Dear subscribers

The time has come for me to update my thesis on Diageo (NYSE:DEO), one that I started a few years ago when I invested in the company. I then went ahead and sold my position during what I viewed as overvaluation for this business back in late 2022, taking home a good amount of 35-40% RoR with dividends.

I then put the company on my watchlist and followed it with great interest to be able to “get back in” at an attractive overall valuation to ensure a good long-term upside.

As of today, and the past few weeks, I believe this upside has finally arrived, and we can “BUY” Diageo with a significant upside.

In this article, I’ll show you why that is and why I consider Diageo one of the more interesting investments that can be made today.

My own goal is to expand a Diageo position to several percent in size in my portfolio, for the 2-5 year upside.

Diageo – Why the short-term is of no interest to me

The reason that Diageo is currently experiencing pressure in terms of share price and valuation isn’t that opaque – the company is expected to see a non-trivial drop in earnings in the near term.

You can invest in Diageo in several, valid ways. One way, and probably the most popular here in SA, is investing in the liquid ADR DEO. That’s a good way. However, as a European investor with access to native LSE (London Stock Exchange) trading, and British Pounds, my choice is for the DGE ticker, which trades at that aforementioned LSE.

Diageo was formed in 1997 when Guinness and Grand Metropolitan came together, and to date, the company’s portfolio is one of the most impressive spirits and beer portfolios on earth.

Diageo IR (Diageo IR)

While it certainly has premiumization, I would call it more “common man” and less premiumized than brands like Pernod Ricard, or luxury spirits and products from LVMH (OTCPK:LVMUY). This is not necessarily a bad thing. However – valuation is key to investing in a player like this, which can be evidenced by RoR since my last neutral article back in February of -21, where we see a negative RoR of 12.5% compared to a market that’s up almost 22%, if going by the S&P500.

The company brands include global giants, which together have a combined retail value of nearly £16B per year. Smaller, local brands are still strong and are complemented by the company’s reserve brands. Diageo is truly a global company, with a reach into nearly every nation of the world. While the main markets are clear, the company has sales virtually everywhere.

It has a 50%+ EU/NA sales split, with a growing exposure to APAC and emerging markets. With sales in over 180 countries and over 25,000 employees, this company is one of the largest players in spirits.

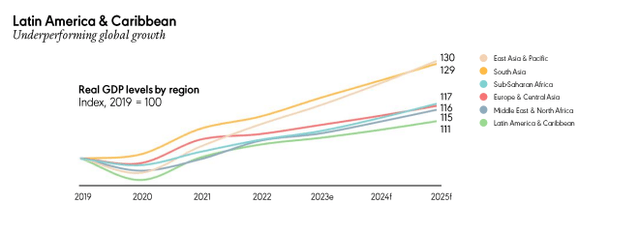

The overall picture here is that the sales trends for Diageo continue to be strong. Slower, but strong. The only really weak market is the LATAM/SA area. The company is still seeing inventory and destocking trends from the tailwind of COVID-19, where sales growth of double-digits was the reason for the company’s significant valuation premium over some time (which was also where I sold my stake).

As of the company’s latest information in November, US distributor inventories were at historically low overall levels during 2023, which is expected to recover. Another part of the reason why the company’s valuation is down is that the LATAM and Carribean geographies are underperforming – and this is expected to continue to 2025E at the very least.

Diageo IR (Diageo IR)

I’m convinced that the short-term uncertainty we’re seeing, and the inflationary trends, are going to continue, also for Diageo. This will mean that I don’t see the company suddenly reverting up in the near term, but that an improvement here will be longer in coming.

But this is not an issue that I put weight on. The company is a long-term player, and any short-term valuation weakness is a positive as I see it, because it enables me to enter Diageo at a weak share price.

Despite all the negativity in valuation, Diageo remains a top-tier player. ‘

By this, I meant that the company manages nearly 60% in gross margins, over 27% EBIT margin, and a net margin of almost 22%. Find me another player in foods and spirits that manages this, or that can speak of RoE of over 47%.

These numbers alone, which are in the 90th+ percentile in the food & beverage industry with 210 comps (Source: GuruFocus), are the reason why Diageo when it is cheap, is always on my “BUY” list. It’s also why the debt/equity of 2.17x doesn’t bother me much, even though it’s below comp averages.

Diageo is A-rated. It has a yield that’s not anything to take to the bank as a high yield. If the company yields 3%, you should seriously consider looking closer.

Can the company drop more from this valuation? Of course, that’s always possible. If that’s the case, I’ll buy more. But historically speaking, whenever the company has been this multiple for the past 20 years, it has been time to “BUY” The company.

