I Was Right About PureCycle Technologies

Broadly speaking, my analysis of PureCycle Technologies, Inc. (NASDAQ:PCT) stock in 2 articles in 2021 was proven accurate. The main thesis was the company couldn’t achieve scale in recycling polypropylene.

I stated,

“I don’t think PureCycle Technologies will be able to scale its recycling technology without major hiccups.”

This was proven accurate. The financial estimates in the original SPAC presentation were way too optimistic. Since those articles, the company still hasn’t generated sales. The stock is down 77% since my first article and down 82% from my 2nd one in which I called it a short.

Summary Of Recent Hurdles

I’m going to summarize and comment on the recent problems the company has faced in the past 6 months. The firm hasn’t reached its goal of recycling post-industrial and post-consumer polypropylene at scale. Management likes to say,

“This was never expected to be easy”

since this is the first-ever polypropylene recycling plant. However, I don’t think that’s a fair excuse following the firm’s aggressive projections. I have been saying for 3 years that scaling a recycling polypropylene plant is difficult and unlikely to work because the tech isn’t proven. The market has mostly come around to my conclusion which is why the stock is down so much.

August Force Majeure

The Ironton plant has never worked at scale. At its peak in 1H last year, it processed only 409,000 pounds of feedstock which created just 110,000 pounds of pellets. Keep in mind that nameplate production is 300,000 pounds of pellets per day (8.9 million per month). The firm has 10 million pounds of feedstock available if it can get the plant running. The firm likes to claim the tech works based on this production and the FEU (Feedstock Evaluation Unit), however, that doesn’t matter if it can’t scale. Test shipments have been made to Milliken and Formerra (PCT partners), but no sales have been generated in company history.

On August 7th, the Ironton plant had a 2-hour power outage. Despite never producing a full day’s worth of pellets, the 2-hour power failure was enough to cause a mechanical component failure. The facility restarted right after the power outage, but was cycled down on August 25th once the mechanical failure was noticed. Ironton returned to service 4 days later. Then on September 3rd, the component failed completely. It was a seal system failure that caused a loss of barrier fluid pressure surrounding the seal. It was replaced on September 9th.

This short-term power failure and relatively quick fix was a big deal because of a bond agreement. PCT needed to declare a Force Majeure since the Ohio bond agreement required the firm to get to 50% of nameplate production by the end of September (4.45 million pounds per month).

The power outage wasn’t mentioned on the August 9th call. That’s likely because the mechanical failure didn’t occur until the 25th. On August 21st, PureCycle Technologies raised $200 million in green convertible senior notes. The next day it was upsized to $215 million at a 7.25% rate due in 2030.

November Plant Shutdown

From November 8th to the 22nd, Ironton was shut down to install a screen changer to fix adsorber bead plugging on the final product extruder pelletizer. PCT posted daily videos on social media detailing the process. I applaud the transparency, but the shutdowns and delays have been unending. It proved to be foolish to promote this since it wasn’t the final shutdown. Keep in mind, at the time, the company was trying to reopen the plant quickly to reach the new bond agreement goal of 50% nameplate capacity by the end of the year. As I will get to later, that didn’t happen.

PureCycle IR

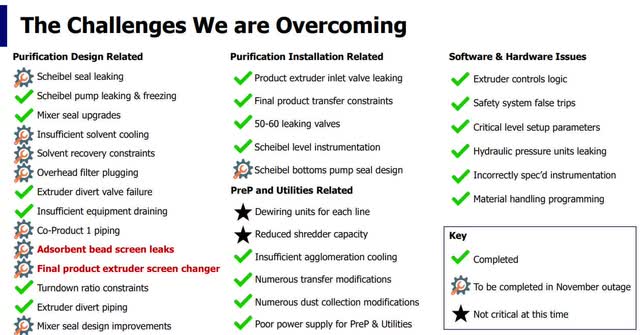

The slide above shows the list of all the challenges PCT has faced with Ironton. They made my original bear case better than I did. The biggest issue is new challenges keep popping up. It’s like a game of whac-a-mole. On the call, the CEO stated

“I’ve worked in polymers for years, and I have rarely encountered pelletization problems. They just work. You don’t have to focus on them, you just turn them on, and they run.”

