Equinox Gold (NYSE:EQX) is a relatively young, international gold miner whose operations are focused in North and South America. It aims to be the “Premier Americas Gold Producer,” and while it may do that, the real question for investors is what kind of return they will get for each share that they buy. I’ll explain why there is a lot of uncertainty and why it’s a better SELL until some of the clouds clear away.

Overview of the Company

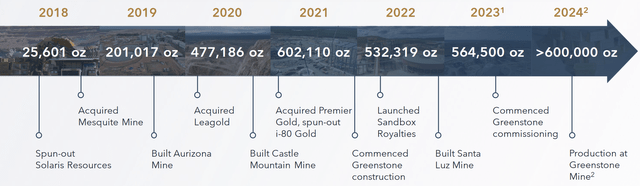

Over the past six years, the company has made a lot of moves to acquire various mining assets in the America and start churning out gold.

January 2024 Company Presentation

It’s employed a variety of options: acquisitions, spinoffs, new construction, and more. I think the flexibility is a good sign, but let’s see what kinds of assets it has right now.

January 2024 Company Presentation

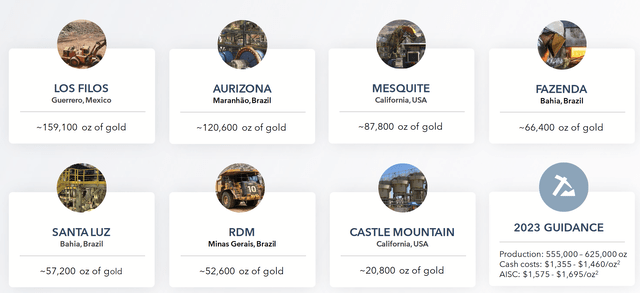

There are currently seven active mines in the United States and Brazil. I’ll note in the corner of their excerpted slide that AISC for 2023 (FY results not out yet) is guided to be $1,575 – $1,695/oz, which is beneath current gold prices around $2,000 but not exactly low compared to other miners whose AISC can range from $1,000 – $1,200. With the exception of Castle Mountain mine (see Q3 2023 MD&A), these mines produce positive free cash flow for the company.

The lives of the mines vary quite a bit, which the company details for each mine on its website. Mesquite mine is as low as 2 years with current reserves, while of a few of the other mines are a decade or more.

January 2024 Company Presentation

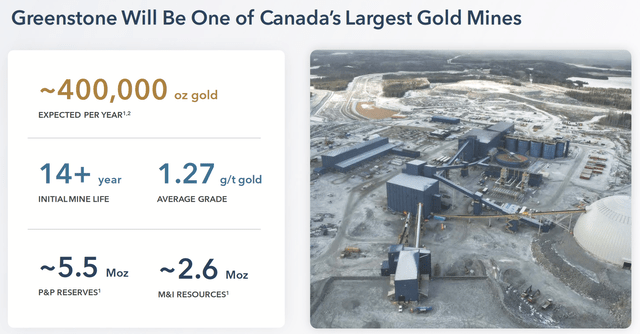

The last major asset is the Greenstone mine in Canada. This mine alone will almost double gold production with the company current estimates.

Recently, the company announced its production levels for Q4 2024, reaching new heights of 155K oz of gold produced for the quarter and FY 2023 results of 565.5K. Actual financial results will be released in late February.

Financial History

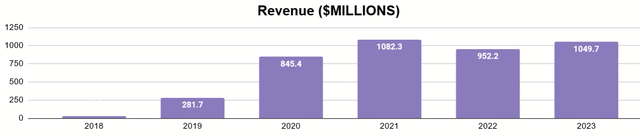

Starting from a single asset six years ago, the company’s growth has led to fast rise in revenues. I’ll include reported YTD 2023 data as well.

Growth with Leverage

Author’s display of reported financial data

This shows that they are coming closer to their objective of being the premier gold producer in the Americas, but what else has come with this rise in revenues?

