Introduction

On August 22nd I published an article with the headline “Exhaling Profits: The Last Puff On My Altria Investment”. Here I laid out why I had decided to lock in my profits and look elsewhere. Altria Group (MO) belongs to the cluster of consumer staples, and I’ve been considering where else I might allocate that capital. Big surprise, I’ve decided to go long Lamb Weston Holdings (NYSE:LW) and in this article I’ll lay out why. For your background before reading further, this is a company that’s delivered strongly in recent years, but in the two most recent quarters has disappointed to the point where the stock has dropped massively. This was topped with a weak forward guidance indicating that growth has come to a complete stop in the short term. As such, this article will highlight the marketplace and the track record of the company, but ultimately, this is a situation where as a potential investor, I believe we have to accept the risk that management can’t rectify the situation in the short term, which would mean the stock would trade sideways, or worse, continue its downtrend for quite a while, resulting in subpar returns for capital allocated to this particular stock.

The thesis in my view is therefore quite simple, it’s the idea of a business being punished in the short term, only to rise from the situation and pivot back towards its historical long-term performance trend, suggesting strong potential upside.

The precautions I take are in terms of position size and dollar-cost averaging my way into the stock. In reality, this means that I’ll most likely layer into the stock through three separate buys; the first two being before the next quarterly update (I’ve already completed those two), saving one last purchase to wait and hear management’s comments during the next earnings call. If it surges, great, then I’m on the right track, and I’ll be happy to pick up shares at a higher pricing point as the majority of my position was established prior to that. If it drops, then it’s another opportunity to pick up shares lower, as I’m viewing this thesis in years, not months.

As already revealed, I’ve come to the conclusion that it’s worth the risk, so here I’ll lay out why.

Lamb Weston’s Background

As I haven’t covered Lamb Weston before, here is a brief description of the company and its operations.

Lamb Weston was founded back in 1950 by Gilbert Lamb. In 1988, the company was acquired by ConAgra Brands Inc (CAG) and was part of its operations until it was spun off in 2016. Lamb Weston is one of the largest providers of frozen potato products globally, with the prime product being the french fry. Just to put it into perspective, according to the company annual report for 2023, its largest customer is no other than McDonald’s (MCD) which accounted for 13% of Lamb Weston’s revenue. The years prior, that percentage came in at 10% and 11% respectively. I’ll be quick to point out, that no other customer who makes up more than 10%, as that’s of course also a risk, but just to point out that Lamb Weston, which might not be a household name for many, is a significant player in its field.

Lamb Weston Global Presence (Lamb Weston Investor Day 2023)

As can be seen above, the company operates with a global footprint, selling its products in more than 100 countries distributed via 27 factories. Factories are distributed globally, but with a U.S. concentration. Sifting through their strategy, the company does have a plan to establish more international factories, for the purpose of improving operations, supply chain and obtaining efficiencies in shipping routes, ultimately supporting margin expansion.

Lamb Weston Key Company Facts (Lamb Weston Investor Day 2023)

Above you see a slide from their investor day back in October 2023 (before the disappointing Q3- & Q4-2024 which I’ll come back to later), and it’s not entirely precise as the FY2024 net sales goal ultimately wasn’t achieved, as it came in at $6.46 billion with EBITDA of $1.47 billion. So that’s a miss on both ends, which I’ll come back to later, but if we observe the other factors, we can see the development the company has undergone since its spin-off. Quite substantial growth, on both a sales and EBITDA level, even when considering the double miss.

