For several quarters now, weaker consumer spending has splashed across financial headlines, especially with softer macro conditions in China, the world’s largest emerging market. These conditions had taken a toll on Canada Goose (NYSE:GOOS) especially, the purveyor of incredibly expensive down jackets and parkas.

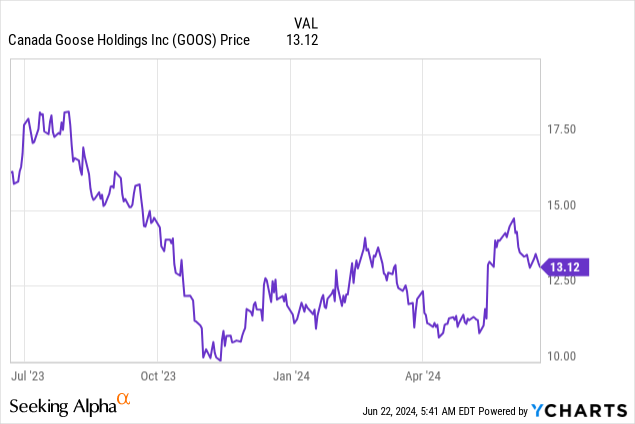

And yet, as the rest of the stock market continues to rally and look frothy from a valuation perspective, Canada Goose is starting to look more and more interesting as it stages its own fundamental recovery. Year to date, the stock’s ~15% rise has lagged the S&P 500 and tech stocks in particular, but I think there’s a reason to believe in further upside ahead.

While risks remain, several factors to be optimistic about

I last wrote a bearish article on Canada Goose in December, when the stock was trading at similar levels, just under $13. Since then, however, the company has issued very strong fiscal Q4 results that showcased tremendous strength in the all-important winter quarter, with an especially notable return to growth in China, the company’s most important market. In addition to that, Canada Goose has also released an optimistic FY25 outlook that calls for continued double-digit profit expansion. With this in mind, and considering the heightened valuations in the rest of the market, I’m boosting my rating on Canada Goose back up to neutral.

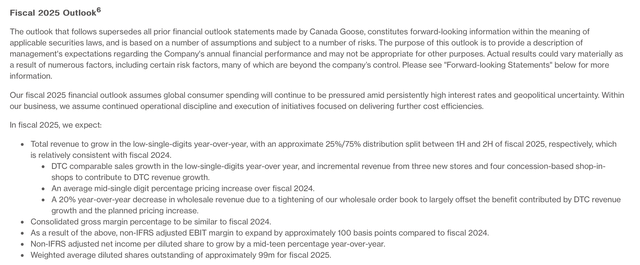

At current share prices, I now see a more balanced argument in favor of Canada Goose. On the bright side for the company, the first thing to note is the company’s optimistic outlook for FY25 (which for Canada Goose is the year ending in March 2025):

Canada Goose FY25 outlook (Canada Goose Q4 earnings release)

The company is expecting low single-digit revenue growth this year, which is driven by a combination of continued DTC growth (the company has launched new retail outlets, including in China and in Hawaii), alongside a mid-single digit increase in pricing, which is an appropriate move as inflation has spread across products and luxury brands have historically shown more inelastic behavior.

In addition to this, Canada Goose has also been very mindful of cost. In March 2024, the company enacted layoffs impacting 17% of its corporate (non-retail) headcount, and this is after a ~10% reduction in mid-2023. The savings from the most recent round of layoffs, after factoring in planned reinvestments back into headcount in 2025, is expected to achieve C$25 million in annual savings, or roughly ~2% of the company’s annual revenue – an important driver for margins.

We note as well that the company has seen growth shoot back in China – we’ll discuss this in further detail in the next section.

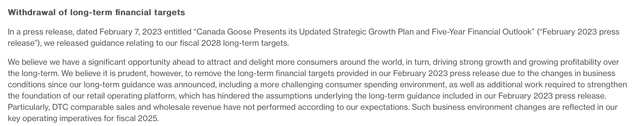

That being said, however, a number of risks still remain for Canada Goose. The company noted that its longer-term visibility has been severely reduced given choppy sales trends over the past year, and the company has since withdrawn its long-term operating targets that it had set for the year FY28, citing difficult trends particularly in the wholesale channel.

Canada Goose outlook withdrawal (Canada Goose Q4 earnings release)

Wholesale contraction, in my view, represents the largest risk for Canada Goose. Even amid expected single-digit growth in FY25, the company is expecting a ~20% y/y decline in wholesale revenue this year. While a positive driver for margins as more sales mix into DTC, wholesale doors help Canada Goose expand its brand reach beyond what its own store and website network can achieve. Less prominent wholesale placement may contract Canada Goose’s brand positioning overall, and also require the company to commit more of its capex to build out more stores.

Valuation checkup

This being said, however, we do have to note that Canada Goose trades at modest multiples.

For the current year FY25, Wall Street analysts are currently expecting $0.84 in pro forma EPS (in U.S. dollar terms), which represents 17% y/y EPS growth – consistent with the company’s own outlook of mid-teens EPS growth this year.

