I assigned a ‘Sell’ rating to Oracle (NYSE:ORCL) in my article published in January 2024, arguing that the company is losing strength in cloud and AI. Oracle released its Q1 FY25 result on September 9th after the bell, reporting 8% growth in revenue and 17% increase in EPS. While I think Oracle’s partnership with Amazon (AMZN) is quite positive for the growth of Oracle’s Autonomous database, I am still concerned about their legacy business including hardware, on-premise license and services. I reiterate ‘Sell’ rating with a fair value of $125 per share.

Partnership With Amazon

On September 9th, Oracle announced the strategic partnership with Amazon’s AWS, launching Oracle Database@AWS, a new service allowing customers to access Oracle Autonomous Database and Oracle Exadata Database Service. I believe the partnership will benefit Oracle in the near future. Key reasons are:

- AWS’s customers can easily deploy their Oracle database using AWS’s existing development tools. The new service offering could facilitate the migration of Oracle’s existing customers’ workloads to AWS’s cloud infrastructure, without requiring significant changes to their database configurations.

- Compared to Microsoft’s (MSFT) Azure and Google Cloud Services (GCS), AWS is currently the leader in the public cloud infrastructure. The partnership with AWS could help Oracle reach a broader customer base, particularly those who have already migrated their workloads to the cloud.

- Oracle Database@AWS can integrate with Amazon’s exiting storage services, allowing customers to utilize both database and storage functionalities within AWS. The integrated services could save customers tremendous time and costs in building their cloud infrastructures.

While the partnership makes strategic sense, I still think Oracle is late to the cloud-based database market.

MongoDB (MDB) designed their database products on AWS from the outset, and their Atlas database revenue grew by 27% year-over-year in Q2 FY25. In the earnings call, MongoDB’s management indicated that the company is migrating away from legacy database providers like Oracle and MySQL. As discussed in my previous report, MongoDB’s JSON format offers great flexibility to database users and makes the Atlas database more suitable for cloud computing and AI workloads.

In contrast, Oracle is burdened by their legacy database businesses. Historically, customers needed to purchase database software from Oracle, along with expensive hardware to run these proprietary databases and SQLs. Additionally, customers needed to pay annual service fees for real-time support and upgrades. However, in the cloud world, the business model changed in a big way, as customers just need to pay subscription fees, or consumption-based expenses to database providers, without needing proprietary hardware. Oracle’s hardware and services represent around 6% and 10% of total revenues, respectively.

Growth Driven by Cloud Services

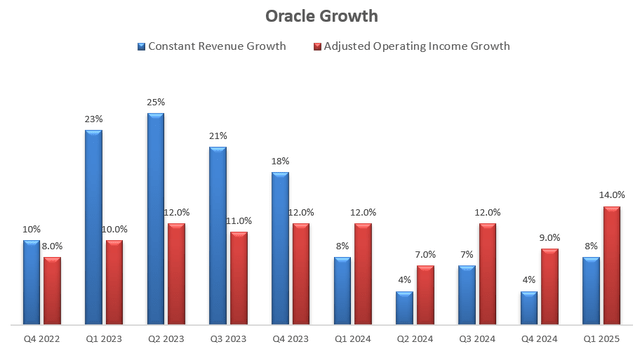

In Q1, driven by a 22% constant revenue growth in Cloud business, Oracle delivered 8% constant revenue growth and 14% increase in adjusted operating income growth, as shown in the chart below:

Oracle Quarterly Results

I have no doubt that Oracle will sustain the strong growth momentum in their cloud business, and the new partnership with AWS could potentially accelerate the overall growth. In addition, Oracle exited the quarter with a $99 billion total backlog, paving the way for FY25’s growth.

