Dear Fellow Investor,

This is the fifteenth annual letter to owners of the Fundsmith Equity Fund (‘Fund’).

The table below shows performance figures for the last calendar year and the cumulative and annualised performance since inception on 1st November 2010 and various comparators.

|

% Total Return |

1st Jan to 31st Dec 2024 |

Inception to 31st Dec 2024 |

Sortino Ratio 6 |

|

|

Cumulative |

Annualised |

|||

|

Fundsmith Equity Fund 1 |

+8.9 |

+607.3 |

+14.8 |

0.87 |

|

Equities 2 |

+20.8 |

+403.4 |

+12.1 |

0.60 |

|

IA Global Sector 3 |

+12.6 |

+254.0 |

+9.3 |

0.42 |

|

UK Bonds 4 |

-2.3 |

+23.6 |

+1.5 |

n/a |

|

Cash 5 |

+5.1 |

+18.5 |

+1.2 |

n/a |

|

The Fund is not managed with reference to any benchmark, the above comparators are provided for information purposes only. 1 T Class Accumulation shares, net of fees, priced at noon UK time, source: Bloomberg. 2 MSCI World Index, £ net, priced at US market close, source: Bloomberg. 3 Source: Financial Express Analytics 4 Bloomberg Series-E UK Govt 5-10 yr Bond Index, source: Bloomberg. 5 £ Interest Rate, source: Bloomberg. 6 Sortino Ratio is since inception to 31.12.24, 3.5% risk free rate, source: Financial Express Analytics. |

The table shows the performance of the T Class Accumulation shares, the most commonly held share class and one in which I am invested, which rose by 8.9% in 2024.

This compares with a rise of 20.8% for the MSCI World Index (‘Index’) in sterling with dividends reinvested. The Fund therefore underperformed this comparator in 2024 but a longer-term perspective may be useful and is certainly more consistent with our investment aims and strategy. Since inception, the Fund has returned 2.7% p.a. more than the Index and has done so with significantly less downside price volatility as shown by the Sortino Fundsmith LLP is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales: OC354233. Registered office: 33 Cavendish Square, London, W1G 0PW.

Ratio of 0.87 versus 0.60 for the Index. This simply means that the Fund has returned about 45%, ((0.87÷0.60)-1)x100, more than the Index for each unit of price volatility, of which more later.

Our Fund is the second-best performer since its inception in November 2010 in the Investment Association Global sector of 162 funds, with a return 353 percentage points above the sector average which has delivered just 254% over the same timeframe.

Outperforming the market or even making a positive return is not something you should expect from our Fund in every year or reporting period, and outperforming the market was more than usually challenging once again in 2024. Just five stocks (the ‘Fab Five’?) Nvidia (NVDA), Apple (AAPL), Meta (META), Microsoft (MSFT) and Amazon (AMZN) provided 45% of the returns of the S&P 500 Index (‘S&P 500’) in 2024. This is similar to the concentration of returns provided by the so-called Magnificent Seven in 2023. Moreover, a single stock — Nvidia — produced over 20% of the S&P 500 returns in 2024.

Nor is this concentration of returns in a few technology companies a purely US phenomenon. In Germany 41% of the return from the DAX Index came from a single stock — SAP (SAP), the software company whose share price rose by 69% so that it is now trading on a mere 97x earnings.

Our Fund owns some but not all of these stocks and it was difficult to perform even in line with the Index unless you owned them at least in line with their index weighting. I do not intend to give a narrative of why we do not own all of them, but I will give some more detail on this point later in this letter.

In looking at individual stock contribution to performance I prefer to start with the problems. The bottom five detractors from the Fund’s performance in 2024 were:

Source: State Street

L’Oréal was adversely affected by events in China where the economy is struggling under the weight of a moribund residential property sector and the associated credit problems. However, this does not alter our view that L’Oréal is fundamentally a very good business. This is not the first time that a major economy it operates in has mis-fired and we believe its management can cope.