I believe this to be true and Dustin does have extensive manufacturing experience. However, at a certain point, public markets need to see results, or they will think this is nothing more than a public science experiment with no sales ever generated.

December Shutdown: Cure Period Invoked

The November shutdown was supposed to end on November 22nd. I gave them a few extra days due to the Thanksgiving holiday. The firm announced on December 5th that it resumed pellet production. This mini delay was caused by delayed electrical component deliveries. A couple of weeks late doesn’t seem like a big deal, but the firm was trying to get to 4.45 million pounds of monthly production by the end of the year. Every week counted if you believed there was a chance of hitting that milestone. The company stated it had a long-term goal of producing 107 million pounds of pellets per year. That seems like a long shot given its history of shutdowns.

That potential quick-scaled production in a few weeks following numerous delays never got going. On December 18th, the firm stated after pushing through about 200,000 pounds of feed through the system in the first 3 days, new mechanical problems arose. That wasn’t a shocking development if you’ve followed this company for a few years. However, investors were very disappointed. It was the straw that broke the camel’s back since the stock fell 43.5% on December 18th to a new record low of $2.8.

This time the firm blamed a lead block valve and a mechanical seal failure unrelated to the core technology. Either this is similar to the issue related to the August seal failure, or it’s a new issue. Neither scenario is positive. Either the same issue keeps popping up or new issues keep popping up. I’m assuming the firm stopped production around December 8th, but it took 10 days to figure out the new issues.

This brings us back to the ill-advised social media posts in November. It’s not a good look to be posting daily how your firm is about to start production only to run into new issues a few weeks later. The company didn’t post any videos about the latest seal failure shutdown in December which worried investors, sending the stock lower in the absence of news. Investors were in the dark about this shutdown until the January 16th presser I will discuss in the next section.

Obviously, the firm came nowhere near reaching its year-end deadline of 50% nameplate production. Therefore, the firm is using its cure period extension to avoid defaulting on this goal. The cure period is a built-in extension in the bond agreement that gives the firm another 90 days. That means the real deadline for 4.45 million pounds of pellets produced per month is the end of March. Investors don’t seem to be that optimistic the goal will be reached since the stock is near its record low.

The firm put $50 million in a trustee account as part of its agreement to extend the original September deadline to December. This means $50 million went from unrestricted to restricted cash in Q4. Some investors think this gives PCT unlimited access to keep pushing back deadlines, but the company will run out of unrestricted cash if they keep needing to put more money in a trustee account.

Obviously, the deadlines associated with these bond deals are a hassle. However, the rates are amazing for a firm without sales; debt is much better than stock dilution. The issue isn’t with having enough time, it’s with the technology not scaling. It makes sense that the bondholders are making the firm put $50 million in a trustee account until production deadlines are hit because of the recent company-specific failures. It makes even more sense when you look at the recycling industry. The table below (from the Bleeker Street Research report) shows all the recent outcomes in the industry. The success rate in this industry is low.

Bleeker Street Research

Bad News Framed As Good News

On January 16th, PCT put out a press release that sent the stock soaring 21.7%. However, I think this was bad news framed as good news. Eventually, the market will realize this. Specifically, the firm stated it restarted Ironton operations in late December. Then, in the first 2 weeks of January, the plant produced 183,000 pounds of pellets which is almost as much as the 200,000 pounds produced in December when the plant was briefly up.

Firstly, fixing a seal failure isn’t a big deal. No one should be surprised that was fixed within a week or two. Secondly, producing 183,000 pounds of pellets in 2 weeks is a much lower rate than the 200,000 produced in 3 days in December. It seems like the firm wanted to run the facility at a lower rate to avoid another seal failure. This update shows the firm is dramatically off the pace of producing 150,000 pounds of pellets per day for an entire month by the end of March.

This isn’t the only bad news in the update. The Chief Sustainability Officer stated,

“Since we resumed operations in December, the color of the product has varied across each feedstock, due in part to purposely bypassing the adsorber step of the operation.”