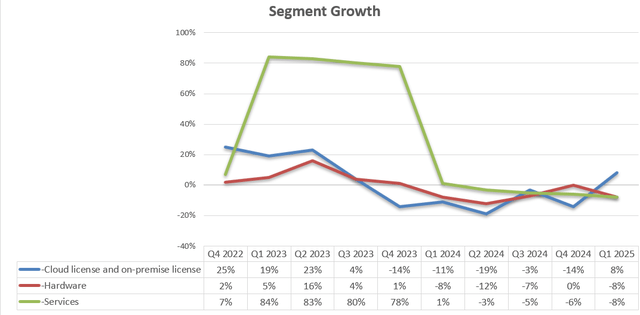

However, other than their cloud business, the other three segments have been experiencing weak growth over the past few years, due to the rising cloud computing and decline in on-premises database market. As depicted in the chart below, both hardware and service revenues declined by 8% during the quarter. While their on-premise license revenue grew by 8% in Q1 FY25, this growth is primarily because of a weak comparison base from Q1 FY24. I anticipate the weakness in these three segments will persist, as more workloads continue to move to public/private clouds, leading to declining demand for on-premises databases.

Oracle Quarterly Results

Outlook and Valuation

For the near-term growth, I analyze the growth rates for Oracle’s legacy businesses and Cloud services separately, as follows:

- Cloud services and license support: As evidenced in Q1, the segment will remain the primary growth driver for Oracle’s overall growth. With increasing workloads being migrated to the cloud infrastructure propelled by AI training/inference, Oracle’s cloud infrastructure and cloud database services are likely to grow at double-digit, in my view. With the partnership with Amazon, Oracle is more likely to attract more potential customers in the near future. As such, I estimate the segment will grow its revenue by 10% in the future.

- Cloud license and on-premise license: I believe the business will continue to decline over time, as it is unlikely that customers will increase their investment in on-premise databases. As Oracle provides mission-critical database services, it will take a long time for customers to migrate the traditional database to a new vendor. Therefore, I think the revenue decline will likely be slow. I assume a 3% annual decline in revenue for this segment.

- Hardware: Similar to their on-premise license business, the demand for hardware is expected to diminish over time. I assume the revenue will decline by 3% annually.

- Services: Services business is closely tied to on-premises license and hardware sales. I anticipate a 3% annual decline, consistent with historical trends.

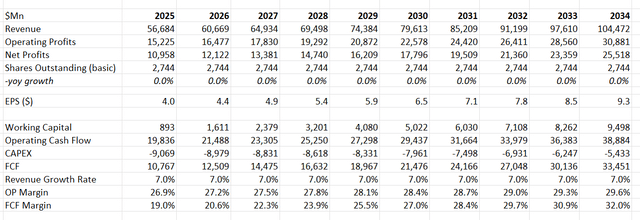

Putting together, I calculate Oracle will grow their revenue by 7% annually. I calculate that Oracle will generate 30bps annual margin expansion, driven by: 10bps from gross profits due to price increase; 10bps from SG&A optimization and 10bps operating leverage from R&D expenses. My DCF model can be summarized as follows:

Oracle DCF

The WACC is calculated to be 10% assuming: risk-free rate 3.7%; beta 1.05; equity risk premium 7%; cost of debt 7%; equity balance $390 billion; debt $87 billion; tax rate 7%. Discounting all the free cash flow, the fair value of Oracle is estimated to be $125 per share.

Upside Risks

As I assign a ‘Sell’ rating to Oracle, I am considering the factors that might trigger an upside in the stock price. Oracle has been investing heavily in their cloud infrastructure globally, with a total of 162 cloud datacenters so far. Oracle maintains a good relationship with Nvidia (NVDA), providing extensive Nvidia GPU clusters for AI training/inference services. As disclosed by the management, Oracle has signed cloud GPU contracts totaling $3 billion. With the rapid growth in AI computing, I anticipate Oracle will secure more large deals, leveraging their cloud infrastructure and database strengths. If Oracle can grow rapidly in their AI training infrastructure, the market might eventually view the company as an AI company in the future.

End Notes

While the partnership with Amazon and launch of Oracle Database @AWS are promising, I remain concerned about the future of their on-premise license, hardware and services. I reiterate ‘Sell’ rating with a fair value of $125 per share.

Read the full article here