Mondelez International (NASDAQ:MDLZ) is a multinational company that sells snack food and beverage products in Latin America, North America, Asia, the Middle East, and Europe. The company’s website highlights its iconic brands, including Oreo, Cadbury, Milka, Toblerone, and many others. Meanwhile, chocolate is a critical input in MDLZ’s products.

The world’s leading producers of cocoa beans, the primary ingredient in chocolate confectionery products, are in West Africa. The Ivory Coast is the top producer, with neighboring Ghana the second-leading cocoa-producing country.

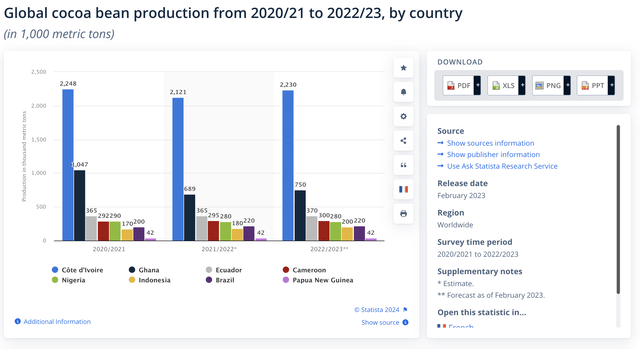

Global Cocoa Production by Country (Statista)

The chart shows that West African countries dominate worldwide cocoa production. In 2023, cocoa prices soared, and it moved even higher in early 2024, increasing MDLZ’s production costs. Meanwhile, like cocoa, MDLZ shares have been in a bullish trend over the past years.

Cocoa is a critical ingredient for MDLZ

Cocoa is a crucial component of the cost of goods sold in many Mondelez products. The company chairs the World Cocoa Foundation, an organization dedicated to “catalyze public-private action to accelerate cocoa sustainability.” The company supports the foundation’s “multi-stakeholdership approach for formative change in the cocoa supply chain via joint learnings and knowledge sharing.”

The foundation’s members are farm-level input providers, financial institutions, cocoa processors, chocolate markets and manufacturers, farm cooperatives, cocoa trading companies and retailers. The World Cocoa Foundation works on equitable and collaborative issues to improve farmer income, reverse deforestation, and combat child labor. Since West Africa is the hub of international cocoa bean production, Mondelez and the other leading food companies manufacturing chocolate confectionery and other chocolate products that rely on cocoa bean output are foundation members.

Cocoa prices have soared

ICE cocoa futures prices reached a $1,769 per ton bottom in June 2017. The price made higher lows and higher highs through April 2023, when the soft commodity broke out to the upside.

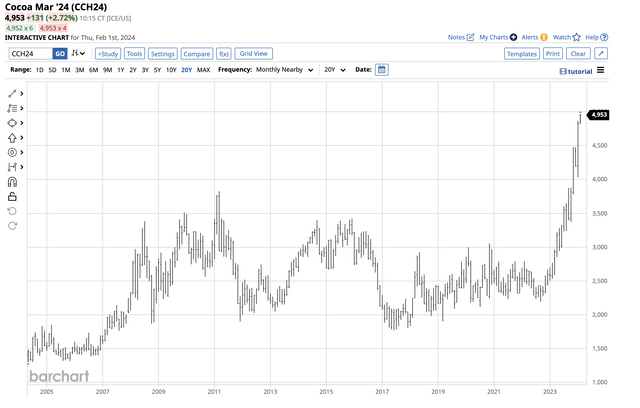

Twenty-Year Chart of Cocoa Futures Prices (Barchart)

The chart highlights cocoa futures’ explosive move in 2023, and that continued to take the price to higher highs in 2024. Nearby cocoa futures eclipsed the March 2011 $3,826 per ton high and long-term technical resistance level in September 2023. Two months later, the price traded above the $4,000 per ton level for the first time in decades.

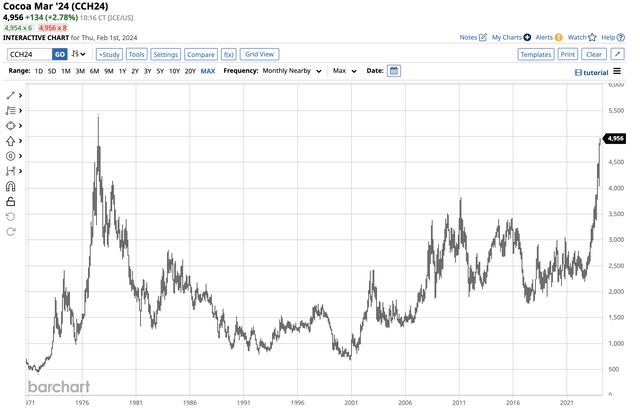

Long-Term Chart of Cocoa Futures Prices (Barchart)

The chart dating back to 1970 illustrates cocoa moved over $4,000 per ton in late 2023 for the first time since 1978. The most recent $4,966 high was the highest since July 1977, when cocoa futures peaked at $5,379 per ton.

