Molson Coors Beverage Company (NYSE:TAP) continues to report beneficial quarterly figures from its ongoing strategy of premiumization of the portfolio, mainly in the EMEA and APAC regions. Even if the volume declines, in my view, TAP could deliver net sales growth driven by successful favorable price and sales mix. I also expect that inorganic growth could bring additional net income growth. In my view, the company’s net debt/EBITDA and expertise in acquiring targets such as Blue Run will most likely help. Putting everything together and considering previous free cash flow growth and decrease in net debt, in my view, the company is significantly undervalued. As soon as more investors do their own numbers and TAP’s stock repurchase program brings demand for the stock, I think that the stock price could reach more logical price marks.

TAP

Molson Coors Beverage Company appears to bring two centuries of expertise in offering beverages. The company’s brands include legendary names like Coors Light, Miller Lite, Coors Banquet, Molson Canadian, and Carling.

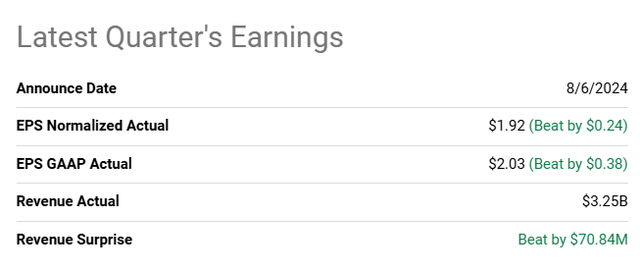

In my view, the know-how accumulated may help the company continue its business expansion all over the world, where the company is not present. If you do not like beer, please note that the company’s financial growth is also attractive. In the last quarter, the EPS GAAP figures, and quarterly net sales were better than expected.

Source: Seeking Alpha

Long-Term Growth, And Lower Net Debt

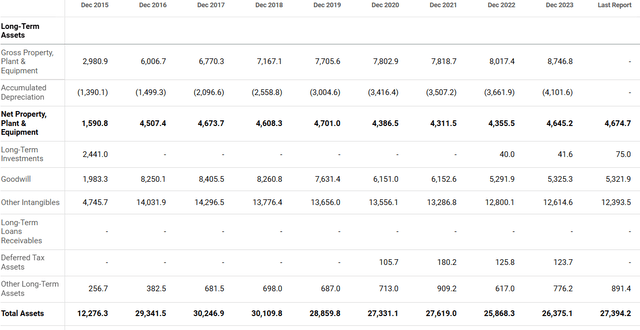

If we forget a bit what happened in the last quarter and focus on the figures reported in the last decade, TAP seems to be improving its financial status. The total number of assets and equity increased significantly as compared to what the company reported ten years ago. Net property and equipment also increased, indicating that directors are confident about the future business environment for TAP. In my view, directors do not increase total capacity when they expect a deterioration of the business model.

Source: Seeking Alpha

The company provided the following information about ongoing capital expenditures in the most recent quarterly report.

We incurred $299.5 million, and paid $392.2 million, for capital improvement projects worldwide in the six months ended June 30, 2024, excluding capital spending by equity method joint ventures, representing a decrease of $3.2 million from the $302.7 million of capital expenditures incurred in the six months ended June 30, 2023. We continue to focus on where and how we employ our planned capital expenditures, with an emphasis on obtaining required returns on invested capital as we determine how to best allocate cash within the business. Source: 10-Q

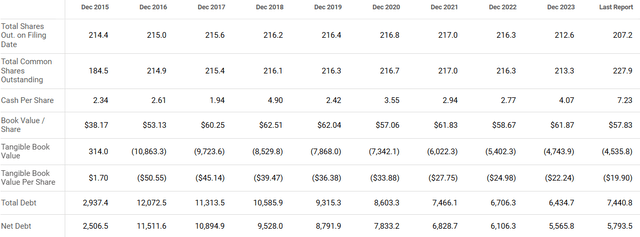

In addition, I think that the most relevant is the company’s reduction in the total amount of debt. Using SA’s tool, I concluded that TAP is using its total free cash flow generated to decrease its total amount of debt.

