This Analysis Assigns a Hold rating for Gatos Silver, Inc.

This analysis assigns a “Hold” rating to shares of Gatos Silver, Inc. (NYSE:GATO) (TSX:GATO:CA), reflecting a downgrade from the “Buy” rating in the previous analysis.

The earlier rating was supported by expectations that investors would flock to silver to ward off the damaging effects of the projected recession resulting from the impact of the Federal Reserve’s restrictive interest rate policy on consumption and private investment.

The rating was thus supported by the idea that the precious metal would have experienced its safe haven properties, and the expectation was indeed confirmed thereafter, albeit triggered by uncertainty and risks different from a recession, amid a global scenario that today is full of potential headwinds.

Most Relevant Upsides for the Stock Price Last Year: The Same Dynamics May Play Out in 2024

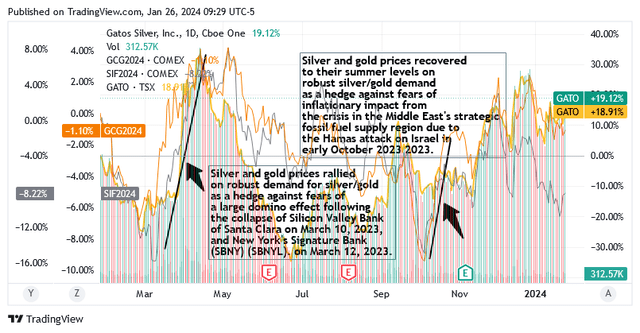

The precious metal was sought as a means to combat headwinds arising from fears of worsening financial problems in the US regional banking system and an escalation of the crisis in the Gaza Strip.

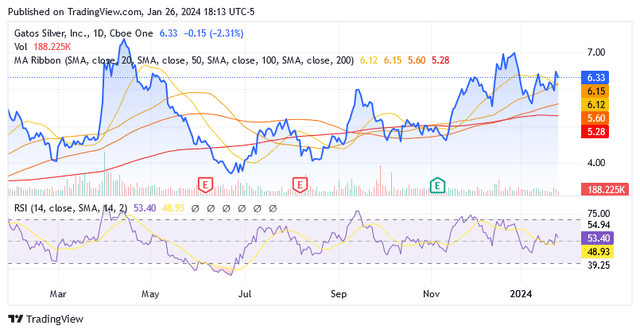

The chart illustrates the two periods in mid-March 2023 and early October 2023, when their problems were associated with a rally and a fast recovery in the price of the precious metal, respectively. Although silver is not the ‘safe haven par excellence’, gold is seen as such, which is why silver is also called ‘poor man’s gold’, the graph shows that the effect on price upside of a greater need for safe havens was for silver no worse than the yellow the metal. Since Gatos Silver is primarily a silver producer and explorer, the stock price followed suit and benefited significantly, gaining nearly 35% from the previous article.

Source: Seeking Alpha

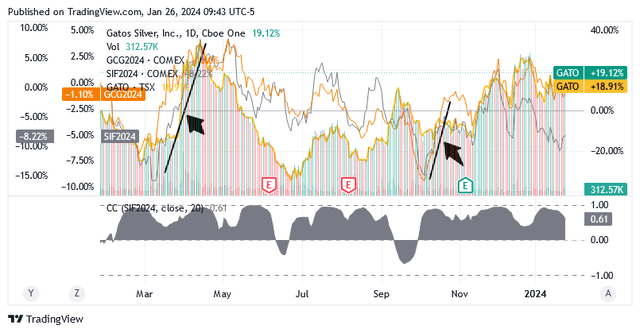

Shares of Gatos Silver, Inc. have benefited like crazy from the silver price resurgence amid the mentioned headwinds, thanks to a significant positive correlation between the two securities, shown in the gray area at the bottom of the chart below. Silver prices are represented by silver futures (SIF2024), and the gray area (the correlation between the two securities) was almost always well above zero in the past 12 months.

Source: Seeking Alpha

The chart above shows that when Gatos Silver stocks are influenced by bullish sentiment (bearish), silver prices are likely to be influenced by the same positive sentiment (negative sentiment) as well, regardless of returns, which can even vary widely between securities.

The Traction for Gato’s Silver Business is also in the Long-Term Outlook for Silver Demand

The Buy rating was also supported by the geolocation of Gatos Silver’s metals activities and their characteristics, which continue to bode well for the rosy outlook for silver demand in the energy transition to low-carbon emissions sources and electrification of transportation.

