One major mistake that investors often make is extrapolating recent trends and events and disregarding important lessons from history. Falling victim to recency bias is now extremely risky when it comes to growth technology stocks, but even sectors like consumer staples are not immune to this problem.

Even though it is a relatively low-risk stock, The Procter & Gamble Company (NYSE:PG) is an excellent example of why investors should zoom out when judging their potential returns.

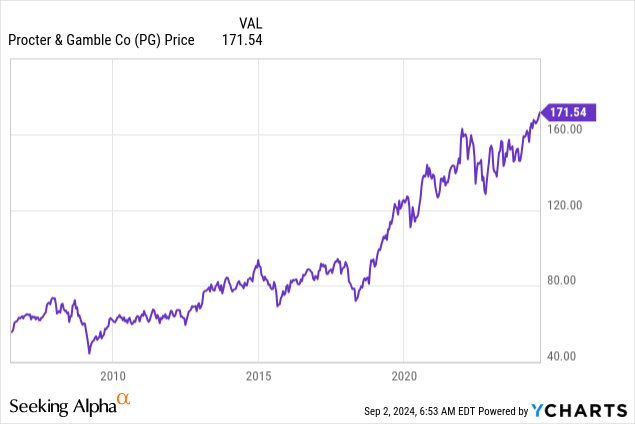

As we see on the graph below, PG’s stock has been gradually increasing up until the 2018-19 period, when it began its ascend from $70 a piece to $172 as of today.

When looking at the chart above and PG’s recent returns, investors should ask themselves the hard question of whether they should expect these kinds of returns to be sustained, or will be confronted with the harsh reality of mean reversion.

Although I do favor lower risk stocks like PG and have recently warned against trend-following behaviours in the stock market, I am not particularly excited about PG stock’s medium to long-term expected returns.

More specifically, for investors who are willing to buy the stock today and sell it in a few months or in a year, the following analysis would be of little use. For investors who want to buy and hold over longer periods of time. However, it is crucial to set your expectations right.

Making Sense Of Long-Term Performance

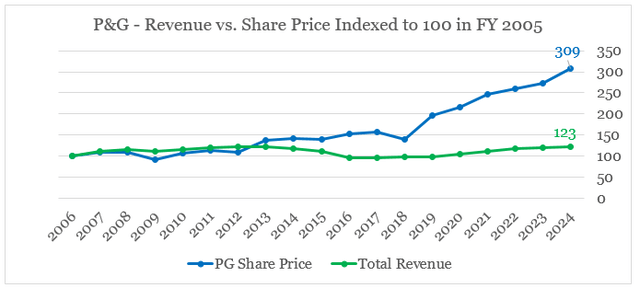

For the purpose of this analysis, I would take fiscal year 2006 as a starting point. This gives us enough data to draw some important conclusions on how PG is priced and what are the key drivers of the company’s premium valuation.

On the graph below, we can see that since the end of fiscal year 2006, P&G’s revenues have grown by around 23% while the stock has more than tripled.

prepared by the author, using data from SEC Filings

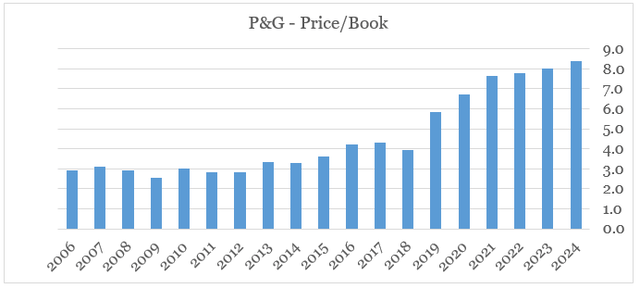

What that means is that the stock price appreciation over the past 20 years or so has not been driven by top-line growth, but rather by multiple expansion. The extent to which PG’s share price return has been influenced by its multiple can be seen in the graph below. The price-to-book ratio of the stock has doubled since fiscal year 2017 and now stands at record-high levels on a historical basis.

