Investment Thesis

IT Operations cloud software company PagerDuty (NYSE:PD) reported its Q2 earnings report for the FY25 fiscal year, which showed some encouraging signs of troubles in its IT Operations software business bottoming.

The San Francisco, CA-based cloud software company has endured a difficult transitory period as has the larger cloud software environment as CIOs and CSOs have allocated a higher share of their IT budgets towards GenAI while sidelining software-focused projects in the process.

In addition, inflationary pressures and high-interest rate environments have also depressed IT budgets for SMB customers over the past 18-24 months, causing severe headwinds for PagerDuty since SMBs represented a major customer cohort for the software company.

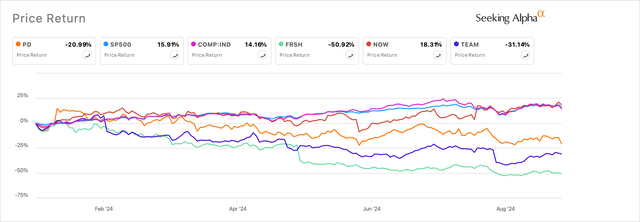

This has affected PagerDuty’s stock as it continues to underperform major indices and benchmarks.

Exhibit A: PagerDuty versus market indices and some of its peers. (Seeking Alpha)

However, stabilization in its customer metrics coupled with an uptick in its ARR and deferred revenue supports the midterm case for PagerDuty.

I am upgrading my rating on the company to a Hold for now.

Q2 Recap: Uptick In ARR, Deferred Revenue Can Revitalize Growth

The last time I covered PagerDuty, I recommended a Sell rating on this company, and I noted that the contraction in the company’s customer base was alarming. Management had made attempts to recalibrate and reduce dependency on its SMB customers, its core customer base at the time. Still, PagerDuty’s customers with >$100k ARR were also quickly decelerating.

Since my Sell rating, PagerDuty fell ~23%.

However, PagerDuty’s Q2 FY25 earnings report showed some solid signs of stabilization in customer volume as well as revenue metrics.

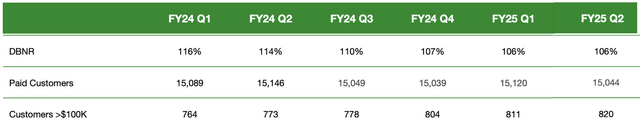

Starting with PagerDuty’s customer base, the company’s total paid customer count hovered around the 15k mark, flat from a year ago. This looked much better than the contraction I had observed through last year. Customers with >$100k in ARR decelerated at a slower rate, growing 6% y/y to 820 as noted in Exhibit B.

Exhibit B: PagerDuty’s customer volume showed signs of retention stabilizing as customer volume counts now remain range-bound. (Company Sources)

For the first time, management revealed that customers with >$500k in ARR grew 20% y/y which points to elevated levels of penetration in the enterprise target market. I would have preferred if the company would demonstrate an uptick in their DBNR ($-based net retention), which landed at 106% in Q2, down from the 114% seen in the same quarter last year but flat on a sequential basis. Management said they expect DBNR to move back to 107% by year-end.

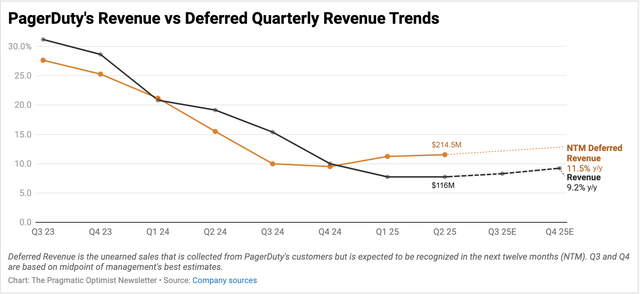

The improving customer metrics through the year have also translated into revenue trends that are now normalizing and appear to be at an inflection point. PagerDuty reported Q2 revenues of $116 million, up 7.8% y/y, within management’s prior guidance range but missing consensus estimates by half a million.

Exhibit C: PagerDuty’s Revenue and Deferred Revenue trends point to an inflection point. (Company filings)

Management attributed the marginal miss in revenues to CrowdStrike’s (CRWD) July 19 outage, as well as seasonal shifts in their business due to the company’s increased focus on selling to enterprise customers. Management also mentioned that due to the gradual shift in its customer base, with enterprise customers accounting for a larger share of its revenue, the company now expects the fourth quarter of its fiscal year to be the strongest quarter moving forward rather than the second or third quarter.

Still, PagerDuty, which makes IT incident management cloud software, is mostly staying on track to deliver ARR growth of 10% for the year, which points to expansion in H2 of this year. This was reiterated multiple times during the conference call to discuss Q2 earnings.

Q2 ARR accelerated on a sequential basis to $474 million, up 10% y/y, better than the 6% growth demonstrated in the previous quarter. The company’s deferred revenue, unearned revenue that the company has collected from customers but will recognize over the next twelve months, has already pivoted higher in the first quarter of this year, which supports management’s theory of re-acceleration in the back half of next year. On the call, management said that “ARR growth is expected to improve through the year, as is DBNR.”

