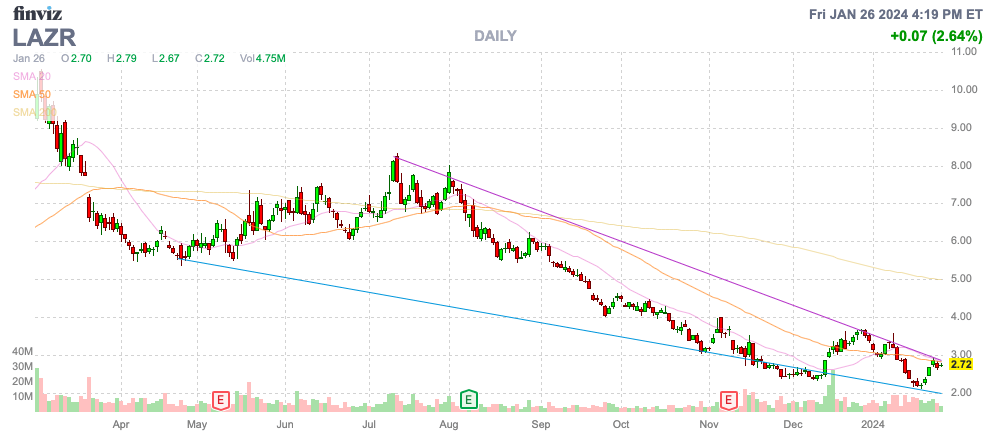

Luminar Technologies (NASDAQ:LAZR) is trading at the all-time lows, but the company recently highlighted a strong lineup at CES 2024. The Lidar company has several large contracts in place with large auto manufacturers, set to ramp in 2024. My investment thesis is ultra Bullish on the stock, with investors abandoning ship while the prospects are the most positive.

Source: Finviz

Focus On Big CES

While the Volvo delay of the EX90 launch has caused some short-term revenue headaches for Luminar, the company had a lot of representation at CES 2024. A recent downgrade by Deutsche Bank seemed to hint at the company losing customers, but the strong showing at CES would suggest otherwise.

Luminar’s Lidars were featured at the following CES exhibits:

- Official FIA F1 Safety car, the Mercedes-AMG GT Black Series at the Las Vegas Convention Center West Hall, # 5917

- Polestar 3 at the Las Vegas Convention Center West Hall, # 5917

- Kodiak Robotics’ Gen 6 autonomous truck outdoors in the West Lot.

- Plus’ autonomous truck outdoors in the West Lot.

- Gatik will feature one of their trucks equipped with Luminar LiDAR in the Goodyear booth located in the West Hall, #4917.

- Mercedes-Benz will also feature a Concept CLA Class show car equipped with Luminar’s LiDAR in the West Hall, #4941.

In addition to the vehicles on display, Luminar debuted new features as follows: Automatic Emergency Steering (AES), 3D Maps and Automated Valet and 6 new purpose-built chips. The Lidar company had a lot going on at CES, and the market completely ignored the progress being made.

The Lidar company has long forecast the YE24 forward contract order book would leap to $4.4 billion after adding $1.0 billion in 2023. The vast majority of the contract book is based on the deals with AB Volvo (publ) (OTCPK:VOLVF), Mercedes-Benz Group AG (OTCPK:MBGAF), and Polestar Automotive Holding UK PLC (PSNY).

The odd part of the stock falling to the recent lows was the news of Lidar competitor Aeva Technologies (AEVA) signing up Daimler Trucks to a deal ramping up in 2026 to 2027. The company posted an 8-K suggesting the deal had a value of up to $1 billion. The hit on Luminar was due to a prior partnership with the autonomous trucking unit.

The ironic part here is that Luminar showcased their Lidar at CES with Kodiak Robotics and Plus trucks. The partnership with Daimler Trucks hasn’t gone anywhere since the original announcement in late 2020.

Either way, Luminar isn’t likely to grab every contract in the automotive space. The company already has a diverse customer base, and the timing of the contract ramp is still 2 to 3 years out.

Big Q4 Report Ahead

The biggest knock on the Lidar companies is that no major contract has ramped up yet. While Luminar and Ouster (OUST) reported combined Q3 revenues of nearly $40 million and guided to Q4’23 revenues topping $50 million, the market still doesn’t give sector stocks much credit for the business models playing out.

The key to the Q4 guidance by Luminar is the progress towards the launch of the Volvo EX90 with the Lidar built into the vehicle. Luminar guided to Q4 revenues of $27 million, down from prior expectations of well over $3 million. The big question is how much of the revenue ramp is due to Volvo and whether or not the ramp actually occurred.

The company was clear on the Q3’23 earnings call that Volvo production wouldn’t start until 2024. Luminar still guided to record Q4 revenues of $27 million, and it isn’t clear where exactly the $10 million sequential revenue boost comes from without the Volvo ramp.

Management guided to the Q4 numbers on November 8 and all indications suggest the Volvo EX90 launch won’t start until mid-2024.

Polestar recently launched the Polstar 4 with 880 deliveries in China during Q4. Luminar is providing the Lidar to the Mobileye (MBLY) Chauffeur product for the 4 and the company directly provides the Lidar for the Polestar 3 and the upcoming Polestar 5.

Management didn’t highlight Polestar as the company producing the revenue boost in Q4, but the Polestar 4 production launch appears the most likely revenue generator with the current EX90 delay. The Swedish performance EV company delivered 12,800 vehicles during Q4, so possibly the company doesn’t want to focus as much on the smaller revenue opportunity compared to the global automakers with millions in annual vehicle production.

The stock has a market cap of $1.1 billion and Luminar will end 2023 with a cash balance of around $300 million. The company has regularly forecasted revenues growing at 100% annually and this should place the 2024 target of at least $150 million with a huge ramp up in Volvo units leading to considerable upside in the growth rates.

The analyst estimates for 2025 revenues approaching $500 million appears aggressive. If Luminar can hit the 100% revenue targets over the next few years, leading to $300+ million in revenues next year, the stock will trade at a far higher multiple of revenue. A technology growth stock with 10% growth, typically trades at multiples in excess of 10x forward revenues, providing for a market cap of $3 billion.

Takeaway

The key investor takeaway is that Luminar has been irrationally beaten down the last year despite strong indications of customer demand and a large order book. The Lidar company has the potential to surprise the market with the revenue growth in the next few years, while the market appears to ignore the progress already made.

Investors should use the ongoing weakness in the stock to load up on Luminar.

Read the full article here