JD Sports Fashion (OTCPK:JDSPY) (OTCPK:JDDSF) is one of the most prominent sports fashion retailers in the world. Its conglomerate style of expansion has allowed it to capitalize on growing trends, and management is shrewd at removing non-core businesses from its portfolio. While there are risks in its balance sheet and contractions in free cash flow recently, the company is well-positioned, in my opinion, to continue to capitalize on North America. In addition, its PS ratio indicates that it is undervalued, potentially opening up an 18-month market cap growth of ~35%.

Operational Analysis

JD Sports Fashion is a global powerhouse in the sports fashion sector, operating over 4,500 stores worldwide across key markets like North America, Europe, the UK, and Asia Pacific. The company has developed strong relationships with Nike (NKE), Adidas (OTCQX:ADDYY), and Puma (OTCPK:PMMAF), among other designers, to provide exclusive products and enhance its brand and market position.

Management is also focusing on aggressively expanding internationally at the moment, with an ambition to open 250 to 350 new stores annually. Its recent acquisition of Hibbett Sports in the U.S. has also been a strategic move to help it improve its presence in the country, which is the world’s largest sportswear market. The acquisition is significantly aiding the company to hit its projected target of 40% of total turnover coming from North America.

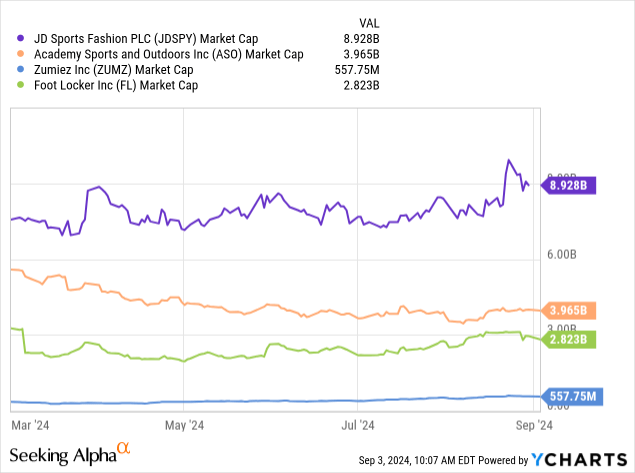

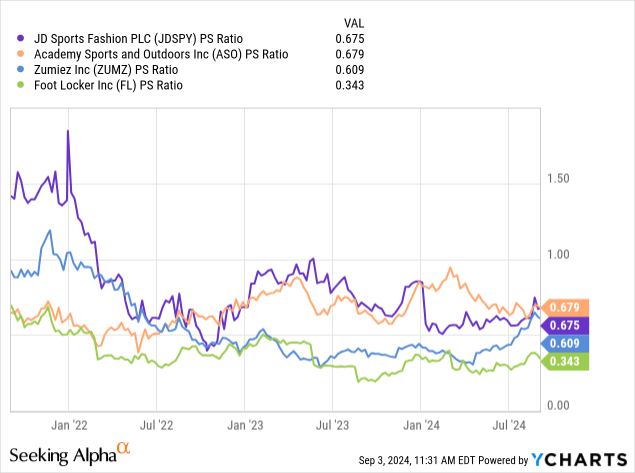

JD Sports Fashion competes with various sportswear companies, but three of its core direct competitors with a similar market cap are Academy Sports + Outdoors (ASO), Zumiez (ZUMZ), and Foot Locker (FL).

- Academy Sports + Outdoors competes with JD Sports through a range of sports and outdoor products; it is based in the United States.

- Zumiez is focused on lifestyle brands, specifically for action sports like skateboarding and snowboarding. While it has a distinct niche focus, it competes with youth-oriented fashion products from JD.

- Foot Locker operates in the athletic footwear and apparel retail sector, competing with JD Sports heavily in North America and Europe.

