MoneyShow’s top contributing analysts, strategists, and newsletter editors share their investment recommendations for the year ahead. See Part 1 here.

Arista Networks

By James Kelleher, Senior Analyst at Argus Research

Arista Networks (ANET), our top pick in Technology-Communications Networks, is a leading supplier of cloud networking solutions for Internet companies, cloud service providers, and next-generation data centers.

After 100%-plus growth in cloud titan spending in 2022, Arista initially expected this category to slow in 2023. The arrival of generative AIs such as ChatGPT and Bard, however, has led to accelerating growth in cloud-based data center networking in support of large language models (LLMs).

As the leader in enterprise and data center cloud networking, Arista is uniquely positioned to benefit from this unfolding opportunity. Having navigated the supply chain crisis, Arista is now successfully managing through macroeconomic weakness, customer caution, cost inflation, and lingering supply issues.

Arista is now seeing strength in most customer verticals, including cloud titans and enterprise data center clients. Arista has supplemented its focus on cloud, carrier, and large-enterprise customers with products for the campus and mainstream switching market, which is now evolving to a distributed workplace environment.

The company early in 2023 offered its first WAN routing solution, which further expands the available TAM. The company is financially strong and cash is growing rapidly. Arista, in our view, appears positioned for sustained annual revenue and EPS growth in 2024 and beyond.

Athene Holding Preferred Series E

By Marty Fridson, Editor of Forbes/Fridson Income Securities

The Athene Holding, Ltd. 7.750% Fixed Rate-Reset, Series E, Non-Cumulative Perpetual Preferred (ATH.PR.E) has investment-grade ratings (Moody’s Baa3, S&P BBB). The company’s senior unsecured debt is rated Baa1/BBB+. In the current environment, we are more comfortable with an issue of this insurance company than with issues of regional banks, which are very prominent in the preferred stock universe.

The issue is not immune from the risk of illiquidity that could cause its price to drop off temporarily if the economy and financial markets falter in 2024, but its dividends should not be in jeopardy of suspension. ATH-E’s dividends are qualified, meaning that they are taxed at a 15% or 20% rate, depending on the holder’s bracket.

We consider the issue suitable for low-to medium-risk taxable portfolios. Athene Holding Ltd. is a major specialty insurer, focusing on retirement services, with $237 billion in total assets. It has been owned by Apollo Global Management (Apollo) since January 1, 2022.

Athene issues, reinsures, and acquires savings products for individuals’ and institutions’ retirement needs. The company offers annuities backed by the financial strength of its Single-A-rated rated operating subsidiaries. Business operations are managed across multiple distribution channels, including Retail, Pension Group Annuities, Acquisitions and Block Reinsurance.

The company’s 7.750% fixed rate-reset preferred is redeemable on or after December 30, 2027 at par (25), plus declared and unpaid dividends. If the preferred is not called in its entirety, the dividend resets to the five-year US Treasury rate plus 3.962%.

Financial flexibility is solid, evidenced by low financial leverage and strong fixed charge coverage. This preferred is qualified, with dividends taxed at the 15%-20% rate. This security is suitable for low- to medium-risk taxable portfolios. The CUSIP is 04686J507.

Aya Gold & Silver

By Peter Krauth, Editor of Silver Stock Investor

As we start 2024, many of the extremely bullish drivers for gold are the same for its cousin, silver. On December 1, 2023, gold hit a new all-time high of USD$2,071 after three previous attempts in 2020, early 2022, and again in early 2023. Now it seems the fourth time’s the charm – making Aya Gold & Silver (OTCQX:AYASF, AYA:CA) attractive.

So, what’s driving precious metals? The two main drivers have been an anticipated end to Federal Reserve rate hikes and a renewed US dollar bear move. As inflation continues to fall and unemployment continues to rise, the Fed’s interest rate hikes are having the intended effect of slowing economic growth.

