AbbVie (NYSE:ABBV) is an American pharmaceutical company whose medications improve the quality of life of tens of millions of patients with autoimmune, oncological, and eye diseases.

Thesis

Since the beginning of 2023, AbbVie’s share price has continued to move in the range of $134 to $165, with neither the bulls succeeding in their attempts to break through the resistance zone for a long time nor the bears being able to maintain their grip below $134.

However, following the financial results for the third quarter of 2023 released in late October, the company’s share price bounced off the strong support zone and continued its upward trend, up 14% over the past two months.

Source: TradingView

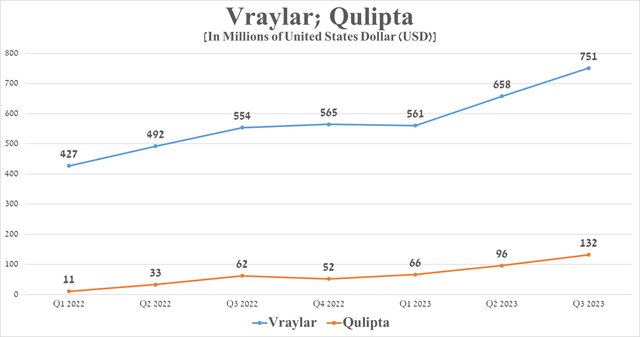

The emerging upward trend indicates that AbbVie’s investment attractiveness is increasing, including due to the expected start of interest rate cuts by the Federal Reserve in 2024, the acquisition of ImmunoGen, which will strengthen and diversify its oncology portfolio, maintaining strong demand for Vraylar, Skyrizi, Qulipta, and Rinvoq.

Nonetheless, in light of the company’s significant debt due to its active M&A policy, the steady decline in Humira sales as a result of the increasing number of biosimilars, falling sales of Imbruvica as a result of increased competition in the BTK inhibitors market, the negative effects of President Biden’s Inflation Reduction Act of 2022, and also considering the expected technical correction, I am initiating AbbVie coverage with a “hold” rating.

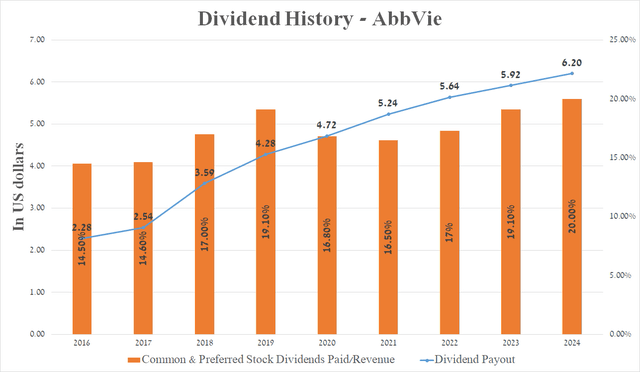

AbbVie’s immunology franchise has significant potential

Over the past two decades, AbbVie has continued to be a key player in the immunology drugs market. Its portfolio consists of medications such as Rinvoq, Humira, and Skyrizi, whose combined sales were approximately $6.78 billion in the third quarter of 2023, down 11.3% year-over-year.

A decline in Humira sales will only negatively impact the company’s financial position in the short term

Humira (adalimumab) is a drug that binds to tumor necrosis factor-alpha (TNF-alpha) and then neutralizes its interaction with TNF receptors with high specificity and affinity. TNF-alpha is an inflammatory cytokine secreted by macrophages during acute inflammation and immune responses against pathogens.

I would like to note that elevated levels of TNF-α are directly associated with the development of various autoimmune diseases, including Crohn’s disease, rheumatoid arthritis, ulcerative colitis, and ankylosing spondylitis.

Although taking Humira does not cure inflammatory diseases, it does help reduce pain, improve symptoms of the conditions described above, and also slow down further bone and joint destruction, ultimately significantly improving the quality of life for tens of millions of patients.

AbbVie’s flagship product is approved by regulators in most regions of the world and generated more than $20 billion a year before losing its exclusivity.