Source: Seeking Alpha

In my view, the reduction in the net debt reduces TAP’s financial risks. As a result, I would expect an improvement in the company’s price/cash flow and the EV/EBITDA in the future. It is also worth noting that a reduction in the total amount of debt would lead to lower interest expenses, and may bring net income growth.

In the last quarterly report, the company noted that the maximum net debt/EBITDA leverage ratio could be close to 4x. The company is far from that level, which means that TAP could receive more debt financing if necessary. Besides, I do not think that investors would sell shares because of the total amount of debt.

The maximum net debt to EBITDA leverage ratio, as defined by the amended and restated multi-currency revolving credit facility agreement, was 4.00x as of June 30, 2024 and December 31, 2023. As of June 30, 2024 and December 31, 2023, we were in compliance with all of these restrictions and covenants, have met such financial ratios and have met all debt payment obligations. Source: 10-Q

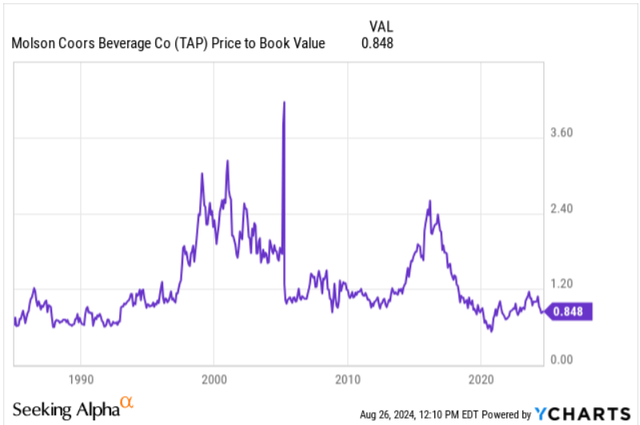

It is also worth noting that the company’s book value per share increased significantly over the years. The current book value per share appears close to the current price mark. In my view, it is an indication of undervaluation.

Source: YCharts

Interest Rate Paid

In the last 10-Q, the company reported debt agreements with interest rates in the range of 3.4%, 3%, 3.8%, 5%, and 4.2%. In my view, given the recent decrease in the stock price, conservative investors would try to use a conservative cost of capital. I used a WACC of about 6%. The following lines include information about the debt outstanding.

– CAD 500 million 3.44% notes due July 2026.- $2.0 billion 3.0% notes due July 2026- EUR 800 million 3.8% notes due June 2032- $1.1 billion 5.0% notes due May 2042- $1.8 billion 4.2% notes due July 2046Source: 10-k

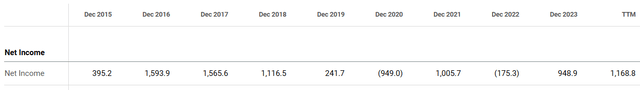

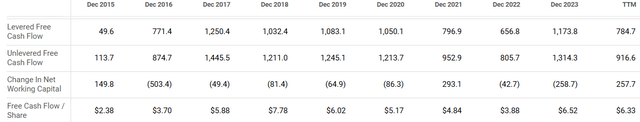

Generation Of Free Cash Flow And Net Income

In the last decade, TAP reported negative net income in only two years. Cash flow from operations was positive every year, and the company’s unlevered free cash flow grew substantially. I believe that the investors running conservative forecasts about the future would most likely include positive and growing free cash flow, given the financial figures reported in the past. In my view, most investors would obtain a target price higher than the current market price.

Source: Seeking Alpha Source: Seeking Alpha

The Stock Repurchase Program Could Accelerate The Demand For The Stock

The company approved a stock repurchase program, and acquired shares at $61 and close to $51 per share. I think that companies know better than outside investors when their stock is cheap. If TAP is buying at $51-$61 per share, we are close to buying territory. The stock price is not far from these price marks.

