Introduction

The technological landscape is swiftly advancing, driven by the increasing demand for enhanced power, endurance, smaller sizes, and lighter weights. Solid-state batteries offer all these benefits over traditional lithium-ion batteries. With all these advantages, I am unsurprised that almost all major automotive manufacturers are already investing heavily in this technology. Solid Power (NASDAQ:SLDP) looks like a promising startup in this business since the company has partnerships with prominent U.S. and European automakers. The industry is anticipated to achieve a robust 45% CAGR over the next five years, and with SLDP’s strategic partnerships, the company is well-positioned to capitalize on the overall industry expansion. Despite the cash burn, SLDP possesses ample financial resources to sustain significant investments, further reinforced by recent lucrative contracts that are expected to enhance its financial performance. While the uncertainty in valuing a young company like SLDP is inherently high, caution is crucial to avoid overpaying for a potential long-term multi-bagger. Given the calculated undervaluation of the stock, I believe it merits a ‘Buy’ rating.

Fundamental analysis

Solid Power is a young company that develops solid-state battery technologies to enable the new generation of rechargeable batteries for the emerging electric vehicles (“EVs”) industry. I want to start by underscoring that the business is still in its early stages of development, signifying a small scale and a path to profitability lies ahead. That said, this is a long-term investment and unlikely to be a good fit for risk-averse investors.

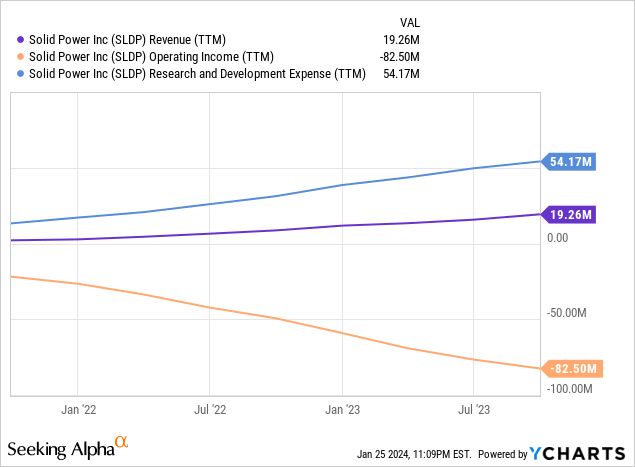

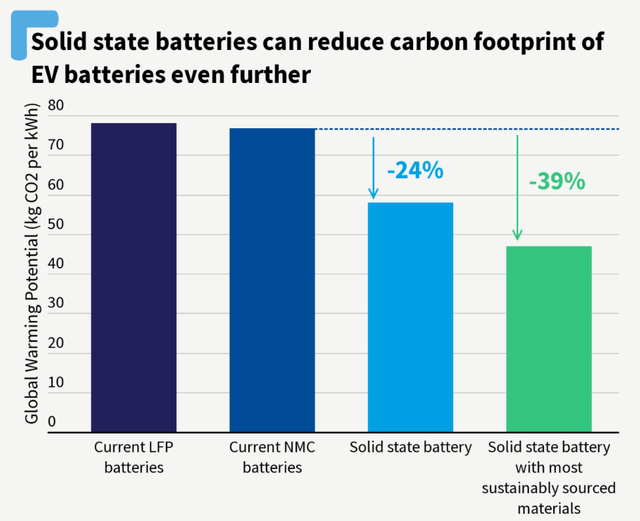

As observed, SLDP’s revenue growth struggles to match expenses, leading to an expanding operating loss. While this might be considered a red flag for a more mature business, for a young company pioneering revolutionary technology, I perceive this as a manageable challenge for now. I consider solid-state battery technologies revolutionary because potential benefits will likely become a breakthrough for the booming EV industry. According to Scott Gorman, a scientist, the advantages of solid-state batteries over traditional ones are massive: smaller size and lower weight, increased safety, greater capacity and range, faster recharging, and lower carbon footprint.

transportandenvironment.org

The great potential of the solid-state battery industry is recognized by almost all major automotive companies, most of them having strategic partnerships with young companies like Solid Power. For example, according to the Q3 report, SLDP is partnered with giants like Ford Motor Company (F) and BMW (OTCPK:BMWYY). The company also partners with SK On Co, and recently entered into three new agreements with this partner. One of the world’s largest automakers, Volkswagen (OTCPK:VWAGY), invested hundreds of millions of USD in another promising solid-state battery startup, QuantumScape (QS). Several other notable manufacturers are also betting big on the technology. I believe major automotive companies are actively recruiting top engineers, making it highly improbable that all of them could be mistaken about the potential of solid-state battery technology.

