ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is seeing a robust profit upswing for its container shipping business and the company announced that it will pay a dividend for the first quarter as well.

A recovery in freight rates as well as a volume recovery has led to ZIM Integrated Shipping Services returning to a positive profit trajectory, which could pave the way for many more dividends to come.

I think that ZIM Integrated Shipping is poised for a sustained recovery which could not only equate to a consistent return of quarterly dividend payments to shareholders, but ZIM also finally has a catalyst for a re-rating that investors have been waiting for so long.

My Rating History

Improving freight pricing trends resulted in a stock classification of ‘Buy’ in April, as I speculated that ZIM Integrated Shipping could indeed announce the resumption of dividend payments soon.

Since the shipping company profited from a nice upsurge in profitability in 1Q24, amid both rising sea freight prices and high volumes, I think that the risk/reward relationship has much improved. Thus, my new stock classification for ZIM Integrated Shipping’s stock is ‘Strong Buy.’

The Profit Recovery Is Finally Here

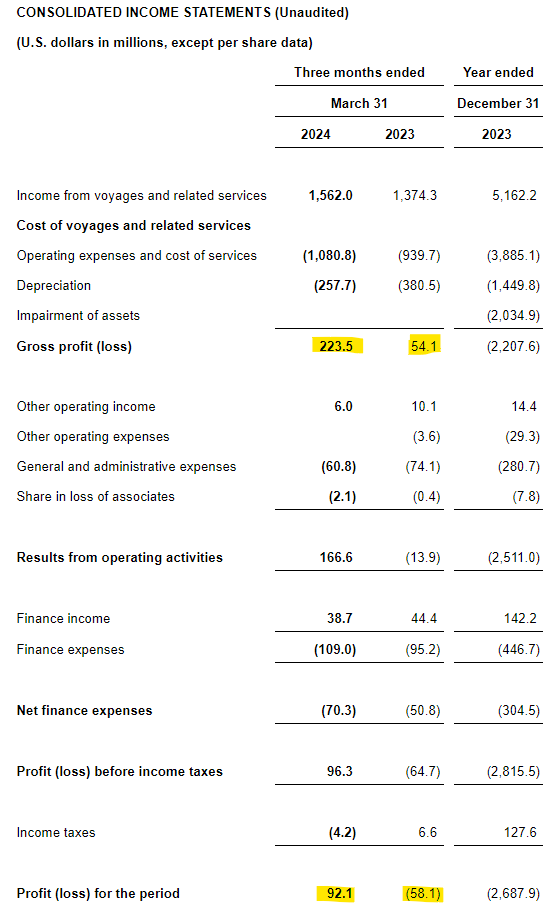

Only a quick glance at ZIM Integrated Shipping’s 1Q24 reveals how profoundly impactful the recovery in shipping rates was as of late: The shipping company earned a gross profit of $223.5 million in 1Q24 on total sales of $1.56 billion, reflecting a 4x increase compared to the year ago period.

The company also returned, finally, to positive net profits which skyrocketed to $92.1 million. In the year ago period, ZIM Integrated Shipping lost money, as it did in the fourth quarter.

Consolidated Income Statements (ZIM Integrated Shipping Services)

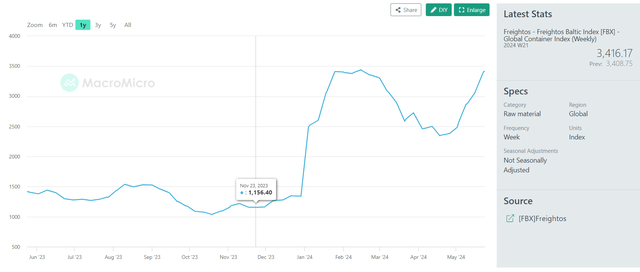

The Freightos Baltic Index, a container pricing index, has seen a sharp increase in sea freight prices in 2024. The Freightos Baltic Index shows that the sea freight price for a 40’ container started to increase drastically at the start of the year, with prices topping out at $3,440 in the middle of February.

Subsequently, prices consolidated for a short period of time, but are now at $3,416 per 40’ container and poised to possibly make new highs as well. The strong surge in freight prices is a result of growing demand for shipping.

Freightos Baltic Index (MacroMicro)

My positive outlook for ZIM Integrated Shipping relates to two considerations:

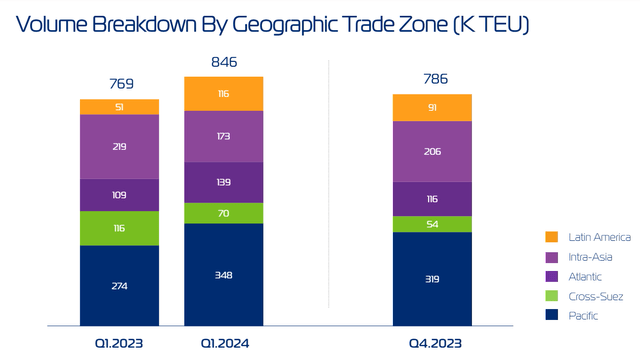

Firstly, the most encouraging aspect of ZIM Integrated Shipping’s first quarter earnings was not the recovery in sea freight rates, which was well-understood way before the company reported 1Q24 earnings. I think the most encouraging piece of information was that the company enjoyed a solid container volume recovery in the first quarter.