IDEXX which makes veterinary diagnostic testing equipment and supplies is suffering from a slackening in the pace of vet visits after the scramble to adopt pets during the pandemic. As the industry leader in an area with real long-term growth prospects and a stock where we would probably struggle to buy back our position if we sold it, we intend to continue holding IDEXX and to try to smile through the pain of underperformance.

Nike is a stock we bought after the share price fall during the pandemic when investors seemed convinced there would be many fewer buyers of trainers. In fact, Nike had made great strides in online marketing and fulfilment. What we hadn’t realised was that the then management would parlay this success into a problem by ignoring the traditional bricks & mortar retail channel, which has recovered as the pandemic passed, and in so doing open the door literally to competition. To be fair there have been other issues such as an increasing dependence on fashion and less on traditional exercise uses. However, the good news is that there has been a change of CEO this year. We see many commentators musing about the reasons why the US economy is so successful. Perhaps one reason is a quicker finger on the trigger when top executives do not deliver. In which context we note that Unilever’s shares were up 20% in 2024. We await developments from Nike’s new management who have after all inherited what is still the dominant market share in the sector.

Brown-Forman, one of the world’s top five drinks companies and the distiller of Jack Daniel’s Tennessee Whiskey has suffered from the fall in consumption from the pandemic highs and is probably seeing early signs of the adverse impact of weight loss drugs. We sold our Diageo stake during the year which I will cover later but retaining Brown-Forman keeps a foothold in what has long been a sector with good business characteristics and which has the potential benefits of family control, which can promote good long-term decision-making, and a larger bias towards premium spirits than Diageo which may help obviate the impact of weight loss drugs (‘drink less but better quality’). It is a company which survived Prohibition so we hope there is literally something in the DNA to help with these adverse circumstances.

Novo Nordisk was arguably our most surprising poor performer in 2024. It remains the market leader in weight loss drugs, which it pioneered, and the year was marked by a stream of news about other conditions which these drugs treat effectively and label expansion applications which drug regulators seem willing to approve. Yet not only did the share price fall 10% but it finished the year on a P/E ratio half that of its nearest competitor Eli Lilly.

In investment it is always better to travel hopefully than to arrive and there is certainly an arms race going on amongst drug companies to develop competitor drugs. Yet we are still dealing with a company in Novo which is the market leader and holds production and labelling advantages which should sustain that position, with revenues that are growing at 20% p.a. Moreover, we originally bought Novo because of its radical approach to drug discovery and would not rule out further developments.

For the year, the top five contributors to the Fund’s performance were:

|

Stock |

Attribution |

|

Meta Platforms |

+4.1% |

|

Microsoft |

+1.6% |

|

Philip Morris (PM) |

+1.5% |

|

Automatic Data Processing (ADP) |

+1.3% |

|

Stryker (SYK) |

+1.3% |

Source: State Street

For Meta and Microsoft I am simply going to repeat my comment from last year’s letter albeit with the number of times updated:

‘Meta Platforms’ (formerly Facebook) performance makes me wonder whether I should have a fund which invests solely in the one stock in our portfolio each year for which we have received the most critical comments. Meta makes its fourth appearance in this list of top contributors while Microsoft appears for the ninth time having attracted strident criticism when we started buying at about $25 a share in 2011 (2023 year end price $376).’ 2024 year end price was $422.

Philip Morris makes its 4th appearance as it continues to show the benefits of its industry-leading move into Reduced Risk Products (‘RRPs’) such as heat not burn tobacco products and its acquisition of Swedish Match with its nicotine pouch business. You can tell when some things are right by the people who oppose them. The governments and dysfunctional health organisations who have set their stance against these RRPs, which are proving to be an invaluable aid in reducing risk to smokers, is yet another indicator that Philip Morris is on the right track.

ADP which makes its 2nd appearance continues its metronomic performance. It rarely shoots the lights out in terms of performance but then neither does it disappoint which makes it a good stock for our strategy.

Stryker, which is making its 5th appearance, is benefitting from work on the backlog of elective surgical procedures which built up during the pandemic.