This puts Canada Goose’s stock at a 15.6x FY25 P/E multiple, and its PEG ratio at 0.9x (wherein a <1x multiple typically represents a company that’s cheap for its expected earnings growth). When the S&P 500 is trading at >21x FY25 EPS expectations, I’d say diversifying into Canada Goose is a smart bet.

Don’t get me wrong: this isn’t a gung-ho safe buy yet. But wading into a cautious position here or putting this stock on the watch list to buy on the next dip makes a lot of sense when a number of fundamental factors are looking brighter.

Q4 recap

Q4 results, in particular, helped to revive some optimism in Canada Goose. Take a look at the Q4 results below:

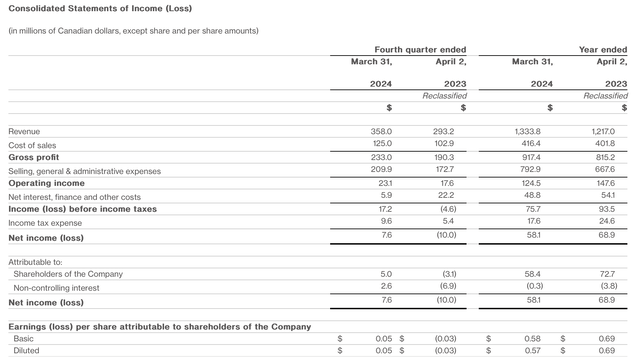

Canada Goose Q4 results (Canada Goose Q4 earnings release)

Canada Goose’s revenue grew 22% y/y to C$358.0 million, which accelerated versus 5% y/y growth in Q3. Note that Q3 and Q4 (September through March) represent more than three-quarters of the company’s revenue, as the company’s winter products are highly seasonal.

As expected, wholesale revenue declined -8% y/y. Management noted that channel partners have been far more cautious in placing inventory orders, a trend that it expects to recur and worsen in FY25 (with -20% decline expected). Still, DTC growth and price increases have been able to offset this.

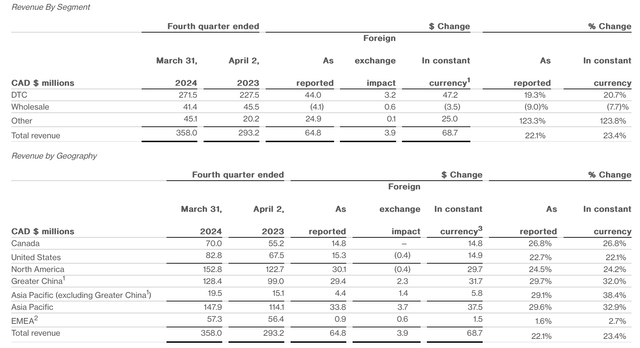

Canada Goose sales by segment (Canada Goose Q4 earnings release)

The more impressive metric was Greater China’s return to 30% y/y revenue growth: at C$128.4 million of total revenue, China is by far Canada Goose’s largest sales region (~50% greater than the U.S., and nearly equal to the U.S. and Canada combined). On a constant currency basis, growth would have been even stronger at 32% y/y.

The company’s CFO, Neil Bowden, noted that China’s performance was especially impressive after comparing against a strong Q4 last year; though this benefit was partially muted by softer performance in Europe, where competitors have been more aggressive on pricing and promotions. Per Bowden’s remarks on the Q4 earnings call:

Breaking this down further, first, from a sales channel perspective, store comps were relatively flat, while e-commerce experienced outsized positive performance, mainly on the strength of improved return levels this year compared to last year. Store sales represented over 70% of our overall D2C revenue, both in Q4 and for the full fiscal year.

Second, at the regional level, both North America and Asia Pacific delivered comparable sales growth in the mid-single digits during the quarter. This performance was noteworthy, especially in Asia Pacific, as the region comped against a very good Q4 in fiscal 2023. EMEA experienced a more promotional environment among both competitors and wholesalers, which challenged our D2C execution. A note on our sales per square foot.”

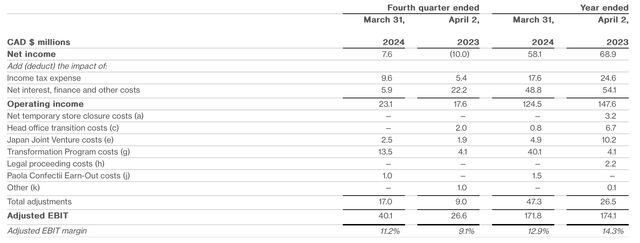

The company also expanded adjusted EBIT margins by 230bps y/y to 11.2%, which was buoyed in part by a 20bps y/y rise in gross margins:

Canada Goose margins (Canada Goose sales by segment)

Key takeaways

Canada Goose will move into the “boring” summer quarters, but investors still need to cautiously watch for the company’s remarks on wholesale stocking behavior ahead of the fall and winter season. I’m optimistic about Canada Goose’s return to growth in China and its modest valuation against expected mid-teens EPS growth this year, but this isn’t a stock to make a huge bet on just yet.

Read the full article here