Investment Thesis

The Gotham 1000 Value ETF (NYSEARCA:GVLU) is an actively managed multi-cap value fund with a 0.50% expense ratio (0.65% before waivers) and $160 million in assets management. Although it has modestly outperformed its benchmark, represented by the iShares Russell 1000 Value ETF (IWD), Gotham’s managers have yet to demonstrate its diversified approach works better than other multi-cap options available. In addition to IWD, I will evaluate three of them in the article below, but ultimately, there’s not enough to warrant a buy rating for GVLU. I hope you enjoy the read.

GVLU Overview

Strategy Discussion

GVLU is actively managed and does not track an Index. However, its website provides some guidelines regarding the overall strategy, which I summarized below using the fund’s prospectus, fact sheet, and annual report.

1. The portfolio is well-diversified, with 400-600 securities selected from a universe of the largest 1,400 U.S. securities.

2. The portfolio is traded daily and is designed to reflect the least expensive 20% of the investment universe.

3. Managers Joel Greenblatt and Robert Goldstein emphasize low price to cash flow and strong operating fundamentals, which involve analyzing a company’s recurring earnings, capital efficiency, and valuation.

Greenblatt founded Gotham Asset Management (then Gotham Capital) in 1985 and is well-known in the investment community. His 2005 book “The Little Book That Beats The Market” described how return on capital and earnings yield are two metrics investors can use to earn superior long-term returns. I view this as combining the quality and value factors, and I will test how GVLU ranks on these factors compared to IWD and three other multi-cap funds:

- iShares Focused Value Factor ETF (FOVL)

- Vanguard U.S. Value Factor ETF Shares (VFVA)

- WisdomTree U.S. Value Fund ETF (WTV)

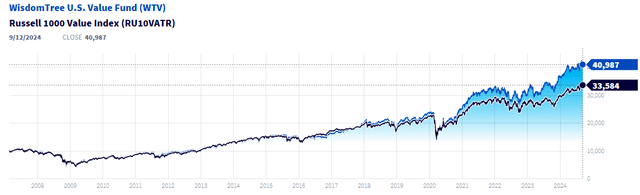

FOVL and VFVA are somewhat new funds, having launched in 2019 and 2018, respectively. WTV is well-established with a 17+ year track record, but the fund’s investment objective changed on December 18, 2017, so its long-term results may no longer be reliable. Still, it’s easily outperformed the Russell 1000 Value Index over the last five years. Since its shareholder yield approach emphasizes quality and value factors, it’s a potential alternative to GVLU.

WisdomTree

Performance Analysis

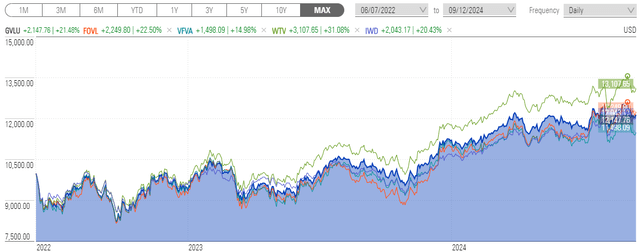

GVLU has delivered a 21.48% total return since it launched on June 7, 2022. This return was slightly better than IWD’s 20.43% gain and 7.50% more than VFVA’s. The more concentrated FOVL also did well at 22.50%, but WTV stood out the most with a 31.06% total return.

Morningstar

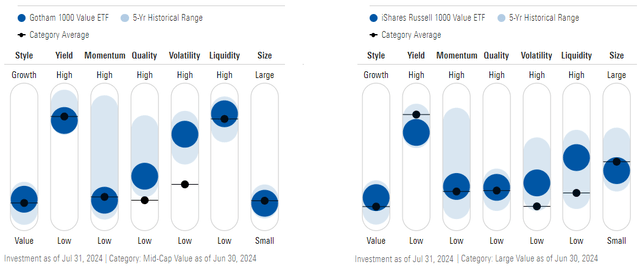

I caution this chart reflects returns for only a couple of years. Arguably, neither ETF’s strategy is proven, but one thing GVLU, FOVL, VFVA, and WTV have in common is a tendency to select smaller Russell 1000 stocks. As shown below, IWD’s size profile over the last five years has been pretty close to the middle, while GVLU’s was consistently near the “small” end since its inception. These funds could complement IWD or other low-cost benchmarks like the SPDR S&P 500 Value ETF (SPYV).

Morningstar

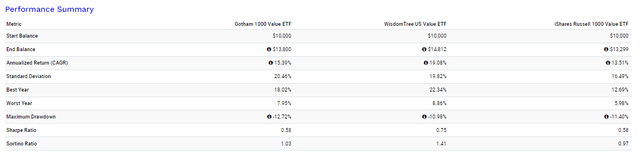

One consequence of holding smaller-sized stocks is an increase in volatility. Since July 2022, GVLU’s annualized standard deviation was about 4% more than IWD’s (20.46% vs. 16.49%), but its stronger returns compensated from a risk-adjusted returns perspective. The table below shows GVLU with a better Sortino Ratio, a standard measure of downside risk-adjusted returns, so this suggests to me the extra risk is worth it. GVLU and WTV outperformed IWD in 2022 and 2023 but are behind by 1-4% in 2024.