Given the number of repeat appearances in our top five contributors I am tempted to repeat one of our mantras which is that ‘You make money with old friends’. However, three of those old friends which have been repeat contributors were detractors this year, namely L’Oréal, IDEXX and Novo Nordisk. However, if anything I would regard this as a blip in their long-term record and we intend to (mostly) patiently await a return to form. In our view they are simply too good to sell and risk being uninvested when the tide turns.

We continue to apply a simple three-step investment strategy:

Buy good companies Don’t overpay Do nothing

I will review how we are doing against each of those in turn.

As usual we seek to give some insight into the first and most important of these — whether we own good companies — by giving you the following table which shows what Fundsmith Equity Fund would be like if instead of being a fund it was a company and accounted for the stakes which it owns in the portfolio on a ‘look-through’ basis, and compares this with the market, in this case the FTSE 100 and the S&P 500. This also shows you how the portfolio has evolved over time.

|

Year ended |

Fundsmith Equity Fund Portfolio |

S&P 500 |

FTSE 100 |

|||||||

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2024 |

2024 |

|

|

ROCE |

28% |

29% |

29% |

25% |

28% |

32% |

32% |

32% |

16% |

17% |

|

Gross Margin |

63% |

65% |

66% |

65% |

64% |

64% |

63% |

64% |

45% |

42% |

|

Operating Margin |

26% |

28% |

27% |

23% |

26% |

28% |

29% |

30% |

16% |

15% |

|

Cash Conversion |

102% |

95% |

97% |

101% |

95% |

88% |

91% |

85% |

85% |

90% |

|

Interest Cover |

17x |

17x |

16x |

16x |

23x |

20x |

20x |

27x |

9x |

9x |

Source: Fundsmith LLP/Bloomberg.

ROCE (Return on Capital Employed), Gross Margin, Operating Margin and Cash Conversion are the weighted mean of the underlying companies invested in by the Fundsmith Equity Fund and mean for the FTSE 100 and S&P 500 Indices. The FTSE 100 and S&P 500 numbers exclude financial stocks. Interest Cover is median.

2017–2019 ratios are based on last reported fiscal year accounts as of 31st December and for 2020–24 are Trailing Twelve Months and as defined by Bloomberg.

Cash Conversion compares Free Cash Flow per Share with Net Income per Share.

In 2024 operating profit margins were higher in the portfolio companies than in the past. Gross margins and return on capital were steady. Importantly all of these metrics remain significantly better than the companies in the main indices (which include our companies). Moreover, if you own shares in companies during a period of inflation it is better to own those with high returns and gross margins.

Consistently high returns on capital are one sign we look for when seeking companies to invest in. Another is a source of growth — high returns are not much use if the business is not able to grow and deploy more capital at these high rates. So how did our companies fare in that respect in 2024? The weighted average free cash flow (the cash the companies generate after paying for everything except the dividend, and our preferred measure) grew by 14% in 2024.

The only metric which continues to lag its historical performance is cash conversion — the degree to which profits are delivered in cash. Although this recovered slightly to 91% in 2023, this is still below its historical level of around 100% and it declined again in 2024 to 85%. This was due to a sharp rise in capital expenditure at a small group of companies: Alphabet, Microsoft, Meta and Novo Nordisk. Novo is racing to build production capacity to supply enough of its weight loss drug Wegovy and finished the year spending €10 billion purchasing three manufacturing sites. The tech companies are in a race to build capacity of Artificial Intelligence (‘AI’) in the form of GPU chips and data centres. Whether this arms race produces adequate profits and returns for the amounts expended remains an open question to which I will return later. At least Novo is building capacity to produce a drug for which there is established demand and profitability and in which it currently has a competitive advantage.

The average year of foundation of our portfolio companies at the year-end was 1920. Collectively they are over a century old.

The second leg of our strategy is about valuation. The weighted average free cash flow (‘FCF’) yield (the free cash flow generated as a percentage of the market value) of the portfolio at the outset of 2024 was 3.0% and ended the year at 3.1%. The year-end median FCF yield on the S&P 500 was 3.7%.