S&P Global reported that Nornickel, a major Russian nickel and palladium mining and smelting company, predicts massive consumption of battery and electric vehicle technologies over the next decade, as well as an increase in charging infrastructure and electricity generation from renewable sources. Both the US administration of the world’s first economy and the endorsement of the Cop28 Global Stocktake at the United Nations Climate Change Conference in Dubai have recently given a huge boost to Nornickel’s rosy expectations: The US plan calls for electric vehicles to account for more than one in two US sales by the end of 2030 and for the country’s infrastructure to be improved with 500,000 additional electric vehicle chargers. The Cop28 Global Stocktake aims to triple the share of renewable energy and double energy efficiency by 2030. One of the renewable energy sources to be exploited the most is solar energy, and silver is used massively, especially in solar panel technology. China, the world’s second largest economy, is poised to give an important stimuli to the demand for silver by introducing solar panels which leverage the photovoltaic principle. The Asian country appears to be leading the way as the International Energy Agency (IEA) indicates that China has tripled the capacity of its solar panel infrastructure in just two years.

China is currently struggling with recovery, but 2024 is seen as a watershed year for the Dragon economy by strategic analysts at UBS Group AG (UBS). If the stock market is a trailblazer in China too, as Wall Street, for example, believes is the case for U.S. listed stocks, the Asian country will once again become a global growth engine as analysts predict Chinese stocks will come back very well from their current lows this year.

UBS Securities China expects the market to take into account the entry into force of existing government stimulus measures, which will bolster nominal gross domestic product and therefore have a positive impact on demand for silver, as China is a major consumer of the precious metal in the world (second only to the United States for industrial purposes).

Since India and Japan are among the largest consumers of the precious metal, strongly they also support the global outlook for silver demand in industrial projects. India is the most populous country in the world and, as a consumption-based economy, is positioning itself as a viable alternative to China in the de-risking strategies of major North American and European multinationals. To pursue a less stringent foreign policy than the original US plan to decouple from the Chinese economy, but still proceed cautiously, Western multinationals will adopt European Commission President Ursula von der Leyen’s “neologism” of de-risking (that is, “to reduce critical dependencies on “systemic rivals” such as China”). So, India became in a flash the fastest growing major nations with a stable political structure and is the main destination for capital from global investors and companies. Driven by robust corporate earnings, the stock market has doubled in capitalization over the past four years, rewarding rising demand from retail investors.

In Japan, the economy should benefit from the Bank of Japan’s decision to maintain the ultra-expansionary monetary policy unchanged, as the desired wage increase and the achievement of the stable inflation target of 2% have not yet been achieved. The decision generates a positive impact on exports, which are at an all-time high, by weakening the Japanese yen against the US dollar and the euro.

With industrial demand accounting for more than 50% of total silver consumption, a 46% growth in 2033 for applications in the electronics and solar industry, as predicted by Oxford Economics, will result in a stronger global silver demand and good price conditions.

Los Gatos Joint Venture’s Operations: How These are Running

The operational improvements that Gatos Silver continues to report at its primary silver production site in Mexico align well with the positive picture of silver demand and prices just outlined.

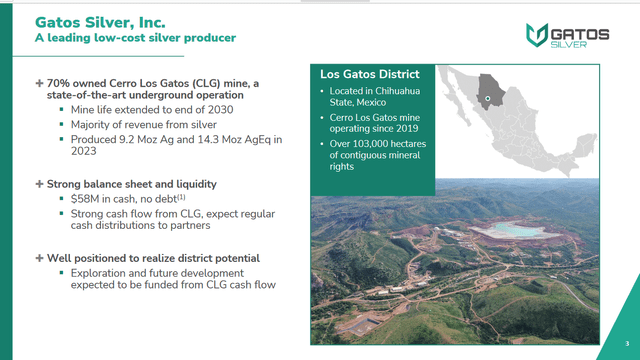

Gatos Silver is based in Vancouver, Canada, and owns 70% of the Los Gatos Joint Venture (LGJV), which produces (primarily) silver, but also lead, zinc, and gold from the operation of an underground deposit located approximately 110 km southwest of Delicias in Chihuahua, Mexico. This is the Cerro Los Gatos mine, but LGJV is also involved in expansion and development activities in the Los Gatos district, supported by the opportunity to own approximately 103,000 hectares of mineral rights in an area that has quite a potential as it is rich in silver and other metals and mineral deposits, although largely unexplored. The remaining 30% of the joint venture belongs to the private company DOWA Metals & Mining America, which operates in the precious metals recycling industry.