Naturally, high rates compete with precious metals as low-risk bonds pay attractive returns. By the same token, as the market starts to price in eventual rate cuts in 2024, likely on the back of a recession, then a weakening US dollar makes sense. With precious metals priced in dollars, it takes more dollars when they are weak to buy an ounce of silver or gold, hence their rising prices.

In addition to this, central banks have become net buyers of gold after the 2008 global financial crisis. In 2022, they bought a record 1,000 tons of gold and are expected to surpass that level once again for 2023. All of this is very bullish for precious metals.

Aya is a silver miner operating in the Kingdom of Morocco, with one of the world’s largest high-grade, pure silver mines. Its Zgounder mine currently produces about 1.8Moz of silver annually. However, the opportunity is highlighted by its current mine expansion program.

Zgounder will ramp up production in Q2 2024, quadrupling annual output to 8Moz silver at an all-in, life-of-mine sustaining cost of just $9.58/oz. This expansion boasts a 48% IRR and a payback of just 1.7 years.

In addition, Aya is exploring and expanding resources at Zgounder as well at its Boumadine polymetallic project, which itself has an IRR of 56% and NPV of $575 million.

Aya is also aggressively acquiring additional highly prospective projects located along the prolific Anti-Atlas Mountain range. In this rising silver price environment, Aya is poised to become a veritable cash machine, making it a true bargain at current prices.

Baxter International

By Tom Hayes, Editor of Hedge Fund Tips

Baxter International (BAX) has four divisions: Medical Products & Therapies, Healthcare Systems & Technologies, Pharmaceuticals, and Kidney Care. The stock aggressively sold off ~65% due to supply chain issues, Hillrom impairment, and most recently, on fears that GLP-1 anti-obesity drugs will impact medical device suppliers. That seems overblown.

The stock’s average historical P/E is around 19x. It was recently trading at 12x 2024 profits. Revenue guidance is +4%-5% prospectively.

Meanwhile, margins are improving sequentially across all segments. It doubled Free Cash Flow YTD on a year-over-year basis. And it’s a double-digit compounder over decades (ROIC).

Baxter also has several catalysts for recovery. They include the company’s sale of BioPharma Solutions for $4.25B, with the proceeds being used to pay down debt (something that reduces interest expense by $180M). BAX is also spinning off its Kidney Care business to shareholders. Doing that with the firm’s slowest-growing segment should allow the parent company to get re-rated for faster growth and a higher multiple prospectively.

Additional product launches and operating efficiency expectations should also help the stock. I think it can work its way up to $60+ over the next 12-18 months.

BlackRock

By John Dobosz, Editor of Forbes Dividend Investor

Just about any of the most famous billionaire investors will tell you not to think of investing as buying stocks but buying businesses. My top name for 2024 is BlackRock (BLK), the asset management firm founded in 1988 and based in New York.

The benefit of buying shares in a variety of companies is that it allows you to access the financial returns associated with a business without needing to possess the means of production or coming up with the required capital to build such an enterprise yourself. This allows talented people to focus on what they do best, which in turn promotes deeper degrees of expertise and ultimately higher profits.

BlackRock has grown over the past 35 years to become the world’s largest asset management company, with $8.6 trillion in total assets under management at the end of 2022. Headed up by famed one-time billionaire Larry Fink as chairman and CEO, BlackRock provides investment management, risk management, and advisory services for institutional and retail clients around the world.

Last year, 81% of $17.9 billion in total revenue came from BlackRock’s advisory business. Two-thirds of revenue derives from North America, and 30% from Europe. One of the big trends that BlackRock has capitalized on is the growing popularity of exchange-traded funds. In 2009, it acquired the iShares collection of ETFs from Barclays.

Wall Street expects BlackRock’s revenue to grow 7.4% to $19.1 billion in 2024, with earnings up 2.4% to $37.68 per share. Free cash flow over the past month totaled $25.05 per share. At the current quarterly rate of $5 per share, dividends total 53% of expected earnings and 80% of free cash flow.

