Investment Approach

- Fidelity® Select Consumer Staples Portfolio is a sector-based, equity-focused strategy that seeks to outperform its benchmark through active management.

- Our core philosophy is that stock prices follow earnings and returns over the long term. We look for durable franchises capable of compounding value and delivering above-average earnings growth over time.

- Investment opportunities arise when there is a differentiated view with regard to the long-term earnings power of a company. We focus on stocks where the market underestimates the magnitude or duration of growth and the valuation is attractive.

- Fundamental research is key to our approach, as we build the portfolio stock by stock and take a multiyear investment perspective to get a differentiated view on long-term performance drivers. We also look to capitalize on short-term market opportunities, with the goal of optimizing risk-adjusted returns for shareholders.

- Sector strategies could be used by investors as alternatives to individual stocks for either tactical- or strategic-allocation purposes.

|

PERFORMANCE SUMMARY |

Cumulative |

Annualized |

||||

|

3 Month |

YTD |

1 Year |

3 Year |

5 Year |

10 Year/LOF1 |

|

|

Select Consumer Staples Portfolio Gross Expense Ratio: 0.69%2 |

9.82% |

12.60% |

17.95% |

8.27% |

9.23% |

7.43% |

|

S&P 500 Index |

5.89% |

22.08% |

36.35% |

11.91% |

15.98% |

13.38% |

|

MSCI US IMI Consumer Staples 25/50 |

8.19% |

16.45% |

22.99% |

9.61% |

9.70% |

9.36% |

|

Morningstar Fund Consumer Defensive |

7.86% |

11.21% |

18.14% |

6.76% |

8.50% |

8.25% |

|

% Rank in Morningstar Category (1% = Best) |

— |

— |

43% |

34% |

28% |

66% |

|

# of Funds in Morningstar Category |

— |

— |

26 |

25 |

25 |

20 |

|

1 Life of Fund (LOF) if performance is less than 10 years. Fund inception date: 07/29/1985. 2 This expense ratio is from the most recent prospectus and generally is based on amounts incurred during the most recent fiscal year, or estimated amounts for the current fiscal year in the case of a newly launched fund. It does not include any fee waivers or reimbursements, which would be reflected in the fund’s net expense ratio. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance stated. Performance shown is that of the fund’s Retail Class shares (if multiclass). You may own another share class of the fund with a different expense structure and, thus, have different returns. To learn more or to obtain the most recent month-end or other share-class performance, visit Fidelity Funds | Mutual Funds from Fidelity Investments, Financial Professionals | Fidelity Institutional, or Fidelity Net Benefits | Employee Benefits. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative total returns are reported as of the period indicated. For definitions and other important information, please see the Definitions and Important Information section of this Fund Review. |

| Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The consumer staples industries can be significantly affected by demographic and product trends, competitive pricing, food fads, marketing campaigns, environmental factors, and government regulation, the performance of overall economy, interest rates, and consumer confidence. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. The fund may have additional volatility because of its narrow concentration in a specific industry. Non- diversified funds that focus on a relatively small number of stocks tend to be more volatile than diversified funds and the market as a whole. |

Market Review

For the three months ending September 30, 2024, the consumer staples sector, as measured by the MSCI U.S. IMI Consumer Staples 25/50 Index, advanced 8.19%, while the broad-based S&P 500® index finished with a 5.89% gain. In July, the stock market rally pivoted away from technology stocks and into cyclical and interest- rate-sensitive shares, which benefited the staples sector.

During Q3, there was a growing consensus that the Federal Reserve would cut rates at its September meeting, which it did. Lower rates were expected to spur economic growth and help staples companies, especially as the sector has benefited from price increases implemented in recent years and resilient consumer spending. By sector, leadership notably shifted amid a cooling in shares of companies that have been fanned by fervor for generative AI heralding transformative change. But AI’s influence was reflected in the roughly 19% advance for the utilities sector, which is sensitive to interest rates and benefited from its key role in providing the electricity needed to power massive data centers used for AI.

