I initiated my coverage of Ecolab (NYSE:ECL) in January 2024 with a ‘Sell’ rating due to the high valuation. Ecolab published its Q2 FY24 results on July 30th, reporting 4% organic revenue growth and 32% operating income growth, and raising the full-year guidance for EPS growth. It is quite impressive for Ecolab to deliver a strong price growth amid a weak macroeconomic environment. However, I continue to believe the stock price is overvalued and reiterate a ‘Sell’ rating with a fair value of $210 per share.

Divestiture of Surgical Solutions Business

On August 1st, 2024, Ecolab closed the sale of the Surgical Solutions business to Medline for $950 million in cash. The Surgical Solutions offer sterile drape for surgeons, patients and operating rooms, generating around $400 million in revenue. I favor the divestiture for the following reasons:

- The divestiture could potentially allow Ecolab to focus on the high-quality global healthcare business, specializing in infection prevention and surgical solutions. As noted over the earnings call, Surgical Solutions is a pure product business with no associated services or consumables. As Ecolab aims to transform into a more recurring business model, the divestiture aligns with its strategic goals.

- The divestiture price represents nearly 2.5x sales, which is a quite decent valuation considering the business primarily sells drapes. Ecolab intends to repurchase up to an additional $500 million of own stocks during the second half of FY24, which could provide some technical support for Ecolab’s stock price.

Strong growth in Institutional and Pest Elimination

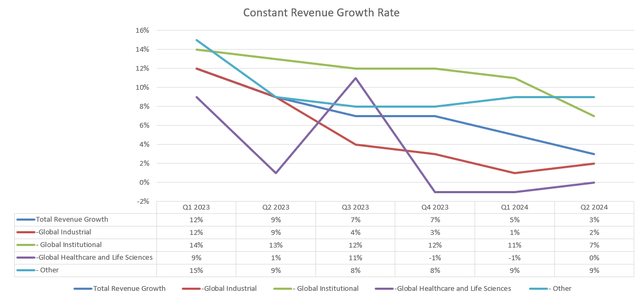

As depicted in the chart below, Ecolab delivered 3% constant revenue growth in Q2 FY24, with robust growth in Institutional and Pest Elimination businesses.

Ecolab Quarterly Results

The strong growth of Global Institutional and Pest Control is propelled by several factors:

- During the earnings call, the management pointed out that institutional customers, such as restaurants and hotels, are seeking Ecolab’s technology to reduce labor costs. Institutional customers could rely on Ecolab’s cleaning and sanitizing products and services to migrate labor shortage risks. For instance, Ecolab offers Ecolab Science Certified program, assisting customers to achieve a higher level of cleanliness, which can reduce customer complaints, and improve customer satisfaction.

- Ecolab has been implementing a valued-based pricing model, achieving 2%-3% pricing growth during the first half of FY24. The value-based pricing model allows customers to benefit from Ecolab’s technology while reducing operational costs. I anticipate that Ecolab will continue to sustain this pricing growth in the near future.

- As discussed in my initiation report, Ecolab has a great pest control franchise, growing at high-single-digit in the past. Compared to Rollins (ROL), Ecolab is more focused on institutional customers. Ecolab is selling their pest elimination services to their existing institutional customers; therefore, the company generates synergies across their business segments.

Outlook and DCF Valuation

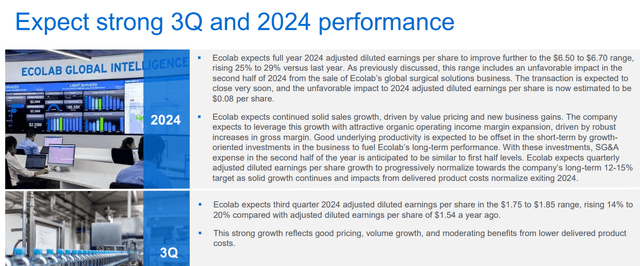

Ecolab is guiding for 25%-29% adjusted EPS growth for FY24, as detailed in the slide below, reflecting strong margin improvement during the year.

Ecolab Investor Presentation

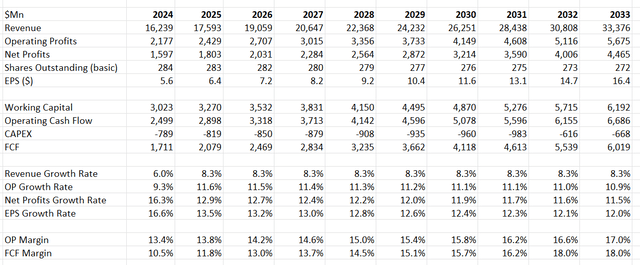

I estimate their near-term growth as follows:

- Global Industrial: The business consists of the Water, Food & Beverage and Paper solutions. The growth rate is tied to the overall industrial production to some extent. When the interest rate starts to normalize in the future, I estimate Ecolab’s Global Industrial business will grow by 4%, driven by 2% volume growth and 2% pricing growth.

- Global Institutional: As previously discussed, the segment is a major growth driver for Ecolab. Ecolab has been investing heavily in their Institutional business. More specifically, Ecolab develops IT platforms and applications to connect customers, suppliers and sales team. I forecast the business will grow by 8% annually, driven by 3% pricing growth and 5% volume growth.

- Global HealthCare: The segment revenue growth will be negatively impacted in FY24 due to the divestiture of Surgical Solutions. From FY25 onwards, I estimate the segment will grow by 5% annually, aligned with historical average.

- Pest Elimination: This segment has shown consistent double-digit growth in recent years. Compared to other segments, pest control is a relatively stable business in nature. I assume 10% annual revenue growth.

Putting together, I calculate Ecolab will achieve 6% organic revenue growth. Additionally, I forecast the company will allocate 7% of revenues towards M&A, contributing 2.3% to overall topline growth.

I model 40bps margin expansion driven by 20bps from gross profits, 10bps from SG&A optimization and 10bps from revenue mix towards high-margin businesses. The DCF can be summarized as follows:

Ecolab DCF

The WACC is calculated to be 12% assuming risk-free rate 3.7%; beta 1.3%; equity risk premium 7%; equity balance $70 billion; debt $7.7 billion; tax rate 18%. Discounting all the future FCF, the fair value is calculated to be $210 per share.

Key Upside Risks

As I assign a ‘Sell’ rating to Ecolab, I am considering the potential upside risks to my thesis.

For the pest control business, both Rollins and Rentokil Initial (RTO) have been expanding aggressively in the U.S. market in recent years, aiming to consolidate the fragmented market. Comparably, Ecolab has not pursued growth in their pest elimination business via acquisitions. Compared to its competitors, Ecolab has a relatively small business franchise in the pest control market. It is quite possible for Rollins and Rentokil Initial to acquire Ecolab’s pest elimination business in the future. In that scenario, Ecolab’s shareholders may further unlock the value of its pest elimination business.

In addition, as Ecolab plans to repurchase at least $500 million of own stocks in the second half of FY24, the stock buyback could provide support for their stock price in the near future.

Takeaways

I favor Ecolab’s divestiture of their Surgical Solutions business and am encouraged by the growth in their Institutional and Pest Elimination businesses. However, I believe the stock price is overvalued; therefore, I reiterate a ‘Sell’ rating with a fair value of $210 per share.

Read the full article here