2023 was a year to forget for several producers with continued margin compression because of inflationary pressures and missed guidance for several mid-cap and large-cap miners. However, Orla Mining (NYSE:ORLA) has continued to stand out in rare air among its peer group, putting up record quarterly production in Q4 and an incredible two consecutive 15%+ beats on its annual guidance midpoint. These results are nothing short of phenomenal in a sector where delivering above guidance is rare, especially factoring in the magnitude of the beats relative to the initial outlook.

In this update, we’ll dig into Orla’s Q4/FY2023 results, recent developments and see where the stock’s updated low-risk buy zone lies.

Dark Star – South Railroad Project

Q4 & FY2023 Production

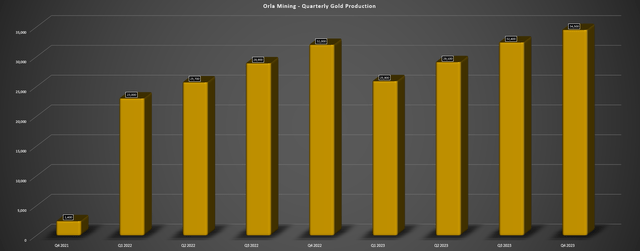

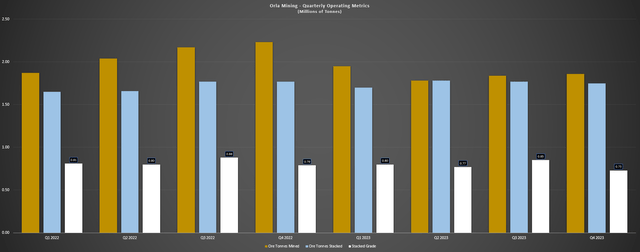

Orla Mining released its Q4 and FY2023 preliminary results last month, reporting a record quarterly production figure of ~34,500 ounces of gold. This was up 8% from the year-ago period and translated to a 6%+ beat vs. the previous quarterly record of ~32,400 ounces (Q3 2023). The strong results were driven by stacking rates consistently being above nameplate capacity (~19,000 tonnes per day), and solid grades of 0.73 grams per tonne of gold in Q4 (0.79 grams per tonne of gold for the year which was down marginally year-over-year). Meanwhile, Orla met its goal of moving to net cash positive by year-end, ending 2023 with $8 million in cash with another $25 million paid towards its RCF in Q4, with the balance down to just ~$88 million and the company having total liquidity of ~$160 million to easily fund South Railroad when combined with cash flow generation from Camino Rojo Oxides.

Orla Quarterly Gold Production – Company Filings, Author’s Chart Orla Mining Quarterly Operating Metrics – Company Filings, Author’s Chart

Digging into the results a little closer, Orla’s stacking rate average ~19,200 tonnes per day in FY2023, up 5% year-over-year and over 6% above nameplate capacity. Meanwhile, it had a lower strip ratio for the year of 0.56 vs. 0.67, and stacked ~7.0 million tonnes of ore vs. ~6.88 million tonnes in the year-ago period. This partially offset the lower stacked grades year-over-year, with Orla able to beat its previous production record of ~109,600 ounces, with annual production in FY2023 of ~121,900 ounces. Notably, this production figure crushed the company’s guidance mid-point of 105,000 ounces (16% beat) and was the most significant beat that I’m aware of sector-wide, just ahead of Lundin Gold (OTCQX:LUGDF) at Fruta del Norte in Ecuador which reported a 7% guidance beat vs. initial midpoint.

Finally, given the significant beat even vs. upward revised guidance, I would not be surprised to see all-in sustaining costs for FY2023 come in at an industry-leading figure yet again and below $710/oz (FY2022: $611/oz) and at the low end of its downward revised guidance range ($700/oz – $800/oz). That said, this was largely because of lower mining costs and a lower strip ratio due to the delayed receipt of permit amendments from SEMARNAT.

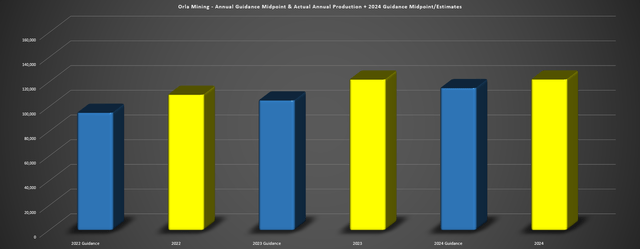

2024 Outlook

Moving to the company’s 2024 outlook, Orla Mining has provided guidance of 110,000 to 120,000 ounces for 2024 with a guidance midpoint of 115,000 ounces of gold at $925/oz all-in sustaining costs. This will represent a 6% decline in annual production at 30% higher costs, assuming Orla delivers at its mid-point this year, but as the chart below shows, Orla has consistently trounced its guidance midpoint and baked lots of conservatism into its guidance. In fact, the company’s average beat in its first two full years of commercial production has been ~15,800 ounces or 15% and a higher production level would help to reduce unit costs, providing leverage on higher sustaining capital expected this year. So, given Orla’s conservatism in the past, I would not be surprised to see annual production of at least 120,000+ ounces (~5% beat on midpoint) and all-in sustaining costs below $900/oz.

