From my experience, many investors and speculators tend to conflate quality with value. In an ideal situation, you would buy into a company that is high quality in nature and that is trading at an attractive price. If you sacrifice on either of these two things, it increases the risk of subpar returns. In particular, you could have a really high quality business that has potential, but if the price is not right, upside can be limited or even nonexistent. When you then look at a company that has certain high quality attributes, but that is also showing weakness elsewhere, that risk becomes magnified.

This is the kind of situation that we have when looking at a financial institution by the name of Commerce Bancshares (NASDAQ:CBSH). Back in January of this year, I wrote an article that took a neutral stance on the firm. The company had seen some deterioration from a deposit perspective. Add on top of this how pricey shares were, and I could not rate the business any higher than a ‘hold’. Normally, when I give a company this rating, it is my statement that shares should see upside that would be more or less in line with the broader market for the foreseeable future. But since then, CBSH has actually fallen short of these expectations. While the S&P 500 is up 13.7%, shares of this institution have risen by only 2.9%.

To be clear, the company continues to have some problems. On the other hand, the quality of its assets are incredibly high and there are certain growth opportunities that shareholders can benefit from. In the long run, I think there is the potential for the business to do well for itself and its shareholders. But because of how the stock is priced, I still expect performance to be severely limited from where it has been.

Delving into Commerce Bancshares

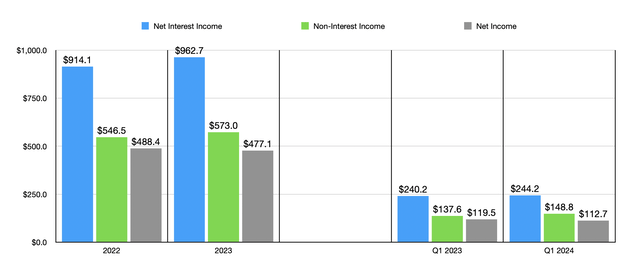

The best way to start this analysis would probably be to look at the most recent financial performance achieved by the firm. When I last wrote about the company, we had data covering through the third quarter of 2023. That data now extends through the first quarter of 2024. From an income statement perspective, the company has shown some weakness. To be clear, net interest income has risen nicely, growing from $240.2 million to $244.2 million. This seems to be due at least in part to an increase in the company’s net interest margin from 3.26% to 3.33%. While net interest income has grown, non-interest income has followed suit. Back in the first quarter of 2023, the company generated $137.6 million in non-interest income. That number in the first quarter of this year was $148.8 million.

Author – SEC EDGAR Data

You would think, with growth across both of these categories, that net profits for the business would be on the rise as well. But that, sadly, has not been the case. Net profits actually shrank, dropping from $119.5 million down to $112.7 million. The largest contributor to this was an increase in costs, primarily salaries and employee benefits and other miscellaneous expenses. Salaries and employee benefits expenses grew from $144.4 million to $151.8 million. Other costs, meanwhile, jumped from $19.3 million to $27.4 million.

Author – SEC EDGAR Data

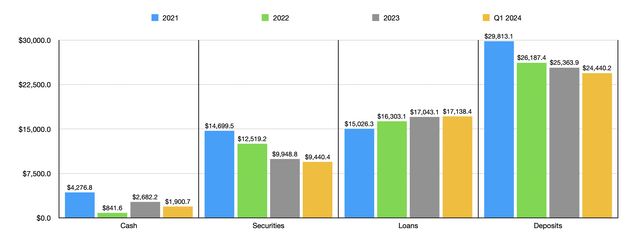

The income statement has not been the only source of weakness for the company. The value of deposits, for instance, has been declining. At the end of 2023, Commerce Bancshares had deposits totaling $25.36 billion. By the end of the first quarter of this year, deposits had declined to $24.44 billion. It’s unclear exactly why deposits fell by this amount. We do know that, in this time of high interest rates, depositors are looking for better returns elsewhere. This makes it more expensive for financial institutions wanting to grow their deposits. What we do know, thanks to management, is that the biggest decline in deposits came from a drop in certificates of deposit of $100,000 or more from $1.95 billion to $1.47 billion. This makes a lot of sense to me when you consider that those with larger deposit amounts would be more aware of the opportunities for funds to be allocated more optimally.

