Standardized performance (%) as of September 30, 2024

|

Quarter |

YTD |

1 Year |

3 Years |

5 Years |

10 Years |

Since inception |

||

|

Class A (MUTF:MLPAX) shares inception: 03/31/10 |

NAV |

4.01 |

27.13 |

31.83 |

25.84 |

14.34 |

2.69 |

6.07 |

|

Max. Load 5.5% |

-1.67 |

20.19 |

24.49 |

23.46 |

13.07 |

2.11 |

5.65 |

|

|

Class R6 shares inception: 06/28/13 |

NAV |

4.07 |

27.49 |

32.25 |

26.31 |

14.73 |

3.03 |

4.54 |

|

Class Y shares inception: 03/31/10 |

NAV |

4.13 |

27.56 |

32.18 |

26.17 |

14.62 |

2.95 |

6.33 |

|

Alerian MLP Index-GR |

0.72 |

18.56 |

24.46 |

25.47 |

13.50 |

1.82 |

– |

|

|

Total return ranking vs. Morningstar Energy Limited Partnership category (Class A shares at NAV) |

– |

– |

44% (41 of 95) |

16% (17 of 94) |

33% (33 of 92) |

34% (20 of 60) |

– |

Calendar year total returns (%)

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Class A shares at NAV |

6.81 |

-31.59 |

25.75 |

-7.46 |

-14.85 |

6.96 |

-28.61 |

39.39 |

29.07 |

20.44 |

|

Class R6 shares at NAV |

7.24 |

-31.37 |

26.28 |

-7.27 |

-14.55 |

7.37 |

-28.36 |

39.70 |

29.61 |

20.76 |

|

Class Y shares at NAV |

7.07 |

-31.40 |

26.06 |

-7.30 |

-14.60 |

7.24 |

-28.38 |

39.76 |

29.45 |

20.45 |

|

Alerian MLP Index-GR |

4.80 |

-32.59 |

18.31 |

-6.52 |

-12.42 |

6.56 |

-28.69 |

40.17 |

30.92 |

26.56 |

|

Expense ratios per the current prospectus: Class A: Net: 3.11%, Total: 3.11%; Class R6: Net: 2.76%, Total: 2.76%; Class Y: Net: 2.86%, Total: 2.86%. The fund is structured as a C corporation and may be subject to certain tax expenses that are reflected in the expense ratio. Please refer to the current prospectus for more information. Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit Country Splash for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. As the result of a reorganization on May 24, 2019, the returns of the fund for periods on or prior to May 24, 2019 reflect performance of the Oppenheimer predecessor fund. Share class returns will differ from the predecessor fund due to a change in expenses and sales charges. Index source: RIMES Technologies Corp. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front-end sales charge, which would have reduced the performance. Class Y and R6 shares have no sales charge; therefore performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details. For more information, including prospectus and factsheet, please visit Invesco.com/MLPAX Not a Deposit Not FDIC Insured Not Guaranteed by the Bank May Lose Value Not Insured by any Federal Government Agency |

Manager perspective and outlook

West Texas Intermediate (‘WTI’) crude oil priced at the Cushing hub ended the quarter at $68.17 per barrel, down 16% from the end of the second quarter and 25% lower than one year ago. The spread between Brent crude, a proxy for international crude prices, and WTI ended the quarter at $3.60 per barrel, tightening during the quarter.

Henry Hub natural gas prices ended the quarter at $2.92 per million British thermal units (MMbtu), up 12% from the end of the second quarter and flat compared to one year ago. Gas pricing in the Permian Basin ended the quarter lower than the end of the second quarter and experienced weakness (even trading at negative prices) during the period, as pipeline maintenance continued to pressure already-constrained takeaway capacity.

Natural gas liquids (NGLs) priced at Mont Belvieu ended the quarter at $24.86 per barrel, down 16% from the end of the second quarter and 17% lower than one year ago. Prices for the NGL purity products were mixed at quarter end, with butane and ethane trading higher while propane, isobutane and natural gasoline traded lower. Frac spreads, a measure of natural gas processing economics, settled at $0.37 per gallon, down 25% from the end of the second quarter and 24% lower than one year ago.

Portfolio positioning

Top equity issuers (% of total net assets)

|

Fund |

Index |

|

|

MPLX LP (MPLX) |

13.50 |

10.24 |

|

Energy Transfer LP (ET) |

13.30 |

10.00 |

|

Targa Resources Corp (TRGP) |

11.32 |

0.00 |

|

Western Midstream Partners LP (WES) |

10.42 |

9.82 |

|

Enterprise Products Partners LP (EPD) |

8.70 |

9.87 |

|

ONEOK Inc (OKE) |

6.77 |

0.00 |

|

Plains All American Pipeline LP (PAA) |

6.21 |

9.95 |

|

Sunoco LP (SUN) |

4.74 |

10.04 |

|

Williams Cos Inc/The (WMB) |

4.42 |

0.00 |

|

Cheniere Energy Inc (LNG) |

3.11 |

0.00 |

|

As of 09/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

For the third quarter of 2024, master limited partnerships (MLPs), as measured by the Alerian MLP Index (AMZ), were down 1.05% on a price basis and up 0.72% when including distributions. For the quarter, the S&P 500 Index (SP500, SPX) gained 5.53% on a price basis and returned 5.89% including distributions.