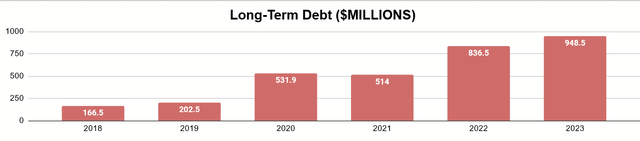

Author’s display of reported financial data

Much of the recent growth has been made possible with leverage. Long-term debt, as of Q3 2023, is almost $1 billion. Now, I usually see miners trying to avoid debt, so it’s worth looking into what kind of debt this is and when it could be a problem.

Examining the Debt

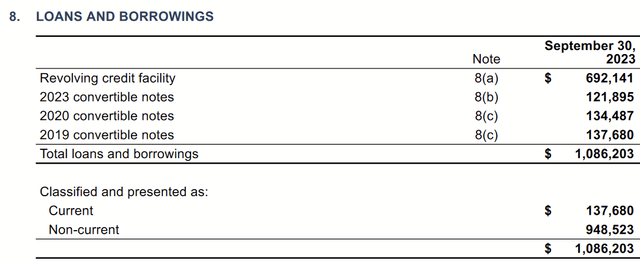

Q3 2023 Financial Report

Citing the same financial report from Q3, we can see that the debt consists of a revolving credit facility and three issues of convertible notes. Let’s start with the facility. I’ll quote how its interest rate works:

Effective February 17, 2023, amounts drawn under the Revolving Facility are subject to variable interest rates at the applicable term rate based on the Secured Overnight Financing Rate plus an applicable margin of 2.50% to 4.50%, based on the Company’s total net leverage ratio, and a credit spread adjustment of 0.10% to 0.25%, based on the interest period.

It’s a variable rate based on two variables, which is interesting. SOFR is naturally going to change a lot and currently stands around 5.3%. The margin being subject to change from 2.5% – 4.5% means the overall interest currently is 7.8% – 9.8%. I believe this is likely to be the rate for the foreseeable future, given the Fed’s current regimen.

I think the company agrees, which might explain some other things. For one, I’ll note that I don’t usually see the revolver being the bulk of a company’s long-term debt. This is because it’s often secured by the assets of the company (and EQX’s is), has the higher rates I mentioned, and it’s considered part of the company’s liquidity. If a business is tapping it out and not repaying it, they don’t have it later on for when they might be in a pinch and need it.

The purpose of the 2019 notes was related to previous acquisitions and served to repay their drawn facility:

On April 11, 2019, in conjunction with the issuance of the Notes, the Company used $116.9 million of available proceeds from the Notes to repay in full the principal and accrued interest outstanding under the Sprott Facility and the Aurizona Construction Facility and terminate the associated Aurizona production-linked payment obligation to Sprott.

Their 2020 notes had a similar purpose:

Proceeds from the 2020 Notes and Credit Facility (note 11(a)) were used, together with other sources, to repay $323.9 million principal and accrued interest outstanding under Leagold’s debt facilities (note 5) at the acquisition date.

Similarly, their 2023 notes were used to repay part of their drawn facility, which was completely tapped out at that moment. These notes not only restore of their liquidity but reduce their interest expense. The 2019 notes are due soon, in April 2024. The 2020 notes are due March 2025, and the 2023 notes are due October 2028.

Cash Flows

Of course, we want to see how all of this growth has affected the cash flow situation. Let’s take a look.

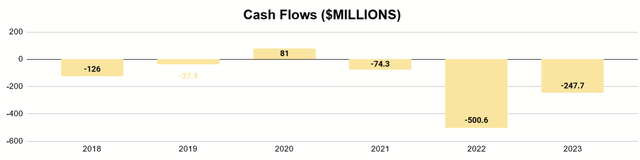

Author’s representation of reported financial data

We can see that free cash flow has been predominantly negative. We already talked about how the company has utilized debt to keep itself going. Between 2018 and 2023, the company raised capital by issuing about 200m more shares, raising the total from about 110m to 310m.

