Investment Introduction

When I look at Ingersoll Rand Inc. (NYSE:IR) one of the first thoughts that comes to mind is about how strong the value creation has been throughout its many years of operations. IR has found its advantages and way to grow rapidly, that being with a strong diversified product lineup enabling it to penetrate several market opportunities globally. The value creation that I talk about with IR comes from in my opinion the growth of the business and how that will continue to drive a higher share price, as a result of bottom-line expansion. IR has been a company that has traditionally traded at quite a high valuation in comparison to perhaps more common levels in the Industrial sector. I am not put off by the premium attached to IR and find the price fair to pay still after the impressive run-up over the last few months. I will rate IR a buy.

Company Introduction

IR operates globally and produces mission-critical technologies across a variety of sectors including air, fluid, energy, specialty vehicle, and medical industries. The operations are divided into two segments, those being: Industrial Technologies and Services, and Precision and Science Technologies. Before we dive into the segments, I think it has to be explained how IR came about. The company was formed in 2020 after the merger between Gardner Denver and Ingersoll Rand Industrial Segment. Looking back at the growth of the company, it has been strong, with revenue going from $2.019 billion in 2019 to $3.973 billion in 2020 following the merger. Since then, it has grown to $6.678 billion and with the current strategy, I think it can reach even higher, supporting my thesis of continued value creation here.

The Industrial Technologies and Services division offers a broad spectrum of air and gas compression, vacuum, blower products, and fluid transfer equipment under brands like Ingersoll Rand and Gardner Denver. Meanwhile, the Precision and Science Technologies division specializes in advanced pumps and systems for liquid and gas management, serving the medical, life sciences, and industrial sectors, with key brands including ARO and Milton Roy. The product expansion and brand expansion have come much from acquiring new business in a rather fast manner, I have to say.

Just in October, the company completed two deals valued at $26 million, which isn’t a whole lot, but the aggressive M&A strategy that IR seems to have implemented is enabling them to penetrate many various markets quickly. The last two upped IR’s market presence in air treatment capabilities and repair and returns of blowers and pumps in the vacuum truck market. The air treatment market for example is expected to reach over $40 billion in valuation by 2029 according to GlobeNewswire, and I think IR is in a position where they can aggressively put in money to grab more market share here for example. The purchase of Oxywise didn’t come with a big price tag as I said, and with IR having a little over $1.1 billion in cash they can afford to boost production without it leaving a significant mark in their financial state.

Valuation

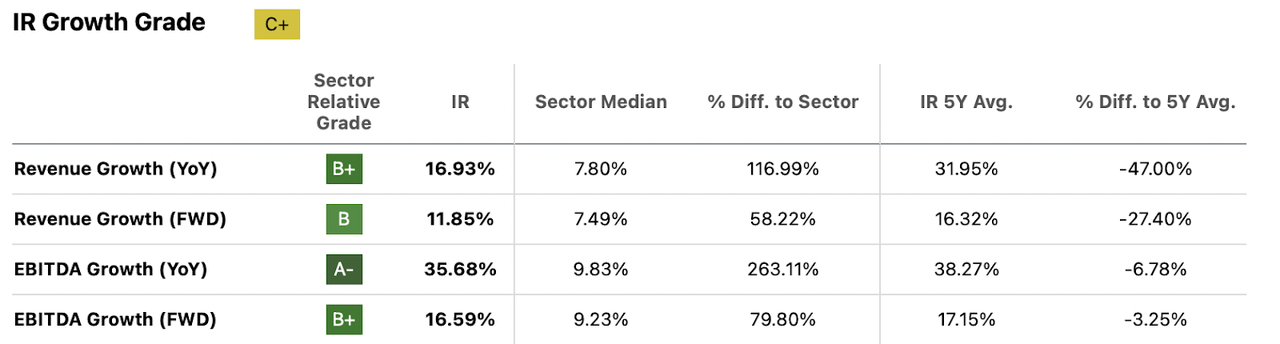

Growth of IR has been impressive in the last 5 years, heavily outperforming the broader industrial sector in many areas like revenue and EBITDA. It seems a leading factor for this was the merger that occurred in 2020 which nearly doubled revenues. But since the revenues have grown an additional 68%.

Growth To Sector (Seeking Alpha)

With IR you are getting a growth company where a large portion of the revenues is not organically growing. In the last quarterly releases, it was noted revenues expanded 15% YoY, but only 6% was organic YoY growth. I don’t think this type of growth strategy is risky since IR hasn’t let it impact its leverage ratio that harshly. When the merger happened in 2020 the long-term debt more than doubled. But IR has priorities paying down what was $3.842 billion in debt to $2.718 billion as of the last report.

