Investment Thesis

Datadog (NASDAQ:DDOG) is a household name in the world of software development operations and security operations (DevOps and DevSecOps). The company’s proprietary cloud software is widely used by DevOps teams in many technology teams that build web and mobile applications. The entire DevOps space has become critical for technology teams to gain more visibility into their backend technology operations, as can be seen by the meteoric rise of Datadog and its competitor, Dynatrace (DT), which dislodged incumbents such as Splunk (SPLK).

Most recently, Dynatrace announced their Q3 FY24 results, which showed the company’s Annual Recurring Revenue (ARR) slightly below expectations. However, per my estimates, I think Datadog is fully valued here, and I will rate this stock as a HOLD for now.

About Datadog

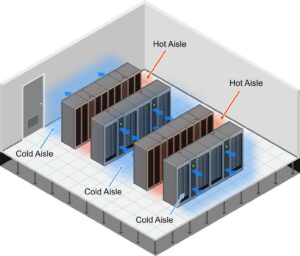

Datadog was founded in 2010 with the goal of making it easier for backend technology teams such as DevOps and SecOps teams to gain more visibility into the inner workings of their organization’s technology tools, systems, and applications. Over the past decade, cloud computing has provided exponential aid to the digital transformation most companies have gone through. In the age of hybrid clouds, where enterprises choose to deploy their applications on more than one cloud, Datadog’s products provide the necessary tools to aid teams in gathering data from a wide range of disparate sources and provide real-time insight to employees.

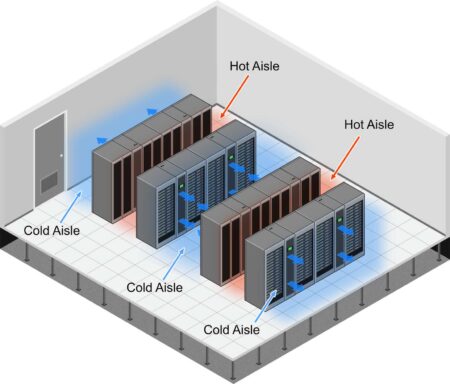

In addition to offering and automating aspects of application performance monitoring, log management, and real-time monitoring, Datadog has also expanded its target market in the past couple years by offering application security management, cloud security, and configuration audits. The company also has integration tools that allow developers to build their own customized cloud-observability solutions. Here’s an overview of Datadog’s suite of products:

Q3 FY23 Investor Presentations, Datadog

At a higher level, Datadog operates within the IT Operations Management market. The company generates revenue by selling subscriptions. In this research note, I will be focusing on Datadog’s customer metrics, as they would be a key differentiating factor vs. its competitors.

Datadog edges over competitors with its product strategy

Datadog’s product roadmap strategy has been extremely effective in broadening the use cases of its observability platform and appealing to a wider audience of the DevSecOps target market. In a recent Barclays Global Tech Conference last month, Datadog’s CFO explained how Datadog stands to gain from their land-and-expand model as ITOM customers are looking to consolidate the operations of their cloud workloads. He said that they were already seeing industry trends of consolidation in the ITOM tech stack, but Datadog was “getting better at consolidation selling in terms of looking at both value and the cost side.” He also added some color by mentioning that customers were starting to consolidate workloads from other vendors onto the Datadog platform.