Proceeds from Issuance of Common Stock (Seeking Alpha)

This has allowed the company to raise a few hundred million over the years. Some might wonder why so much is needed and why the negative FCF is mostly larger after all this growth, particularly when I mentioned before that 6 out of 7 of the mines report positive free cash flow. Why the YTD outflow of $247m?

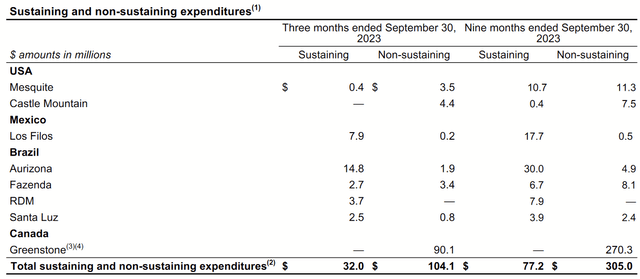

Q3 2023 MD&A

About 73% of capex comes what is spend on the Greenstone project, which is currently non-productive. That $270m spent in the first nine months of 2023 is the difference cash generation and cash depletion.

A Look to the Future

With the current capacities of the company and obstacles laid out, this gives us an idea of what to expect or, at the very least, what questions we should be asking about the future. Let’s start with the convertible notes.

Convertible Notes

The first thing to consider is exactly what happens with these three issues of convertible notes between now and their maturities. Namely, this is a question whether they will be repaid, defaulted, or converted.

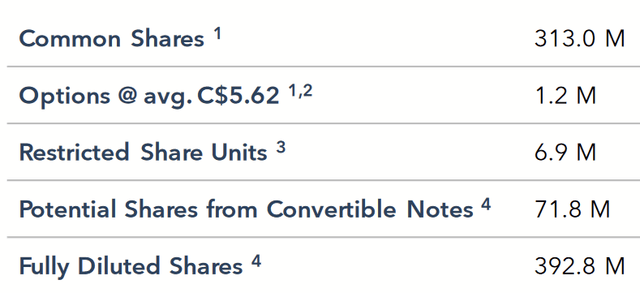

Jan. 2024 Company Presentation

The company has conveniently laid out how the equity could be diluted through various instruments, to confirm the total number of shares that could be created by the notes. Full conversion of all three issues would create 71.8m new shares and would thus reduce a current shareholder’s stake in Equinox by over 18%, and the notes allow conversion at any time. The 2019, 2020, and 2023 conversion prices are $5.25, $7.80, and $6.30 respectively.

With the price of EQX around $4.50 lately, there is no immediate arbitrage opportunity, but there is plenty of time for one to materialize. With the 2019 notes due this April and having the lowest conversion price, it’s very possible that this could occur with that issue. If the share price remains below that, we then have to ask if the $137m in principal due on that loan can be repaid.

Jan. 2024 Company Presentation

With $192m in cash and $123m in marketable securities, it should have the means to repay this. Still, I would prefer to wait and see what happens with this 2019 issue first, particularly as the cash flow situation is likely to change soon.

Greenstone

Greenstone Mine (Company Website)

In its Q3 2023 MD&A, the company discussed its outlook for the Greenstone mine:

Gold production for the first five years of operations is estimated at more than 400,000 ounces annually with life-of-mine production expected to average 360,000 ounces annually, with 60% attributable to Equinox Gold.

And added:

At September 30, 2023, the overall project was 93% complete…The project remains on track to pour gold in the first half of 2024.

400K oz per year with gold prices around $2K/oz and a 60% stake in the Greenstone mine means about $480m in additional, annual revenue for Equinox. Since most of company-wide capex lately has been for the development of this mine, that means there’s room for less outflows alongside a new source of revenues. It depends on what sustaining levels of capex end up being for Greenstone at that point, but a pivot to positive free cash flow could very well be on the horizon.