Diageo issues trading and half-year updates. It also has a non-standard fiscal, which means that it reported F23A results in August, and those results confirm what is going on in the company. Sales are down in terms of volume, but the bottom line is saved by price increases and efficiencies, resulting in a net sales value growth of 6%.

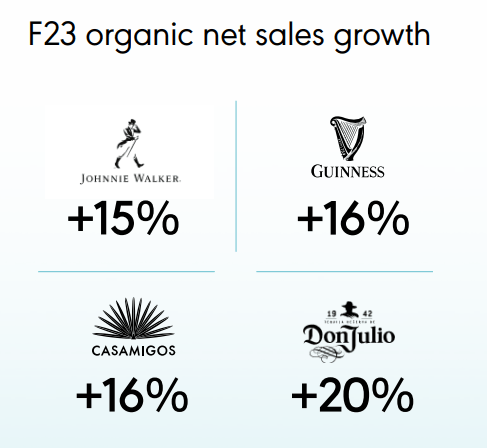

Price and volume increases were visible in several key product lines.

Diageo IR (Diageo IR)

Remember, Johnnie Walker is the company’s #1 international spirit brand, and it continues to grow at double digits here. The company is also the #1 player in global tequila, and it’s targeting a global tequila sales expansion.

Diageo IR (Diageo IR)

Despite what you see in share price trends, there was not a single geography that saw a downturn in terms of organic net sales growth. From 13% growth in APAC to 11% in Europe, to 9% in LATAM/Carrib, to 0% growth, but no decline in NA. These results, and these prospects, are not as bad as analysts or forecasts want to make them out to be.

I’m a conservative investor. Whenever I see someone being conservative, this is something I welcome. But we need to stay realistic. And many of the segments and sales that the company works with especially the premiumized spirits segment, are far more resilient and less cyclical than you might believe.

That is also why this stock is cyclical in a manner that does not reflect what I would consider a more linear than cyclical adjusted earnings growth trend. While periods of slump exist, these are typical in conjunction with company strategic pushes, not because people stop drinking alcohol.

Let’s look at company risks & upside.

Risks & Upside to Diageo

So, first off, let me make it clear that Diageo is very rarely undervalued. Even seeing it here, some analysts can make a decent point in the fact that this company isn’t all that undervalued if we look at it from a conservative 15x P/E. But given what this company does, viewing it at 15x would be wrong, in my opinion.

Consumer spending trends are hitting Diageo like a punch to the stomach, in that we’re seeing a decline, but the mistake I see analysts making is mistaking this for a decline in overall premiumization, which is “wrong”, as I see it.

Diageo has risk. The company’s sales mix is spirit-heavy, and the non-premiumized sales segments are certainly more cyclical than beer. There is some risk to the company’s premiumized segment if and when the economy slows down further – there’s an inflection point when investors will spend less for alcohol here, but that point is not reached here yet.

Political plays are a real risk here – not just by China and other Asian geographies, but by Russia as well. As I’ve experienced in Sweden, sometimes politics come into alcohol consumption, and while I believe this to be fruitless in the long term, it can impact sales through regulatory intervention. This is also part, as I see it, of the current overall downturn. Specifically, what i mean by “political plays” is the fact that some geographies, not limited to the aforementioned ones, may change regulatory frameworks in a way that punishes or makes things more difficult for a company like Diageo, an international player. It’s happened in the past (and is happening now).

The perhaps biggest risk for the company and its future value creation and growth is expressed well through its current balance sheet. The company tends to grow inorganically and when it does, it has a risk of overpaying for acquisitions, depending on the target and market climate of course. However, any inorganic growth strategy runs the risk of overpaying. The risk for overpaying for any M&A is a risk that’s factually established not only by studies (Mandelker, 1974; Draper and Paudyal, 2006), but specifically because valuation is a very inexact “science”. Value is entirely a market perception, and because we’re in a market that i view as overvalued, it makes sense that many M&A’s and bids are likely to be made at excessive multiples relative to when the market is overvalued (say, in GFC). Whatever DEO management says here, the company has recent historical examples where it has overpayed, or where it has had to correct books after the fact (meaning they should have paid less). United Spirits back in -17 is one such example (Source).

Upsides?

Simple – market position, sheer size, portfolio, branding, the “affordable luxury” of decent spirit products. Also, a point raised by some analysts, and raised by me as well when I survey the balance sheet – Diageo recognizes the maturing spirits inventory on its balance sheet at cost.

This is a severe understatement of company book value, even if done by relevant accounting regulations. Numbers that I’ve seen here are that book value is understated by between £2-£3B (Source), and this would of course be material. However, I want to clarify that this understatement is in fact a requirement by both IFRS and GAAP – it’s not that the company is making a mistake, it’s that i, as a valuation analyst, see this as an erroneous way of accounting for value. I’m an investor, not an accountant – and this is one of many places where my accounting of value differs from such a perspective.