Many sector participants continued to buy back stock as attractive valuations persisted. Buyback disclosures historically typically accompany earnings reports, which trail the quarter end by several weeks (approximately $1.3 billion of buybacks were disclosed with second quarter earnings reports).

We estimate MLP-focused investment vehicles, including closed-end funds, open-end funds and index-linked products, experienced approximately $313 million of net inflows during the quarter.

MLP capital investment included an estimated $5.0 to $6.0 billion of organic capital spending. As producer growth plans have remained moderate, midstream capital spending requirements have lessened, increasing the free cash available to sector participants for debt retirement, unit repurchases and distribution increases in current and future periods. Corporate mergers and acquisitions (M&A) remained healthy, with multiple transactions announced during the quarter.

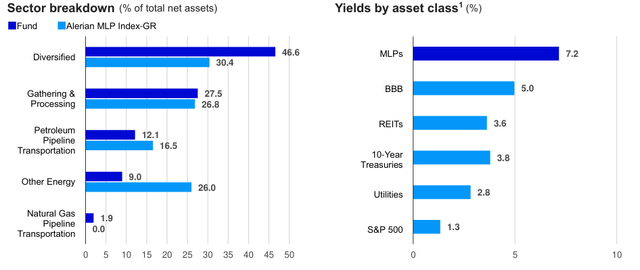

The 10-year US Treasury (US10Y) yield was 3.78% at quarter end, down 0.62% from the end of the second quarter. The MLP yield spread, as measured by the implied yield of the AMZ Index relative to the 10-year Treasury yield, widened by 0.72%, ending the quarter at 3.38%. The long-term average for the MLP yield spread (2000 through the third quarter of 2024) is 4.39%. At quarter end, the AMZ Index’s yield was 7.16%.

We believe that despite several years of outperforming the S&P 500 Index, midstream equities are well positioned to provide investors with an attractive yield and total return experience over the coming years. Valuations have remained in our view attractive and fundamentals support expectations for cash flow growth for most sector participants, particularly those with business segments focused on key producing basins and those that support activities to export crude oil, refined products, liquified petroleum gases (LPGs) and/or liquified natural gas (‘LNG’).

|

1Source: Bloomberg. Data as of September 30, 2024 and is calculated using the most recent annualized distribution. MLPs are represented by the Alerian MLP Index (AMZ). Real Estate Investment Trusts (REITs) are represented by the FTSE NAREIT Equity REIT Index. BBB Bonds (BBB) are represented by the U.S. Corporate Bond BBB yields. Utilities are represented by the Dow Jones Utilities Index. 10-Year Treasuries are represented by the U.S. Treasury Bond 10-year yield. S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks listed on various exchanges. Index performance is shown for illustrative purposes and does not predict or depict performance of the Fund. The indexes are unmanaged and cannot be purchased directly by investors. Past performance does not guarantee future results. |

Performance highlights

The natural gas pipelines sub-sector and the petroleum pipelines sub-sector provided the best relative performance during the quarter. The natural gas pipeline group likely benefited from an outlook for rising natural gas demand driven by LNG exports and data centers. The propane and marine sub-sectors had the lowest average returns during the quarter. Each sub-sector was hampered by idiosyncratic factors affecting certain sub- sector participants.

Contributors to performance

Targa Resources Corp. (TRGP)

TRGP outperformed after reporting better- than-expected financial and operating results and raising 2024 cash flow guidance. The company is participating in the Blackcomb Pipeline joint venture, taking a direct equity stake in the next natural gas egress solution out of the Permian Basin, which is expected to be in service in the second half of 2026.

ONEOK Inc. (OKE)

OKE outperformed after reporting financial and operating results that were above consensus expectations. During the quarter, OKE announced it will acquire both Medallion Midstream, a private crude gathering and transportation system, and Global Infrastructure Partners’ equity interest in EnLink Midstream (ENLC).

Williams Companies Inc. (WMB)

WMB outperformed during the quarter after reporting better-than-expected financial and operating results. The company also brought the second phase of its Regional Energy Access natural gas system online earlier than anticipated, building on its reputable track record of solid execution.

Detractors from performance

Western Midstream Partners LP (WES)

WES units underperformed during the quarter after its sponsor, Occidental Petroleum (OXY), sold a block of shares at a discount to the recent trading price. The partnership reported financial and operating results that were in line with expectations and signed several new long-term contracts with customers. WES is a crude and natural gas gathering and processing midstream company focused on the Denver-Julesberg and Permian basins.

Sunoco LP (SUN)

SUN units underperformed during the quarter despite continued strength in fuel margins supporting strong quarterly results and market participants appearing to generally support its recent NuStar acquisition. SUN’s diverse geographic footprint, healthy balance sheet and focus on the wholesale fuel distribution business is expected to provide steady long-term operational results.

Energy Transfer LP (ET)

ET underperformed during the quarter despite reporting quarterly earnings that were in line with expectations and increasing its 2024 EBITDA guidance to account for the $2.3 billion WTG Midstream acquisition that closed in July. ET is, in our view, well positioned with one of the largest and most diversified portfolios of midstream assets in the US, with a strategic footprint in all the major domestic production basins.

Read the full article here