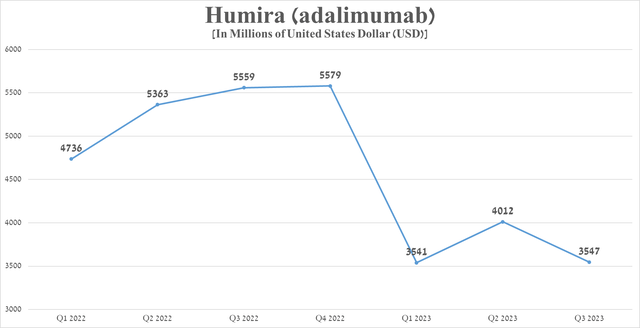

Nevertheless, the situation began to change dramatically from 2023 after the launch of Amgen’s Amgevita, which is the first biosimilar of Humira to be launched in the United States. As more and more biosimilars produced by companies such as Boehringer Ingelheim, Sandoz, Organon (OGN), Biocon, Fresenius Kabi arrived, the demand for the branded drug continued to fall, which also negatively affected AbbVie’s margins. Humira sales reached $3.55 billion in the third quarter of 2023, down $2.01 billion from the previous year.

Source: graph was made by Author based on 10-Qs and 10-Ks

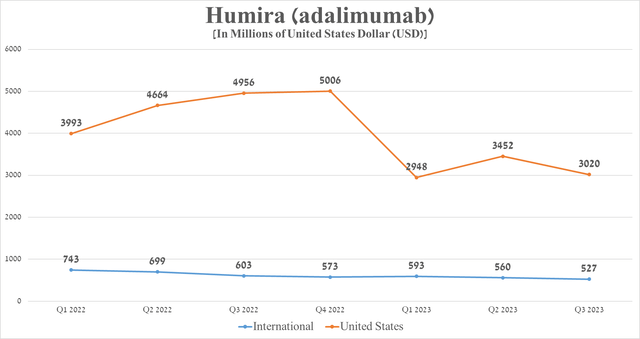

However, a more detailed examination reveals that the rate of decline in demand for Humira outside the United States is significantly lower, which is explained by several factors that I highlight. In particular, this is due to the smaller difference in prices between Humira and biosimilars and the reluctance of some doctors to switch patients to cheaper analogs due to the lack of sufficient long-term data confirming their safety. In addition, some countries have no effective mechanisms, including financial incentives for doctors to prescribe more biosimilars.

Source: graph was made by Author based on 10-Qs and 10-Ks

Skyrizi sales continue to please investors

Skyrizi (risankizumab) is a drug that binds to the p19 subunit of interleukin-23 (IL-23) and then inhibits IL-23-dependent cell signaling and also chemokine release. IL-23 is a pro-inflammatory cytokine, and its elevated levels are directly associated with the development of various autoimmune diseases.

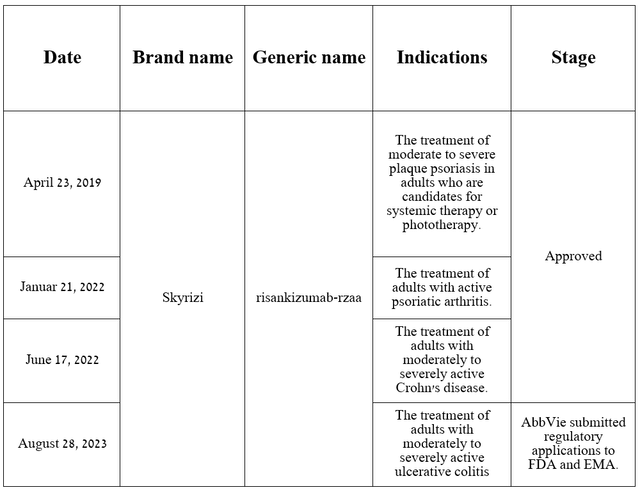

This monoclonal antibody was developed jointly with Boehringer Ingelheim and is currently approved by the FDA for three indications. Additionally, on June 15, 2023, the company reported excellent results from a Phase 3 clinical trial evaluating the efficacy of risankizumab in the treatment of patients with ulcerative colitis, one of the most common inflammatory bowel diseases in the world.

Source: table was made by Author based on AbbVie press releases and its pipeline

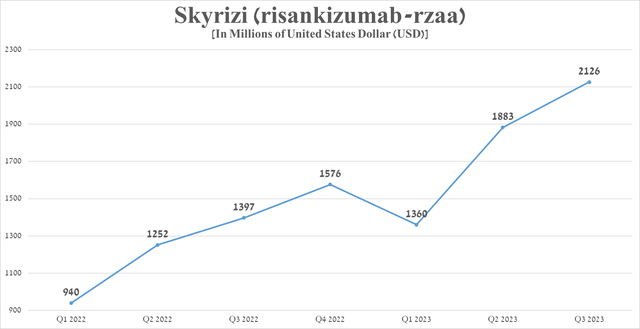

Sales of Skyrizi were approximately $2.13 billion for the three months ended September 30, 2023, an increase of 52.2% from the previous year, driven by increased share in the autoimmune disease therapeutics market, higher efficacy relative to Humira, and expanded geographic use.

