Gold, silver, and platinum all have different degrees of moneyness and this largely explains their price action. Gold is the purest form of money due to its intrinsic usefulness combined with its high stock-to-flow ratio of around 70-80x, meaning that the above ground stock of the metal is many multiples of the metal’s annual mining supply. Silver has a significantly lower stock-to-flow ratio estimated at between 20-50x, but it is still much higher than that of platinum which is often as low as 1x.

The different monetary and industrial characteristics have significant implications for how the metals prices change over time in response to economic fundamentals. While gold is seen as an inflation hedge, its price is driven more by changes in real interest rates, with changes in inflation expectations having only a minor impact on the metal. This contrasts with platinum, and to a lesser extent silver, which are more responsive to changes in inflation expectations. The table below shows the rolling correlation of each metal with inflation expectations, interest rate expectations, and real interest rate expectations.

| Gold | Silver | Platinum | |

| Inflation Expectations | 0.13 | 0.25 | 0.36 |

| Nominal Bond Yields | -0.26 | -0.1 | 0.08 |

| Real Bond Yields | -0.44 | -0.35 | -0.20 |

Rolling 100-day correlation with 10-year US breakeven inflation expectations, 10-year US bond yields, and 10-year US inflation-linked bond yields since 2004.

Gold: An Alternative To Fiat Money

Due to its high stock-to-flow ratio gold prices are driven primarily by changes in demand rather than supply. Over the long term this demand tends to be driven by the supply of fiat money in the economy, while in the short term it is driven largely by the real interest rate on fiat money.

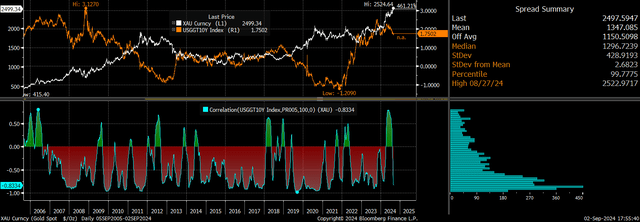

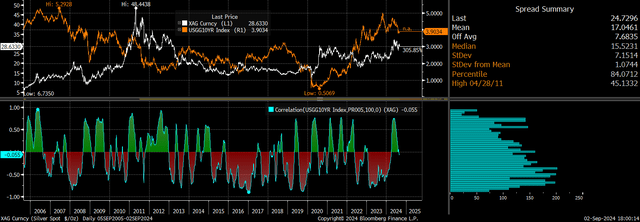

Demand for gold rises when the opportunity cost of holding the metal declines, which occurs when the expected interest rate on fiat currency falls relative to the expected rate of inflation. This can be captured in the close inverse relationship between gold and 10-year US inflation-linked bond yields.

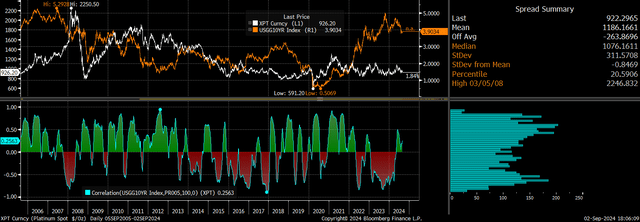

100 day rolling correlation between gold and US 10-year inflation-linked bond yields (Bloomberg)

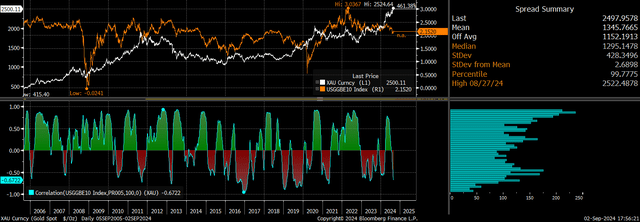

Note that rising inflation expectations on their own tend to have only a positive impact on gold prices. This may seem counterintuitive given that gold is widely seen as a hedge against inflation, but the weak correlation between gold and inflation expectations reflect the tendency for rising inflation expectations to drive up interest rate expectations to the detriment of gold demand.