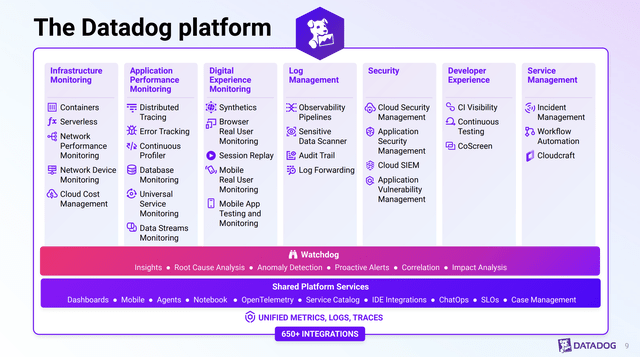

While reviewing Datadog’s competitor, Dynatrace’s recent Q3 FY24 earnings call, I came across some commentary from their management, who also mentioned that they were seeing vendor consolidation in the ITOM market, which is why they guided their ARR slightly under in terms of constant currency, in my opinion. When answering a question about how Dynatrace could improve ARR, management mentioned they “need to be able to convert that pipeline at a higher rate” and they also need to have better sales execution against larger deals and larger transactions. To me, it appears that Datadog has stood to gain in this cycle of ITOM vendor consolidation, as Dynatrace is seeing some headwinds. The strength of Datadog’s customer base stands out to me, especially in the enterprise cohort of customers that contribute an ARR >$100K and >$1M, as can be seen in the compilation of charts that I added below:

Q3 FY23 Investor Presentations, Datadog

Moreover, I see that these customers also appear to spend more on Datadog’s platform as they land with one Datadog product but start expanding to use more products across Datadog’s platform, as can be seen in the charts above. Datadog’s Net Retention Rates are also very strong, mostly staying in the 120%–130% range as compared to Dynatrace, which has fallen from 119% in March 2023 to 113% in December 2023.

However, Datadog is richly valued (for now).

As per Datadog’s Q3 FY23 presentation, TAM is expected to grow to $62 billion at a CAGR of 11.3%. However, I am more optimistic about the company’s growth prospects given recent sales execution cycles as seen by management, Datadog’s impressive product and feature roadmap, and the company’s laser focus on being financially responsible while executing on growth. In the Oct-Dec quarter, Datadog expanded its strategic partnership with Google Cloud by launching more products in the fast-growing AI/ML Ops market. In addition, the company has also gotten deeper into the cloud serverless market by expanding security and observability support for Amazon’s AWS serverless solutions. I believe that with the current pace of product and feature iteration, Datadog will be growing faster than its target market, implying deeper penetration into its TAM, as I have illustrated below.

Author

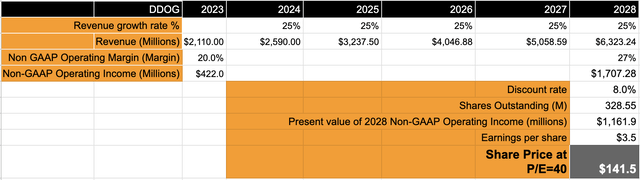

Datadog is guiding for a 20% non-GAAP operating margin in FY23. I believe over the next five years into FY 28, the non-GAAP operating margins will improve to at least 27% as the company unlocks more operating leverage through deeper product adoption, streamlining operating expenses, and securing larger deals. With operating income growing at a CAGR of 32%, a forward PE of ~40 would be justified for such impressive top-line and bottom-line projected performance. Still, with such high forward multiples, Datadog looks fully valued at these levels.

The company reports their earnings in the morning on Tuesday, February 13th, followed by their FY24 Investor Day presentation on February 15th. In both of these presentations, I will be looking for more details about their sales strategy, additional details on the expansion into newer markets such as AI/ML Ops, etc., as well as their updated outlook on operational efficiency.

Risks & Other Factors to consider

As mentioned earlier, Datadog directly competes with Dynatrace within the ITOM market, along with NewRelic, which was recently taken off the market. I am not too concerned with competition, as I believe Datadog’s robust suite of observability and ITOM products are constantly innovated and refreshed, giving Datadog a consistent edge over competition. However, if there is any slowdown in the pace of innovation, if Datadog’s products fail to meet its customer requirements, or if there are security breaches within Datadog’s platform, this may significantly impact the growth prospects and the credibility of Datadog.

On a broader level, if Datadog also experiences the same weakness in platform spend as experienced by Dynatrace that I noted earlier in this post, it may force me to re-evaluate the growth story for Datadog.

Conclusion

In summary, Datadog is a great company that is very well run by management in all aspects of product, sales, and financial operations. I am encouraged by the management so far in how they have executed on Datadog’s goals and consistently outperformed expectations. However, the company appears to be fully valued, and next week’s earnings and investor day presentation should provide more context for updating my valuation model for Datadog. For now, I rate this as a hold.

Read the full article here