On the surface, Innovative Industrial Properties, Inc. (NYSE:IIPR) and Plymouth Industrial REIT, Inc. (NYSE:PLYM) are quite similar.

- Industrial real estate investment trusts, or REITs

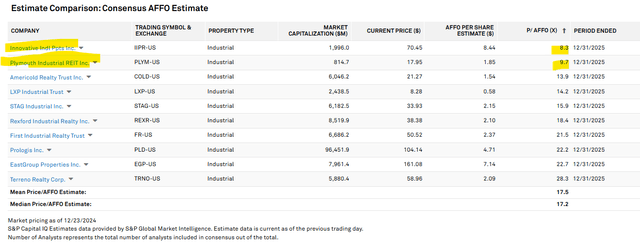

- Discounted adjusted funds from operations, or AFFO, multiples relative to the rest of the industrial sector

- Enticing dividend yields.

Yet, we are bullish on PLYM and bearish on IIPR.

As value investors, the extremely low AFFO multiples appeal to us, but value alone does not create a total return. Business models need to be durable such that earnings will grow over time.

We believe PLYM passes this test and IIPR does not. The difference comes in acquisition strategy and the way properties are leased. Any acquisition looks good when it is cash flowing, but the real test of a REIT’s strategy is in times of struggle.

Both IIPR and PLYM have experienced some tenant difficulties lately, affording an opportunity to stress test the companies. The fundamental outcomes of each company’s leasing events show a large quality gap between the discounted industrial REITs.

IIPR’s Tenant Difficulties

PharmaCann defaulted on its leases with IIPR. As IIPR’s largest tenant at 17% of rental revenues, it is a fairly sizable hit.

IIPR

Other tenants are struggling to pay rent as well, with IIPR dipping into security deposits from TILT Holdings, 4Front Ventures, and Emerald Growth to cover their rent. Per the 10-Q:

“For the three months ended September 30, 2024, we applied $1.4 million of security deposits for payment of rent on properties leased to 4Front Ventures Corp. (“4Front”) (four properties), TILT Holdings Inc. (“TILT”) (one property), and Emerald Growth Holdings LLC (“Emerald Growth”) (one property).

A lease was terminated with Temescal Wellness and IIPR retook possession of the property, also per the 10-Q:

“We terminated our lease with Temescal Wellness of Massachusetts, LLC at our Massachusetts property and regained possession of the property on September 30, 2024. For the three months ended September 30, 2023, we applied $2.2 million of security deposits for payment of rent.”

Rent collection continues to struggle post Q3 2024, with more of it being paid from security deposits:

“Subsequent to September 30, 2024, we applied $0.9 million in security deposits for the properties leased to 4Front, TILT and Emerald Growth for the payment of rent owing in October 2024, and, including those security deposits applied, we collected $1.4 million of the contractually due rent and interest of $2.2 million for the month of October 2024 for 4Front, Emerald Growth, TILT and a secured loan for which we are the lender for a California property portfolio.”

These security deposits will be depleted, at which point we believe the rent will become delinquent.

We find 2 aspects of the poor rent collection troubling:

- It represents a large portion of their portfolio. PharmaCann is 17% of rental income alone, and some of their other significant tenants are struggling.

- The prospects for replacing that revenue look weak.

Allow me to elaborate on the 2nd point because I think that is the true weakness of IIPR’s business model.

Tenant defaults are fairly common among REITs. Think of something as simple as an apartment tenant defaulting on their monthly rent. This sort of thing happens quite routinely, and it is so routine that the chance of occurrence is actually factored into the underwriting of property acquisitions.

When the tenant defaults, the landlord kicks them out and finds a new tenant. Assuming the tenant was paying a normal amount, rent from the new tenant would be roughly the same. Perhaps the landlord loses out on a few months of rent during the transition, but overall, it is not that big of a deal.