Our portfolio consists of companies that are fundamentally a lot better than the average of those in the S&P 500, so it is no surprise that they are valued more highly than the average S&P 500 company. In itself this does not necessarily make the stocks expensive, any more than a lowly rating makes a stock cheap. However, we expect some of this disparity in valuation to be eradicated in 2025 if, as we expect, the cash conversion of our portfolio companies improves.

Turning to the third leg of our strategy, which we succinctly describe as ‘Do nothing’, minimising portfolio turnover remains one of our objectives and this was again achieved with a portfolio turnover of 3.2% during the period. It is perhaps more helpful to know that we spent a total of just 0.002% (one fifth of a basis point) of the Fund’s average value over the year on voluntary dealing (which excludes dealing costs associated with subscriptions and redemptions as these are involuntary). We sold three companies and purchased two. As last year this may seem like a lot of names for what is not a lot of turnover as in some cases the size of the holding sold or bought was small. We have held four of the portfolio companies since inception in 2010, nine for more than ten years and 15 for over five years.

Why is this important? It helps to minimise costs and minimising the costs of investment is a vital contribution to achieving a satisfactory outcome as an investor. Too often investors, commentators and advisers focus on, or in some cases obsess about, the Annual Management Charge (‘AMC’) or the Ongoing Charges Figure (‘OCF’), which includes some costs over and above the AMC, which are charged to the Fund. The OCF for 2024 for the T Class Accumulation shares was 1.04%. The trouble is that the OCF does not include an important element of costs — the costs of dealing. When a fund manager deals by buying or selling, the fund typically incurs the cost of commission paid to a broker, the bid-offer spread on the stocks dealt in and, in some cases, transaction taxes such as stamp duty in the UK. This can add significantly to the costs of a fund, yet it is not included in the OCF.

We provide our own version of this total cost including dealing costs, which we have termed the Total Cost of Investment (‘TCI’). For the T Class Accumulation shares in 2024 the TCI was 1.05%, including all costs of dealing for flows into and out of the Fund, not just our voluntary dealing. We are pleased that our TCI is just 0.01% (1 basis point) above our OCF when transaction costs are taken into account. However, we would again caution against becoming obsessed with charges to such an extent that you lose focus on the performance of funds. It is worth pointing out that the performance of our Fund tabled at the beginning of this letter is after charging all fees which should surely be the main focus.

We sold our stakes in Diageo (DEO)(OTCPK:DGEAF), McCormick (MKC) and Apple during the year.

Diageo, which we had owned since inception, has exhibited problems with its new management, shown by a lack of information about its Latin American business which produced results far worse than the sector in this area. Moreover, we suspect the entire drinks sector is in the early stages of being impacted negatively by weight loss drugs. Indeed, it seems likely that the drugs will eventually be used to treat alcoholism such is their effect on consumption.

We sold McCormick as we had been disappointed by the slow response which the company exhibited in its ability to pass on input cost inflation so compressing its margins, together with its exposure to own label competition which has stiffened as inflation has caused consumers to trade down.

We began purchasing Apple two years ago at about $156 a share when its P/E was below the S&P 500 average and the growth in service revenues had somewhat convinced us that the much talked about ecosystem, tying its users to the products, might really exist. We correctly foresaw a number of reporting periods ahead when sales growth would be lacklustre and so bought a small stake hoping to add to it as the poor sales performance came to pass. We were right about the sales performance — its sales grew just 2% last year but wrong about the share price which rose strongly, placing the shares on a rating about 50% higher than the S&P 500. We were not going to buy more stock against that background and it was occupying a place in our portfolio and so we sold our stake.

We started purchasing stakes in Atlas Copco (OTCPK:ATLKF) and Texas Instruments (TXN) during the year.

Atlas Copco is a Swedish industrial company which makes compressors, vacuum equipment, electrical and pneumatic tools and which has three characteristics which we find attractive:

- it outsources much of the manufacturing so making it capital light which enhances returns;

- it is highly decentralised with over 600 operating entities which have considerable autonomy in addressing their local market; and

- there is a controlling stake held by the Wallenberg family vehicle which should lead to good long-term decision-making since they have been in business for 151 years this year.