Yet, even if this occurs and becomes the basis for repaying the 2019 notes, there’s one more major question to address.

Paying Down the Credit Facility

While the company did boast an undrawn $165m from their revolver, what I really want to see is that the company will proactively start paying down the $535m in principal that is costing tens of millions more interest expense each year. It’s a question of how quickly and diligently they will do this as cash flows start to turn positive.

It’s also a question of how they will choose to do this without refinancing through more convertible notes and thus potential dilution. As it stands, the conversion prices on the notes are not that much higher than the current price, and the lenders are getting decent yields in the absence of dividends for what can later be equity that pays dividends. These private offerings are good deals for them, but I question its continued use as a means of paying down the facility, as was done in September.

Don’t Forget the Other Mines

The existing mines will also continue to have their own incremental improvements in production and cost management to consider. Similarly, there’s the question of what to do as the ones with shorter lives of mine reach their end. Yet, with the clouds presented by the issues I’ve just mentioned, I don’t know that insightful analysis can be gleaned from these at the moment.

What Could Be the Valuation?

Normally I would prefer to do a Discounted Cash Flow, but that does require a minimal level of certainly about what free cash flow will tend to be, what kind of growth (if any) there will be going forward, and how we would split that down to the value of an individual share.

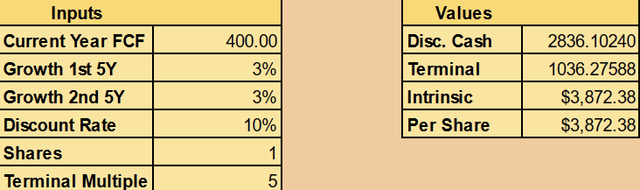

A hypothetical miner trying to reach 1m/oz per year in production, current gold prices, and the AISC that Equinox has could produce $300m to $500m in free cash flow each year, hypothetically.

Author’s calculation of hypothetical miner

Even with very low-level growth based on no assumptions in particular, such a hypothetical miner could be worth almost $3.9 billion, and this is assuming other things, like being unencumbered by debt.

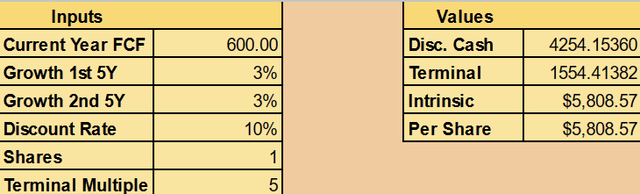

Author’s calculation of hypothetical miner

Getting the AISC down to a more average level raises the potential free cash flow to the range of $500m to $700m and thus a fair value for such a company. Are these hypothetical miners what an investment in EQX, today, represents?

Well, we don’t know because much of that cash flow will have to go toward repaying debt. Some of that repayment could come in the form of continued dilution by printing more share and/or more convertible notes down the road. Even if the market cap rises 3x to 5x in the long run, whether we might experience that as individual shareholders is difficult to calculate for the time being.

Then, of course, it’s all in the execution. It seems unwise to count positive free cash flow before it happens.

Conclusion

Equinox Gold is inching closer to achieving its goal of being the premier gold producer in the Americas. Yet, much of this story of growth is a story of debt and dilution before there is free cash flow. With the completion of the Greenstone project coming up this year, which should account for the largest source of revenue of all the company’s assets, we will soon see if these moves bear any fruit.

Yet, we want to see that the company actually moves forward with making this mine work, and we want to see how management chooses to start paying down this debt and if such can be done without further dilution. Once a stabler idea of the company can be made, I think it’s much more practical to determine what price makes EQX a buy. Lacking that, and having miners that offer more certainty, I think the shares are a SELL for now, but that doesn’t mean we shouldn’t keep watching.

Read the full article here