Here’s some comforting history if you’re worried about your dividends keeping up with inflation: Since it paid its first dividend of $0.20 in 2003, BlackRock has hiked the quarterly payout 17.5% annually over the past two decades.

It’s a notable sign of respect if you’re in the investment business and you attract enough interest from peers that they invest in your company. Ken Fisher’s Fisher Asset Management has been accumulating shares since 2021 and now owns a $1.97 billion stake. Israel Englander’s Millennium Management has boosted its ownership in BlackRock steadily over the past year, and owned 305,000 shares worth $277 million as of the fourth quarter of 2023.

BP Plc

By Kelley Wright, Editor of Investment Quality Trends

BP Plc (BP) is an oil and gas supermajor that operates across exploration and production, refining, distribution, marketing, electricity generation, and trading. BP is also one of the world’s largest companies by revenue and profits in any industry.

Listed on the London Stock Exchange, BP is an FTSE 100 index constituent. It also trades in the US. It is a company in transition as it has a “decarbonization” strategy with a focus on renewables, bioenergy, carbon capture and storage technologies, hydrogen, electric vehicle charging, and a target of net zero emissions by 2050.

This does not mean the company has abandoned hydrocarbons, however. BP projects EBITDA of $46-49 billion in FY2025, unchanged vs. previously announced targets; and a hydrocarbons EBITDA of $41-44 billion and group EBITDA of $53-58 billion by FY2030. That was $2 billion higher versus previous targets, driven mostly by hydrocarbons.

BP expects capex of $14-18 billion per year between 2024 and 2030, capacity for a 4% annual dividend increase with oil at $60/barrel, and capacity for $4 billion of share buybacks per year at $60/barrel.

In short, BP is integrating green energy into its hydrocarbon business. Based on its historically repetitive dividend yield boundaries, BP is solidly in our Undervalued area. The Return on Invested Capital is 14%, and the Free Cash Flow Yield is 12%.

The stock was trading in the $34-$35 range in late 2023, significantly below its Economic Book Value of $179 per share. Including its 4.7% dividend yield, BP is a strong growth and income option for any portfolio.

Brookfield Infrastructure Partners

By Aaron Dunn, Senior Equity Analyst at KeyStone Financial

Brookfield Infrastructure Partners (BIP) is a global infrastructure company with a portfolio of high-quality, long-life assets that generate stable cash flows and support a stream of growing income distributions to investors. BIP is what we consider to be a core income and growth investment.

The company has a tremendous long-term track record of growing its cash flow and delivering tremendous value to its investors. BIP has a 14-year history of consistently increasing its income distributions on an annual basis. Over the past 10 years, the distribution has grown at an average compound rate of 8%, nearly doubling from US$0.69 in 2013 to US$1.53 in 2023.

It’s not easy to find a fundamentally strong investment that offers stable cash flows, growth, and income. BIP defines itself as a “grow-utility” which combines the stability of a utility with the upside of a growing company. The company’s portfolio includes essential assets such as ports, railroads, energy infrastructure, and data centers.

Approximately 90% of the company’s revenue is based on long-term contracts or regulatory rates of return and 70% is indexed to inflation, both of which help to insulate the company from adverse economic events. Despite the stable nature of the business, the company’s internal investments and acquisitions have resulted in cash flow (FFO – funds from operations) per unit more than doubling over the past decade from US$1.31 in 2013 to approximately US$2.95 in 2023.

Looking forward, BIP is well-positioned for future growth. The company completed significant asset sales and acquisitions during 2023. The outlook for 2024 is strong and management believes that the current environment provides exceptional opportunities to make investments at returns well above the target rates.

BIP has also been very active in expanding its data center business and has identified this market as providing solid growth opportunities as well as an avenue to participate in key trends such as AI and cloud computing. The company is targeting 12%+ growth in FFO per unit annually over the next one to three years.

