By Seema Shah, Chief Global Strategist and Arthur Jones, Senior Director, Global Research

After a turbulent and unexpected 2023, there is widespread concern that commercial real estate (CRE) will face an additional challenge in 2024: a wall of maturities that threatens to undermine the asset class further.

Yet, while the ability to service existing debt maturities appears challenging and is a potential source of weaker pricing trends in 2024, this vulnerability is primarily focused on the office sector.

Other sectors remain well-funded and will be supported by a constructive economic backdrop, suggesting that the market is over-pricing the risks and, in turn, setting up an opportunity for investors to take advantage of attractive valuations in CRE.

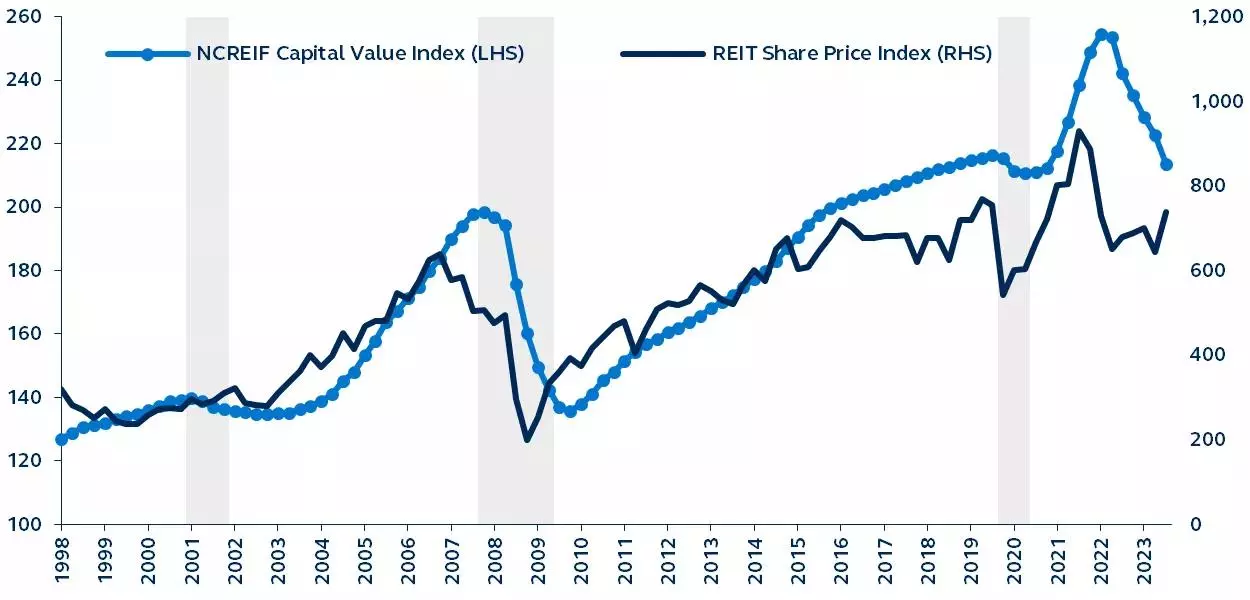

U.S. equity REIT share price and NCREIF (NPI) capital value indices

Rebased to 100 at 1977Q4, recessions are shaded

Source: NCREIF, NAREIT, Principal Real Estate. Data as of December 31, 2023.

The fallout from the 2023 regional banking crisis

2023 was the worst year for CRE investors since 2009. On the heels of the Fed’s historic tightening cycle that began in March of 2022 and after the failure of two major regional banks – Silicon Valley Bank (SVB) and Signature Bank – debt capital from depository institutions, which accounts for 38% of all outstanding CRE loans, was effectively removed from the market.

Transaction markets were effectively shuttered in the first half of 2023, ultimately resulting in total property sales declining by 65% relative to 2022.