Source: graph was made by Author based on 10-Qs and 10-Ks

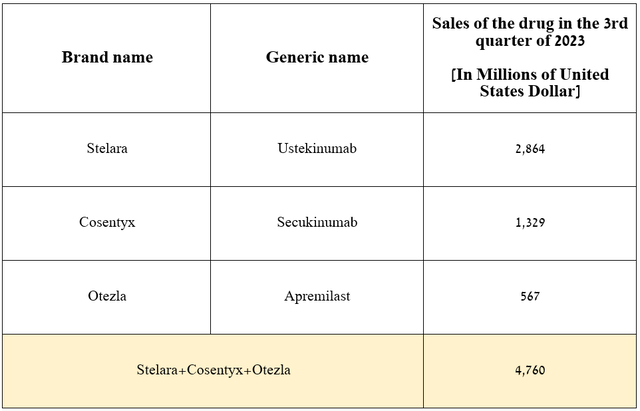

That said, I expect demand for AbbVie’s product to continue to grow in the coming years due to its competitive advantages relative to blockbusters such as Novartis’ Cosentyx (NVS), Amgen’s Otezla (AMGN), and Johnson & Johnson’s Stelara (JNJ), which had total sales of $4.76 billion in the third quarter of 2023.

Source: graph was made by Author based on 10-Qs and 10-Ks

So, on September 12, 2023, the company published encouraging results from the phase 3 SEQUENCE study, according to which Skyrizi was significantly more effective than Stelara in treating patients with Crohn’s disease.

Rinvoq is no less important AbbVie’s drug

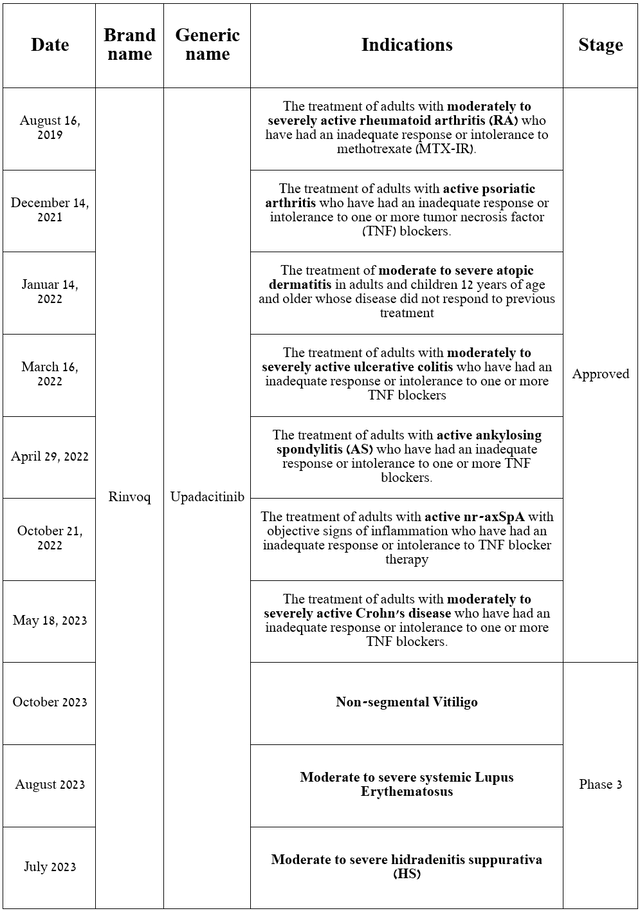

Rinvoq is a drug that is a selective Janus kinase 1 (JAK1) inhibitor, approved by the FDA for the treatment of patients with various autoimmune disorders and is also being developed to combat non-segmental vitiligo, systemic lupus erythematosus, and hidradenitis suppurativa.

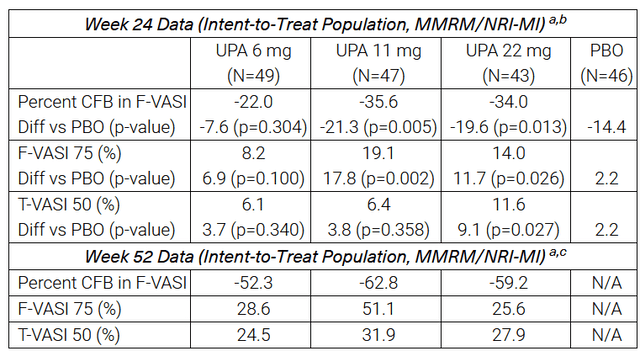

On October 11, 2023, AbbVie reported that results from a phase 2b study evaluating upadacitinib in patients with non-segmental vitiligo demonstrated a statistically significant reduction in the Facial Vitiligo Area Scoring Index compared with placebo at week 24 and week 52 from the start of treatment. In addition, I would like to note that other endpoints were met in this study, which significantly increases the likelihood of success in the pivotal clinical trial.