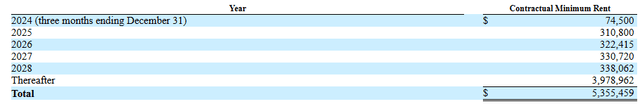

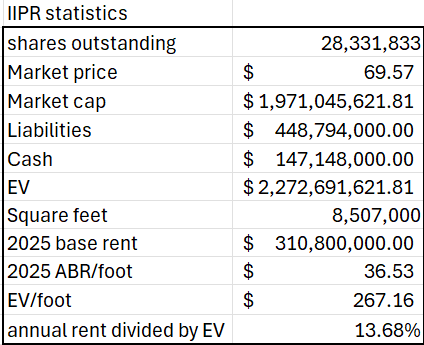

IIPR’s problem is that its tenants are not paying a normal amount of rent. The company reports 2025 annual base rent (ABR) of $310.8 million, which allows us to run various calculations on its leases.

IIPR

Annual rent totals a whopping 13.68% of enterprise value. A company could theoretically get to that level by its stock price getting cheap, but that is not the case here.

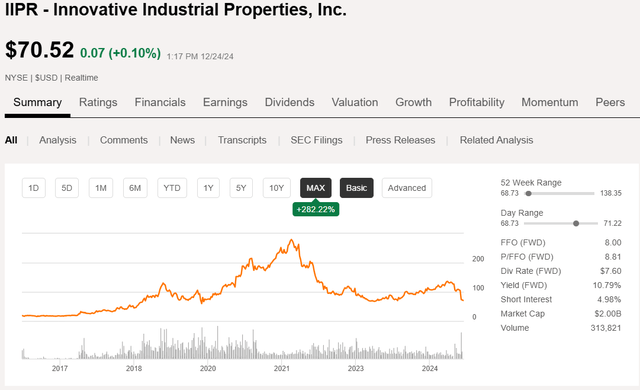

Sure, IIPR crashed on the PharmaCann default announcement, but over a longer period of time, the stock price is up quite considerably.

SA

Normal cap rates for industrial REITs are around 4%-9% depending on the vintage of the lease and various property quality factors.

Thus, rent being over 13% of EV is quite strange.

The extremely high rent as a percentage of EV is due to going in cap rates in the mid-teens.

We previously identified in the article linked earlier that IIPR’s high cap rates are the result of its leases being partially loans.

Industrial buildings are quite cheap to build, often costing less than $100 per square foot. Yet, IIPR’s enterprise value per foot is $267.

High EV/foot could be due to IIPR’s stock trading at a bloated valuation, but that is clearly not the case here with an 8.5X AFFO multiple.

See, the way most REITs work is that the REIT invests in the building and then the tenant pays rent to use that building. IIPR does things a bit differently. It owns the building, but a substantial portion of its investment is directly with the tenant.

IIPR gives its tenants millions of dollars to be used for property improvements in exchange for higher rental rates and longer lease terms. They have been doing this since IPO and are still doing it with recent announcements in its 10-Q. In fact, as recently as February, IIPR invested an additional $16 million in PharmaCann, the now defaulting tenant.

“In February 2024, we amended our lease and development agreement with PharmaCann at one of our New York properties, increasing the construction funding commitment by $16.0 million, which also resulted in a corresponding adjustment to the base rent for the lease at the property. We also amended the lease to extend the term.”

In April, they provided a similar tenant allowance to Battle Green Holdings:

“In April 2024, we amended our lease with a subsidiary of Battle Green Holdings LLC at one of our Ohio properties to provide an additional improvement allowance of $4.5 million, which also resulted in a corresponding adjustment to the base rent for the lease at the property.”

Also in April, IIPR provided an additional $1.6 million to 4Front in exchange for higher rents.

“In April 2024, we amended the lease with a subsidiary of 4Front at one of our Illinois properties to provide an additional improvement allowance of $1.6 million, which also resulted in a corresponding adjustment to the base rent for the lease at the property and increased the annual base rent escalations for the remainder of the lease term.”

That is the same 4Front that is now only covering its rent by dipping into security deposits.

Perhaps one could technically classify these as property investments because the funds given to tenants are earmarked to improve the properties. However, I consider it to be the financial equivalent of investing in tenants in the form of loans with interest payments and principal to be paid back to IIPR through higher rent over the lease term.

The result of all this investment in tenant improvement is that IIPR’s rent per foot has gotten to a whopping $36.53.

2MC

That is an insane level of rent for industrial properties.