100 day rolling correlation between gold and US 10-year breakeven inflation expectations (Bloomberg) 100 day rolling correlation between gold and US 10-year bond yields (Bloomberg)

Silver: An Industrial And Monetary Metal Hybrid

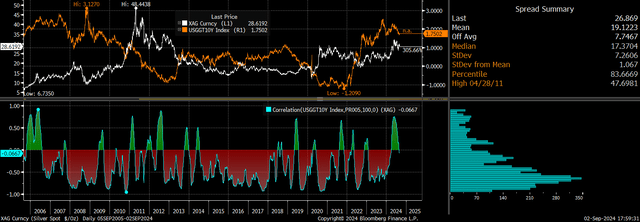

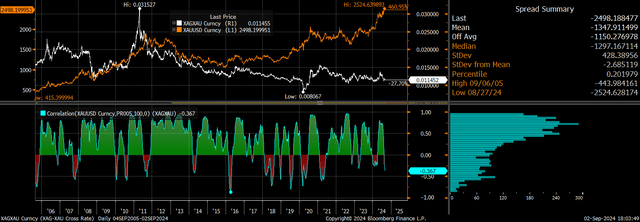

Silver is driven in part by monetary demand and in part by industrial demand. Like gold, silver is driven by fiat money supply over the long term, but in the short term it is driven in equal parts by monetary demand as a store of value and industrial demand.

100 day rolling correlation between silver and US 10-year inflation-linked bond yields (Bloomberg)

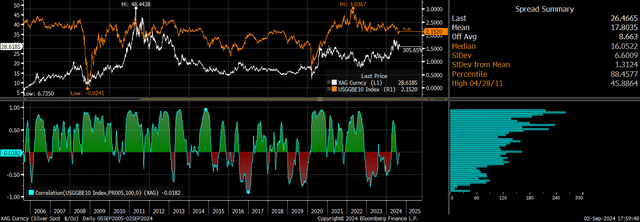

As a result, silver tends to be more positively impacted by rising inflation expectations and less negatively impacted by rising bond yields as these conditions tend to reflect rising economic growth expectations, which benefit industrial commodity demand. This also explains why silver is slightly less negatively correlated with real bond yields when compared with gold.

100 day rolling correlation between silver and US 10-year breakeven inflation expectations bond yields (Bloomberg) 100 day rolling correlation between silver and US 10-year bond yields (Bloomberg)

Another interesting feature about the price of silver is that although it has underperformed gold over the past two decades, it has actually outperformed during periods of gold strength. This can be seen in the chart below, which shows the rolling correlation between the gold price and the silver/gold ratio. Most of the time, if gold is up, silver is up even more, while if silver is up, it is almost guaranteed to be up by more than gold. This is because silver is a smaller market and can therefore more easily be driven up during periods of speculative demand for precious metals.

100 day rolling correlation between gold and the silver/gold ratio inflation (Bloomberg)

Platinum: An Industrial Metal With Monetary Qualities

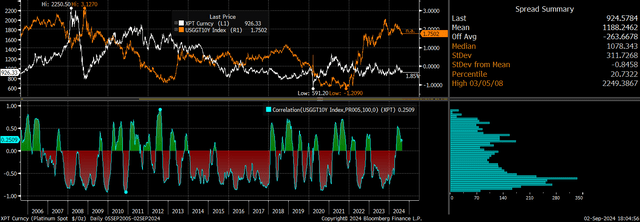

While platinum has a degree of moneyness its low stock-to-to flow ratio means mine supply is a much more critical factor in driving prices and demand is driven much more by industrial use, with investment only representing about 10% of total demand on average.

100 day rolling correlation between platinum and US 10-year inflation-linked bond yields (Bloomberg)

As a result, the metal is much less dependent on changes in real bond yields. In contrast, platinum is driven more by inflation expectations, while rising bond yields tend to be slightly positive for the metal as they tend to reflect periods of economic strength which are supportive for industrial demand.

100 day rolling correlation between platinum and US 10-year breakeven inflation expectations (Bloomberg) 100 day rolling correlation between platinum and US 10-year bond yields (Bloomberg)

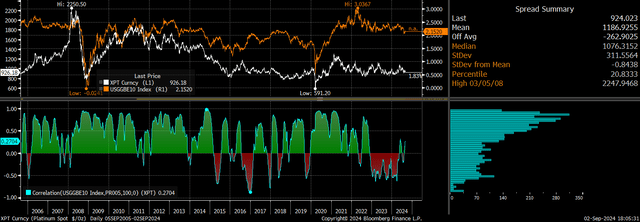

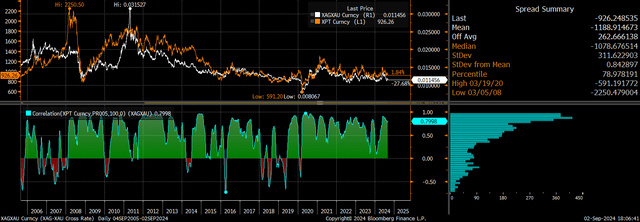

Platinum’s role as predominantly an industrial metal explains why it has closely tracked the ratio of silver over gold prices over the past 20 years. The correlation is extremely high and strongly suggests that if silver outperforms gold, platinum will rise.

100 day rolling correlation between platinum and the silver/gold ratio (Bloomberg)

Read the full article here