As we begin 2024, coffee legend Starbucks (NASDAQ:SBUX) is struggling. The stock is about 14% off its November high, and there seems to be no interest from the bulls in arresting the current decline. While Starbucks is a world-class business, I think it has some potential headwinds in front of it that make it unattractive, even after the big move down. I’m putting a hold rating on the stock given the full picture here, as I believe tailwinds and headwinds may roughly offset each other. Let’s dig in.

Where will it stop?

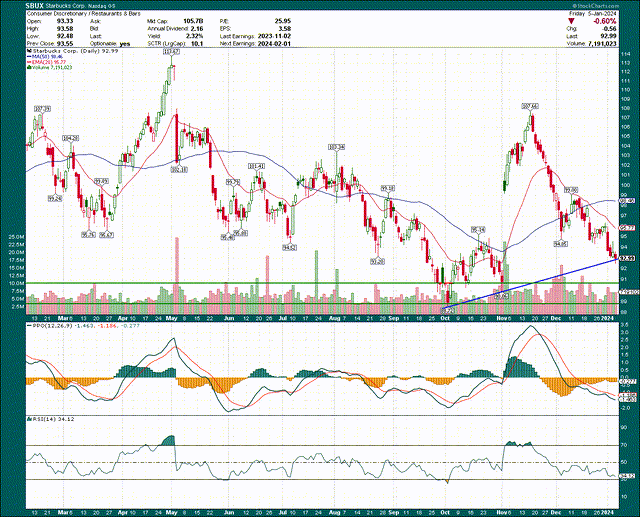

The first thing we’ll look at is the price chart, which is pretty ugly at this point. The gap in early November was completely ignored by the bulls on the way back down in November and December, which is not a good sign for the near- and medium-term future of the stock.

StockCharts

The stock is testing trendline support from the last two relative lows, and it’s oversold. However, I’m not seeing any kind of shift in behavior from a momentum perspective, so it is my view that the odds of this trendline holding are fairly low. If that’s proven correct, the next two support levels are the two prior relative lows, at roughly $90 and $88, respectively. If the stock gets there, how it behaves will be extremely telling. Either we’ll get a sustainable bottom, or a massive breakdown that will likely lead to a very tough 2024. For now, I just don’t like the look of this chart and see no reason to try and catch this falling knife.

Will top line growth translate to higher profits?

The answer to that question is almost certainly ‘yes’, but the key question is will margin expansion be enough to arrest the decline of the stock? On that one, I’m not so sure.

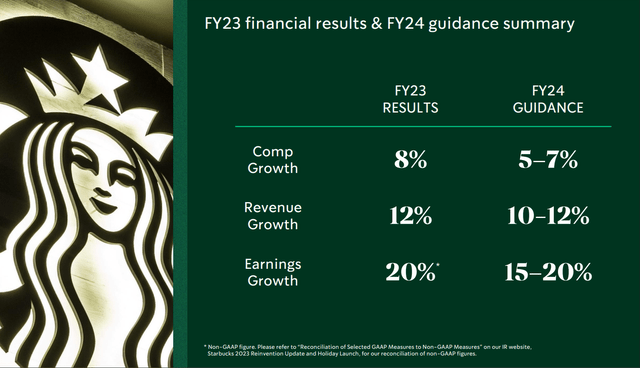

Investor presentation

Management guided for 5% to 7% comparable sales growth for this year, which is quite good if it comes to fruition. Total revenue growth is slated to be 10% to 12%, and EPS growth is expected to be in the high-teens. These are great numbers, but the stock isn’t moving higher despite these guidance numbers being well known to the market. Why is that?

I think it’s because Starbucks has been thus far unable to translate much higher revenue in meaningfully higher margins. Generally, we’d expect to see revenue growth lead to margin expansion as things like rent, salaries and benefits, etc. get leveraged down as a percentage of revenue.

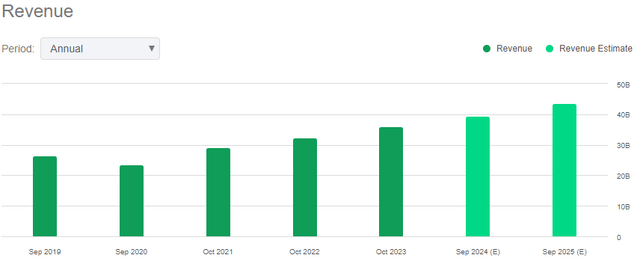

Seeking Alpha

Starbucks has managed a lot of very consistent revenue growth, so that’s never really been a problem apart from the extraordinary circumstances of the COVID era.

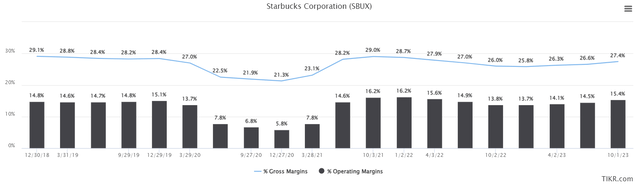

But is it translating into higher margins? Sort of. Below is trailing-twelve-months looks at both gross and operating margins to illustrate this point. With operating leverage, you’d expect to see the gap between gross and operating margins to shrink over time, as expenses are leveraged down. We are seeing that, but at an extremely slow pace given how quickly revenue has risen.