Therefore, PCT isn’t producing the virgin-like plastic they set out to produce originally. This isn’t going to work for consumer product companies. That’s important because CPG firms are the ones willing to pay a premium for recycled material since it helps with marketing. The press release stated initial interest in this colored plastic is coming from compounders supplying the auto and furniture industries. This product isn’t going to be sold at a premium once it’s produced at scale. To me, producing recycled plastic with color is an admission PCT can’t produce virgin-like recycled resin at scale.

To make matters worse, the company stated there are coproducts stuck in the purification which are limiting recycling production. Coproducts are solid waste contaminants like polyethylene and other inorganics. This limits the recycling rate and the rate feed can be put into the system. PCT is stuck in a modified manual mode. They haven’t solved any of the limiting factors that prevent production at scale. This is a step backward since the firm isn’t producing virgin-like pellets.

PCT Can’t Get Its Act Together

PCT started missing deadlines even before it went public. In 2017, the firm guided for production to start in late 2020. In a 2019 Time Magazine article, the firm predicted production would begin in 2021. Soon after it went public in March 2021, PCT guided that it would start sales in 2H 2022.

Peak 3-day virgin-like production in December 2023 hit 200,000 pounds which is unlikely to have led to commercial sales similar to the previous 110,000 pounds of production in 1H 2023 (test shipments). I’m not counting the recent 183,000 pounds of production this year since it’s not virgin-like and can’t be sold to CPG brands at a premium. The intermediate-term goal of nameplate production is 8.9 million pounds of production per month. That’s 300,000 pounds per day. As you can see, the firm is nowhere near that.

As of the mid-December 2023 budget, management guided for Ironton to hit 100% of its nameplate production by June 2024. Since it hasn’t hit 50% of the nameplate in January as it guided for, I’m skeptical that can be hit. Management stated in the November 2023 quarterly press release,

“as expected, we are working through many challenges in getting the facility to run on a continuous basis.”

Originally, management didn’t forecast so many challenges. Now it’s an unfortunate expectation that the plant will run into new problems.

On December 1st, PCT announced a layoff of 22 employees most of which don’t work at the Ironton facility. This brings us back to my article in 2021 where I mentioned it was a mistake to work on future plants before the first one was done. I stated,

“The firm will be working on line 2 before line 1 is commercially viable which makes no sense to me because there might be some unforeseen technological issues.”

Boy, did they end up having issues. The company has done separate bond raises and has separate batches of restricted cash for future projects like Augusta. However, I still think focusing on Ironton exclusively would have been the fiscal and logical right move.

Revolving Door CFO Position

As part of this layoff, the firm announced its CFO Larry Somma resigned. The new CFO, Jeff Fieler is the 3rd CFO in the firm’s nearly 3-year history. The CFO position has been very important for PCT since the firm needs to generate funding without the benefit of having sales or profits. I think the previous CFO did a good job given all the missed production deadlines. If you told me at the start of 2023 that the firm would miss every single deadline, generate no sales, and still raise $215 million from a debt offering, I’d say the CFO did his job.

Mr. Fieler is the founder of Sylebra Capital Management. He was the portfolio manager from 2010 to 2018. He’s been on the PCT board since 2021. He has obviously been influential in Sylebra’s investment in PCT along with Dan Gibson. Usually if an investor takes a more active role in an underperforming business, they can extract more value for shareholders. However, in this case, it’s still up to the CEO and workers at Ironton to get production going.

About 2 weeks ago, James Haw announced he left PCT at the start of the year. He had been with the firm for 3 years. He recently was the VP of Program Management; he had been the VP of Automation and Digital Strategy. Usually, high-level employees don’t leave a company about to finally hit its long-awaited targets.