Texas Instruments is a manufacturer of analogue and embedded microprocessors which go into a wide range of consumer and industrial devices, automobiles, and communications equipment. It is investing ahead of a probable upturn in the semiconductor cycle although it is now apparent that there is not one cycle. Demand for GPUs of the sort made by Nvidia far from being in a down cycle has been on a lunar trajectory, and there are clear differences between the cycle for regular automotive chips and chips for electric vehicles or chips for other appliances, as well as between regions. However, Texas Instruments has a long history of investing well ahead of upswings in demand and producing handsome returns from it. It is also a beneficiary of the onshoring of semiconductor manufacturing to avoid the geopolitical risks of Taiwan and China.

Last year I spent some time in this letter discussing the rise of interest in AI, as one of the driving forces behind the rise of most of the Magnificent Seven stocks and especially Nvidia. This boom/hype (you choose) continued in 2024, but some of its characteristics changed. One is that it may have become more focused. It had been seen as a driver of share prices of companies which we had previously held such as Adobe (ADBE) and Intuit (INTU), both of which had blotted their copybook with us by engaging in over-priced and seemingly ill-conceived acquisitions or attempted acquisitions. Both of them significantly underperformed the market in 2024 as reality seemed to dawn on investors that AI may not be of immediate and/or universal benefit and could actually be detrimental. Conversely, this has had the effect of focusing investors’ attention on fewer real immediate beneficiaries of the AI boom such as Nvidia.

During this period commentators have frequently asked whether the AI boom is the same as the Dotcom era and therefore will have a similar ending. In response I am tempted to quote Mark Twain, ‘History doesn’t repeat itself, but it rhymes.’ Undoubtedly some of the AI enthusiasm is hype, as was the Dotcom mania, but there are a couple of key differences:

The leading company in the AI boom, Nvidia, is very profitable, albeit with a history of some downturns, whereas in the Dotcom boom a lot of the share price performance was driven by reference to clicks and eyeballs in the absence of any profits or even revenues. Even companies which were to rise Phoenix-like from the ashes after the Dotcom meltdown, such as Amazon, were not yet profitable; and the rise of so-called passive or index funds.

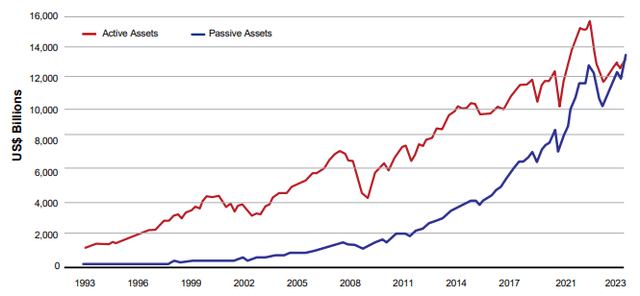

The Rise of Index Funds

Source: Morningstar

In late 2023 passive investment via index funds exceeded the amount of assets held in active funds for the first time. They are now more than half of Assets Under Management (‘AUM’). However, during the Dotcom boom only about 10% of AUM was in passive funds. As ever we do not always aid understanding with the labels which we sometimes use in investment. Index funds are not truly a passive strategy. There may be no fund manager taking investment decisions, but such index investing is in fact a momentum strategy.

The vast majority of index funds are market capitalisation weighted, like the indices on which they are based. The size of holdings in companies in the index fund is based upon their market value compared with the market value of the index. So when there are inflows to index funds the largest portion goes to the largest companies, and vice versa when there are outflows.

The result is that as money flows out of active funds and into index funds, as it has been doing, it drives the performance of the largest companies which are companies whose shares have already performed well which is how they came to be the largest companies by market value.

This is a self-reinforcing feedback loop which will operate until it doesn’t. For example, were there to be an economic downturn which led to a reduction in tech spending, which is now so large a proportion of overall spending that it cannot be non-cyclical, one area of vulnerability might be spending on AI as it is not currently generating much revenue. They were the largest companies then to produce disappointing results, their share prices are likely to react badly which will drag down the index performance more than that of those active managers who are underweight in these stocks. But even if some scenario like this awaits us in the future, what exactly will cause this and when it may occur is difficult or impossible to predict.