In Q3, management expects revenue to grow to $115.5-$117.5 million, representing ~7% y/y growth, while also expecting $463-467 million in revenue for the full year, which implies 9% growth in their Q4 FY25.

Management making improvement on operating leverage

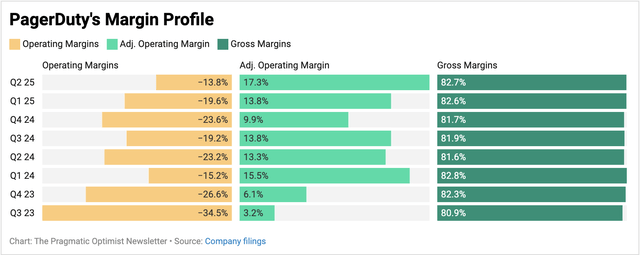

In Q2, PagerDuty recorded earnings per share of 21 cents, beating consensus estimates by 4 cents.

During the quarter, management demonstrated efficiency in capping its S&M spend, which grew just 2.5% y/y while administrative expenses contracted 7% y/y. The cost control shown by management allowed the company to expand its operating margins by 400 bp in the quarter on an adjusted basis. While adjusted operating margins expanded to 17.3% in Q2, GAAP operating margins also showed improvement, as noted in Exhibit D below.

Exhibit D: PagerDuty’s margin profile (Company filings)

Management said they continue to control components of their sales, marketing, and general expense structure, which should help the company expand margins further in the back half of the year.

PagerDuty’s capital structure remains fairly stable, with debt on its balance sheets remaining relatively unchanged at $461 million, while cash & equivalents marginally increased to $385 million and ST investments at $214 million.

PagerDuty’s valuation now looks more appealing than before

PagerDuty now expects FY25 revenues to be growing ~7.5% y/y this year, below the 8% y/y growth management was initially expecting. Part of the management’s reason to lower their guidance is based on elevated levels of seasonality arising out of CrowdStrike’s outage in July. I believe there are some heightened levels of conservatism being baked in since management does not want to repeat the string of downgraded outlooks it was forced to issue last year, which made it lose its credibility to a certain extent. In my view, the customer metrics, ARR, and the deferred revenue uptick all point to stabilization in PagerDuty business, in contrast to the bearish outlook I had earlier.

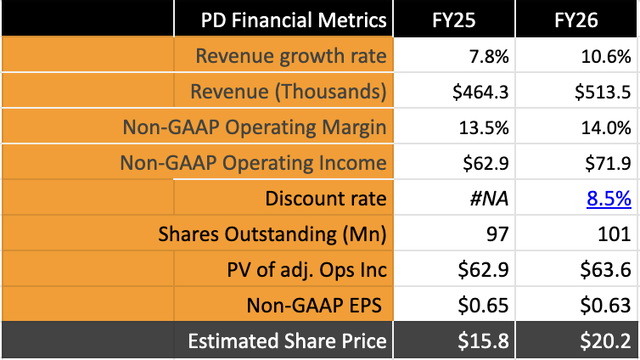

Management still expects 13.5% adjusted operating margins while projecting about 3.8% share dilution, marginally less than the 4% I was expecting. This translates to ~11.5% growth in earnings on an adjusted basis, which implies a forward earnings multiple of ~24x.

Exhibit E: PagerDuty’s valuation now shows the company is fair-priced after its Q2 earnings slump. (Author)

Based on the ~24x forward multiple, I estimate PagerDuty’s price per share to be ~$15.8, implying a 13.4% downside from the close on Sept. 3 or a further 1.2% downside from the aftermarket moves where PagerDuty’s price settled at $16.

At these price levels, I believe the worst could be priced in for PagerDuty, and at worst, the stock may remain range-bound. If the inflection story plays out, PagerDuty could be well-positioned to grow next year.

Risks & Other Factors To Look For

When commenting about the challenging environment for cloud software companies to conduct business, management mentioned that this is now the norm for them. They said they will continue to see elongated sales cycles, especially in their target market, which now includes enterprise customers who usually have more red tape and sales hoops at their end for PagerDuty’s sales teams to cycle through. Any relative change from here on in the current business environment for PagerDuty will cause more headwinds for the company.

Conversely, any improvement in the business environment could also boost the outlook for PagerDuty, as factors such as interest rates and improving IT budget expansions will improve the sales dynamics for the company. At all times, investors would do well to listen to management’s stance on their business environment while paying close attention to the company’s deferred revenue, ARR, and DBNR for hints about its outlook.

Takeaway

I certainly feel more encouraged about the improvements that PagerDuty’s management has shown in the past two quarters since I issued a Sell rating on the company earlier this year.

Deferred revenue, stabilizing DBNR, and a much better-looking customer mix and base now position the company in a posture to benefit from business expansion that lies ahead for its IT operations Incident Management business.

I have upgraded my ratings on PagerDuty to a Hold and remain optimistic on management turning around the company.

Read the full article here