Source: Gatos Silver, Inc., Corporate Presentation

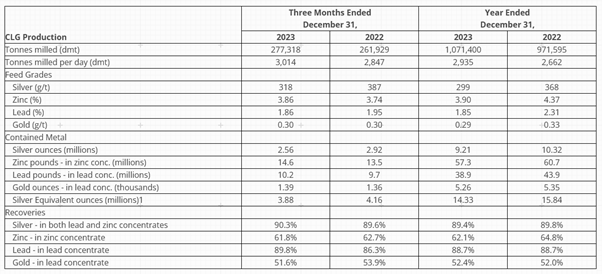

As seen in the previous article, thanks to an improvement in ore tonnage, the mill reached 794,082 tonnes (or a rise of 12% on an annual basis to 2,909 tonnes per day) in the first 9 months of 2023.

Thanks to this operational factor: The Cerro Los Gatos mine was able to produce 6.65 million ounces of silver in the last 9 months, as expected, despite the mineral containing a lower concentration of precious metals (293 g/t in first 9 months of 2023 vs. 361 g/t in first 9M 2022).

Production fell noticeably compared to the first 9 months of 2022: about 10.5%. However, the Cerro Los Gatos mine is rising again. Driven by another record mill throughput in the fourth quarter of 2023 (such that the mill plant average exceeded 3,000 tonnes per day in the fourth quarter of 2023), the mine ended 2023 with production of 9.21 million ounces of silver, just below the updated cap of 9.3 million ounces, but has adjusted the production trajectory, which is now on track to be close to 10 million ounces per year.

The company also produced 57.3 million pounds of zinc, 38.9 million pounds of lead and nearly 5,260 ounces of gold. With the exception of gold, secondary production of the other metals was within company forecasts.

Production in silver equivalent ounces (GEOs) for all of 2023 was 14.33 million ounces, not bad considering this was just a whisper away from the upper limit of guidance of 13.8 to 14.6 million ounces, thanks to positive trends in throughput and the recovery which compensated very well for the lower silver grades.

Source: Gatos Silver, Inc. / Company Report: Q4 2023 and Full Year 2023 Production Results at the Company’s 70% owned Cerro Los Gatos mine in Mexico

Going forward, the lower costs and higher mine productivity rates in throughput and recovery resulting from continuous improvement of processes await to be coupled with the mill processing capacity of 3,500 tonnes of mineral per day in the first half of 2024 through an expanded milling circuit that allows for better utilization of capacity in the existing floating circuit.

Gato’s Silver Business Plans Fit well into the Positive Picture of Silver Demand and Robust Prices

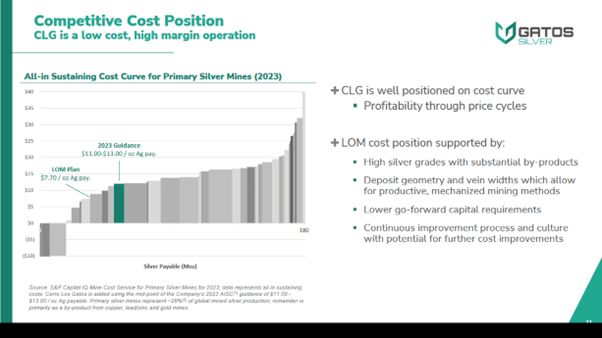

Gatos Silver aims to pursue the goal of low-cost silver production in the mining industry, including the future capital requirements to extend the life of operations from 2030 to 2035, and seeks to do this through better operating rates, even at the expense of lower production as mining progresses towards the end of the mine’s life in 2030.

(Source: Gatos Silver, Inc., Company Presentation)

