We previously covered ASML Holding N.V. (NASDAQ:ASML) (OTCPK:ASMLF) in October 2023, discussing how the October 2023 bottom was highly attractive for investors looking to dollar cost average, significantly aided by Taiwan Semiconductor’s (TSM) commentary on the near bottoming of the semiconductor market.

Combined with its 20Y moat, we had maintained our optimism on its long-term prospects while reiterating our Buy rating on the stock.

In this article, we shall discuss why we believe that ASML’s 2024 commentary has been on the cautious side, with multiple Big Tech companies and data center REITs reporting growing appetite for cloud computing/ generative AI services and infrastructure related spending.

However, with the stock already recording massive recoveries since the recent October 2023 bottom, we recommend interested investors to wait for a more attractive entry point for an improved upside potential.

The Semiconductor Investment Thesis Remains Insatiable

For now, ASML has reported a bottom line beat in its FQ3’23 earnings call, with revenues of €6.67 billion (-3.3% QoQ/ +15.5% YoY) and GAAP EPS of €4.81 (-2.4% QoQ/ +12.1% YoY).

While its bookings have notably decelerated to €2.6B (-42.2% QoQ/ -70.7% YoY), the overall backlog remains more than robust at over €35B, implying that its capacity are still fully booked through the next five or six quarters.

Much of ASML’s booking deceleration is attributed to the delayed capex from multiple foundries, such as TSM and Samsung (OTCPK:SSNLF), with Intel (INTC) and Micron (MU) being the few exceptions thus far.

However, we believe that the headwinds may not last long, with the Semiconductor Industry Association already reporting excellent growth in the global chip sales to $48B for November 2023 (+2.9% MoM/ +5.3% YoY), with it marking the first growth in over a year.

There is still great demand for cloud computing post pandemic and generative AI services, with multiple Big Tech companies already projecting higher infrastructure data center capex ahead. The list includes Amazon.com, Inc. (AMZN), Microsoft Corporation (MSFT), Alphabet Inc. (GOOG) (GOOGL), and Meta Platforms, Inc. (META).

Multiple data center REITs have also reported growing leases with higher rates, with demand being gated by capacity and construction/ power requirements, including Iron Mountain (IRM) and Digital Realty Trust (DLR).

Combined with the projected expansion in the global semiconductor capacity to 30M wafers per month in 2024 (+6.4% YoY), up from the 29.6M wafers per month reported in 2023 (+5.5% YoY), we believe that the ASML’s flat 2024 net sales guidance may have been more on the cautious side.

For now, the management’s prudence is a good thing indeed, because any top/ bottom line beats may trigger the stock’s upward movement ahead.

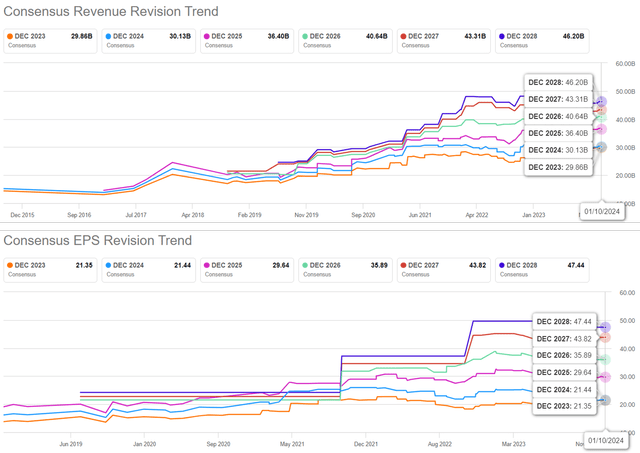

The Consensus Forward Estimates

Seeking Alpha

The consensus has also maintained their forward estimates, with ASML expected to generate a top and bottom line expansion at a CAGR of +16.2% and +24.1% through FY2025.

This is compared to the previous estimates of +15.9%/ +26.1% and its historical growth at +20.9%/ +26.6% between FY2016 and FY2022, respectively.