Overall, staples finished with the sixth-best return among the 11 S&P 500® sectors. Information technology, which had been the market’s top-performing sector in the first six months of 2024, settled for 10th place during Q3, outpacing only energy, while utilities topped the market sectors for the period as the sector benefited from the potential energy-use required by AI.

Among the biggest segments in the consumer staples index, consumer staples merchandise retail – which accounted for about 26% of the index in Q3 – gained 7%. The top performer here was discount retailer Walmart (WMT)(+20%) but was held back by Dollar General (DG) (-36%) and Dollar Tree (DLTR) (-34%), as both struggled in Q3 amid slowing sales, weak earnings and heightened competition.

Household products rose 6%, driven by Procter & Gamble (PG) (+6%) and Energizer (ENR) (+9%). The soft drinks & non-alcoholic beverages segment, making up about 17% of the index the past three months, advanced 8%, with Keurig Dr. Pepper (KDP) (+13%) and Coca-Cola (KO) (+14%) standing out. In contrast, personal care products (0%) notably lagged, hampered by e.l.f. Beauty (ELF) (-48%), while agricultural products & services (+2%) also lagged the broader sector.

Performance Review

For the quarter, the fund’s Retail Class shares gained 9.82%, topping the 8.19% advance of the MSCI U.S. IMI Consumer Staples 25/50 Index.

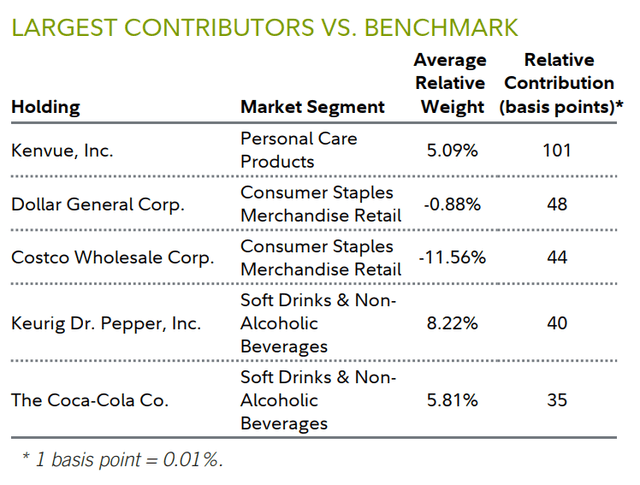

Security selection notably contributed versus the sector index, especially within personal care products and soft drinks & non-alcoholic beverages. From the former, a large overweight stake in Kenvue (KVUE) (+28%), the maker of Listerine® mouthwash and Tylenol® pain reliever, was by far the top individual relative contributor.

Kenvue has been investing heavily to turn around its skin health & beauty segment. We believed we were starting to see early signs of improvement, as shoppers, despite financial pressure, continued to spend on health care items. We reduced the position in Q3 but Kenvue was a top holding and overweight as of September 30.

Steering clear of index component Dollar General (-36%) also helped relative performance, as the stock declined in late August following disappointing quarterly earnings. While the company has successfully catered to a niche market for the past decade, we’ve observed significant changes in the past two years. Rising labor costs and theft issues have pressured its profit margin. Additionally, Walmart’s enhanced e-commerce capabilities have intensified competition.

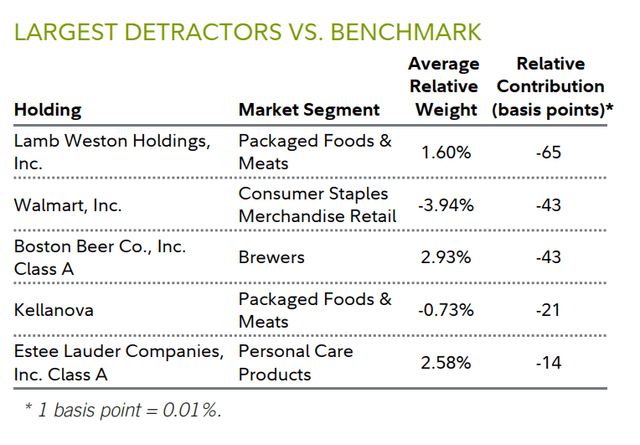

Conversely, security selection in packaged foods & meats, brewers and food retail detracted versus the index, as did an overweight in personal care products. An overweight stake in Lamb Weston Holdings (LW) was the biggest individual detractor. Our shares of the food-processing company, which specializes in frozen potato products, returned roughly -22% in Q3, reflecting a sharp decline following the July 24 release of disappointing quarterly sales and earnings.