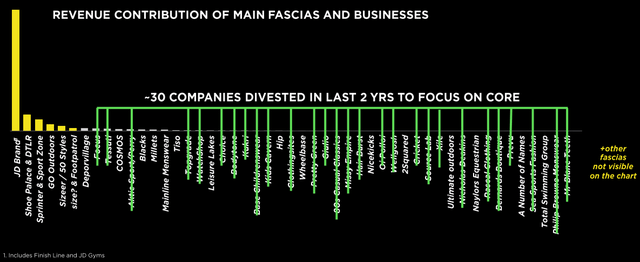

Based on my review of the investor relations reports from JD, one of the elements that stood out about its operational strategy is how focused it is on its core growth drivers and willingness to divest non-core subsidiaries. I think this approach from management shows agility and willingness to adapt, which supports the conglomerate’s long-term flourishment and sustenance amid changing market preferences.

JD Sports FY24 Presentation

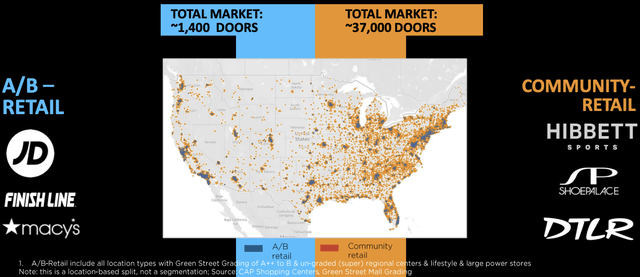

As I mentioned international expansion, with the key market for JD Sports being America, it is good to see JD’s strong presence in the country evolving with multiple brands providing both prime locations and local community storefronts, with a total of 38,400 stores.

JD Sports FY24 Presentation

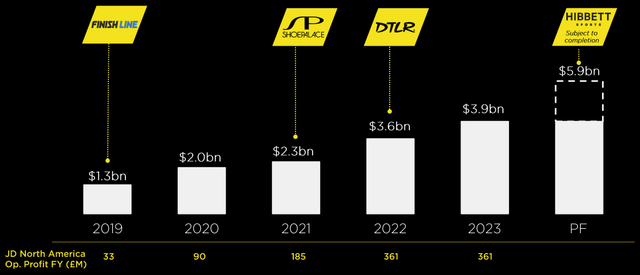

The company is largely able to pull off this aggressive expansion strategy through its acquisitions, and I believe this conglomerate style of expansion is a reason to be bullish on JD, especially as it is willing to sell its assets if its strategy and the data changes. I think as the U.S. is already so saturated with fashion retailers, management only really has this option to consolidate its position in the country. It also allows for it to attach itself to trends that established businesses are already capitalizing on rather than build the infrastructure for a target market from the ground up.

JD Sports FY24 Presentation

- Finish Line, including its partnership with Macy’s, has been particularly strong for JD as it has managed JD to capitalize on a widespread presence in U.S. malls.

- Shoe Palace has allowed JD to tap into the West Coast market, known for its thriving sneaker culture.

- DLTR has provided JD with access to urban markets and a younger demographic and expanded its presence in metropolitan areas.

- Hibbett came with a strong presence in the southeastern U.S., along with a robust e-commerce and omnichannel platform.

