Introduction

Many of my readers probably know by now I’m an avid investor and fan of BDCs. Not only because of their dividends, but because they are also great long-term investments. Well, at least some of them. Most investors view these as income vehicles but if you catch them at the right valuation, they will also reward you with some capital appreciation.

One of my portfolio best performers Capital Southwest (CSWC) has rewarded me with some stellar dividend increases and share price appreciation over the years. In this article, I discuss why Silver Spike Investment (NASDAQ:SSIC), a fairly new BDC, could potentially be a rewarding investment as well. Let’s get into why SSIC may be an attractive investment for those looking for not only dividends, but share price appreciation as well.

Who Is Silver Spike?

Silver Spike is the only BDC focused on direct-lending to the cannabis industry. This is one reason why the stock could be an attractive investment down the line. The BDC is the first of its kind and currently their only peers operate in the REIT sector (VNQ).

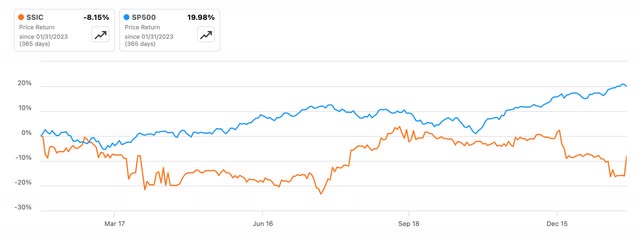

They’re also externally-managed by Silver Spike Capital, an alternative asset manager and SEC registered investment adviser. The BDC went public in 2022 so they currently have a very short track record. Unlike most of its peers, SSIC has not performed well in the high interest rate environment, down almost 16% in the last year.

Seeking Alpha

If you have been a holder of the stock for the last year, you’ve seen the share price decline from $9.14 to the current price of $7.70 at the time of writing. So, while so many BDCs have enjoyed strong returns due to high interest rates, SSIC has not fared so well.

The Cannabis Industry Uncertainty

Every couple of years a new phenomenon comes along, and investors get excited as they think they’ve caught the new big thing. Sometimes these can work out, but also, they can lead to huge losses if you get in too early. Now, it’s Artificial Intelligence, but a few years ago cannabis was the hot topic of the market.

I never got into any cannabis stocks, but one investment I almost made was in the REIT Innovative Industrial Properties (IIPR). Back then the REIT was trading at almost $300 but has since seen its share price decline significantly. And while I do think they are a solid company and pay a well-covered dividend, investors who bought into the craze too late are probably down huge if they are still holding.

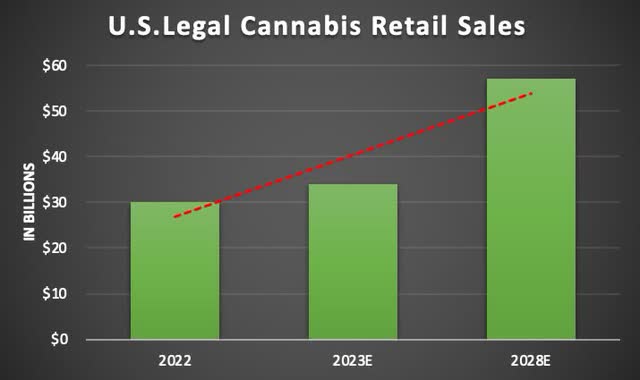

One reason is the uncertainty surrounding the sector. But the market is projected to grow to $57 billion over the next four years in retail sales. So, if you believe in the outlook of the cannabis industry, SSIC could be turn out to be a great investment if you’re willing to hold the stock for the long-term.

Author creation via SSIC investor presentation

Financials

Since going public, SSIC’s financials haven’t been the greatest. This is probably one reason the share price has fallen despite the high rate environment where many of its peers have seen their share prices trend upward.

Since the end of 2022, their net investment income only grew from $0.22, or $1.4 million, to $0.26, or $1.6 million. Furthermore, this declined quarter-over-quarter from $0.31, or $1.9 million. However, total investment income of $2.9 million did increase from $2.0 million in Q1 but remained flat from Q2.

SSIC investor presentation

Although the BDC hasn’t been making additional investments like some of their peers in the (BIZD) sector, management stated they did have an active pipeline of $448 million in the works that the company plans to pull the trigger on in the next year which should help fuel growth for the newcomer in the not too distant future.

They’ve also reviewed nearly $8 billion worth of deals across 386 debt transactions. With the banking crisis last year and tighter lending standards from commercial banks, SSIC is in a strong financial position to making accretive deals to continue growing its portfolio.

Furthermore, they experienced a drop in NAV quarter-over-quarter from $14.49 to the current $14.06 but managed to grow this from Q1 to Q2 by $0.20. They’ve also grown their NAV since going public from $13.64 in 2022.

Management attributed the drop in NAV due to the dividend paid during the quarter. But with the $448 million worth of deals in the works, the company can see some NAV growth over the coming quarters. If so, this will likely attract new investors, moving the share price forward.