Source: AbbVie

Vitiligo is a skin disease affecting millions of people worldwide, and currently, only Incyte’s Opzelura (INCY) is approved by regulatory authorities for the treatment of this disease.

Source: table was made by Author based on AbbVie press releases and its pipeline

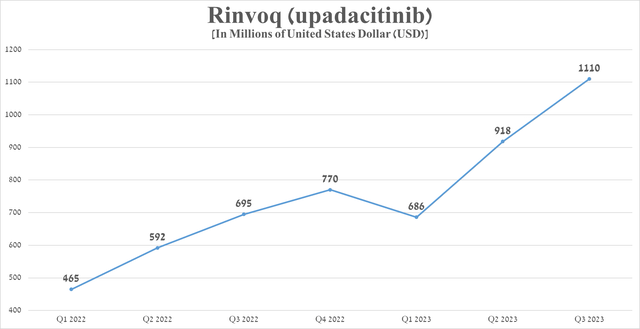

Rinvoq sales were $1.11 billion in the third quarter of 2023, up 59.7% from the prior year, mainly due to its label expansion and continued strong demand for the treatment of patients with inflammatory bowel disease.

Source: graph was made by Author based on 10-Qs and 10-Ks

Will Rinvoq and Skyrizi be able to offset the decline in Humira sales?

The short answer is yes.

However, another question arises: when will this happen?

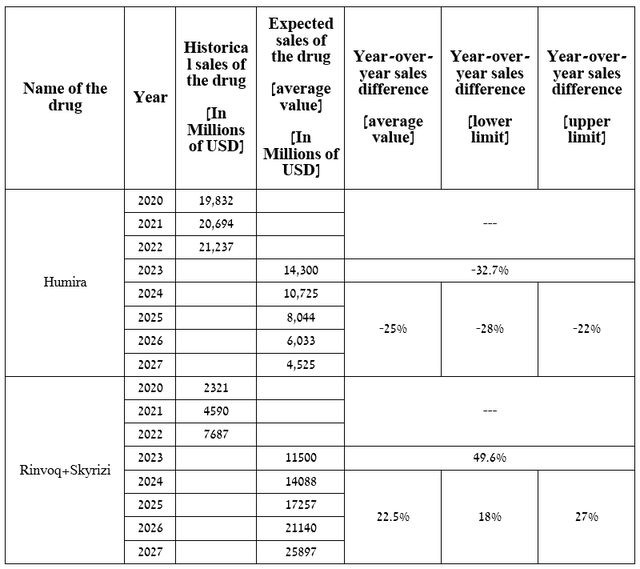

To answer this question, I first analyzed the rate of decline in sales of dozens of blockbuster drugs after losing their exclusivity between 2010 and 2020 to project Humira’s net revenues through 2027. After that, I moved on to forecast the combined sales of Rinvoq and Skyrizi based on historical data, potential label expansions over the next five years, comments from the company’s management, and an analysis of their competitors in the immunology medicines market.

For example, on January 10, 2023, AbbVie announced that it expects sales of Skyrizi and Rinvoq to exceed $17.5 billion by 2025, which is slightly higher than my expectations noted in the table below.

Source: table was made by Author

A graph based on this table indicates that sales of Rinvoq and Skyrizi will equal sales of Humira in the second half of 2024.

Source: graph was made by Author

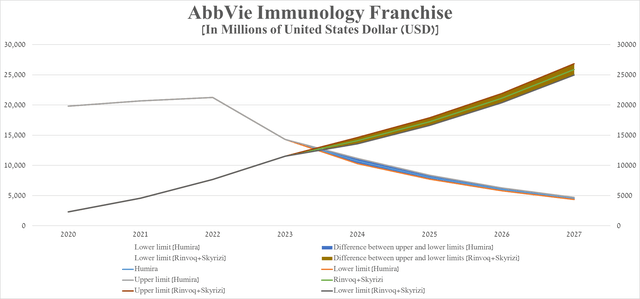

AbbVie has a high dividend yield and return on equity

AbbVie has an ROE of more than 45%, which not only indicates its effective financial policy but also outperforms many of its healthcare peers like Gilead Sciences (GILD), Biogen (BIIB), and Pfizer (PFE).