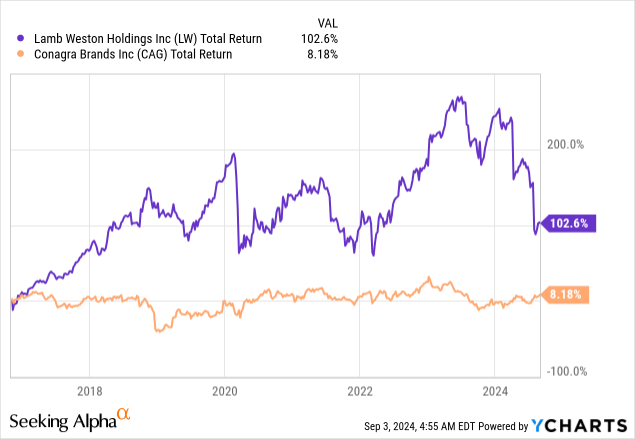

Having been spun-off from Conagra has been a profitable venture for shareholders, confidently outperforming its old constellation. However, once more, a sharp decline can be observed during 2024, which is one of the reasons why I find the company attractive in its current position – more on that later.

Operating In A Niche All Age Groups Love

So, what attracts me to a company that failed to deliver on both its top- and bottom-line for the FY2024? Well, it’s operating in a niche everybody loves, potato fries. Stumbling upon the company, I must admit some of the information provided in this section surprised me quite a bit, I simply didn’t realize just how popular fries really are.

If we stick with the financials for a second, then it’s evident that management has succeeded with securing a growing business since having become a standalone company. A growing top- and bottom-line as well as an expansion in gross margin from FY2017 to FY2023, has led to outperformance compared to its peers. However, let me once more be quick to point out, that the stock has suffered a severe beating throughout 2024, down almost 43% YTD. This is also the reason why it no longer outperforms the S&P 500 since having been spun off.

Lamb Weston Track Record Performance (Lamb Weston Investor Day 2023)

If we focus on the product offering for a second, then it quickly becomes clear just how popular fries are. 42% of global menus come with a serving of fries, and it’s the preferred option across generations ahead of burgers.

Consumer Fast Food Preference (Lamb Weston Investor Day 2023)

If we pause for a second, then we can form an analogy relevant for many businesses. One of the perhaps most popular industries to invest in currently is semiconductor manufacturing. However, these companies compete with one another, and you have therefore probably heard people compare the current market to those centuries ago, when digging for gold was the hottest business around. Selling shovels and picks were perhaps safer, as you didn’t know who would discover the gold, but they all needed shovels and picks. Similarly, why bother with dealing with competition risk amongst restaurants or fast food providers when they all sell fries. As such, similarly, to investing in the semiconductor machine- or software provider, here I can invest in the supplier of the fries as opposed to riding the ebbs and tide of a specific fast food chain.

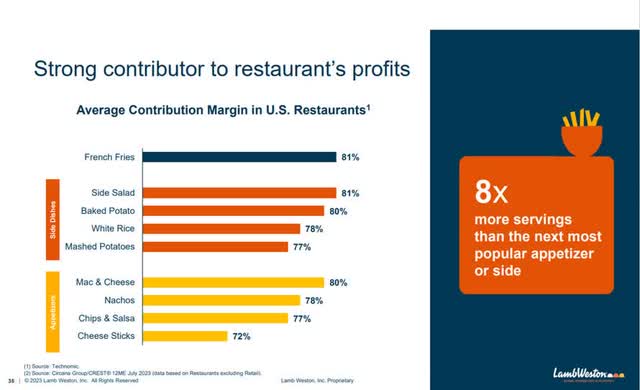

And if you are concerned about fries going out of fashion, then the illustration below clearly pencils out why restaurants want to continue having it on the menu. They come with strong margins, according to Lamb Weston, it’s one of the strongest margin contributors amongst side dishes.