During the year ended December 31, 2023, we repurchased 3,454,694 shares under the share repurchase program at a weighted average price of $61.06 per share, including brokerage commissions and excluding excise taxes, for an aggregate value of $211.0 million. During the year ended December 31, 2022, we repurchased 995,000 shares under the share repurchase program approved in 2022 at a weighted average price of $51.70 per share, including brokerage commissions, for an aggregate value of $51.5 million. Source: 10-k

I also think that the repurchase of shares could bring demand for the stock from new investors. As a result, the company may enjoy more buying pressure at around the current stock price.

Valuation, Peers, And My Assumptions

Given the explanation about the company’s net sales in EMEA and APAC regions, I would expect further increase in net sales. In my view, favorable sales mix combined with premiumization and higher financial volumes could bring net sales growth.

Price and sales mix favorably impacted net sales for the three months ended June 30, 2024, compared to prior year, by 5.8%, primarily due to increased net pricing and favorable sales mix driven by premiumization. Source: 10-Q

Net sales increased 7.4% for the six months ended June 30, 2024, compared to prior year, driven by favorable price and sales mix as well as higher financial volumes and favorable foreign currency impacts. Source: 10-Q

In my view, the company’s premiumization of the portfolio is expected to drive earnings growth up. Management provided a full explanation of these strategies in the last annual report. We may see a decline in volume in the coming years, however if TAP sells premium products, net sales growth will most likely trend north.

In order to support continued premiumization of our portfolio, we strategically de-prioritized and rationalized certain non-core SKUs predominantly in the economy segment. While we rationalized certain non-core economy SKUs, we retained key economy brands allowing us to maintain a portfolio for all socio-economic demographics. We believe the continued premiumization of our portfolio will drive sustainable net sales and earnings growth but result in potential volume declines due to the rationalization of certain SKUs and as the portfolio mix shifts towards a higher composition of above premium products. Source: 10-k

The numbers do not seem that good in America; however, I would expect that successful net pricing and favorable sales mix could bring beneficial financial figures in the coming years like we saw in the last quarter. The following words were obtained from the most recent quarterly report.

Price and sales mix favorably impacted net sales for the three months ended June 30, 2024, compared to prior year, by 4.1% primarily due to increased net pricing and favorable sales mix as a result of lower contract brewing volumes. Source: 10-Q

My financial model also included assumptions with regard to inorganic growth. Given previous acquisitions such as that of Blue Run in 2023, I think that TAP is capable of making meaningful acquisitions to enhance net income growth. Considering the current net debt/EBITDA levels, in my view, debt investors would most likely approve new transactions.

On August 7, 2023, we acquired a 75% equity interest in Blue Run, a U.S. based high end whiskey business, for a purchase price of $77 million, which included cash paid of $64 million. The acquisition is aligned with our strategy to expand beyond the beer aisle and enhance ourpresence in the spirits category. Source: 10-K

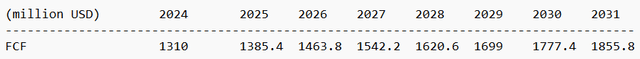

My free cash flow expectations are pretty much in line with the free cash flow and FCF growth seen in the past. My results include a total enterprise value of $22 billion, with a target price of close to $78-$79 per share. I used a conservative cost of capital of 6% and a terminal FCF multiplier of 11x. I think that my assumptions are quite conservative.