ZIM Integrated Shipping transported 846K TEU (twenty-foot equivalent unit) in the first quarter, reflecting a 10% jump compared to the year ago period. The volume jump together with the price increases for container shipping resulted in a quite substantial reversal of fortune for ZIM Integrated Shipping in 1Q24, as far as net profits were concerned.

Volume Breakdown By Geographic Trade Zone (ZIM Integrated Shipping Services)

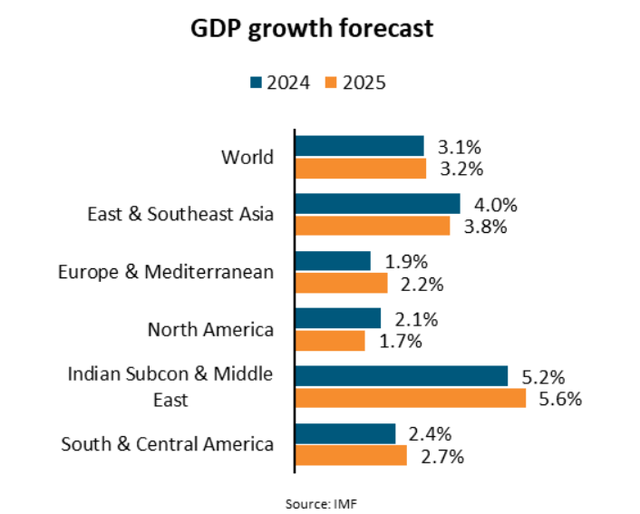

Secondly, the odds of an ongoing recovery in shipping container volumes as well as favorable sea freight pricing trends are robust, in my view, primarily because the IMF’s projects robust global economic growth in 2024.

With ZIM Integrated Shipping also revising its profit forecast for 2024, primarily due to growing demand reasons, I think that shipping rates as well as cargo volumes are poised to see sustained growth tailwinds this year.

GDP Growth Forecast (IMF)

Due to volume growth and higher shipping prices, ZIM Integrated Shipping revised its outlook for adjusted EBIT upward as well: The shipping company now anticipates to earn adjusted EBIT of $0 to $400 million, compared to a prior guidance of $(300) million to $300 million.

Profit Recession Is In The Rear-View Mirror

ZIM Integrated Shipping’s first quarter business activities resulted in $92 million in net profit.

Since the company laid out its dividend policy in advance (which states that the company will pay out 30% of its profits on a quarterly basis in case its net profit is positive), ZIM Integrated Shipping announced that it would pay a $28 million, $0.23 per-share 1Q24 dividend.

The dividend will be paid to shareholders on June 11, 2024 with the record date of June 4, 2024. Based on a $0.23 per-share dividend pay-out, ZIM is set to have a gross yield of 1% (before with-holding taxes).

While this yield may not yet be great enough to lure passive income investors back into buying the stock, I think it is only the first dividend and many more are set to follow, particularly if ZIM Integrated Shipping succeeds in clawing its way back to consistent profitability in a rising shipping market.

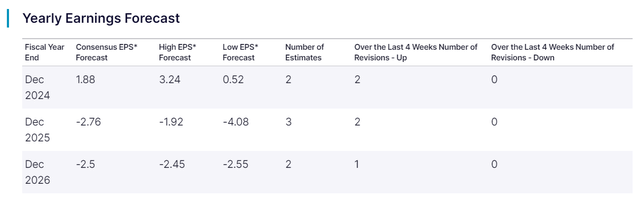

Most importantly, with demand for shipping picking up again, investors are seeing profound movement in terms of profit estimates. The market actually already models positive earnings of $1.88 per share, on a consensus basis, for 2024.

This means that ZIM Integrated Shipping’s stock is presently selling for a very modest 11x earnings multiple (based on present year estimated profits) which is a steal, particularly when ZIM’s dividend potential is considered. In 2022, for instance, the company paid a whopping $27.55 in gross dividends.

I am not saying that we are immediately going to return to this level of dividend, but what I am saying is that we could be at the beginning of a new shipping cycle that could lead to a steady flow of dividends throughout the year.

Yearly Earnings Forecast (NASDAQ)

I think that ZIM Integrated Shipping, with an improved profit outlook and a return to consistent profitability, has substantial re-rating potential. Earning $3 per share in 2024 is a distinct possibility (and probably a low estimate) as ZIM earned $0.75 per share on a diluted basis in 1Q24. Three dollars per share and a 11x multiple leads us to an implied intrinsic value of $33 (assuming no multiple expansion in a rising shipping sector).

With the stock selling for just about $22 now, 50% upside is totally realistic, in my view. And this return doesn’t even include the payment of dividends.

Why My Investment Thesis Might Be Misguided

Spiking shipping rates obviously are a huge boon to cash-strapped shipping companies that fell into a deep profit recession last year. Thus, a deterioration in the pricing trend for shipping containers would probably have a severely negative effect on the profit prospects of ZIM Integrated Shipping.

A cargo volume contraction might also be an early indication that the sector is experiencing some more serious headwinds.

My Conclusion

ZIM Integrated Shipping’s profit recession is in the rear-view mirror, in my view, and the clearest indication that this is the case lies in the fact that the shipping company drastically revised its forecast for 2024 EBIT.

The appearance of a net profit on the company’s 1Q24 statements is a positive as well, as is the increase in container volumes and the context of rising sea freight rates.

The macro outlook is favorable, and the market is now modelling a return to full-year profitability, which is a drastic change compared to last year.

Yes, the dividend is back, with is great, but I am even more excited about ZIM’s potential to grow its valuation in a rising shipping market.

Read the full article here