TIKR

Not only are gross margins still below pre-COVID levels, but the gap between gross and operating margins is about 12%, which is only slightly better than the ~14% we used to see. In other words, despite revenue moving consistently higher, and at high rates, margin expansion has been tough to come by. Revenue last year was about 35% higher than 2019, and margins are only fractionally better.

With the company introducing personal cups as an option in 2024, we have the potential for at least temporary disruption in serving times, particularly in the extremely popular drive-thrus. We’ve seen this kind of thing happen with complicated new menu items, where the popularity of something becomes a net negative if lines elongate. We won’t know if the personal cup initiative will introduce this risk for a few months, but given how long lines are at Starbucks anyway, anything that lengthens service times is not a good thing. The goal of reducing waste is a noble one, so I applaud the effort. But I am still concerned about the potential impact on serving times.

Then there’s the constant investment the company makes in its associates, which is a very good thing for a variety of reasons, but not good for margins. Starbucks has committed to sizable compensation and benefits packages for its store associates, which can only be a margin headwind.

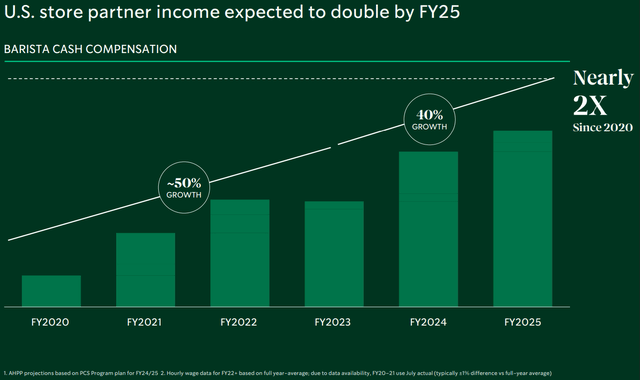

Investor presentation

Cash compensation for baristas at US stores has grown about 50% in the past three years, and that is set to continue into 2024/2025 (at least). Again, I think this is terrific for those impacted, but this can only introduce yet another margin headwind to overcome.

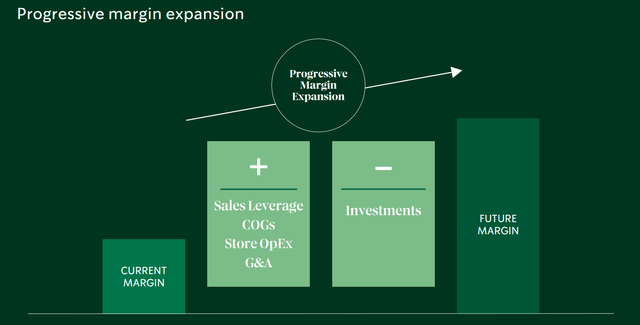

Curiously, management lists margin expansion as occurring despite what appears to be offsetting sales leverage and investments, the latter of which includes the barista pay we just looked at.

Investor presentation

How this is going to occur if the leverage and investment items offset each other is a mystery to me, as we know from recent years that rising revenue isn’t enough to boost margins meaningfully. Unless there’s some secret weapon to improve profitability that is unknown to me at the moment, I think Starbucks will struggle to meaningfully boost margins from here for the foreseeable future given the investments it’s making.

It’s cheap, but is it cheap enough?

The answer to that question depends upon your personal perspective, of course, but for now, we can say with some certainty that shares are in fact cheap.

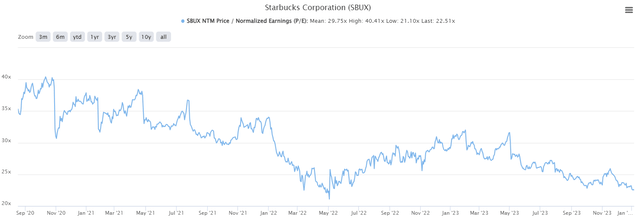

TIKR

The stock is at ~22.5X forward earnings right now, which is quite low based on post-COVID valuations, so that’s a net positive for the outlook of the stock. The average over this time frame is almost 30X, and it’s very near the low of 21.1X. Is that because investors share my fear that margins face a tough, uphill battle? Maybe. Whatever the reason, the stock is at least cheap. If it were trading for 30X earnings, I would slap a strong sell on it, but the valuation being quite low is pushing me towards a more neutral stance.

The bottom line here is that Starbucks has never had a problem producing sales growth, but margin expansion is a different story. With potential headwinds for 2024 and into 2025 on that front, I think the company may struggle to hit margin guidance numbers. With the price chart looking very weak, I don’t see any reason to own it. I don’t think it’s a short by any means, so I’m putting a hold on it. I think your money is best used elsewhere, and I am simply avoiding Starbucks at the moment.

Read the full article here