Source: My Expectations

- NPV of FCF: $8945 million

- NPV of TV: $13,576.34 million

- Total EV: $22,521.43 million

- Shares Outstanding: 217 million

- My Target Price: $78.12

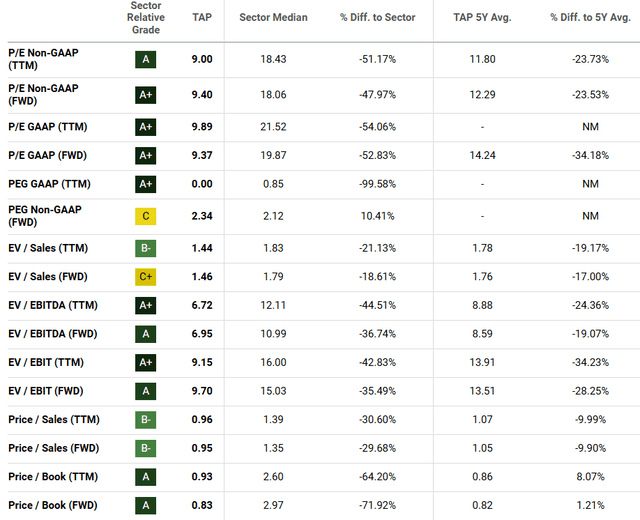

The company also appears to be quite undervalued as compared to peers. The company’s P/E Non-GAAP, P/E GAAP, the EV/ FWD EBITDA, and other financial ratios indicate significant undervaluation as compared to competitors.

Source: Seeking Alpha

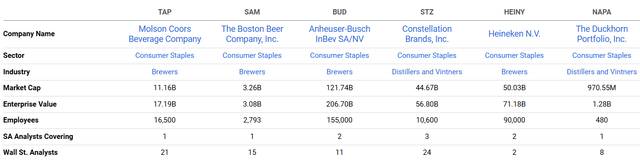

Seeking Alpha obtained the previous sector median valuation figures from the following list of competitors. In my view, given the size of competitors, these are adequate peers, which can be compared with TAP.

Source: Seeking Alpha

Risks From A Deterioration Of The Company’s Brands

Issues with respect to product recalls or any type of destruction of the reputation of the company’s brands and products could affect future net sales expectations. Many years experience of operating in the sector and accumulated expertise could be destroyed because of negative publicity about the products offered by TAP. The company offered significant explanation in this regard in the last annual report.

We may experience recalls or liability in addition to business disruption which could further negatively impact our brand image and reputation, negatively affect our sales and cause us to incur additional costs. A widespread product recall, multiple product recalls or a significant product liability judgment could cause our products to be unavailable for a period of time, which could further reduce consumer demand and brand equity. Source: 10-k

Supply Chain Risks Or Risks From Changes In The Price Of Commodities Or Tariffs

There are many factors that may bring the company’s free cash flow growth down, but overall, I would say that failed supply chain management, certain changes in commodity, and input prices could be quite detrimental. The company offered a list of raw materials including hops, corn, water, and aluminium, which seem quite relevant for the business model.

We use a large volume of agricultural and other raw materials, some of which are purchased through supply contracts with third parties, to produce our products, including barley, malted barley, hops, corn, other various starches, water and packaging materials, including aluminum cans and bottles, glass and polyethylene terephthalate containers as well as cardboard and other paper products. We also use a significant amount of diesel fuel, natural gas, electricity and carbon dioxide in our operations. Source: 10-k

In addition, international geopolitical tensions like the Russia-Ukraine conflict could affect the energy price. In this regard, transportation issues or an increase in transportation costs could also lower the company’s free cash flow growth. In addition, changes in governmental regulations in the America and elsewhere, tariff changes, or taxes may also affect future net income growth.

Conclusion

Currently trading at very undervalued price marks, in my view, TAP will most likely benefit from premiumization of the portfolio, which is expected to be an earnings catalyst. Besides, I think that the current net debt/EBITDA level will allow management to execute new M&A transactions like that of Blue Run in the United States. Hence, inorganic growth could also be a driver of future FCF growth. In addition, given the number of years operating in the industry, I would expect that TAP will most likely continue to report favorable price and sales mix mainly in the EMEA and the APAC region, where the company seemed to be successful in 2024. With all this being said, previous FCF growth and equity growth would imply a fair valuation that is significantly higher than the current stock price. From here, TAP looks like a Buy.

Read the full article here