Margin Profile For Fries (Lamb Weston Investor Day 2023)

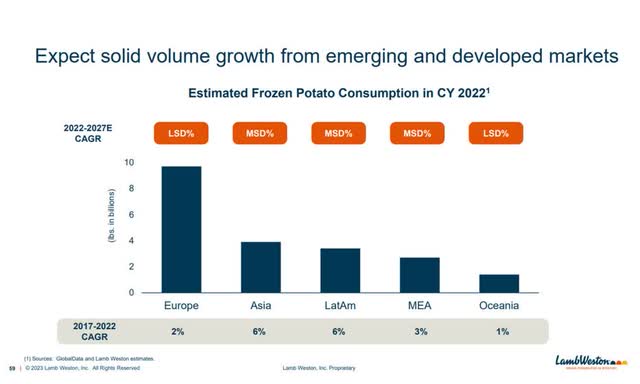

The outlook for fries is also interesting, as even mature markets with saturated levels of fry demand, is expected to grow over the coming years. Perhaps a bit surprising, is that most other nations in the illustration below, exhibit a higher fry demand occurrence than the U.S.

Fry Order Frequency (Lamb Weston Investor Day 2023)

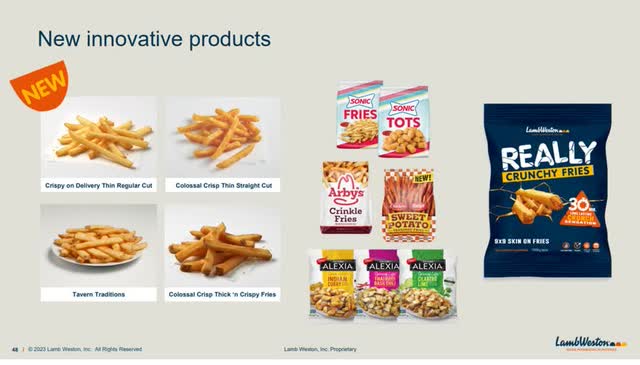

I’ve been speaking about fries a lot here, but the company does label itself as working with frozen potato products, so it’s also important to mention that innovation is a focal point for the company in order to ensure a differentiated product offering, to the extent possible when dealing with potatoes. As such, the company has dedicated innovation centers located in Washington state, The Netherlands and China.

Lamb Weston Innovation (Lamb Weston Investor Day 2023)

The company has successfully managed to run an efficient production, meaning that price increases have been relatively low compared to restaurants, suggesting that Lamb Weston has been able to capture market share without compromising on profitability. Lastly, the company focuses on the opportunity in emerging markets over the coming years, while still delivering to already established markets, with a focus on improving its supply chain and production network.

Estimated Frozen Potato Consumption Outlook (Lamb Weston Investor Day 2023)

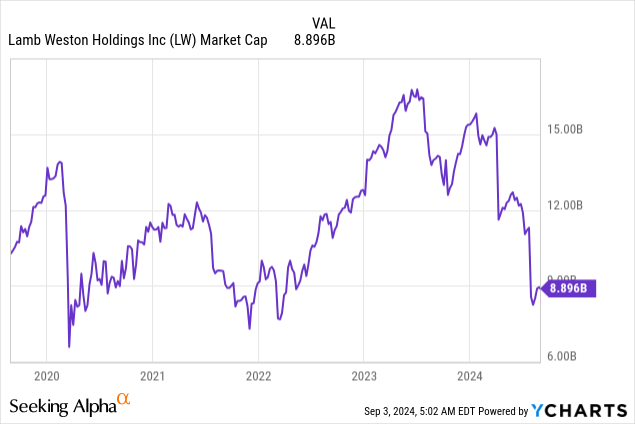

The Shareholder Rollercoaster

Lamb Weston shareholders have been on quite a rollercoaster ride in recent times. When 2024 began, the company commanded a market cap above $15 billion, which has since dwindled to just shy of $8.9 billion as of this moment. However, during the early days of the spin-off, the market cap was just above $4.8 billion, so a lot has happened since, and despite having grown revenue and profits substantially, the company now finds itself back at a market cap it has previously visited during pullbacks.

Management has consistently been conducting value-adding activities for shareholders, with a focus on returning cash in the form of both buybacks and a growing dividend.

Return of cash to shareholders profile (Lamb Weston Investor Day 2023)

Above, you can see the cumulative development in buybacks and dividends. I particularly like the concept of a disciplined approach to buybacks, as I far too often observe companies who outright buyback consistently without considering the best use of its capital. Capital can, after all, only be deployed once, so do it wisely.