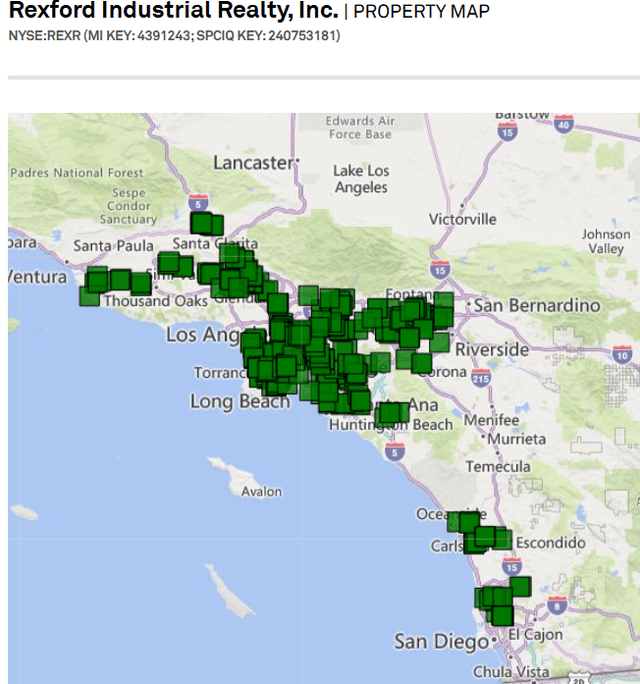

As a point of comparison, Rexford Industrial Realty (REXR) has rent per foot of $16.23 and their portfolio consists almost exclusively of class A+ real estate in the highly dense Inland Empire.

S&P Global Market Intelligence

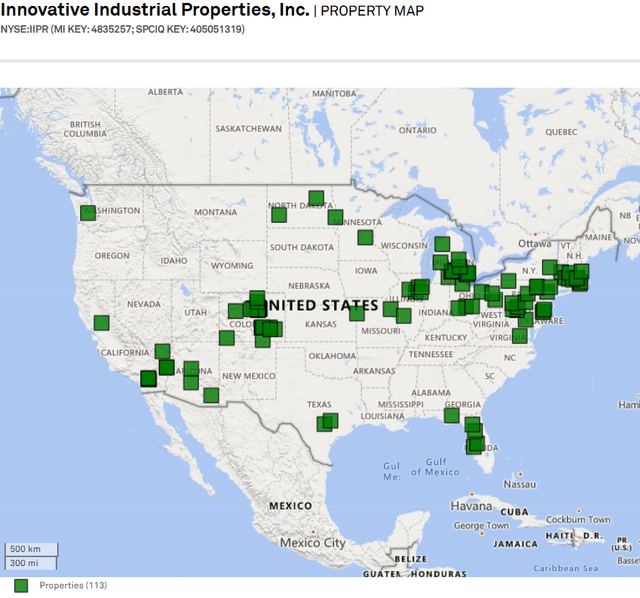

In comparison, IIPR’s properties are in the middle of nowhere.

S&P Global Market Intelligence

I love the Midwest, but property values in Michigan are a fraction of property values in the port of Los Angeles.

So, IIPR’s rent per foot of $36.53 is absolutely insane compared to Rexford at $16.23.

Rents are high to essentially pay IIPR back for the tenant allowances that IIPR pays the tenants.

That works out great when the leases go to full term. It is a disaster when leases end early, such as the PharmaCann default, a few other defaults recently, and the slew of tenants currently struggling to pay rent.

The problem for IIPR is that, unlike that apartment landlord who just finds a new tenant at the same rent, a new tenant’s rent is likely to be closer to $8 a foot.

If they are lucky, a cannabis-related tenant would be able to use the tenant improvements installed in the buildings and could potentially pay $16 a foot.

I just don’t see any realistic scenario in which a replacement tenant pays anywhere close to $36 a foot. IIPR is looking at either substantial vacancies or large cuts in rent when replacement tenants are found.

So while the stock is cheap, trading at a very low multiple relative to the industrial sector, I think the fundamental downside makes it cheap for a reason.

S&P Global Market Intelligence

Plymouth Industrial is similarly discounted at a 9.7X AFFO multiple.