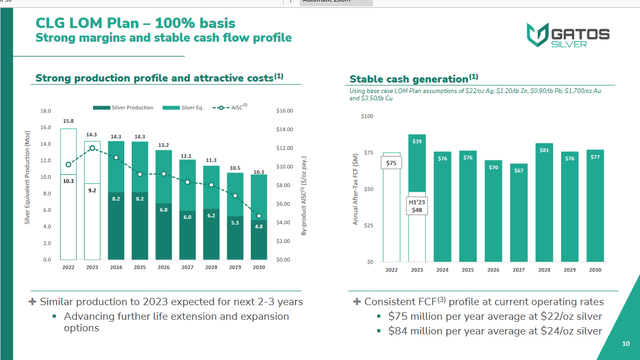

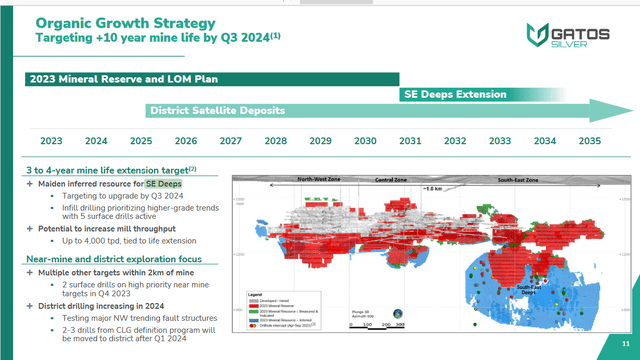

Owning Gatos Silver shares today essentially means 1) financials with $57.7 million in cash and cash equivalents and no debt, 2) next 7-year mine plan with high probability of silver production with a strong cash operating margin supporting regular free cash flow distribution, 3) the possibility of extending the life of the mine by 3 to 4 years through resource exploration in the deep south-east, and 4) investigating the possible existence of district satellite deposits.

Source: Gatos Silver, Inc., Corporate Presentation

Drilling and exploration programs covering intervals of high-grade mineralization in the South-East Deeps zone at Gatos Silver, Inc.’s 70%-owned Cerro Los Gatos mine appear to be producing encouraging results and are consistent with the goal of expanding production until 2035, with a possible increase in the mill’s throughput of up to 4,000 tonnes per day. An updated estimate of mineral reserves and mineral resources is expected in the third quarter of 2024.

Source: Gatos Silver, Inc., Corporate Presentation

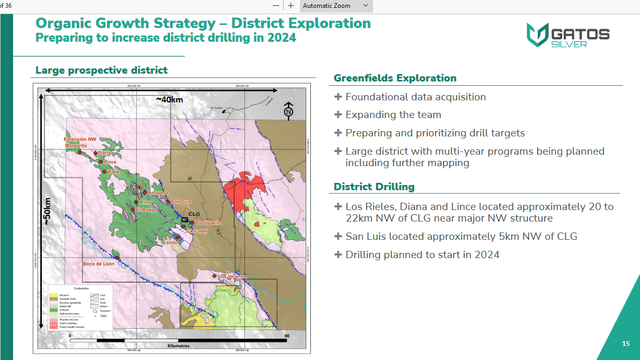

With regard to the possible existence of regional satellite deposits, the exploration team is mapping the Esperanza, Cieneguita and San Agustin areas but has found that the Portigueño area is more complex than previously thought, while Cascabel is an interesting, mineralized prospect and the San Luis area is an area for greenfield exploration activities.

Source: Gatos Silver, Inc., Corporate Presentation

The Stock in North American Markets: Shares have Upside Potential Following a More Attractive Valuation

Shares of Gatos Silver, Inc. under the GATO symbol, were trading at $6.33 apiece as of this writing, for a market capitalization of $448.29 million.

Given the above catalysts and the high probability of silver price rallying as a safe haven from the looming recession in 2024, the current stock prices do not really look expensive despite being above the 20-, 50-, 100- and 200-day simple moving averages. Additionally, the 14-day relative strength of 53.40, with still plenty of room before overbought, suggests that the stock price can rise sharply from these levels.

Source: Seeking Alpha

The same considerations apply to shares under the symbol GATO:CA that trade on the Canadian Stock Exchange. They were trading at CA$8.47 apiece as of this writing, for a market capitalization of CA$604 million, and were above the 20-, 50-, 100- and 200-day simple moving averages. Relative 14-day strength of 52.20, which is far from overbought, suggests plenty of room to move higher.

Source: Seeking Alpha

However, for now, this analysis suggests sticking with a “Hold” rating, as the uncertainty surrounding the Federal Reserve’s next interest rate moves will have mixed effects, and the stock will most likely move very little up or down from current levels.

The recent upturn in inflation, combined with the threat of a hiccup in the disinflation process due to tensions in the Red Sea, could not lead to a rate cut until June. But on the contrary, interest rate traders continue to bet on a rate cut at the next Fed meeting in March. Interest rate cuts are good for silver, which does not produce income, while high interest rates that remain unchanged for a long time are not beneficial because they reduce silver’s competitiveness against U.S. bonds.