Which brings me back to the subject of volatility which was raised at the start of this letter. We don’t agree that true volatility is measured by ratios such as the Sharpe or Sortino ratio which look at the volatility of fund prices or share prices, but they are widely accepted as a measure. Moreover, whilst investors should rationally focus on volatility in the fundamental value of the businesses they invest in and accept higher price volatility if this leads to higher returns, it is easier said than done. One problem is that it is difficult to remain calm and focus on the fundamental characteristics when the price volatility is sharply negative. Take a stock like Nvidia, which has been a spectacular performer for the past two years. The Nvidia share price fell by over two thirds as recently as 2021–2022. Would we or you feel comfortable owning it in such circumstances, and if not, might that share price performance cause us to make poor decisions? We have experience owning this sort of stock, as the performance of Meta demonstrates, but given how difficult they can be to own maybe one is enough for our portfolio at any one time. In 2021–2022 Meta’s stock price fell by 76%, but whilst we continued to own it despite this, to our current benefit, there are several key differences between the situation of Meta then and Nvidia now:

Meta serves some 3.3 billion consumers and several million advertisers. Nvidia’s demand is dominated by a literal handful of so-called hyperscalers building data centres to handle Large Language Models for AI.

People sometimes ask us whether it is dangerous to own consumer stocks in an economic downturn. To which we reply yes, but it is not as dangerous as not being close to the consumer in those circumstances. If you think the performance of consumer companies is a worry in a downturn wait until you see what happens to their suppliers, especially the suppliers of capital equipment like factory machinery. A 5-10% downturn in sales revenues at the consumer companies can translate into a cessation of orders for some suppliers. Nvidia supplies capital goods — its latest generation GPU server sells for about $3m each — and a significant downturn in demand from its clients who do service consumers would be interesting to watch from a safe distance. Before its share price fall Meta was on a P/E of 28x whereas Nvidia is currently on a P/E of 54x.

All of which brings me to a reminder of what we are seeking to achieve with the Fundsmith Equity Fund and that is to produce a high likelihood of a satisfactory return rather than the chance of a spectacular return which could be spectacularly good or spectacularly bad.

Finally, once more I wish you a happy New Year and thank you for your continued support for our Fund.

Yours sincerely,

Terry Smith, CEO, Fundsmith LLP

|

Disclaimer: A Key Investor Information Document and an English language prospectus for the Fundsmith Equity Fund are available via the Fundsmith website or on request and investors should consult these documents before purchasing shares in the fund. Past performance is not necessarily a guide to future performance. The value of investments and the income from them may fall as well as rise and be affected by changes in exchange rates, and you may not get back the amount of your original investment. Fundsmith LLP does not offer investment advice or make any recommendations regarding the suitability of its products. This document is a financial promotion and is communicated by Fundsmith LLP which is authorised and regulated by the Financial Conduct Authority. The views and opinions expressed herein are those of Fundsmith as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented. Sources: Fundsmith LLP, Bloomberg and FE Analytics unless otherwise stated. Data is as at 31st December 2024 unless otherwise stated. Portfolio turnover is a measure of the fund’s trading activity and has been calculated by taking the total share purchases and sales less total creations and liquidations divided by the average net asset value of the fund. P/E ratios and Free Cash Flow Yields are based on trailing twelve-month data and as at 31st December 2024 unless otherwise stated. Percentage change is not calculated if the TTM period contains a net loss. The MSCI World Index is a developed world index of global equities across all sectors and, as such, is a fair comparison given the fund’s investment objective and policy. The Investment Association Global Sector in Sterling is representative of funds that invest at least 80% of their assets globally in equities. This facilitates a comparison against funds with broadly similar characteristics. The Bloomberg Bond Indices UK Govt 5-10 yr shows what you might have earnt if you had invested in UK Government Debt. The £ Interest Rate shows what you might have earnt if you had invested in cash. MSCI World Index is the exclusive property of MSCI Inc. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or final products. This report is not approved, reviewed or produced by MSCI. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s and ‘GICS®’ is a service mark of MSCI and Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here