For the entire FY2024, reported on July 24th, the company published that $210 million had been used for buybacks throughout the year, with $174 million returned in form of dividends. As such, if you compare to the 2023 cumulative balance above, a massive amount of cash went towards buybacks during FY2024.

Here Comes The Bad News – Q3 & Q4 of Fiscal 2024

If everything was as great as laid out in the sections above, then the stock wouldn’t have crashed so massively during 2024, but that is the reality, and I’ll briefly touch upon why in this section.

Lamb Weston EPS Profile (Seeking Alpha)

The EPS overview above provides a very visual representation of what happened during the fiscal year of 2024. Lamb Weston has gone through two difficult quarters of the fiscal year 2024. In addition, we can also observe the weak outlook for 1H of FY-2025, more on that in a second

First was the Q3-2024, which was reported on April 4th 2024, where the consensus EPS of $1.45 missed by $0.20. In addition, revenue also missed consensus by $190 million arriving at $1.46 billion.

This was related to an enterprise resource planning system update gone wrong. Here is what management had to say about it when they reported for the quarter, emphasis added by myself

“At the beginning of the fiscal third quarter, the Company transitioned certain central systems and functions, including order to cash, produce to deliver, source to pay, and inventory management, among others in North America to a new ERP system. After the transition, the Company experienced reduced visibility into finished goods inventories at its distribution centers, resulting in a higher-than-expected effect on customer order fulfillment rates. The transition had a greater impact on shipments of higher-margin mixed-product loads than shipments of single-product orders, resulting in unfavorable mix. The Company partnered closely with its customers to minimize the impact and estimates the lower order fulfillment rates reduced sales volume growth by approximately 8 percentage points and net sales by approximately $135 million during the fiscal third quarter, with $123 million and $12 million in the Company’s North America and International segments, respectively”

Management estimates the negative consequences of the failed transition resulted in a negative net income impact of $72 million for the quarter. For a company who delivered net income of $146.1 million, that is absolutely massive. This, of course, shouldn’t happen, and all companies plan diligently for such a transformation. The good news is, that it should be a temporary issue, except perhaps for customers who lost trust in Lamb Weston’s ability to deliver as they had to seek other providers as they, after all, still needed fries.

The stock responded with a sell-off in excess of 20%, the worst in the history of the company.

Remember the key company facts slides from earlier in the article, where a FY2024 net sales and Adj. EBITDA guidance was mentioned? Management had to revisit full year guidance due to the Q3-2024 issue, with the adjusted revenue guidance coming in at $6.54 billion to $6.6 billion. Adj. EBITDA was also reviewed to $1.48 billion to $1.51 billion. Quite a severe consequence of the failed ERP transition.

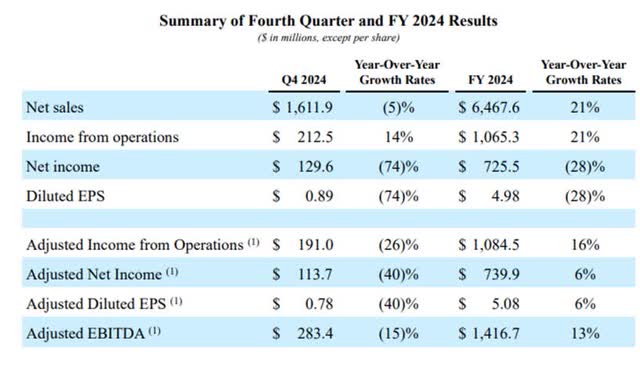

If that wasn’t enough, then came Q4-2024 with more bad news. Lamb Weston reported its Q4-2024 results on July 24th with EPS of $0.78, a miss of $0.48 compared to consensus estimates. Similarly, revenue was $1.61 billion (-5.3% Y/Y development), which was a miss of $100 million.

The full year picture can be seen below.