Portfolio Visualizer

GVLU Analysis

Sector Allocations and Top Ten Holdings

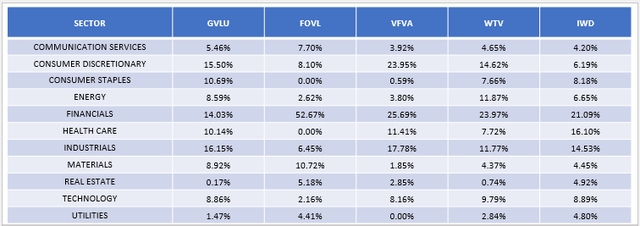

The following table highlights the sector allocation differences between GVLU, FOVL, VFVA, WTV, and IWD. Diversification is on the minds of Gotham’s managers, as no sector accounts for more than 17% of the portfolio. In contrast, VFVA, WTV, and IWD allocate 21-25% to Financials, a traditionally low P/E sector, while FOVL allocates 53%, mainly to small regional banks and insurance companies.

The Sunday Investor

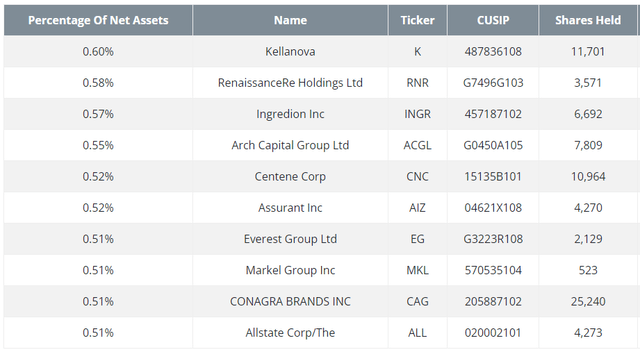

GVLU is also well-diversified by company. As shown, its top ten holdings have only a 5.38% combined weight compared to 17.25% for IWD, where stocks like Berkshire Hathaway (BRK.B) and JPMorgan Chase (JPM) are prominent.

Gotham Asset Management

GVLU Fundamentals By Sub-Industry

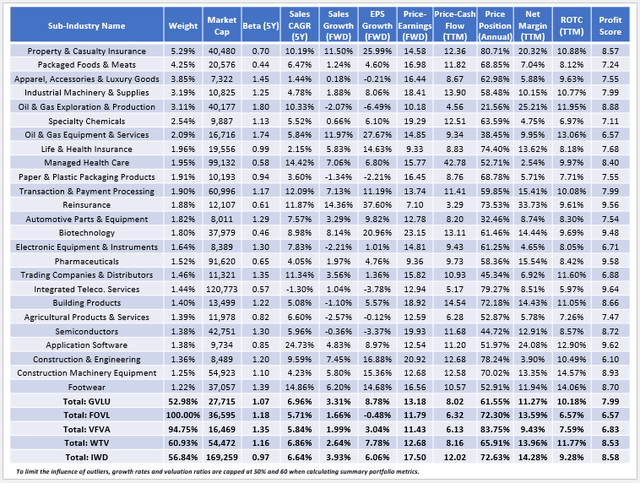

The following table highlights selected fundamental metrics for GVLU’s top 25 sub-industries, which total 52.98% of the portfolio. Again, this is good evidence the fund is well-diversified because even with more holdings (867 vs. 505), IWD’s sub-industry concentration level is more significant at 56.84%.

The Sunday Investor

This table covers many factors, including diversification, risk, growth, and momentum. While all are important, I want to focus on value and quality, which Greenblatt emphasizes with his “Magic Formula.”

GVLU trades at 13.18x forward earnings and 8.02x trailing cash flow, ratios which are relatively high compared to its multi-cap peers but a few points cheaper than IWD. I also considered GVLU’s different composition but derived only a 5.10/10 sector-adjusted value score using Seeking Alpha Factor Grades. In comparison, FOVL, VFVA, WTV, and IWD scored 5.54/10, 5.91/10, 4.70/10, and 3.51/10, respectively, so GVLU is only third-best.

Greenblatt also insists on low value accompanied by sufficient quality, and that is where GVLU comes out ahead against FOVL and VFVA. GVLU’s 10.18% return on total capital figure is 2-3% better, and these figures are consistently strong across all sub-industries. Still, WTV also ranks well on these same metrics. Specifically, it trades at only 12.68x forward earnings and 8.16x trailing cash flow, which is about the same as GVLU. Its return on total capital figure of 11.77% is 1.59% better, and its sector-adjusted 8.53/10 profit score is also higher. Drawbacks are greater volatility and slightly less estimated one-year sales and earnings growth, but I believe GVLU’s managers would also be impressed with this portfolio.

Investment Recommendation

I appreciate value managers who consider quality. Too often, managers pick stocks trading at favorable valuations without recognizing that they trade cheaply for good reasons. Greenblatt and Goldstein ensure poor quality isn’t one of those reasons by emphasizing metrics like return on capital, and it’s what sets GVLU apart from funds like FOVL and VFVA. However, I found WTV also has strong value and quality features, and since its 0.12% expense ratio and performance track record are superior, I’m more confident it’s the better pick. Therefore, I have assigned GVLU a “hold” rating, and I look forward to answering your questions in the comments below. Thank you for reading.

Read the full article here