is going to become much more efficient once it sorts all the kinks out. What will help the company’s margins is the announcement of price hikes for the F-150 Lightning models. The vehicle has been a top-selling product for over 4 decades, and I believe the increase in prices won’t affect the sales too much. It may deter some people; however, I don’t think the company would have raised prices if it didn’t think it was viable.

Valuation

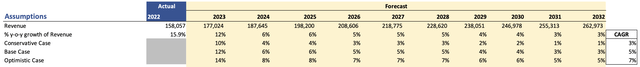

For revenue growth, I went with around 5% CAGR over the next decade, which incorporates the 12% estimates for FY23, after that I assume that Ford is going to slow down quite considerably but will not perform as badly as in the past. To cover my basis, I also included a conservative and an optimistic case. Below are those assumptions.

Revenue Assumptions (Author)

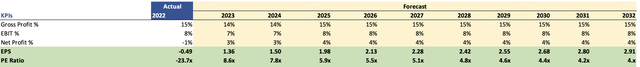

For margins and EPS, I went with a slight decrease in the next couple of years to account for the growing pains of transitions to EV. After that, the company will return to the margins seen at the end of FY22. I didn’t want to improve margins past that year for an extra margin of safety. Below are those assumptions.

Margin and EPS Assumptions (Author)

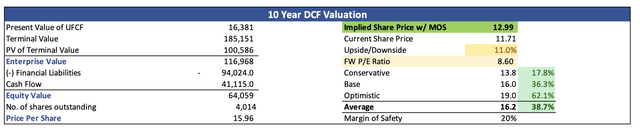

For the DCF model, I decided to use the company’s WACC of around 6.3% and a terminal growth rate of 2.5%. On top of these estimates, I went ahead and added another 20% margin of safety to the calculation just to give myself more room for error. With that said, Ford’s intrinsic value is around $13 a share, meaning the company is trading at a discount to its fair value.

Intrinsic Value (Author)

Closing Comments

Ford will continue to have growing pains for the next while, which may keep the company’s share price low, however, once the kinks have been sorted out, people will see that the company is making good strides in the EV sector and will be selling their new vehicles at a decent pace. The pickup trucks will continue to sell well and will continue to take the top spot, as I don’t see how people will be substituted for another truck that may be more reliable than the F-150, which I doubt, as there is a reason the truck is a top-selling vehicle for so many years now.

In the next 5 or so years, the company will be a very different animal. One that is going to be much more efficient after the transition and will continue to offer value for their customers.

Read the full article here