Orla Mining Annual Guidance Midpoint & Actual Annual Production + 2024 Guidance Midpoint/Estimates – Company Filings, Author’s Chart

So, why the higher costs?

As noted in its year-end update, Orla expects to have a much higher strip ratio this year of 1.2 (FY2023: 0.56) related to waste mining as part of the east-west pit expansion. Meanwhile, the company expects to see higher sustaining capital of $18.0 million, with this including $12.5 million for a heap leach expansion (Phase 2). In addition, Orla noted that two-thirds of annual sustaining capital is expected to land in Q1, suggesting a significant increase in costs sequentially and year-over-year vs. Q4 2023 and Q1 2023. That said, getting the bulk of sustaining capital out of the way early will help with lower costs as the year progresses, assuming the MXN/USD doesn’t continue to appreciate, which is another drag on costs. That said, Orla is in a much better position than its higher-cost Mexican peers like Endeavour Silver (EXK) and First Majestic (AG) given its margins and less than 50% of its costs are denominated in Mexican Pesos according to the company.

Recent Developments

As for recent developments, Orla is planning another aggressive year for exploration with a budget of ~$44 million with a 52/48 split at Camino Rojo and South Railroad, respectively. Not surprisingly, the company does not plan to drill at Cerro Quema given the less favorable outlook in Panama with the massive Cobre Panama Mine moving into care & maintenance after the First Quantum (OTCPK:FQVLF) was deemed unconstitutional. The good news is that the company has more than enough targets to drill over the next few years with the second-largest contiguous land package on the Carlin Trend following its Gold Standard Ventures acquisition, and significant upside at depth below the Camino Rojo Pit as well as surface and regional oxide targets. In fact, the company recently released new results from Camino Rojo Sulphides [CRS] with several thick mid-grade intercepts that included:

- 36 meters at 3.41 grams per tonne of gold

- 66 meters at 2.94 grams per tonne of gold

- 49.5 meters at 2.44 grams per tonne of gold

- 96.5 meters at 2.22 grams per tonne of gold

These intercepts continue to be some of the better intercepts on a grade/thickness standpoint drilled in North America, and quite similar to what Agnico Eagle (AEM) is hitting at Odyssey Underground where it has transitioned to underground mining after over a decade of surface mining at its Malartic Complex. Just as importantly, Orla is also seeing drill success near-mine on the surface, with thick intercepts in Layback drilling (76 meters at 0.85 grams per tonne of gold, 67 meters at 0.48 grams per tonne of gold), and southeast of its current pit boundary at Camino Rojo Oxides (67.1 meters at 1.16 grams per tonne of gold, 65.1 meters at 0.86 grams per tonne of gold). Finally, the company noted that there’s the potential for more selective underground mining methods to target high-grade areas at the CRS deposit with narrow intervals of up to 3 meters at 10+ grams per tonne of gold.

While ignored by many, Zacatecas has elephant-sized deposits like Penasquito and San Nicolas among many others, and the existence of a higher-grade underground opportunity at Camino Rojo is quite significant, helping to explain some of its premium valuation. And with a resource estimate expected out this year, we should finally be able to get an idea of the economics of this opportunity. That said, with full permits not in place at South Railroad and more time needed to advance CRS, Orla Mining will remain a ~120,000-ounce producer for at least the next two years which makes its valuation less compelling even if it is one of the top-5 highest margin producers sector-wide based on 2024 guidance.