prepared by the author, using data from SEC Filings and Seeking Alpha

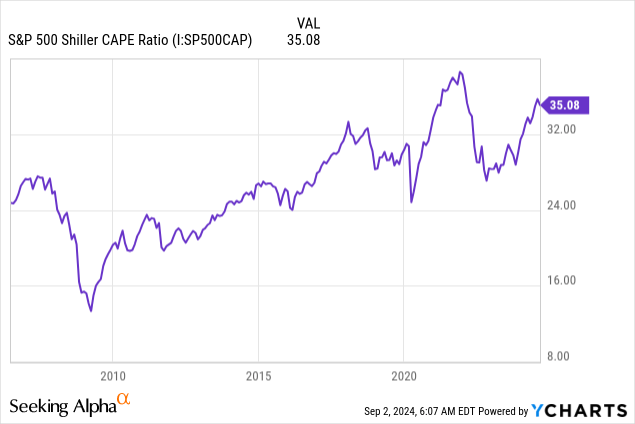

Of course, this has been partly influenced by the overall multiple expansion seen within equity markets. This was due to the extremely loose monetary policy recently, which brought the Shiller P/E ratio of the S&P 500 (SP500) to one of its highest levels ever.

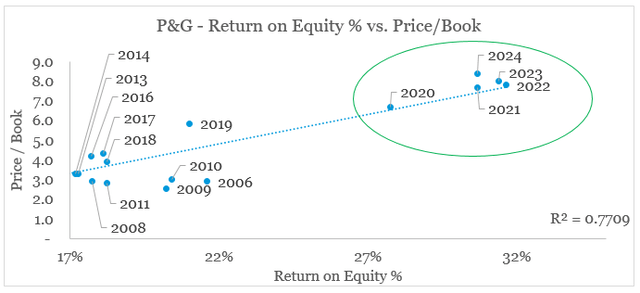

More importantly, however, Procter & Gamble’s multiples have been mostly driven by the company’s improving return on equity since fiscal year 2020. This can be seen in the graph below, where we have the ROE plotted on the x-axis and the price/book multiple on the y-axis.

We could clearly see the dramatic change in return on capital that occurred a couple of years ago and which in turn has been the main reason why PG shareholders enjoyed such high returns since 2019.

prepared by the author, using data from SEC Filings and Seeking Alpha

On one hand, this is good news for shareholders as the share price is less influenced by market-wide movements and changes in liquidity. On the other, however, PG investors should adjust their future return expectations as further multiple expansions from current levels are unlikely.

Investors should also clearly understand what were the key drivers of this sharp increase in ROE and how sustainable it is.