Source: GuruFocus

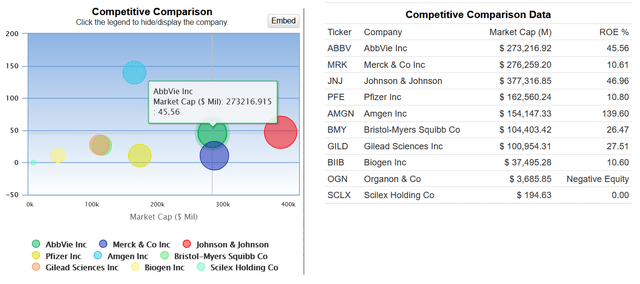

Over the past 52 years, the company’s management has consistently increased its dividend payout, and I expect this trend to continue even despite the decline in demand for Humira and the acquisition of ImmunoGen (IMGN) and Cerevel Therapeutics (CERE) thanks to growing sales of AbbVie’s neuroscience franchise.

Source: graph was made by Author based on Seeking Alpha

Furthermore, the company’s 5-year dividend growth rate is 10.52%, which, together with the Payout Ratio [non-GAAP] of 49.66%, indicates a reasonable ratio between its profit and dividends paid.

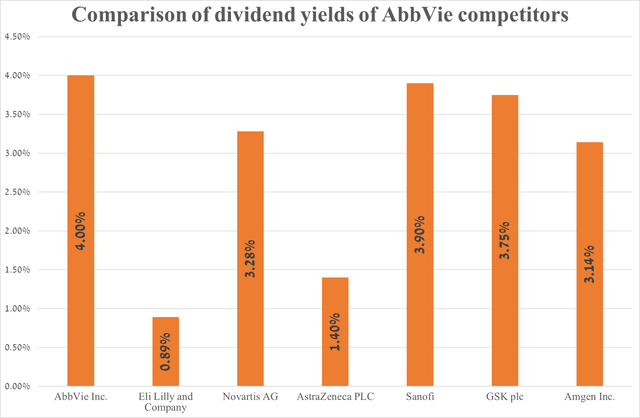

AbbVie’s dividend yield is 4%, outperforming many of its major competitors in the oncology and immunology markets.

Source: graph was made by Author based on Seeking Alpha

Acquisition of ImmunoGen by AbbVie

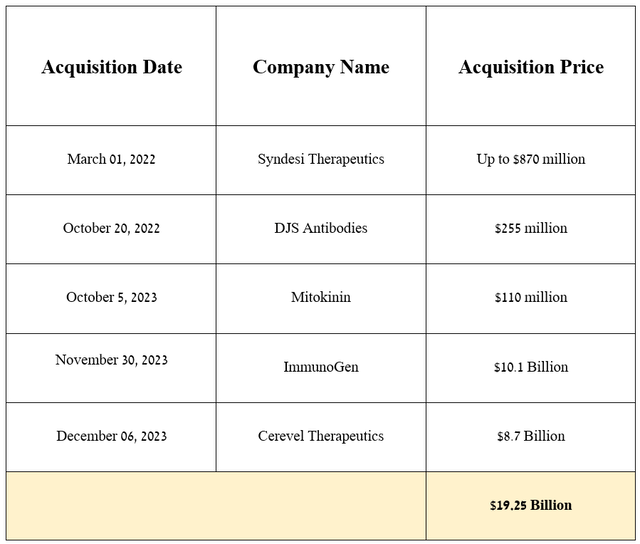

Before moving on to the discussion of the acquisition of ImmunoGen, I want to note that over the past two years, AbbVie has been pursuing a relatively passive M&A policy due to the $63 billion acquisition of Allergan, of which the company’s total debt still exceeds $60 billion, thereby creating pressure on its balance sheet.

