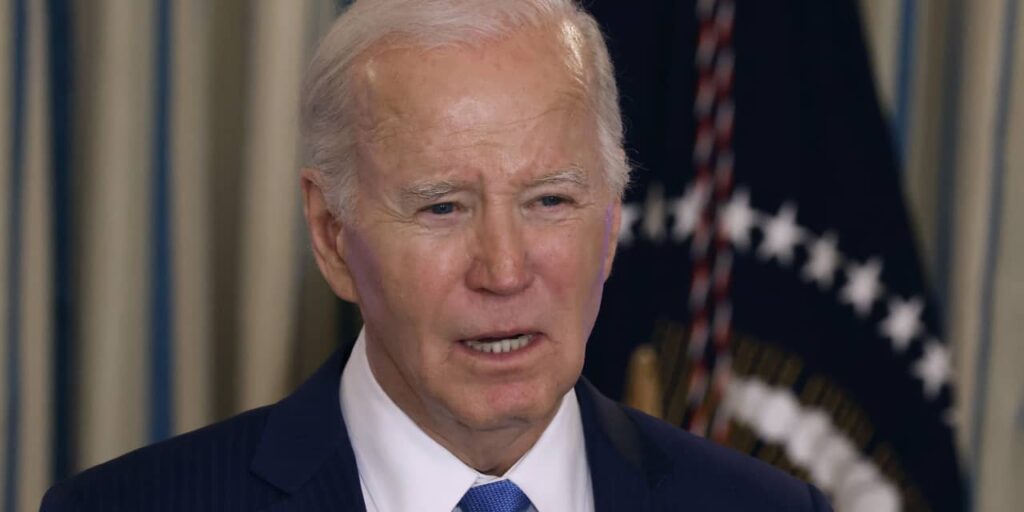

With home prices at an all-time high, the Biden administration is planning to address rising housing costs with a slew of new programs to boost supply, officials announced on Thursday.

The White House announced that multiple federal agencies will use government programs to encourage the construction of affordable rental and manufactured housing. That’s on top of the federal government offering nearly $4 million in research grants to explore new ways to boost inventory, including office-to-residential conversions.

The announcements come as the U.S. housing market faces a drastic shortfall of homes due to a decade-plus of under-building. Based on data documenting the number of households formed in 2023, the nation is short of 2.5 million homes, including both single-family homes and apartments, according to Realtor.com.

That persistent lack of inventory has driven U.S. home prices to an all-time high. Many homeowners who bought during the pandemic are effectively locked into their homes due to their relatively rock-bottom mortgage rates, and either unwilling or unable to sell.

The number of apartments under construction is now at the highest level since the 1970s, when the federal government began tracking the data, which is helping to bring down rents and ease renters’ housing costs.

But that’s not enough, Adrianne Todman, deputy secretary of the U.S. Department of Housing and Urban Development, told MarketWatch in an interview. She said that the new policies would address housing costs for renters and some home buyers.

“One of the things we want to do is ensure that the American people have access to affordable rental units,” Todman said.

The strategy behind the actions on Thursday is “really centered around making sure that there is affordability in a housing market for families who need it the most,” she added.

Among the policies announced is an extension of a risk-sharing initiative between the Federal Housing Administration and the Federal Financing Bank. The program provides capital to state and local housing-finance agencies to continue to offer FHA-insured multifamily loans at reduced interest rates to build affordable rental housing.

“Building housing is expensive,” Todman said. “What this program will do is not necessarily make it less expensive to build the housing, but allow there to be more federal resources involved in building the units, thereby making it more affordable for families to live there.”

The extension will build around 38,000 housing units over the next 10 years, the FHA estimated.

“From a renter’s perspective, what they will see is more units coming online in their neighborhoods, across states, and more opportunity to find a rental unit that is affordable to them,” Todman added.

The federal government is also working to increase the availability and affordability of manufactured homes. Manufactured housing refers to homes built off-site at factories, before being moved to where they are set. It can also refer to mobile homes.

Under the new policy, HUD would update how it calculates loan limits for the manufactured-home loan program so that it is viable for people to buy them, as well as to encourage lenders to participate in the program and originate loans to interested buyers.

Around 22 million people live in manufactured housing, the government said.

“Manufactured homes are an important part of the nation’s lower-cost housing stock, yet many families, especially historically underserved communities, lack access to safe and affordable financing for these homes,” Rachel Siegel, senior officer with the nonprofit Pew Charitable Trusts’ housing-policy initiative, said in a statement.

The announcement is also “a major step towards improving access to financing for thousands of American families that are shut out of today’s housing market,” Siegel added.

The White House’s announcement also said it was banning fees such as application and screening fees for government-subsidized housing vouchers; issuing new policies to reduce evictions; and protecting renters from flawed tenant-screening reports.

How have higher home prices affected your life and how you think about the U.S. economy? Let us know at readerstories@marketwatch.com. One of our reporters might reach out to you to learn more.

Read the full article here