Investment overview

I wrote about Kanzhun Limited (NASDAQ:BZ) previously (July) with a buy rating, as I expect the business to continue growing strongly by disrupting the industry and riding on its flywheel effect. Despite the sharp sell-off in share price, I believe the stock remains cheap as the long-term growth potential is not impaired.

2Q24 earnings

Total revenue grew 29% y/y to RMB1.92 billion, with cash billings growing by 20% y/y to RMB 1.95 billion. Adj gross profit saw RMB1.6 billion (84.1% margin), an expansion from 83.3% in 1Q24 and 8.27% in 2Q23. The scalability of the BZ business model is well demonstrated, as adj EBIT margin expanded by 520 bps to 34.4%. Adj net profit grew 27% y/y accordingly to RMB723 million, implying a margin of 37.7%. However, despite a strong 1H24 performance, management guided 3Q24 to see massive growth deceleration from 29% y/y in 2Q24 to 19% y/y in 3Q24. I believe this weak guidance has caused the massive share price sell-off post-earnings.

Fundamentals remain sound

I believe the sell-off has been overdone, and the market is not giving BZ the credit it deserves, given that fundamentals remain strong. First and foremost, I think it is fair to agree that the weak macro environment has certainly put pressure on BZ’s ability to monetize its customers, as businesses are not very keen on stepping up their pace of hiring, especially among SMEs and for white-collar jobs. However, this does not mean that BZ growth is structurally impaired. The reality is that BZ is still seeing rapid user growth.

- Monthly active users [MAU] grew 25% y/y in 2Q24, representing a 700 bps acceleration vs. the 17% growth in 1Q24.

- BZ added 28 million total verified users in 1H24, more than half its full-year target of 40 to 45 million, indicating really strong underlying demand.

- Enterprise users, on a last twelve-month basis, grew 31% to 5.9 million.

Why this is important is because it shows that BZ capacity and potential to grow have not weakened. On the contrary, it has gotten even better because when the macro environment gets better – which it should eventually get since China is still a developing country – BZ will have access to a much larger pool of users to monetize.

Long-term, I think BZ’s growth potential remains sound, as there are many other industries that it can penetrate. Take, for instance, the blue-collar manufacturing vertical, which has seen very strong adoption in its Hailuo project (for brief info, refer to page 23 of this report) so far – generated RMB40 million in revenue so far (note the project was launched just a few months ago). The acquisition of W.D. Technology [WDT] in 1Q24 should further enhance BZ ability to grow in the blue-collar sectors as BZ leverages on WDT expertise in handling blue-collar recruitment (WDT originated from focusing on manufacturing factory workers, which is a different skillset vs. BZ that focused on white-collar platform).

Furthermore, expanding overseas remains a huge growth driver for BZ. While this is going to take a while before it becomes a strong growth driver, it was encouraging to learn that BZ is already allocating resources to test out the viability of this strategy. So far, they have launched a minimum viable product launched in Hong Kong, and we should learn more about the progress over the coming months.

Morgan Stanley

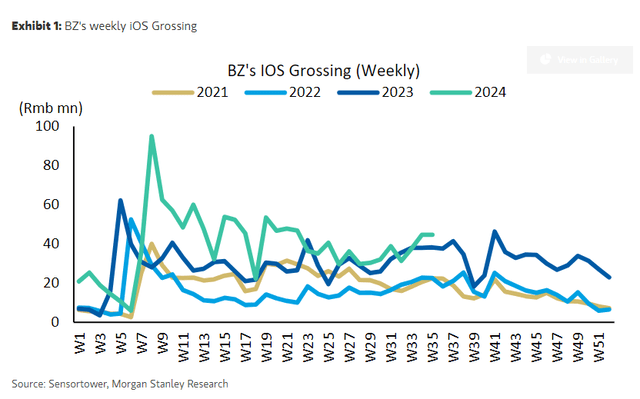

Coming back to the near-term, I think there is a case to be made that management is being overly conservative on its 3Q24 numbers. According to Morgan Stanley’s data (based on Sensortower), BZ gross billings for iOS have seen great improvements so far vs. the latter half of 2Q24. While this does not represent the actual revenue performance, it gives a sense of how demand has trended so far. If this trend continues, it suggests that 3Q24 performance may come in line with 2Q24 (which means a beat vs. management’s guidance).

Commitment to return capital to shareholders

A big, good news for shareholders is that management is vocal about their intention to return capital to shareholders. In the call, management talked about buying back shares and issuing dividends.

Regarding the former, BZ has already bought back $88 million shares over the past 4 months pre-the earnings call and has announced a new share repurchase program of US$150 million (effective from August 29) for a 12-month period. Notably, this new program will operate in conjunction with the existing buyback program ($200 million total) that became effective on March 20 (also for a 12-month period, and it is within this program that BZ has already bought back $88 million). Doing the math, it means that over the next 12 months, BZ could potentially buy up to $262 million worth of shares, and this is about 5% of the current market cap.

Regarding dividends, management is currently strategizing their payout plan, which is a good start. Given the large amount of cash sitting on the balance sheet (~RMB15 billion of net cash), BZ should have no issues supporting consistent dividend payouts if they wished to.

And about the dividend, I can say that for a potential dividend payout plan, we are still under research, and that’s my answer to your question. Company 2Q24 earnings

Valuation

The stock now trades at just 10x forward EBITDA, which, I think, is cheap for a company that can continue to grow at >20% in FY24 (assuming 2H24 grows as per 3Q24 guidance) and higher over the longer term as the macro environment recovers and BZ penetrating to other verticals. There are no major concerns regarding profitability, either, as management reiterated their profit guidance for FY24. As BZ grows, it should also benefit from strong incremental margins given the fixed cost nature of its platform. On a relative basis, comparing BZ against Pagegroup, which is trading at 9x forward EBITDA, the little premium that BZ is trading at (1x above Pagegroup) doesn’t seem justified either, as BZ is expected to grow way faster than Pagegroup (consensus expected growth is flattish for the next 12 months). On a historical basis, the stock trades really cheap as well (average was 17x for note), so there is definitely room for valuation to rerate upwards.

Risk

My current view is that the growth slowdown is due to the weak macro. However, if growth remains lackluster (deceleration and showing no signs of improvements) despite the macro background getting better, it could signal that BZ platform is not as strong as I thought. In addition, growth in users may never translate to revenue opportunities, as businesses may simply join the platform but not use it for various other reasons that may not be known.

Conclusion

I give a buy rating for BZ as I remain optimistic about the business’s long-term growth prospects. While the challenging macroeconomic environment has impacted near-term revenue growth, fundamentals remain strong, as evident from the continued user growth and positive traction in penetrating other verticals. At 10x forward EBITDA, I believe it is too cheap relative to Pagegroup and its own trading history.

Read the full article here