Dividend

Silver Spike has a very short dividend track record, but the company managed to raise the regular dividend from $0.23 to $0.25 while also raising the supplemental dividend from $0.40 to $0.45 giving them a total payout of $0.70.

Even if you’re not willing to hold the stock for the long-term or don’t believe in the outlook for the cannabis industry, collecting a $0.70 dividend at the current share price is very attractive. Especially for those looking strictly for income.

And although dividend coverage is tight currently, the stock is a compelling investment. And if they can manage to grow their portfolio for the foreseeable future, I expect this to widen as they comfortably out-earn their dividend. Furthermore, this should also increase the NAV as well if they can manage to consistently out-earn their dividend.

Portfolio

One thing I did like about Silver Spike Investment is that the company does lend to some well-known cannabis operators in the space. Currently, the BDC has 6 portfolio companies and some of these include operators like Verano (OTCQX:VRNOF) and the largest public cannabis company, Curaleaf (OTCPK:CURLF). Others include PharmaCann, Shryne, Dreamfield Brands Jeeter, and MariMed.

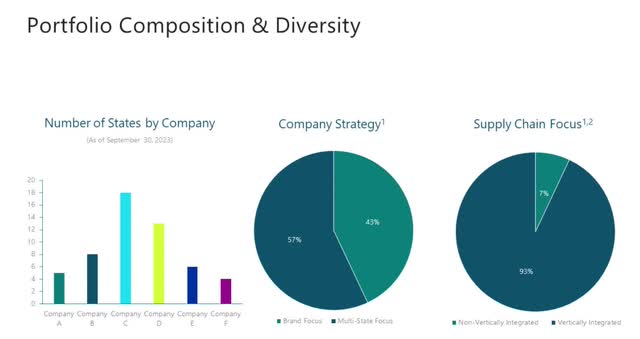

SSIC Q3 investor presentation

In the chart above you can see Curaleaf is their largest company by states with Verano in 2nd. Both have market caps over $1 billion so the BDC does lend to some strong cannabis companies. Furthermore, all of their investments are first-lien or secured bonds.

Additionally, their portfolio had an average yield to maturity of 18.20% with PharmaCann’s loan maturing the earliest in June 2025, which also happens to be their smallest loan at $3.87 million.

The remaining loans mature in 2026 and none were on non-accrual status. The company also had a total of $29.8 million in cash on its balance sheet so if their portfolio companies do experience some headwinds and need financial assistance temporarily, SSIC has the funds to assist.

Huge Discount To NAV

At a share price of less than $8 currently, SSIC is trading at a discount of roughly 45%. This also gives them a P/NAV ratio of just 0.55x. This is in comparison to smaller peers WhiteHorse Finance (WHF) and Saratoga Investment (SAR) who current ratios stand at 0.84x and 0.90x, respectively.

Additionally, the stock does offer some nice double-digit upside of nearly 50% to its price target. Furthermore, Wall Street rates the BDC a buy. So, again Silver Spike is an attractive investment if you’re willing to take on the risk. And if the BDC can manage to close on some of the deals in their active pipeline in the near future, the company may see some share price appreciation in the foreseeable future.

Seeking Alpha

Risks

Besides being considered a risky investment already due to their business structure as a business development company, SSIC is also risky due to the changing regulations in the cannabis industry. As previously mentioned, there’s a lot of uncertainty surrounding the industry.

They are subject to ever-changing rules & regulations regarding the legalization in certain states. Because of these, this affects cash resources and working capital for portfolio companies. Another risk the company could face in the foreseeable future is the risk of a recession.

And even though they’ve managed to have no loans on non-accrual status, this could be subject to change in an expected downturn such as a recession. Additionally, this could cause a rise in PIK income as well.

At the end of Q3, Silver Spike Investment had a total of $78.1 million in PIK income according to their 10-Q. And if portfolio companies face financial pressure in a downturn, SSIC could see this rise in the coming months or quarters.

Conclusion

If you’re an investor that invests strictly for income, Silver Spike Investment might be an attractive investment currently. I think one reason the BDC has seen their share price decline in comparison to others is their somewhat unstable earnings, but also uncertainty surrounding the cannabis sector.

The BDC is also much lesser known to other peers in the sector and fairly new having IPO’d in early 2022. However, if you believe in the cannabis industry outlook and enjoy dividends, this is a BDC you may want to consider. Their portfolio is small but the company lends to some well-known cannabis operators which makes them somewhat of a credible, and attractive investment.

If the industry can see some nice growth in the coming years and Silver Spike Investment can manage to grow its portfolio while increasing earnings and comfortably out-earning its dividend, this may attract more investors as the company continues to grow and become more known within the BDC space.

SSIC seems to have some great opportunities to continue expanding its portfolio with their active pipeline and deals reviewed. But due to their short track record, somewhat unstable earnings, and uncertainty surrounding the cannabis industry, for now I rate the Silver Spike a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here