An underweight stake in Walmart (+20%), a sizable index component, hurt the fund’s relative result. We believe Walmart’s stock was too expensive to overweight it. Still, it was the No. 4 holding as of September 30.

Outlook and Positioning

As October begins, markets enjoy favorable momentum and easier financial conditions. Falling oil prices and headline inflation bolstered disinflationary trends in Q3, although core inflation in the U.S. remained higher than the Fed’s 2% target.

Consumer spending and economic output expanded steadily this year, but the labor market has shown a pronounced cooling trend, with rising unemployment, fewer job postings and weak consumer sentiment about job conditions. The global business cycle remains in expansion, with a broad shift toward monetary easing and a stable earnings outlook.

Near-term risk for a recession in the U.S. is muted, but a full pivot to a disinflationary midcycle environment is uncertain. Both headline and core inflation meaningfully declined from 2022 highs, but core inflation remained higher than 3% in Q3. Meanwhile, the Fed’s preferred inflation metric registered a lower price gain compared with other measures.

With that said, our outlook is influenced by a consumer environment that is somewhat stressed but not severely so. Consumer balance sheets remain strong, employment is healthy and real wage growth is stable. With the Fed making its first rate cut since March 2020, our view of the sector outlook is positive. Consumer demand hasn’t plummeted, but it’s also not robust enough to easily absorb price increases from suppliers.

The portfolio is therefore aligned with a “return to normal” in fundamentals. Companies that temporarily appeared as growth entities are now reverting to their usual profiles.

With that, we continue to focus on core fundamentals and traditional industry drivers, favoring companies that operate in favorable market structures and maintain a strong underlying growth profile. Key factors we consider include price and volume, with businesses returning to normal growth rates.

We also focus on valuation spreads, which are currently wide, creating opportunities to invest in turnaround stories or undervalued stocks. This strategy involves selling highly valued, obvious winners and investing in undervalued stocks when we have a strong company-specific thesis. We are applying this approach across the portfolio to take advantage of current market conditions.

In the past three months, we made several strategic adjustments to the portfolio. Notably, in the soft drinks category, we increased our stake in Monster Beverage, recognizing the long-standing growth in energy drinks and their widespread acceptance. Monster has been a significant success both domestically and internationally, benefiting from its distribution partnership with Coca-Cola, which holds a stake in the company. Despite recent challenges in convenience store sales, we believe international growth prospects for energy drinks remain robust, and the U.S. market will eventually stabilize. Monster was a sizable holding and overweight as of quarter end.

In household products, we reduced Clorox (CLX) and Procter & Gamble. These decisions were based on the realization of our thesis regarding margin expansion as input costs decreased, leading to substantial margin improvement and stock performance. With the re-rating of valuations, it was an opportune time to reduce our allocation to this group.

|

Before investing in any mutual fund, please carefully consider the investment objectives, risks, charges, and expenses. For this and other information, call or write Fidelity for a free prospectus or, if available, a summary prospectus. Read it carefully before you invest. Past performance is no guarantee of future results.Views expressed are through the end of the period stated and do not necessarily represent the views of Fidelity. Views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund. The securities mentioned are not necessarily holdings invested in by the portfolio manager(s) or FMR LLC. References to specific company securities should not be construed as recommendations or investment advice. Diversification does not ensure a profit or guarantee against a loss. S&P 500 is a registered service mark of Standard & Poor’s Financial Services LLC. Other third-party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917. Fidelity Distributors Company LLC, 500 Salem Street, Smithfield, RI 02917. © 2024 FMR LLC. All rights reserved. Not NCUA or NCUSIF insured. May lose value. No credit union guarantee. 656509.48.0 |

Read the full article here