Limited Profitability Upside

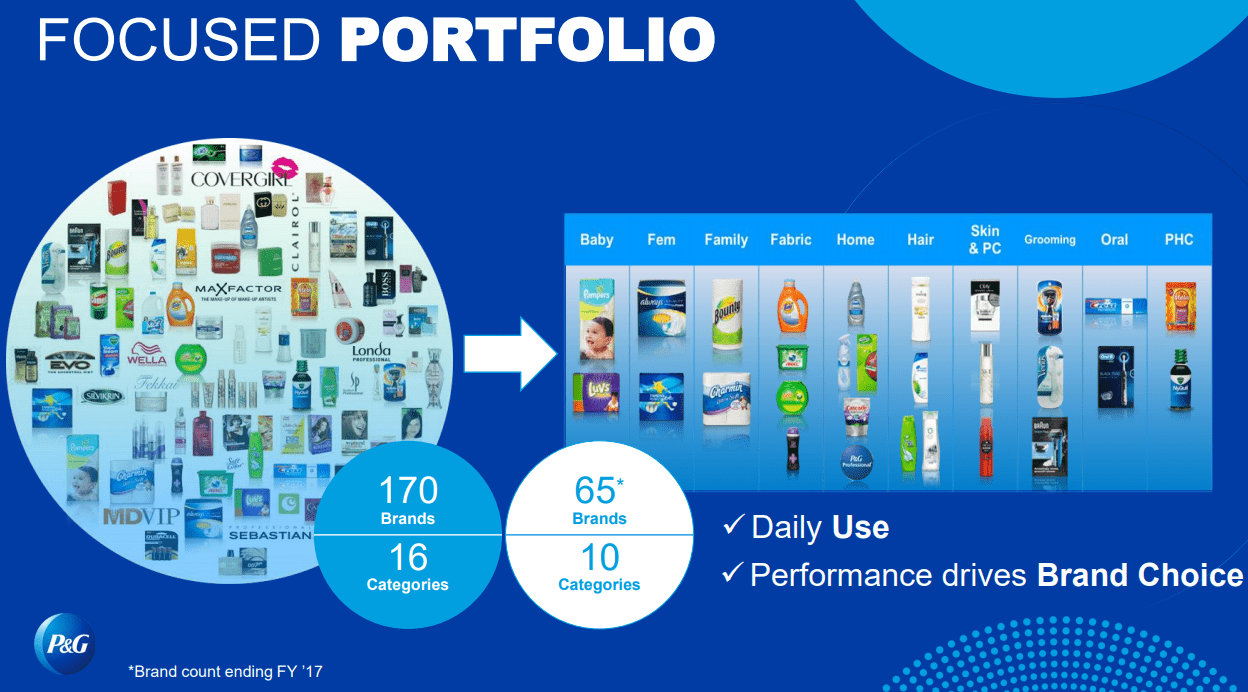

Procter & Gamble’s brand portfolio optimization and the reduction in fixed costs associated with managing and selling these brands have been one of the key drivers of the company’s improved return on equity. From fiscal year 2017 to fiscal 2021, the company slashed more than 100 brands and reduced the number of categories from 16 to 10.

PG DbAccess Global Consumer Conference 2021

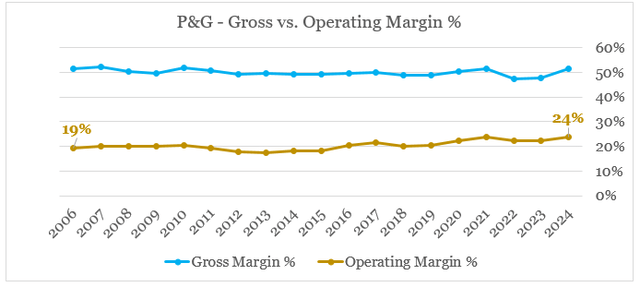

As a result, the operating margin improved from an average of 20% between FY 2006 and FY 2019 to 24% in 2024. As we can also see on the graph below, the gross margin has not changed much, which confirms that profitability improvements have been solely due to improved efficiency within the company and not by the higher price premium of the products sold.

prepared by the author, using data from SEC Filings

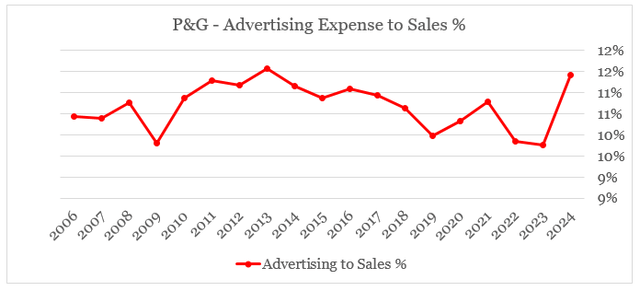

It’s worth noting that P&G’s management has also significantly increased its advertising expenses during the past year, with the ratio of advertising costs to sales now standing at record highs.

prepared by the author, using data from SEC Filings

Ultimately, this higher spending on brand building and supporting activities gives the company a solid foundation to retain or improve market share, which could result in higher topline growth down the road. To achieve that, however, P&G should retain its high level of ad spending for now, which in turn means limited upside for margins.

Efficiency and Leverage

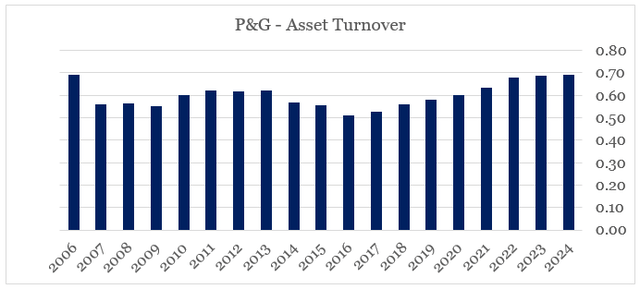

Procter & Gamble’s asset turnover also noted a significant improvement from FY 2016-17 to 2024. The rate of improvement, however, has been slowing, with very little progress being made from FY 2023 to FY 2024 (see below). What this is likely telling us is that improvements in efficiency have likely peaked already.