Author – SEC EDGAR Data

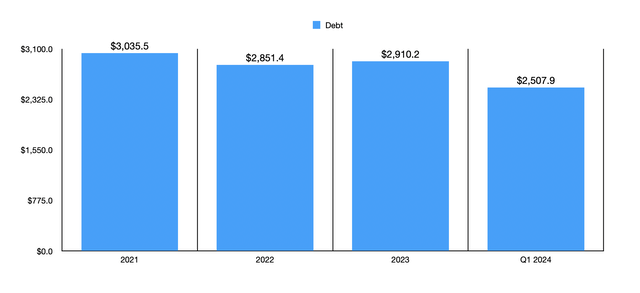

This is not to say that everything has been on the decline. Even though the value of securities fell from $9.95 billion at the end of last year to $9.44 billion this year, and as cash and cash equivalents dropped from $2.68 billion to $1.90 billion, the value of loans on the company’s books actually increased slightly from $17.04 billion to $17.14 billion. As disappointing as it is to see securities and cash drop, not all of this was because of weakness. Management actually made a concerted effort to reduce overall debt on the bank’s books. At the end of last year, debt totaled $2.91 billion. That number, as of the end of the most recent quarter, was $2.51 billion.

Author – SEC EDGAR Data

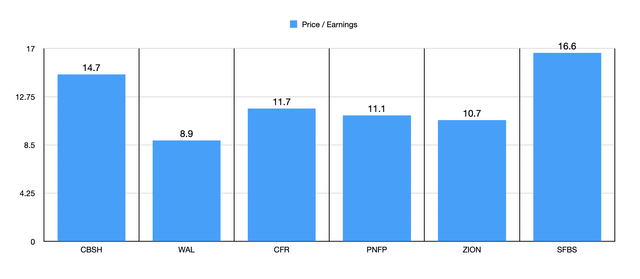

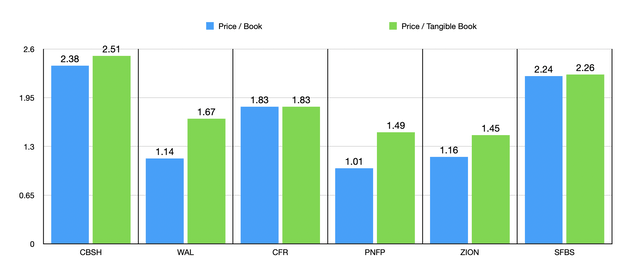

Purely from a valuation perspective, shares of Commerce Bancshares look anything but great. In the chart above, you can see the price to earnings multiple of the institutions stacked up against the price to earnings multiple of five similar firms. Four of the five ended up being cheaper than it. In the chart below, meanwhile, I compared the company to the same five businesses using both the price to book approach and the price to tangible book approach. And in each of these cases, it was Commerce Bancshares that was the most expensive of the group.

Author – SEC EDGAR Data

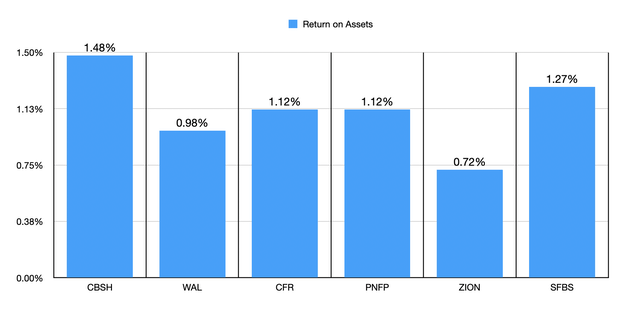

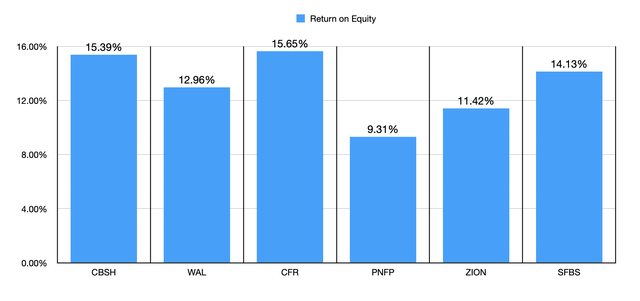

So to recap up to this point, we have a bank that has seen weakness on the bottom line because of increased costs, a balance sheet that is largely declining, and shares that are expensive, both on an absolute basis and relative to similar firms. Some of you might be wondering why I don’t rate the company a ‘sell’ because of these factors. And my answer is because there are some other positive things about the institution that investors should be aware of. For starters, in the first chart below, you can see the return on assets of the institution compared to the return on assets of the other companies I have already compared it to. With a reading of 1.48%, Commerce Bancshares is actually the highest of the six firms. And in the subsequent chart, the return on equity of 15.39% that the bank boasts places it higher than four of the five companies I compared it to.