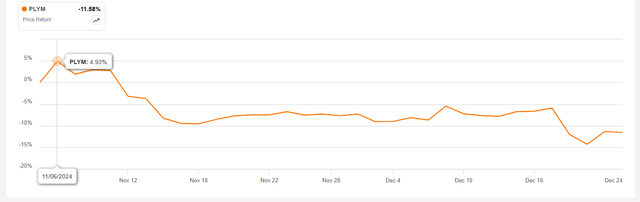

It, too, has had tenant troubles with 2 recent tenant defaults on rent. This valuation would indicate that the market thinks Plymouth will also suffer a fundamental downside resulting from these defaults. Indeed, PLYM stock has been clobbered since the tenant lease defaults were announced on November 6th.

SA

This, in my opinion, is incorrect.

The fundamental impact of PLYM’s tenant issues is entirely different for 2 reasons:

- These tenants were quite a small slice of PLYM’s revenue

- PLYM has a different business model in which they invest exclusively in the real estate, not the tenant.

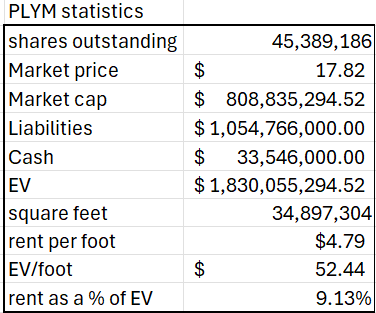

We tabulated IIPR’s vitals earlier and PLYM’s are below.

2MC

There are some considerable differences worth pointing out.

PLYM’s enterprise value per foot is $52.44 compared to $267 for IIPR.

Part of this is PLYM stock trading cheaply, but most of it is that PLYM’s acquisition criteria involves purchasing properties below replacement cost. It is not feasible to build warehouses of reasonable quality today for $52.44 a foot.

Perhaps the more pertinent difference is that PLYM’s rent per foot is $4.79. That is well below market rent for industrial real estate of the quality (usually class B) and location of PLYM’s properties.

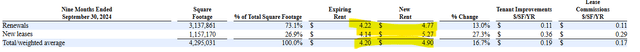

Rent per foot varies throughout PLYM’s portfolio by vintage of lease and the particular property with which it is associated. In the most recent quarter, PLYM had some of its lower rent leases expire at $4.14 per foot and signed new tenants at $5.27 per foot.

Supplemental

That is a 27% increase, and I think quite indicative of the rest of the portfolio in terms of existing rents being below market.

Below-market rent is a make-or-break when it comes to tenant issues.

When an above-market rent tenant fails as was the case with IIPR, rent comes back down to market and that is in the favorable outcome where a new tenant is found.

When a below-market rent tenant fails, it is almost an opportunity. It allows the REIT to accelerate marking that rent to market. That is what happened with PLYM’s vacancies.

We discussed the replacement of PLYM’s defaulted tenants on our portfolio update on Portfolio Income Solutions.

“Digging into the content of {Plymouth’s} the 3Q24 call, both vacancies have already been replaced with new tenants at equal or higher rent. Thus, it is clearly not a demand issue and the financial hit to PLYM will be limited to the roughly 6 month window between the previous tenant leaving and rent of the new tenant commencing.”

Anthony Saladino, PLYM’s CFO, confirmed on the Q3 2024 earnings call that the replacement tenant is paying higher rent than the tenant that defaulted.

“We sourced, identified and fully negotiated with a new tenant at a 27% positive spread to expiring rents”

That is a night and day different outcome than IIPR.

PLYM will have a few months of vacancy followed by a larger cash flow stream. That is the result of good asset underwriting and a business model that focuses on good real estate.

IIPR will have either a long-term vacancy or a new tenant that pays a fraction of the rent of the previous tenant. Most of the capex IIPR spent on PharmaCann and the other struggling tenants could be lost, and AFFO/share is likely to suffer as rent gets marked to market.

The Bottom Line

As value investors, we have to choose carefully.

- PLYM is a strong industrial REIT that happens to be trading at a discounted AFFO multiple and well below NAV.

- IIPR is cheap for a reason.

Read the full article here