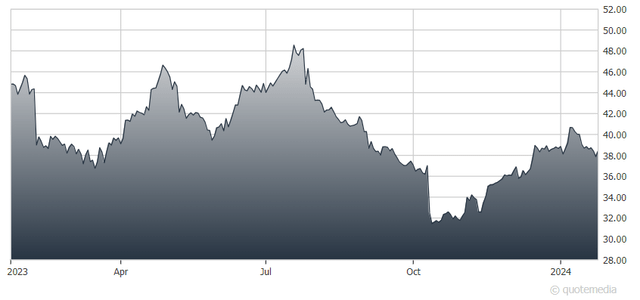

BIP’s stock price has experienced significant volatility over the past year, which has moved the valuation and income yield to attractive levels. We believe the company is well-positioned to generate significant shareholder value over the next three-plus years.

BYD Co. Ltd.

By Chris Preston of Cabot Wealth Network

Short for “Build Your Dreams,” BYD Co. Ltd. (OTCPK:BYDDF, OTCPK:BYDDY) has quickly become China’s version of Tesla (TSLA). In March 2022, the company stopped making combustion engine vehicles to go full electric, or at least mostly electric. It now produces both battery electric vehicles (BEVs) and hybrids.

The shift in focus paid immediate dividends in a country that loves the electric vehicle: BYD’s revenues leapt to $63.1 billion in 2022 from $33.5 billion in 2021 and $22.7 billion in 2020. In 2023, BYD has grown revenues by double digits every quarter, and is likely to exceed its stated goal of selling more than three million electric vehicles.

What makes BYD unique is the wide array of price points on its vehicles. The company just released the “Seagull,” the cheapest electric vehicle in existence at a starting price of a mere $10,200 (or 73,000 yuan). It also makes the most expensive mass-produced car in China, the Yangwang U8, an off-road hybrid that costs $159,000.

BYD’s “something for everybody” identity – with cars for consumers of all income ranges – has Elon Musk spooked. It’s a big reason why Musk and Tesla have repeatedly slashed prices on some of their top models (Model 3 and Y) this year. The goal is to better compete with BYD not only in China – where BYD is far and away the largest automaker – but also globally, as BYD is just scratching the surface of its worldwide expansion.

Notably, BYD does not yet sell cars in the US, and likely won’t for some time in part due to current frigid relations between the US and China. But even without an American presence, BYD sold roughly the same number of BEVs worldwide in the third quarter of 2023 as Tesla (431,603 to Tesla’s 435,059), and could top Tesla as the global electric vehicle leader soon.

And yet, BYD stock has been a bit “meh.” Plus, the stock’s tendency for fits and starts has been maddening, with investors seemingly selling off after every big move, including an 18% faceplant in the second half of November 2023.

All the ups and downs should dissipate once China’s recovery picks up steam, and there are signs that it is after its GDP growth (4.9%) exceeded expectations (4.4%) in the third quarter. US investors will likely be more willing to take on the “risk” of snatching up shares of a Chinese EV stock. And with that stock recently trading at less than 15 times forward earnings estimates – and exactly a third off its 2022 highs – this is an ideal time to buy.

Caesarstone Ltd.

By Benj Gallander, President of Contra the Heard

Caesarstone Ltd. (CSTE) has seen its stock price drop by about half over the past year, but we feel a major turnaround is in store. This corporation manufactures and markets engineered quartz and other countertop surfaces in numerous countries. You have likely eaten off one of their tabletops (as I do virtually every day).

This enterprise is a global leader in its space and has been profitable every year since going public in 2012, except for the last two years. The corporation is conservatively operated and trades at less than half its book value. It pays dividends when annual earnings per share are greater than $0.10. Insiders are well aligned with investors as they own more than 40% of the company.

In the United States, the market share for quartz countertops jumped from 5% to 20% since 2010. In Canada, they possess 28% of the market, up from 9% since 2010.

There was a big revenue drop in the third quarter of 2023, to $142.4 million from $180.7 million in the prior year. The lower volumes were primarily impacted by global economic headwinds that resulted in diminished demand.