Author – SEC EDGAR Data

Author – SEC EDGAR Data

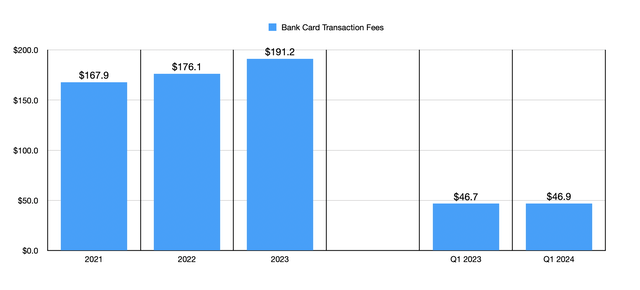

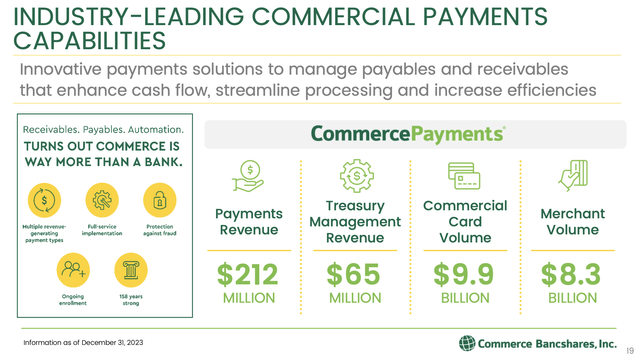

When you have a bank with high quality assets, a premium relative to similar firms can often be justified. But of course, we should touch on what those assets are. The fact of the matter is that Commerce Bancshares has a robust set of non-banking operations that generate significant revenue and profits for the enterprise. In 2023, for instance, 37.3% of the firm’s net revenue came from non-interest income. Over the past few years, the fastest growing portion of this non-interest income has involved bank card transaction fees. From 2021 through 2023, these fees expanded from $167.9 million to $191.2 million. And in the first quarter of 2024, the $46.9 million that the company generated was slightly above the $46.7 million generated just one year earlier.

Author – SEC EDGAR Data

While some of these fees come from merchant activities, debit cards, and credit cards, the largest chunk actually comes from corporate cards. These are commercial card products that offer cash rewards to corporate card holders. Gross revenue associated with these activities totaled $220.2 million. But after factoring out network charges and rewards, net corporate card fees totaled $110.6 million last year.

Commerce Bancshares

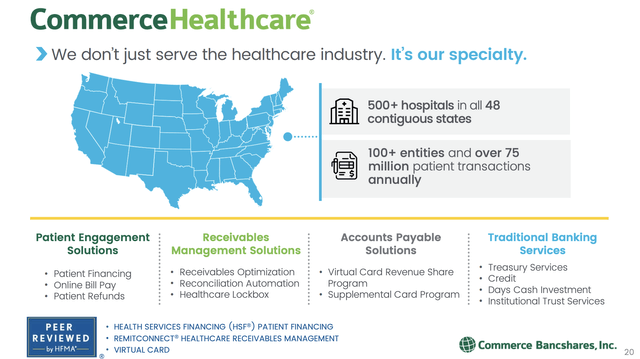

Truly, Commerce Bancshares does boast a significant market presence when it comes to some of these activities. In 2023, for instance, the firm saw commercial card volume totaling $9.9 billion. During the year, the company processed merchant volumes of $8.3 billion as well. Plus, it is engaged in a few other interesting activities. For starters, CommerceHealthcare is a service that the institution makes available to over 500 hospitals spread across 48 states. They processed over 75 million patient transactions and provide services involving patient financing, online bill paying, receivables management solutions, accounts payable solutions, and even traditional banking services.

Commerce Bancshares

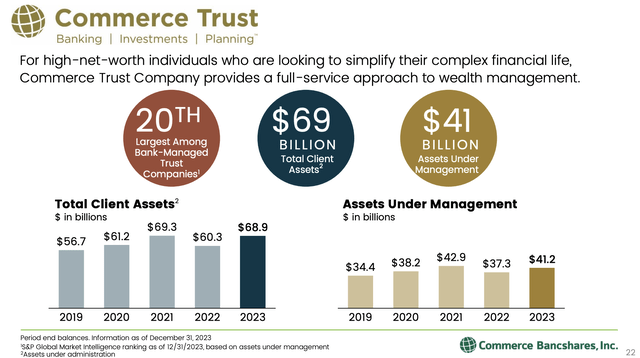

Amongst other things, the institution also has a trust business that caters to high-net-worth individuals. Total client assets under these full-service wealth management functions came in at $69 billion as of the end of last year. Total assets under management is still recovering from a decline seen from 2021 to 2022. But at $41.2 billion, the firm is definitely well established in this space.

Commerce Bancshares

Takeaway

On the banking side of things, I must say that Commerce Bancshares is not exactly an ideal prospect. It also doesn’t help how pricey shares are, the increase in costs that the business saw, and some of the changes in its balance sheet. Having said that, the company does have some high-quality assets that would typically justify a premium. My only problem is that the premium in question that is being demanded by the market seems awfully high even after factoring in asset quality. Because of this, I cannot help but to keep the company rated a ‘hold’ at this time.

Read the full article here