Source: graph was made by Author based on 10-Qs and 10-Ks

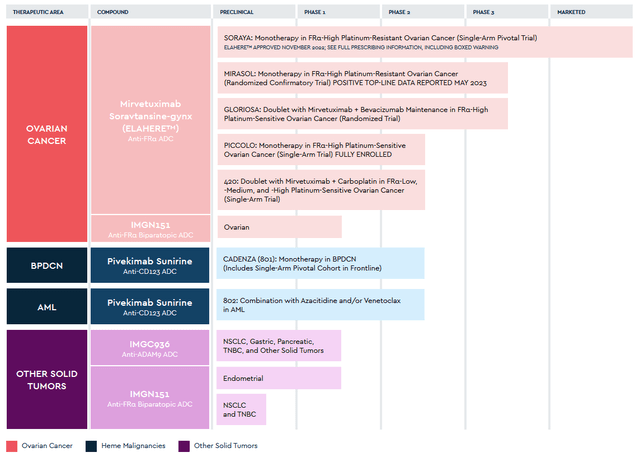

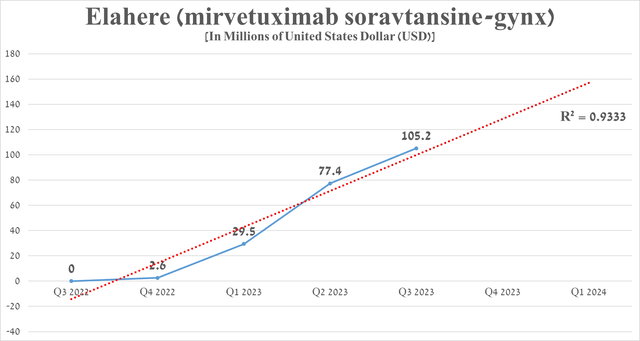

On November 30, 2023, AbbVie announced the acquisition of ImmunoGen for $10.1 billion. The deal will strengthen the company’s prospects in the rapidly growing cancer market, thanks to Elahere, which is an FDA-approved drug for the treatment of certain patients with ovarian cancer and also product candidates targeting gastric, pancreatic, endometrial and non-small cell lung cancers, and acute myeloid leukemia.

Source: ImmunoGen

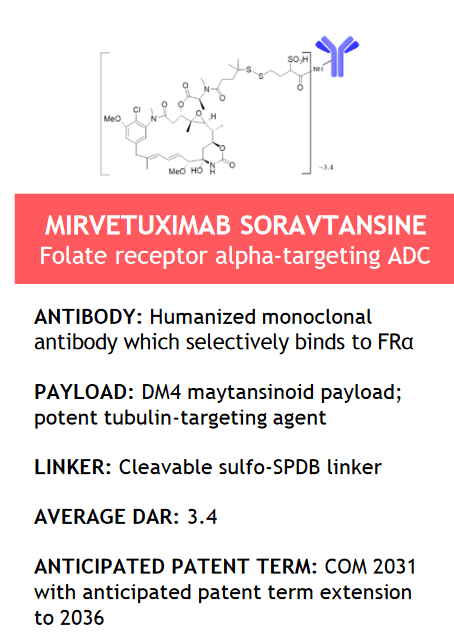

The flagship product developed by ImmunoGen is Elahere (mirvetuximab soravtansine-gynx), an antibody-drug conjugate directed against FRα and consisting of three main components: mirvetuximab, which is an antibody of IgG1, a cleavable sulfo-SPDB linker, and the anti-tubulin agent DM4.

Source: ImmunoGen

This medication was approved by the FDA on November 14, 2023, for the treatment of certain patients with ovarian cancer.

Since then, the demand for Elahere has continued to grow at a fantastic pace, thanks to its high efficacy and also competitive advantages over PARP inhibitors. For the three months that ended September 30, its sales totaled $105.2 million, an increase of 35.9% from the previous quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

AbbVie’s financial results and outlook

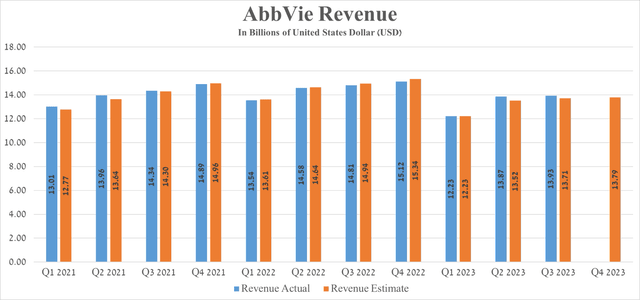

AbbVie’s revenue for the three months ended 2023 was about $13.93 billion, down 5.9% from the previous year but beating analysts’ expectations by $220 million.

Source: Seeking Alpha

The decline in this financial indicator was primarily caused by a drop in demand for Humira, Imbruvica, and also two drugs for the treatment of eye diseases, such as Restasis and Lumigan. On the other hand, Abbie pleased investors with the continued increased demand for Vraylar and Qulipta despite increased competition in the major depressive disorder and migraine markets.