Financial & Valuation Analysis

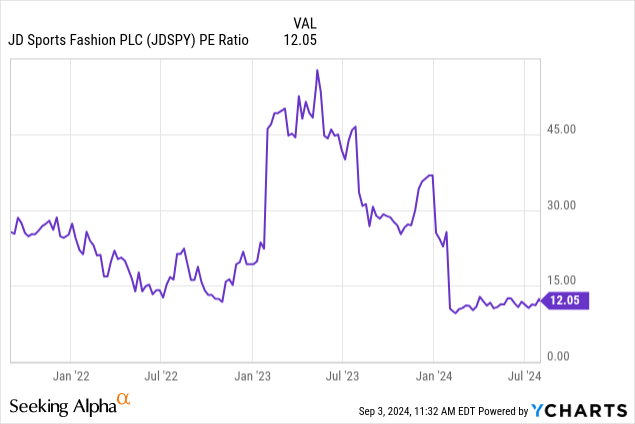

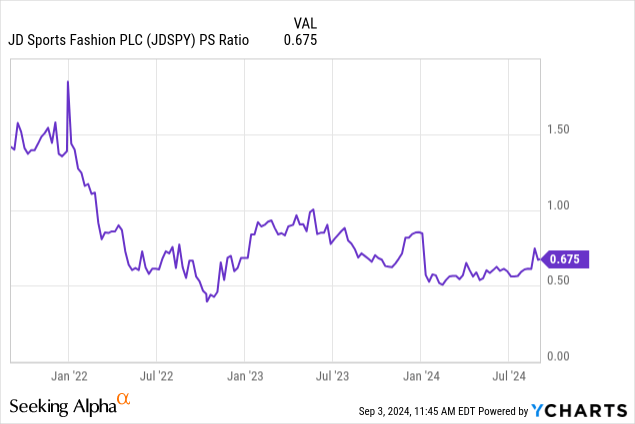

JD Sports is currently moderately undervalued, based on my analysis. The company has a 10-year median PE ratio of approximately 23, but it is now 12. Furthermore, JD has a PS ratio of 0.69 on a TTM basis and 0.61 on a forward basis, providing an element of deep value.

However, JD Sports also has lower growth rates compared to historically. Its 5-year average for revenue growth is 19.27%, but its FY25, FY26, and FY27 growth rates are less competitive at 11.6%, 10.3%, and 10.6%, respectively. Therefore, some valuation contraction is definitely warranted, but a PS ratio of under 1 is certainly too low, in my opinion.

JD has a 10-year median PS ratio of 1.2. However, it is worth noting that its similar-sized peers all have PS ratios below 1, so this is not uncommon, and does speak to the fact that JD is not a deep value play despite it selling for below its total sales.

That being said, JD’s future revenue growth estimates are much higher than its peers, and considering its PS ratio is very similar to both Academy Sports and Zumiez, this indicates that it is indeed undervalued relative to its peers, despite it not being a deep value play.

| Company | FY25 Revenue Growth Estimate | FY26 Revenue Growth Estimate |

| JD Sports | 11.6% | 10.3% |

| Academy Sports | 6.4% | 9.5% |

| Zumiez | 3.2% | 2.5% |

| Foot Locker | 2.9% | 3.7% |

In my opinion, JD Sports could trade at a fairer PS ratio of 0.75 in FY25, and if it meets the revenue estimate of $16.67B, it will have a market cap of $12.50B, indicating valuation growth of ~35% from the current market cap of $9.20B.

Risk Analysis

JD Sports Fashion, like many other retailers, is likely to face reduced demand in the coming years, in my opinion, related to cost of living concerns amid high inflation. This is affecting both the United Kingdom and North America, which are its two primary markets. It is also affecting Europe, which is its third-largest market. As JD Sports could be considered a retailer for discretionary purchases rather than essential goods, its business model is more vulnerable at the moment than other companies that sell consumer staples. That being said, some of its clothing is cheap enough to be considered recession-resistant to some degree.

In addition, the company’s balance sheet could be stronger, as it has an equity-to-asset ratio of 0.31 and a cash-to-debt ratio, including lease obligations, of 0.44. As the company is currently expanding aggressively overseas, this could mean that it faces inhibitions in possible acquisitions, as it has less liquidity than one would hope and less room to take on further debt. In addition, management has negative free cash flow growth at the moment, with a 10-year median FCF growth rate of 21.6% compared to -16% as a three-year average. Its free cash flow is still quite high but lower than one would hope given its track record, further indicating lowered room for expansion.

Conclusion

In my opinion, JD Sports is an excellent business trading at an attractive valuation. Its position in the market, strong partnerships, and international expansion strategy with a heavy focus on the United States means that investors are getting continued growth at a reasonable price. There are risks with inflationary pressures that are likely to reduce demand in the coming years, but this is largely unavoidable by management, although it could double down on affordable goods. In addition, I think its balance sheet and free cash flow are a bigger growth inhibitor, but despite this, I am bullish on the company overall. I rate JD Sports Fashion a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here