Yahoo Finance

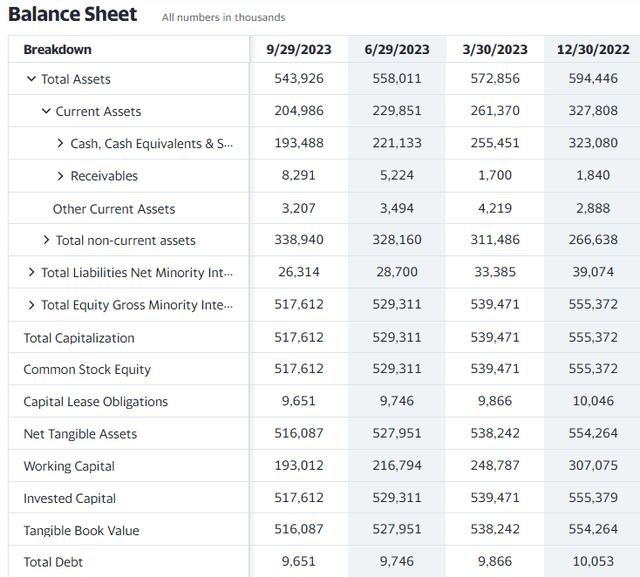

Now, let’s revisit the concern of operating losses. The company is experiencing cash burn, with a rate of approximately $30 million over the last two quarters. With a current cash balance of $193 million, SLDP has a runway of six more quarters to sustain its investments in new technology at the current pace. This provides ample time to achieve and announce significant technological advancements, securing potential financing either through strategic support from partners like Ford or BMW or by raising debt capital. Therefore, I assess the liquidity risk as low.

My optimism is echoed by analyst Brian Dobson from Chardan Research, who anticipates a substantial upside for SLDP following the announcement of an expected $50 million in revenue from three new contracts with SK On. Mr. Dobson has set a target price of $5 for SLDP, representing a nearly fourfold increase from the current levels.

SA

The upcoming quarterly earnings release is scheduled for February 28. Given SLDP’s early stage of development, I view short-term financial fluctuations as noise, emphasizing instead the significance of major technological advancements and the overall business development with its prominent partners. With the recent signing of three agreements with SK, I anticipate noteworthy advancements to be highlighted by the management during the Q4 earnings call.

Valuation analysis

SLDP peaked on November 21 at the above $13 level; now, the stock trades about ten times cheaper at $1.41. The stock demonstrates weak momentum, but at the same time, the last three months’ dynamic was almost flat, which might indicate that the stock has bottomed.

SA

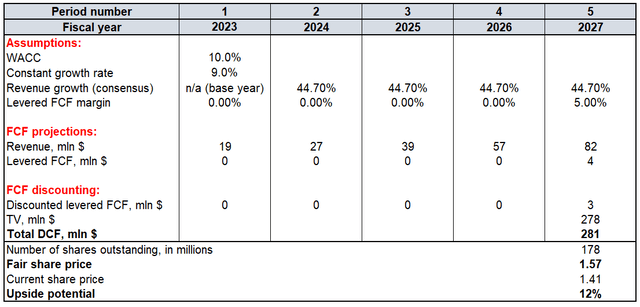

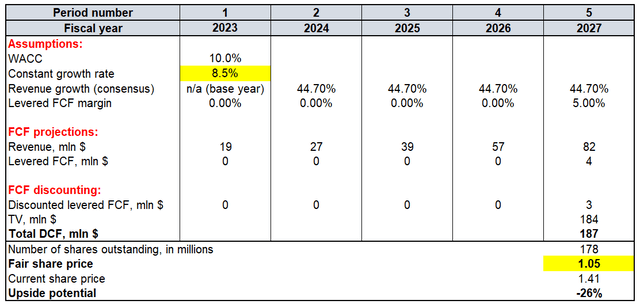

To derive my estimated fair price for the stock, I will conduct a discounted cash flow (“DCF”) analysis with a 10% discount rate. The solid-state battery market is forecasted to grow at 44.7% CAGR for the next five years, and I incorporate this growth rate into my DCF analysis. Considering such a rapid growth rate for the next five years, I use a 9% constant growth rate for the terminal value (“TV”) estimation. I expect the free cash flow (“FCF”) margin to turn positive in 2027 at the 5% level. There are 178 million SLDP shares outstanding.

Calculated by the author

Based on the outlined assumptions, the fair share price is $1.57. This is about 12% higher than the current market price, meaning SLDP is attractively valued.

Mitigating factors

As highlighted in the DCF table from the preceding section, most of the business’s fair value is derived from the terminal value, projecting figures for 2027 and thereafter. This underscores the significant level of uncertainty associated with the fair value estimation. The fair value of the stock is highly sensitive to the constant growth rate, which, being inherently uncertain, substantially influences the final valuation. A mere reduction of 50 basis points in the constant growth rate results in a significant drop in fair price estimation from $1.57 to $1.05.

Calculated by the author

Investors in SLDP face a notable risk associated with the rapid evolution of technologies. The development and economic viability of solid-state batteries may take several years, during which more advanced and efficient technologies could emerge, potentially rendering solid-state batteries obsolete even before achieving widespread adoption in mass markets. This fast-paced technological landscape introduces a significant element of uncertainty for SLDP investors.

I’ve emphasized the positive aspect of having automotive giants as investors in this industry, signaling a promising future. However, there’s another side to this coin, indicating intense competition. It’s plausible that one competitor could outpace others technologically, setting the industry standard. A precedent for this occurred in the EV charging market, where nearly all major automakers adopted Tesla’s (TSLA) charging standard. Fierce competition poses the risk that SLDP may struggle to capture a significant market share, hindering the company’s ability to scale up sufficiently to achieve a return on capital above the cost of capital.

Conclusion

While the solid-state battery industry is still in the early stages of commercialization, the strong involvement of major OEMs provides confidence in its future viability. Solid Power’s strategic partnerships with automotive giants like Ford and BMW further solidify its position. According to my valuation analysis, the current stock price levels appear reasonable, minimizing the risk of overpaying for a long-term investment in this promising technology. To conclude, SLDP deserves a “Buy” rating.

Read the full article here