Valuation

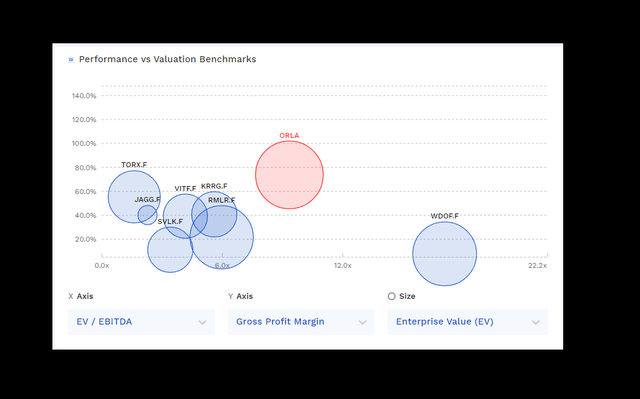

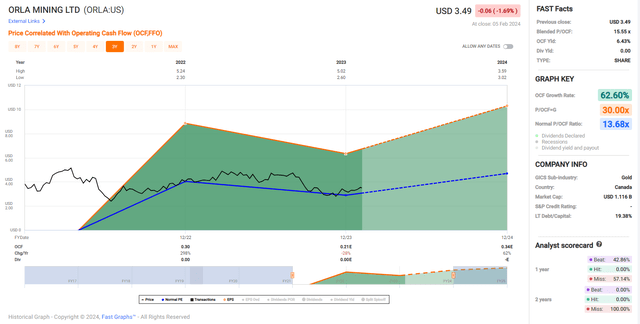

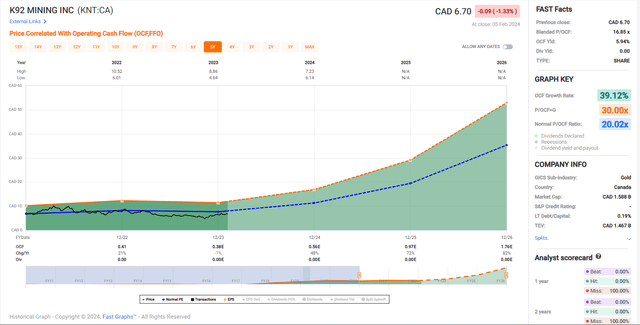

Based on ~352 million fully diluted shares and a share price of US$3.53, Orla Mining trades at a market cap of ~$1.24 billion and an enterprise value of ~$1.23 billion. This continues to be a steep valuation among the junior producer space and even compared to some mid-tiers like Torex Gold (OTCPK:TORXF), and especially among its high-growth junior producer peers. In fact, Orla Mining is now trading at a higher valuation than Torex which is a 400,000+ ounce per annum producer in Mexico with industry-leading costs and a very strong track record, even if Guerrero State (Morelos Complex owned by Torex) deserves a discount relative to Zacatecas (Camino Rojo). Meanwhile, if we compare Orla Mining to K92 Mining (OTCQX:KNTNF), K92 is trading at a lower enterprise value but will be a much larger producer in 2026 with production of 350,000+ gold-equivalent ounces [GEOs] and set to generate average annual free cash flow of ~$280 million in 2025 through 2027.

Orla Mining Valuation, Margins & Enterprise Value vs. Peers – FinBox

One could certainly argue that Orla deserves a premium vs. the average junior producer given its strong track record to date of over-delivering on promises. In addition, Camino Rojo may be small but it’s a phenomenal asset, and Orla has 350,000+ gold-equivalent ounces per annum potential in its portfolio with Railroad South and Camino Rojo Sulphides. That said, permits are still not in place at Railroad South, meaning that the path to 300,000+ ounces per annum will take longer than some of its lower capitalization peers (K92 Mining is set to reach ~300,000 GEO per annum status by H2 2025). In summary, although I don’t see Orla as undervalued, I think there are several more attractive bets elsewhere in the sector today if one is going to pay a $1.0+ billion valuation for a gold producer.

Orla Mining Cash Flow Multiple & Historical Cash Flow Multiple – FASTGraphs K92 Mining Cash Flow Multiple & Historical Cash Flow Multiple – FASTGraphs

Using what I believe to be fair multiples of 0.90x P/NAV (all of operating NAV tied to Mexico) and 8.5x cash flow and a weighting of 65% to P/NAV and 35% to P/CF, I see a fair value for Orla of US$4.25. However, I am looking for a minimum 40% discount to fair value to justify entering new positions in small-cap producers, and ideally closer to 50% for producers with the bulk of their NAV tied to Tier-2/Tier-3 jurisdictions. And if we apply this discount to ORLA, its ideal buy zone comes in at US$2.60 or lower. In summary, I would only get interested if we saw a deeper pullback in the stock where a larger margin of safety would be present.

Summary

Orla Mining had another exceptional year in 2023, marking its second consecutive year of beating its guidance midpoint by at least 15%, with an even larger beat in 2023 (+16%). And while the company’s 2024 guidance implies lower production at higher costs, I would not be surprised to see another 120,000+ ounce year in 2024, given the company’s conservatism when issuing guidance and track record of massive over-delivery on promises. That said, I prefer to pay the right price or pass entirely in cyclical sectors, and while K92 Mining below US$4.00 and B2Gold (BTG) today below US$2.70 certainly fit the bill, I don’t see nearly enough margin of safety in Orla Mining today. Hence, while I would not be shocked to see further upside in the stock this year, I see more attractive reward/risk bets elsewhere.

Thanks for reading! I am currently in the process of setting up an Investing Group on Seeking Alpha. My subscription service, Alluvial Gold Research, will be going live soon and will include my proprietary sentiment indicator for miners, exclusive research and my top-ranked precious metals names across multiple scoring metrics. Be sure to check out my upcoming articles for more information which will include special pricing for early subscribers and my launch date.

Read the full article here