Source: graph was made by Author on 10-Qs and 10-Ks

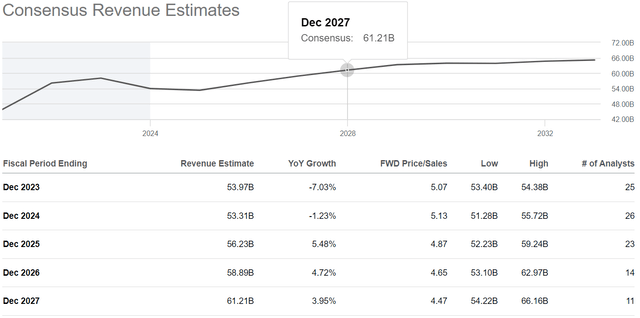

Seeking Alpha offers financial data based on analyst anticipations for subsequent quarters. So, AbbVie’s revenue for the fourth quarter of 2023 is expected to range from $13.87 billion to $14.34 billion, which is 8.8% less than the previous year.

In addition to the company’s year-over-year revenue decline, its price/sales [FWD] is 5.07x, indicating AbbVie is trading at a premium to most of its healthcare peers.

Source: Seeking Alpha

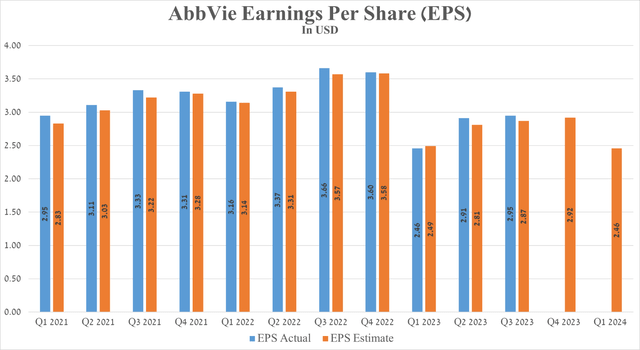

AbbVie’s Q3 Non-GAAP EPS was $2.95, beating analysts’ consensus estimates by $0.08. However, its EPS is expected to be in the range of $2.84 to $3.08 in the fourth quarter of 2023, down 19.03% from the fourth quarter of 2022.

Source: Seeking Alpha

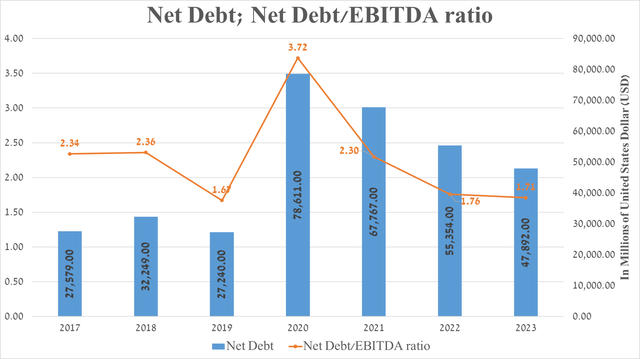

It is equally important to discuss AbbVie’s debt, which, in my assessment, is not a significant risk to its financial position. So, the company’s net debt amounted to about $47.9 billion at the end of September 2023 and has continued to decline since 2020 due to the repayment of senior notes issued as part of the financing of the acquisition of Allergan.

However, due to the fall in EBITDA, the company’s net debt/EBITDA ratio has remained virtually unchanged over the past two years and remains around 1.7x. Also, given the acquisition of Cerevel Therapeutics, whose operating expenses exceeded $400 million over the past 12 months, this will not only continue to put negative pressure on AbbVie’s net income margin but will also limit its ability to pursue its share repurchase program in 2024 actively.

Source: Seeking Alpha

Key risks to consider

In addition to the sharp drop in Humira sales, I highlight several risks that financial market participants need to consider to minimize potential losses.

Falling sales of Imbruvica due to increased competition with other Bruton’s tyrosine kinase inhibitors

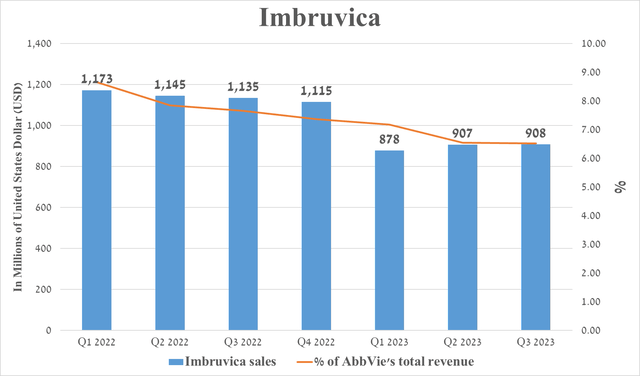

Imbruvica is a first-generation Bruton’s tyrosine kinase inhibitor whose sales were $908 million in the third quarter of 2023, down 20% from the prior year.