As a result of its profitable growth trend, we believe that ASML remains well poised as one of the most important companies globally, with another being TSM, no matter the ongoing geopolitical concerns surrounding the trade curb, with it only “impacting a small number of customers in China.”

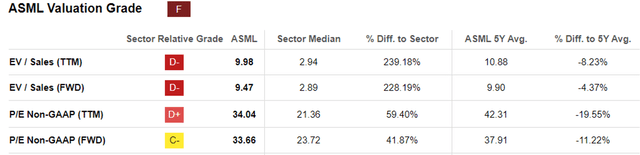

ASML Valuations

Seeking Alpha

And it is for these reasons, we believe that ASML deserves its premium FWD EV/ Sales valuation of 9.47x and FWD P/E valuation of 33.66x, compared to its 1Y mean of 9.03x/ 32.60x, 3Y pre-pandemic mean of 6.34x/ 26.80x, and the sector median of 2.89x/ 23.72x, respectively.

Its moat in the advanced semiconductor lithography equipment is undisputed as well, with Canon’s (OTCPK:CAJPY) (OTCPK:CAJFF) alternative lithography offerings unlikely “to replace EUV machines,” with the latter’s price being one digit lesser.

This is the case of when one gets the quality that they pay for, with TSM and INTC likely to be loyal ASML customers as the leading edge global foundries.

So, Is ASML Stock A Buy, Sell, or Hold?

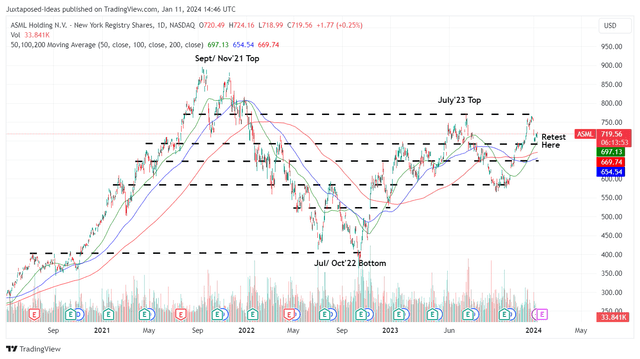

ASML 4Y Stock Price

Trading View

Now that the Chinese trade ban has been announced, ASML’s stock has reversed its upward momentum, quickly plunging after the news, but also bouncing off its previous support levels of $690s.

Based on the management’s FY2023 guidance, with revenues of €27.52B (+30% YoY), gross margins of 51% (+0.5 points YoY), stable quarterly operating expenses of ~€1.31B, and ~15% in income tax (inline YoY), it appears that we may see an approximate net income of €7.47B (+32.9% YoY).

Combined with its decreasing FQ3’23 share count of 393.7M (-0.2M QoQ/ -2.9M YoY), we may see ASML record exemplary FY2023 adj EPS of €19.00 (+34.4% YoY) indeed, or the equivalent of $20.90 based on the foreign exchange at the time of writing.

Thanks to the recent correction and its premium P/E valuation of 33.66x, the stock appears to be trading near its fair value of $703.50 as well. Based on the consensus FY2025 adj EPS estimates of $29.64, there appears to be an excellent upside potential of +38.9% to our long-term price target of $997.60.

At the same time, ASML offers a token dividend yield of 0.85%, allowing investors to regularly DRIP on a quarterly basis no matter the volatility in the stock market, as we have similarly done.

As a result of the excellent dual pronged (prospective) returns, we continue to rate the ASML stock as a Buy, though with no specific entry point since it depends on individual investors’ dollar cost average.

Based on the lifting market sentiments attributed to the cooling inflation and the Fed’s speculative pivot from Q1’24 onwards, it appears that we may not see another low entry point of $580s, with the stock already rallying by +24.1% since the recent October 2023 bottom.

With the stock market already entering extreme greed territory, investors may want to observe ASML’s stock movement for a little longer and add upon a moderate pullback, preferably at its previous support levels of $650s for an improved margin of safety.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here