Let’s look at valuation.

Diageo’s Valuation

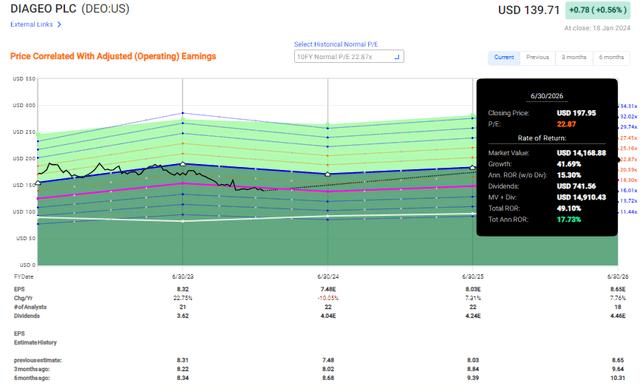

Here’s the primary reason why I’ve been slowly expanding a position in Diageo for the last few weeks and months or so. The company typically, on a 10-20 year average, tends to trade at 20-25x to earnings. Compared to the company’s state in early 2000, it’s also vastly changed from that, so I view any likening of the company’s valuation to that lower overall valuation as somewhat problematic – but even on a 20-year average, it’s at 20x.

If we forecast the company at 20x from the current 17.6x even with an adjusted EPS growth CAGR of 4% as forecasted, we still get a double-digit 11% annualized RoR – and this is the bearish case to me.

The base case forecasts Diageo at 22.5x, which is the 10-year average.

F.A.S.T graphs DEO Upside (F.A.S.T Graphs)

As you can see, 15% annualized is not hard to forecast conservatively when DEO trades below $140, or the native ticker is where it currently is. Losing money with Diageo here would entail the company dropping to below 15x P/E, which it has not done for an extended period in a very long time.

The reason I view average earnings multiples as relevant here is the company’s near-linear earnings profile. Analysts like to characterize Diageo as more cyclical than it actually is due to its premiumized cyclicality in certain subsegments – but overall, this is not reason enough to step away from this historical average, or P/E as an indicator, in my opinion.

Besides, even if we recognize the company’s maturing assets at cost, the book value and tangible multiples are below historical averages here. We can look at a wide range of multiples that could imply to us how the company is being treated by the market here.

First off is Sales. Price/Sales can be implicative of where the company goes, and in this case, it moves from lows of 3.6x to highs of 7x. We don’t want to buy at 7x – and currently, on a 5-year basis, we’re at a P/S of 3.67x. It’s really at the low end.

Forward EV/EBITDA is another good proxy for valuation here. We move between highs of around 17x to lows of around 13.8x. The current EV/EBITDA on a forward basis is 14.03x. Also low.

Looking at book value, due to inventories and premiumization, the company tends to trade higher in terms of book. We have peaks of around 10x, with lows of around 7.8x – and we are in fact, on a 5-year average, at 7.84x, which is the lowest it’s been since COVID-19.

And keep in mind, this is before adding back what I would view as a fair value for the maturing inventories of spirits that are being held on the BS at cost, instead of at their actual sale values.

Overall, I believe there to be a strong case to be made for why Diageo is significantly undervalued. I would unpack my target of at least £38/share by saying that the company’s portfolio is worth, a 20-22x p/E even if the growth rates go down to about 4-5% in the long term. And keep in mind, post the rationalizations we see in 2024, the company is expected to go back to 8-9% EPS growth. The yield isn’t fantastic here, but it’s good enough for where I would say that a world-leading company is worth this premium. This also includes the fact that Diageo has sector-outperforming profitability on every level – top line, EBIT, and net.

Based on this, I say that this company has the following thesis.

Thesis

- This is one of the most quality beverage businesses on the planet, and it typically trades above 25X. The current company price for the native ticker DGE on the LSE implies a P/E of 17.6x, which is the lowest it’s been in some time and has pushed the yield to almost 3%.

- Because of that, and because of the market, I believe it is time to shift my stance on DEO, which is what I am doing here.

- I consider DEO a “BUY”, and the upside to that buy is at least 20+% annualized to a normalized 24-25x P/E, which I consider valid for the largest spirit and beer play in these categories.

- I give Diageo a native PT of at least £38/share and an ADR PT of $200/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

The company also fulfills several of my investment criteria.

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

- The company can be considered cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won’t call the company “cheap” here, but aside from that, this company has a superb upside here alongside an attractive yield.

Read the full article here