Lamb Weston Q4-2024 and FY2024 overview (Lamb Weston Q4-2024 Results)

Here is what management had to say about the quarter and forward guidance, emphasis added by myself.

“We are disappointed by our fourth quarter performance,” said Tom Werner, President and CEO. “Our price/mix results were below our expectations, while market share losses and a slowdown in restaurant traffic in the U.S. and many of our key international markets were greater than we expected. We also incurred losses related to a voluntary product withdrawal.”

Essentially, cost increases are hurting restaurant goers to the point that companies like Lamb Weston are also feeling the impact. Turning the attention to FY2025, management was adamant that it’s time to tighten the belt and focus on a streamlined operation, due to a difficult FY2025 on the horizon.

“We expect fiscal 2025 to be another challenging year. The operating environment has changed rapidly over the past twelve months as global restaurant traffic and frozen potato demand softened due to menu price inflation continuing to negatively affect global restaurant traffic. This has resulted in an increase in available capacity in North America and Europe. We believe this supply-demand imbalance will persist through much, if not all, of fiscal 2025. Accordingly, we are making some operating adjustments in the near term to fit the macroeconomic reality and business environment, including reinvigorating volume growth, targeted investments in price and trade support, decisive measures on cost, supply chain productivity initiatives, and a rephasing of investments to modernize production capabilities to better match the demand environment.”

So, What Are We Left With?

Lamb Weston and its management team has delivered year in, year out through 2017-2023, with the second half of FY-2024 turning out to be nothing short of a disaster, topped with a soft guidance for FY2025.

One could arguably be concerned about management’s ability to deliver at this point, but they are also, in my opinion, focusing on the right levers.

FY2025 will be a gap year. Management hiked the dividend 28.6% on the 14th of December in 2023. Don’t expect that to happen again, this will be a year of efficiency and no partying, in my opinion. I believe shareholders will also feel it, as capital discipline will, and should be, a focus point.

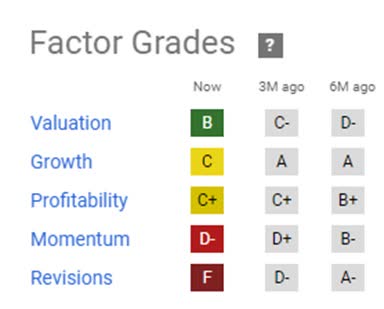

Lamb Weston Seeking Alpha Factor Grades (Seeking Alpha)

If we look at the Seeking Alpha factor grades, then I’ve seldom seen such a landslide shift in a short period. We were dealing with an outperforming stock on more or less any parameter. Beating consensus estimates, showing excellent profitability and growth, to suddenly being in a situation of especially weak revisions, causing investors to ask if the management team is really in control of the situation.

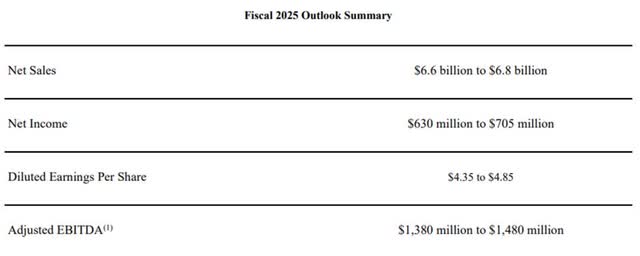

Below you may find the FY2025 guidance, with some quick math showing that management is expecting at least a 1.5% topline growth. Hardly something to be very enthusiastic about compared to historical performance and the current inflation level just above 2%.

Facing cost pressures, weak consumer sentiment and execution difficulties, I don’t blame management for being on the safe side. The last thing you want, as a management team, is to have to communicate another downwards revision. Perhaps this turns out to be a situation of taking a conservative approach, only later to up the guidance a bit. Perhaps, perhaps not – time will tell.