prepared by the author, using data from SEC Filings

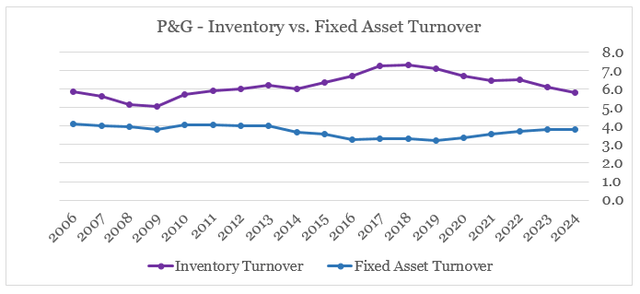

Recent improvements in total asset turnover have been almost entirely driven by better fixed asset utilization, which remained flat from 2023 to 2024. To an extent, the higher fixed asset turnover was offset by lower inventory turnover, as P&G needed to keep more inventory at hand.

prepared by the author, using data from SEC Filings

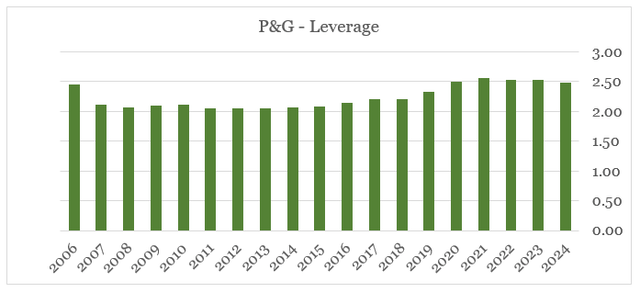

The last factor that played a role in P&G’s recent increase in return on equity has been the notable increase in the company’s leverage (total assets / total equity).

prepared by the author, using data from SEC Filings

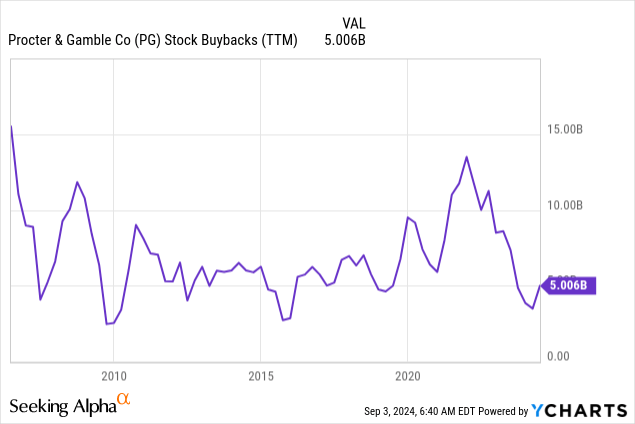

If we are focusing on the 2017 to 2024 period again, this leverage increase wasn’t driven so much by the issuance of debt, rather than the significant share repurchase program recently. As we see below, however, share buybacks now stand at only $5bn, which is one of the lowest levels in the past 20-year period.

Conclusion

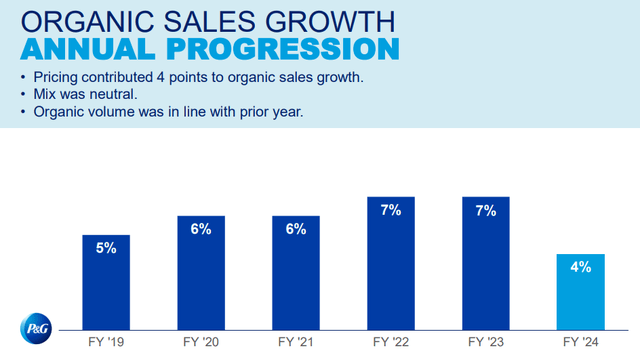

Based on everything said so far, we could conclude that The Procter & Gamble Company’s abnormal share price returns of the past few years are unlikely to be sustained into the future. All major tailwinds for the stock’s multiple expansion are now dissipating and with that, investors, would need to rely on elevated topline growth to support the share price. Unfortunately, however, revenue growth fell sharply in fiscal year 2024 as pricing contributed by only 4 points to organic sales growth, compared to 9 points in 2023.

prepared by the author, using data from SEC Filings

Having said that, PG and other high-quality consumer staples remain a good way to store wealth at a time when growth stocks are exposed to significant risks. Therefore, I retain a hold rating on PG at this time and will be looking for more attractive levels before I rate the stock as a buy once again.

Read the full article here