Source: graph was made by Author based on 10-Qs and 10-Ks

The first reason for the decline in demand for the oncology franchise’s flagship product is AbbVie’s withdrawal of accelerated approval for the treatment of certain patients with mantle cell lymphoma in May of this year. The second reason, which in my opinion is the main one, is competition with such second-generation Bruton’s tyrosine kinase inhibitors as BeiGene’s Brukinsa (BGNE), AstraZeneca’s Calquence and Eli Lilly’s Jaypirca (LLY). These medications have higher efficiency and selectivity relative to Imbruvica, and, as a result, I expect this will continue to affect its sales negatively.

The impact of the Inflation Reduction Act on AbbVie’s financial position

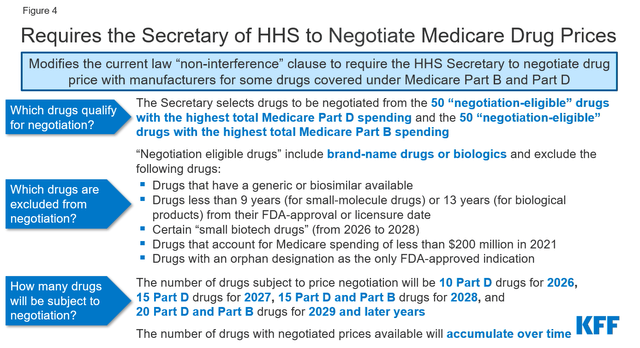

Government regulation and the impact of the Inflation Reduction Act adopted in 2022 may negatively affect AbbVie’s business. These changes include negotiating with Medicare, introducing discounts on drugs covered under Medicare Part B and Medicare Part D, and introducing penalties if drug prices rise faster than inflation.

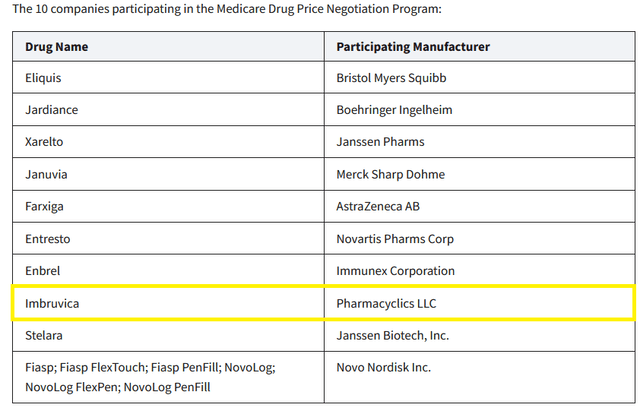

Source: KFF

In my assessment, the impact of the Biden administration’s regulations and reforms on the pharmaceutical industry could slow AbbVie’s revenue growth from 2026, and consequently, its management will need to revise its business model to minimize this risk.

So, in October 2023, the Biden-Harris Administration released a list of ten Part D-covered drugs for which Medicare will negotiate prices. Imbruvica was on this list, and as a result, this created additional financial risk for AbbVie’s oncology franchise.

Source: HHS

Takeaway

AbbVie is an American pharmaceutical company whose medications improve the quality of life of tens of millions of patients with autoimmune, oncological, and eye diseases.

Despite declining Humira sales, the company’s neuroscience franchise continues to remain competitive with Rinvoq and Skyrizi, whose sales continue to grow 50% yearly. At the same time, sales of these two medications will offset the negative impact of the launch of an increasing number of Humira biosimilars as early as the end of 2024.

Thanks to the acquisition of ImmunoGen, AbbVie has significantly strengthened and diversified its oncology portfolio, incorporating Elahere, which is potentially one of the most effective drugs in the global ovarian cancer market, estimated at $20 billion by 2031.

However, due to the decline in demand for Imbruvica, the acquisition of Cerevel Therapeutics, whose operating expenses exceed $400 million per year, the negative impact of the Inflation Reduction Act, the US presidential election in 2024, event due to which heated debates may begin in the information space aimed at further regulating drug prices, these factors continue to create downward pressure on the price of AbbVie shares.

In addition, I expect a correction in the company’s share price since it is in the overbought zone, which, coupled with bearish divergence and approaching a strong resistance zone, is not an attractive entry point for long-term investors. I plan to buy the company’s shares in the price range of $141 to $143.

Source: TradingView

I’m initiating coverage of AbbVie with a “hold” rating.

Read the full article here