FY2025 Guidance (Lamb Weston Q4-2024 Results)

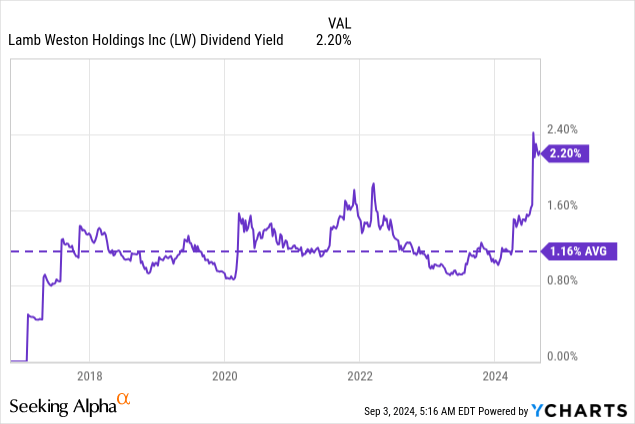

As can be seen, we shouldn’t expect any improvement in profitability either, and with management targeting a payout ratio in the band of 25% to 35%, then I would expect a token dividend raise as the forward payout ratio is 33% if we assume they only accomplish the bottom of their EPS guidance of $4.35. Should they manage the upper end of the guidance, then the current forward payout ratio comes in at 29.6%. Regardless, I expect a token raise with the forward dividend at 2.3%, well above the historical average, underlining the unusual situation the company is finding itself in.

Lastly, I’d like to touch on the balance sheet, as this becomes more important than ever when a business is facing difficulties. Net debt to Adj. EBITDA is 2.7x, which is acceptable, and the company reduced its outstanding debt by $40 million during Q4-2024 to $3.7 billion. The company has $71.4 million in cash on the balance sheet and access to a $1.2 billion revolving credit. Make no mistake, such a credit comes with covenants, such as not to exceed a certain leverage or otherwise, but Lamb Weston, at this point in time, does have access to sufficient liquidity. Perhaps even more important, consensus is the company will deliver $225 million in free cash flow in FY2025, so unless everything comes down, I don’t foresee issues here.

In my opinion, we are then left with a market leader, with a strong track record, going through a period of headwinds. I can live with that, and as I highlighted in my opening, as an investor, what I can then do, is to not overexpose the position in my portfolio until an improvement in the situation becomes clear.

Reflections Concerning Valuation

It can be a bit mute to discuss valuation in the midst of a turbulent period. When considering price-earnings multiples, if the ‘E’ expands or contracts, it can make a current stock price appear both expensive or cheap depending on what way the pendulum swings.

However, for the sake of it, taking the midpoint of the analyst P/E outlook, then EPS is expected to contract during FY2025 (ending in May 2025).

Lamb Weston Price to Earnings Outlook (Seeking Alpha)

If, and this is a big if, the company can regain its footing short- to mid-term then I don’t think this company should trade with a P/E of low double digits. Assuming the previous track record can be revived, it should be closer to the market average, as both the top- and bottom-lines have shown strong historical growth.

If I apply a P/E of 16 for FY2026, then we arrive at a stock price of $81 per share, and $91 if we apply a multiple of 18. This is just math, but I still have trust in the management team, so I would expect the stock to outperform once the company arrives at smoother waters. Those assumptions could indicate we have 35-50% upside to fair value.

This is a big risk, as shareholders are currently pedaling against the wind, with a short interest in the stock just shy of 5%. So big money is betting against Lamb Weston at this point, but as a retail investor I’m happy to gobble up shares and simply park them in my drawer while I wait for the turn-around to unfold.

Again, I would caution those who go long at this point. There could be more bad news on the horizon. Lamb Weston should have its ERP change under control now, but if cost pressures turn out to be worse than anticipated or consumer sentiment continues to weaken, then it will inevitably hit Lamb Weston and impact the forward guidance, making that ‘E’ in the P/E multiple go in the wrong direction and make the current stock price appear fitting for the long-term, thus crushing the idea of a reversion to prior levels.

Read the full article here