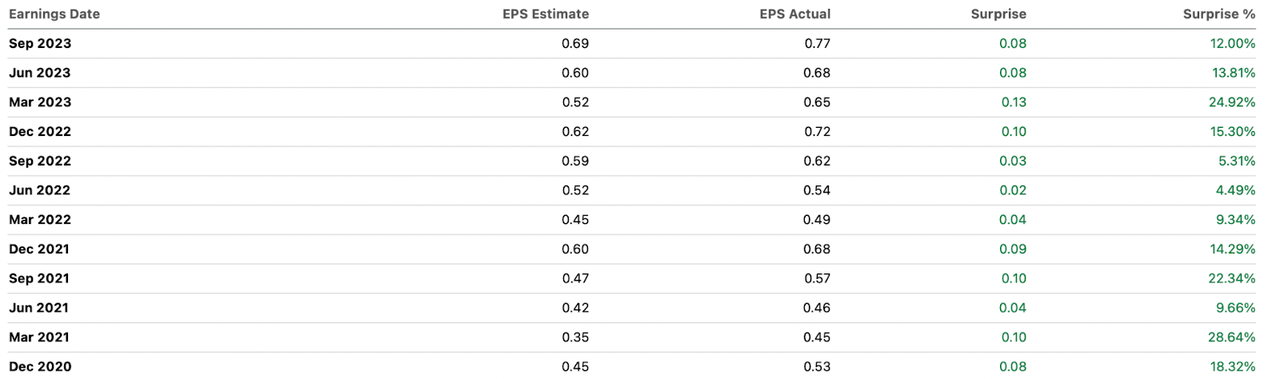

Earnings Surprise (Seeking Alpha)

IR is set to report its fourth-quarter results in about 2 weeks and we might see the share price consolidate somewhat until then, but in my view will likely grow even higher if IR can continue its trend of beating out on EPS estimates in an impressive fashion. The last 4 reports saw EPS beat out estimates by over 10% and with the highest beating by 24% even. As I will discuss further down, the valuation remains appealing to buy at as I assume growth will continue, and that justifies the current price tag very well.

The Value You Get

IR does not distribute a significant dividend, it’s very low at just a 0.1% yield right now. It has remained the same since late 2021 but there is potential for future raises for sure. The payout ratio is under 3% and growing it to 10 – 15% is sustainable in my opinion. IR generates strong organic growth still at 6% YoY and would support continued dividend raises. I do see a scenario though where a bigger focus placed on a dividend could cut the valuation as the market may see growth as slowing down then.