Gross margin in the third quarter of 2023 was 19.1%, compared to 23% in the prior year. Adjusted gross margin in the third quarter was 19.8%, compared to 23.1% in the prior year. The decrease in gross margin resulted from lower revenues and increased manufacturing unit costs due to lower fixed cost absorption mainly related to lower capacity utilization. This was partially offset by lower shipping costs and the benefits of an improved production footprint.

The operating loss in the quarter was $2 million, compared to operating income of $3.2 million in the prior year. The decrease mainly reflects the reduced gross margin.

The corporate dividend policy is very distinct. Fifty percent of net income on a year-to-date basis will be paid, unless this is less than $0.10 a share, in which case nothing is given. That makes for a spotty payout and there will not be one from the most recent quarter. Yes, another reason to discourage potential investors and cause some people to sell.

Geopolitical risk is also an important factor with the firm. It is headquartered in Israel, where it has one of its three manufacturing facilities. Persistent tension and regular armed conflict in the region seem to have been going on forever and there does not seem to be an end in sight.

But this stock used to trade north of $71 seven years ago. Five years ago, it was almost $40. From this angle, it appears to have the ability to regain form with lots of upside. A stock price north of $30 seems eminently reasonable.

Cameco

By Sean Brodrick, Editor of Resource Trader

If they were asked to name conservative investments, most investors wouldn’t pick uranium. After all, the energy metal has been under pressure for years. But I’m here to tell you that profiting from select uranium stocks over the next few years is like shooting fish in a barrel: It’s hard to miss. One of my favorite names is Cameco (CCJ).

The fundamentals are easy. Big stockpiles depressed the price of uranium for years. So, no one built new mines; it was too cheap to mine profitably. But stockpiles got used up. The price has been soaring. The price of uranium was at a 15-year high recently, and it’s just getting started. Supply is tight.

What’s more, the US and the European Union are both working on laws to cut or halt imports of Russian uranium and uranium enrichment services, due to that country’s ongoing war in Ukraine.

Russia provides about 10% of the world’s uranium and 35% of its enriched uranium fuel. When combined with other major uranium-producing countries like Kazakhstan and Uzbekistan, which are in Russia’s sphere of influence, this means more than 60% of the world’s uranium supply is controlled by Russia and its clients.

On the demand side, each 1,000-megawatt reactor uses about 27 metric tonnes of uranium per year; triple that to start up a new reactor. There are about 407 nuclear power plants currently operating, 60 new atomic plants being built, and another 110 planned.

Let’s add in that, at the recent COP28 climate summit in Dubai, 22 countries pledged to triple their nuclear power capacity by 2050. Now, it’s a race for uranium supply.

That brings us to CCJ. The company is the biggest uranium miner in the Western world. Most of its operations are in Canada’s Athabasca Basin. Its flagship assets are Cigar Lake, with 84.4 million pounds in uranium reserves, and McArthur Lake, with 275 million pounds. The company also operates the Inkai mine in Kazakhstan with Kazatomprom.

Cameco is signing more delivery contracts, and at higher prices. The company’s long-term commitments require an average annual delivery of 29 million pounds of uranium over the next five years. Compare that to the 26 million pounds reported at the end of March.

Most of those are fixed-price contracts. That means those contracts won’t benefit from rising uranium prices. However, Cameco is also signing more market-priced contracts. Those contracts offer exposure to rising uranium prices.

Recently, Cameco acquired a 49% stake in Westinghouse Electric Company, one of the leading nuclear reactor manufacturers. The remaining 51% is owned by Brookfield Renewable Partners (BEP). The deal transformed Cameco into a fully integrated uranium producer.

Cameco recently raised its earnings forecast. And yet, the price of uranium is probably going much higher. Cameco’s earnings ramp-up is really something. But man, you ain’t seen nothin’ yet.

Originally posted on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here