A bull market in MDLZ since 2009

Meanwhile, MDLZ shares have been in a bullish trend since reaching a $10.40 low in March 2009 when the global financial crisis gripped markets across all asset classes.

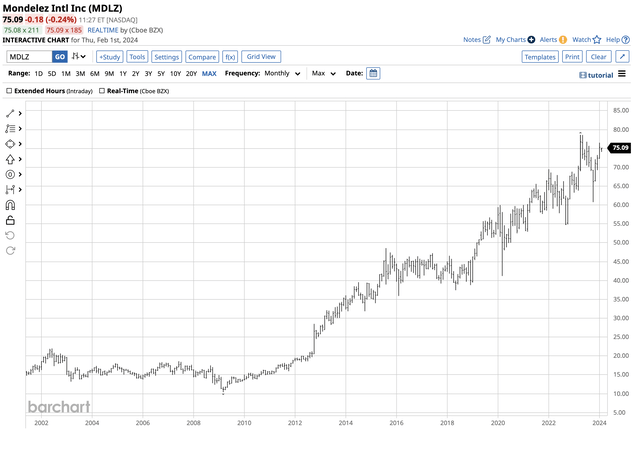

Long-Term MDLZ Chart (Barchart)

The chart shows that the next significant world crisis, the 2020 global pandemic, weighed on MDLZ shares but took them to a higher $41.19 per share low.

MDLZ reached a record high of $78.59 in April 2023, and was not far below that level, at $75.09, on Feb. 1, 2024. The latest earnings report showed a beat on EPS and revenue.

Rising cocoa prices could weigh on MDLZ – Or Not

Rising cocoa prices impact the cost of goods sold for MDLZ and other companies that require cocoa for their products. Inclement weather in West Africa caused the explosive price move, and excessive rain causing harvest delays could lead to devastating crop diseases. Supply shortages and high prices could weigh on MDLZ and other cocoa consumers’ shares as they cut into profit margins.

Meanwhile, chocolate is one of the most popular worldwide treats. If the prices of chocolate products do not display the price elasticity of other commodities, chocolate manufacturers could increase prices to retail consumers, allowing them to maintain, or even increase, their profit margins, leading to even higher share prices over the coming months and years.

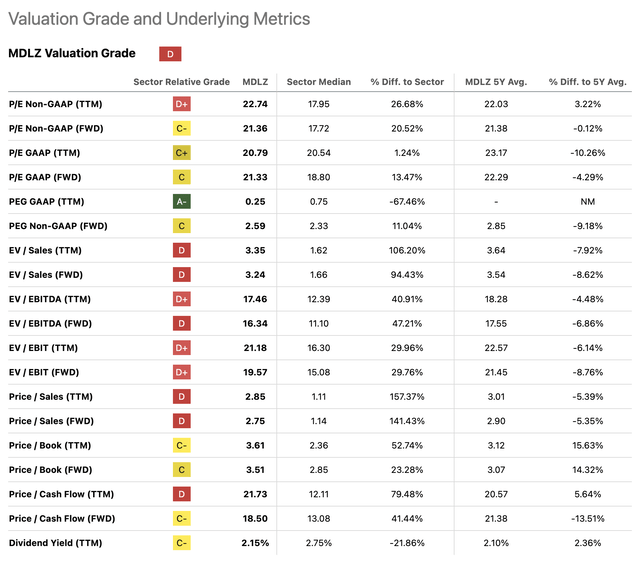

Seeking Alpha factor grades give MDLZ a “D” on valuation.

Valuation Factor Grades (Seeking Alpha)

As the chart shows, the D-rating could be problematic for the stock over the coming months. Moreover, the company expects slower growth in 2024, which could weigh on MDLZ shares.

A good time to consider taking profits or a short position

If the current sky-high cocoa prices cause consumers to cut back on their favorite treats, MDLZ, and other chocolate-related companies could see sales decline over the coming weeks and months, leading to lower earnings and share prices.

While MDLZ was able to raise prices in the past to offset the impact of rising cocoa prices by increasing their product prices, the trajectory of the cocoa rally over the past weeks and months has been far more dramatic than in the past years.

At $75.09 per share on Feb. 1, MDLZ had an over $102.4 billion market cap. The highly liquid stock trades an average of over 6.57 million shares daily. The $1.70 annual dividend translates to a 2.26% yield.

If cocoa futures are heading for a challenge of the 1977 high over the $5,000 per ton level, it could impact MDLZ shares, pushing them lower. With the stock trading near its all-time high, this could be an excellent time to use trailing stops to protect profits and capital. The trajectory of cocoa prices could also justify a short position in MDLZ or the purchase of put options. A $70 strike price MDLZ put option for expiration on Sept. 20, 2024, had an under $2 premium on Feb. 1, a limited-risk option to take advantage of potential downside price action in the stock.

The trend is always your best friend in all markets. Cocoa’s trend in early 2024 remains highly bullish, with the soft commodity trading at its highest price in 46 years. Continuing higher highs could eventually cause profits and sales to slip for MDLZ and other companies relying on cocoa supplies, lowering their share prices lower.

Read the full article here