Pricing Issues

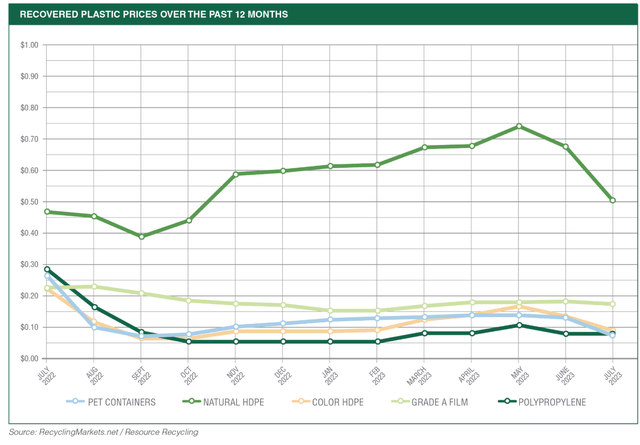

I’m aware that PCT already has pricing agreements for its initial production. However, in the long term, PCT’s prices will be identical to the market price since both virgin and recycled polypropylene are commodities. The price of recycled polypropylene has been weak as you can see from the chart below. Low virgin prices have pressured recycled prices. Recycled polypropylene is correlated with virgin prices and trades at a 10-20% premium because consumer goods companies like using the recycled labels in their marketing/packaging.

Plastics Recycling Update

This chart only goes until July 2023, but recent prices haven’t moved much since then. As of December, recycled polypropylene was 4.94 cents per pound, down from 5.06 in November and 5.38 cents 1 year prior. If you want to read more about the plastic recycling price weakness in Europe and Hong Kong, read these industry articles. Competition, cyclical weakness, and oversupply are hurting pricing. Chinese production of plastics represented 60% of petrochemical production in 2023. The rest of the oversupply is coming from the US shale gas boom. This is making recycled plastic uneconomical. If the government doesn’t add new regulations requiring the use of recycled plastic, the industry will be in trouble.

Balance Sheet Woes

As of Q3 2023, PCT had $211 million in unrestricted cash and $185 million in restricted cash. $50 million moved from unrestricted to restricted cash in Q4 as part of the 3-month deadline extension. In Q3, the firm spent $7.9 million on building Augusta and PreP. Obviously, the firm wouldn’t have been able to raise this much money without Augusta, but the entire plant won’t matter if they can’t get Ironton running. PCT spent $7.7 million on payrolls/benefits & $23 million on Ironton working capital, general corporate, and insurance. It’s worth noting that the firm will continue to incur losses after Ironton starts running. In the mid-December budget, PCT guided for a $28.596 million loss in 2024 which included modest net income in Q4.

After taking the $50 million away, the firm will have $161 million in unrestricted cash. Let’s assume they burnt $30 million in Q4. That leaves the firm with $131 million. You can see why management isn’t trying to just pay off the $50 million that has strings attached. We already know the firm hasn’t generated much production in January which means PCT will probably burn more cash in 2024 than the budget guided for. Liquidity is good for a firm that has never generated sales in its existence, but that’s a low bar. A crunch is coming in the next few quarters without scaled production at Ironton. The firm paid $7 million in interest on its long-term debt in Q3. It had $468 million in non-related party long-term debt and $38 million in related party long-term debt.

I’m Bearish On PCT Stock

PCT has a market cap of about $479 million and an enterprise value of about $695 million. There’s still a lot of room to the downside if it can’t get to scaled production at Ironton in 2024. I think the stock is headed lower; I would sell it if I owned shares.

However, shorting the stock is way tougher than it was in 2021. It has a 27.33% short interest which is the 11th highest on the Nasdaq. Personally, I like recommending shorts when the company is the most overvalued. However, others like to short stocks when the business is doing horribly and the stock is cratering. If you are among the latter, shorting PCT can work.

The biggest risk on the short side is the firm producing recycled virgin-like plastic at scale in Ironton. Even if PCT can’t sell recycled plastic for a profit, the short-term rally would be fierce if that was announced. Given the mishaps in the past 2 years, I think this is unlikely. The firm announced it will have an Ironton Showcase on March 7th to show off its technology. Unless the firm announces it will hit its end of March target production of 4.45 million pounds per month, I don’t think this Investor Day presentation will impact the stock.

Read the full article here