After this period, this analysis sees the formation of a lower share price for Gatos Silver due to the following scenario. Fed policymakers believe that interest rates may not move as fast or as much as expected by the broader market, which essentially assumes the Fed wants to surprise with better policy than it is currently signaling because the goal is to please the market. If this is the case, U.S.-listed stocks could be hurt not a little from disillusionment with the Fed’s decisions, because while policymakers are simply doing their job as usual based on economic data and trends, markets are instead getting a complete one misconception of how things work. This scenario poses a risk that investors should not neglect.

Based on a 24-month market beta of 1.50 (scroll down to the “Risk” section on this Seeking Alpha page), GATO shares will feel the effects of the above disillusionment scenario and this will be the opportunity of a more attractive entry point into the stock in order to take advantage of the long term growth catalysts and the probable silver price bull market in 2024.

Bull Market for Silver Price in 2024

Silver is poised to experience a bull market this year as investors seek safe havens in response to the economic recession triggered by the Fed’s aggressively tight interest rate policies to curb elevated inflation.

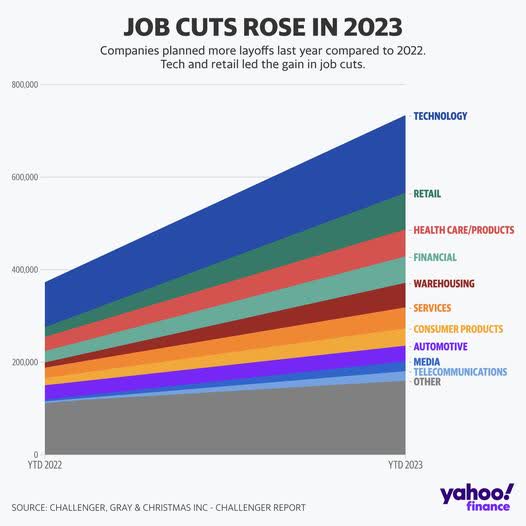

The US economic cycle will turn negative as the slowdown in consumption continues (see chart of retailers leading the way in announcing layoffs in 2023) and credit to the US private sector stagnates (further below is the chart).

If retailers are shedding jobs so rudely along with tech stocks, that means consumption is slowing down. Why else would retailers do this if not to protect their profit margins, since labor costs are a crucial part of the total cost of operations?

Source: Challenger, Gray & Christmas Inc – Challenger Report reported by Yahoo Finance

Along with the above trend, the US labor force is now showing signs of deterioration, with a significant decline in new jobs created from 4.8 million in 2022 to 2.7 million in 2023.

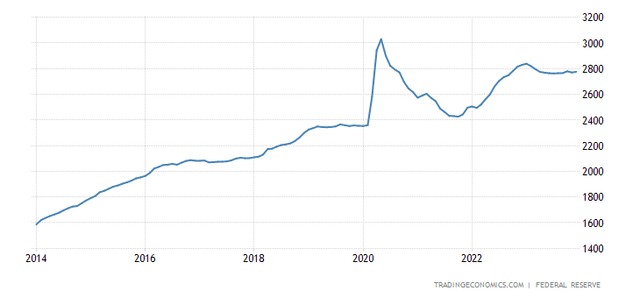

Businesses always need financing. To grow, the economy always needs external capital, otherwise the private sector lending curve would not show a very positive underlying trend over time until mid-2022, except during the COVID-19 virus pandemic. But when interest rates rise and companies are unable to sustain high financing costs, they are forced to cut spending. The figure below shows that lending to the private sector has been stagnant since 2023, meaning that the negative impact on economic cycle remains to be seen.

Source: Trading Economics

Duke professor and Canadian economist Campbell Harvey’s inverted yield curve for the spread between 10-year and 3-month U.S. Treasury bonds (current 10-year rate of 4.139% vs. 3-month rate of 5.367%) is a reliable indicator of an economic recession: In fact, each of the eight economic recessions of the last six decades were correctly predicted. Normally, the shorter the term, the lower the risk of the borrower becoming insolvent, and the return can therefore only be lower than on loans with a longer term. When relationships change, the short-term future is seen as riskier and highly uncertain than in calm times.

Conclusion

Gatos Silver stock is well positioned to benefit from the projected rise in silver prices and bright prospects for the silver demand, as the company’s 70% stake in the Mexican mining and exploration joint venture provides cash payouts on continued silver production, limited costs and will extend mine’s life.

Should silver experience a bull market due to fears of a looming economic recession, shares of Gatos Silver will rise too, according to a dynamic that has already worked this way several times in 2023, amid robust demand for safe haven assets. However, sideways patterns ahead of a lower entry point are on track to emerge first, so retail investors may want to stick with the “Hold” rating for now.

Read the full article here