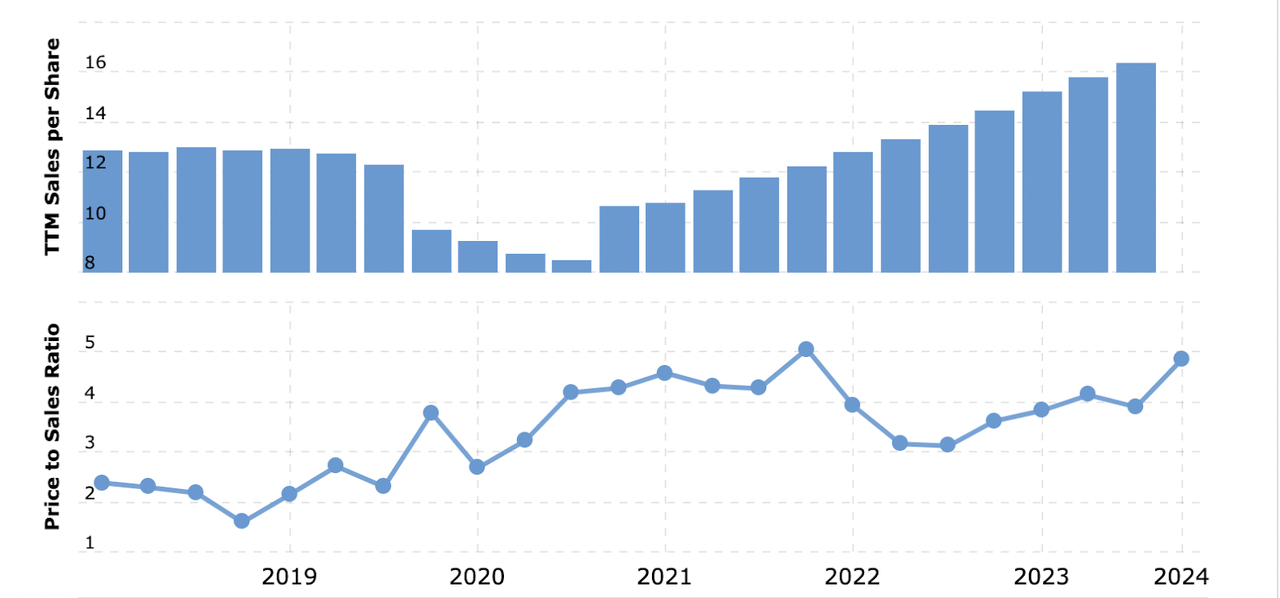

Sales Multiple (macrotrends)

The stock price has made a 42.81% return in the past 12 months, and outperforming the broader markets very well. Still, IR trades below what it has historically averaged. On a price-sales ratio, for example, IR is 3.4% below it, and on an earnings ratio, it is 15.7% below using the FWD p/e non-GAAP of 27.62 which IR currently trades at. Estimates suggest a 10.36% YoY EPS growth rate in 2024, slower than what the past years have produced. I would argue that value creation for investors still exists here as YoY EPS growth of 10 – 12% seems sustainable over the long term if the M&A strategy that IR has successfully deployed is maintained.

Price Target

On a p/e basis, IR displays a 15.7% discount to its 5-year average and a 3.4% discount based on p/s. I think IR has been performing well enough that it deserves to trade at these historical price valuations, which gets us a price target of $103 in the short term based on earnings, and that IR generates EPS of $3.17 in FY2024. On a revenue basis, I think IR can reach $7.1 billion in total in the next 12 months. Shares outstanding seem to have begun to be bought back so I do think it’s reasonable to assume IR will end 2024 with around 400 million shares, which gets us a revenue per share of $17.75. With a multiple of 4.7, we get a price target of $85. Combined with the p/e price target of $103 and then the dividend by 2 we get an average price target of $94 in the next 12 months. An 18.9% upside is what IR provides right now as I see it, and this is the value creation I am rating it a buy for.

The Bear Thesis

The bear thesis is very much circulating right now on how IR can weather an environment with potentially lower interest rates. At first, though it should be bullish as many companies will see increased demand following lower expenses for consumers. With more capital circulating in the economy, I think there will be more demand naturally. But there could also be more competition from other businesses, forcing IR to be even more active in their R&D to expand the product line, but also potentially take on more debt to fund this. IR has been good at paying back its debt, but a turnaround of this I would expect to the harmful to the stock price. The book value is perhaps not the best to value IR on, a p/s and p/e ratio would be better. But nonetheless, higher debt would remove some of the earnings potentially generated by IR which could lead to a valuation cut to better reflect the actual value of the company. However, if IR can continue to grow at strong 10 – 12% EPS rates in the coming years without the debt levels rising rapidly, this bear thesis is quickly trumped.

State Of The Company

One of the trends that I watched from Q3 was that the Industrial Technologies and Services Segment remains the high-growth part of the business. Orders grew by 8% organically YoY to $1.347 billion, and revenues grew to $1.428 billion, 19% up YoY, and 10% up organically. This is the sort of numbers that I want to see. Full quarter revenues were $1.719 billion and is setting IR up very well to reach $7 billion in annual revenues soon. I think what makes me predict IR will reach that in 2024 is the fact it holds a strong lineup of brands and products where they can pass down expenses to consumers and merchants. Organic sales growth of 10% in a high-interest rates environment tells me the products that IR could be classified as essential and high-priority products as well. IR even noted this pricing strength as the adjusted EBITDA margin grew 260 basis points YoY to 28.8%, outperforming the average industrial EBITDA margin of 13.64% very well.

With the next report around the corner, I think IR is well set up to post another strong beat on the top and bottom lines if this pricing strength can continue. Watching out for continued organic growth and no rapid increase in debt are some of my spots to watch for, but the bear thesis as discussed doesn’t hold enough weight in my opinion to warrant anything other than a buy here.

Investment Conclusion

IR is the result of a merger back in 2020 between two strong businesses. It has placed a focus on M&A to boost revenues and earnings and the results have been impressive. Investors that seek a growth opportunity in the industrial sector will do very well going with IR over the next decade I think. I am bullish on continued value creation by investing in IR and will go with a buy rating here.

Read the full article here