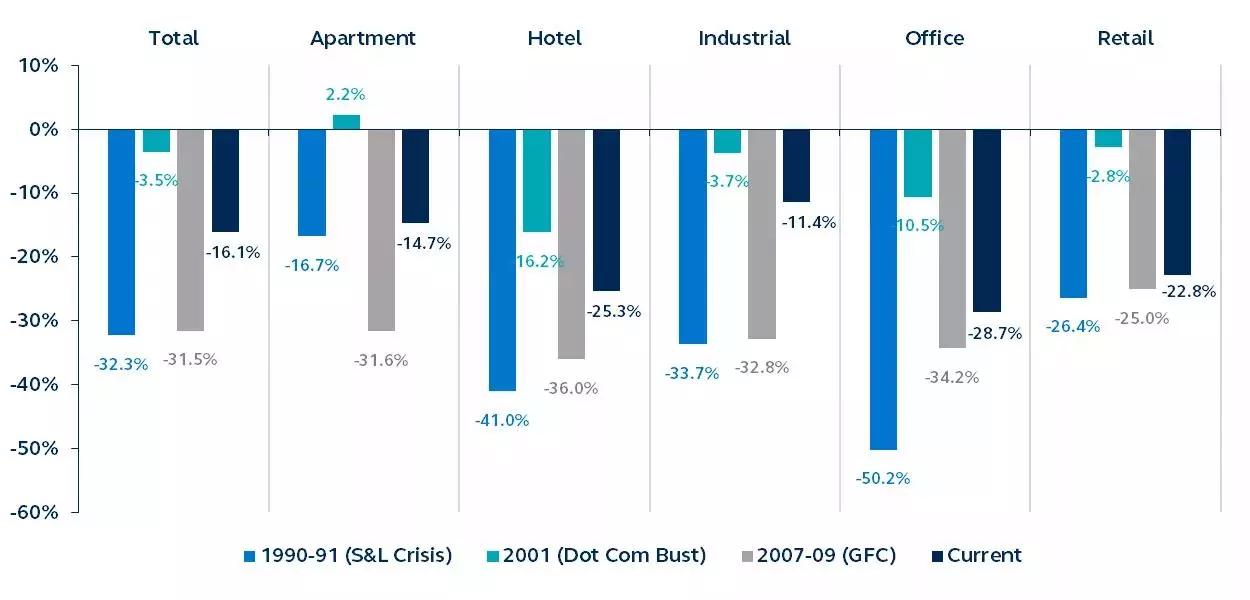

While the lack of debt capital originating from banks reduced liquidity and contributed to capital value declines across all property sectors (the NCREIF Property Index, the NPI, saw a decline of 12.5%), the impact on office market values was exceptionally destructive, declining 28.7%, since Q2 2020.

NPI appreciation: Peak to trough declines

By sector across various time periods

Source: NCREIF, NAREIT, Principal Real Estate. Data as of December 31, 2023.

Valuations, friend or foe?

After such a torrid 2023, the CRE market is deeply discounted. But while such attractive valuations would typically present a compelling opportunity, CRE’s challenges are now compounded by fears of elevated refinancing risk.

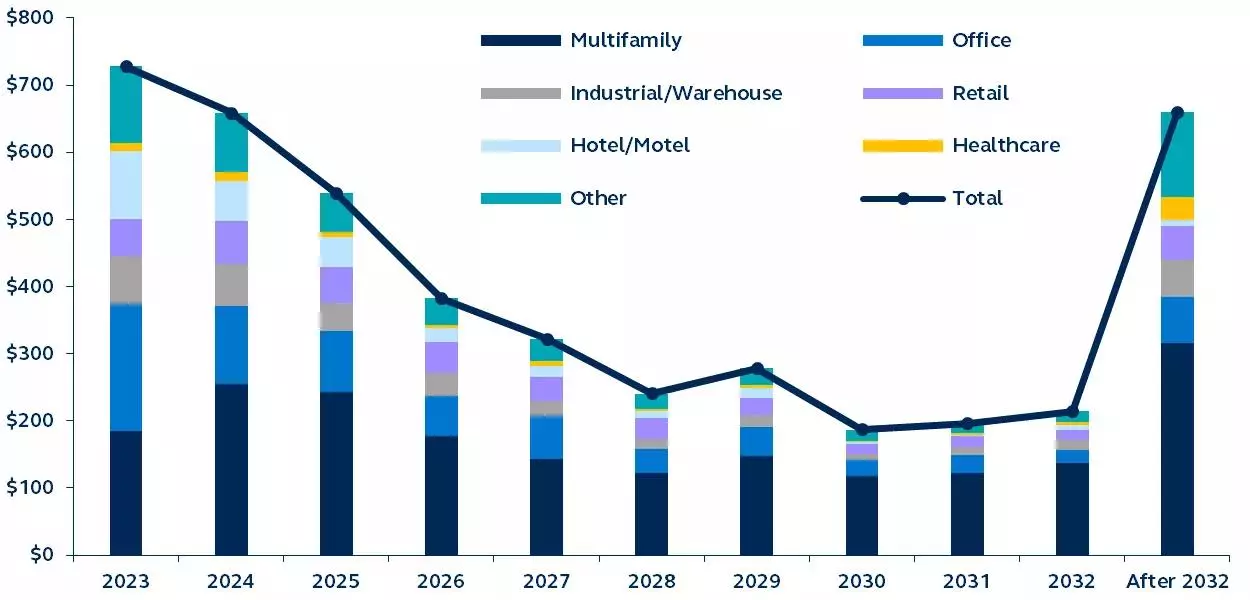

Of the $4.4 trillion outstanding CRE debt, roughly $1.2 trillion is scheduled to mature by 2025.

Furthermore, with debt markets remaining pressured by stringent underwriting requirements and amid higher borrowing costs, this risk was explicitly highlighted by the Federal Reserve (Fed) in its December 2023 meeting minutes, commenting that “a significant share of properties would need to be refinanced in 2024 against a backdrop of higher interest rates, continued weakness in the office sector, and balance sheet pressures faced by some lenders.”

Yet, while the maturity wall is undoubtedly significant, refinancing risk should be relatively well contained for three reasons.

- Policy backstops: Although refinancing risk in the CRE market tends to arise during periods of illiquidity and stress in market fundamentals, worst-case scenarios have seldom come to pass. During the worst financial crises of the past 40 years – namely, the Savings and Loans Crisis (1980-1989) and the Great Financial Crisis (2007-2010) – the federal government backstopped distress in the CRE and financial markets via the Resolution Trust Company and the Troubled Asset Relief Program. Given the potential contagion impact of CRE, policymakers will be keen to avoid additional stress on the financial system. They would be likely quick to head off any possible run on banks, as they did following the regional bank failures in 2023.

- Economic backdrop: The CRE sector is not currently burdened by a financial crisis or recession, and tenant demand for space remains healthy, providing sustained income returns to investors.

- Sectoral make-up: In 2024 alone, $658 billion of CRE debt is scheduled to mature. Yet more than half of this sum is in the apartment ($225 billion) and office sectors ($117 billion). The apartment sector currently poses minimal risks. Not only is it experiencing healthy market demand, but this sector is unique in that it directly benefits from government-sponsored entities (i.e., Fannie Mae and Freddie Mac) with the express mission of providing liquidity to the residential market. Consequently, it has been the one sector in which debt capital has been consistently available since 2022, and this is expected to persist.

The office sector, by contrast, is already facing several meaningful challenges, such as weak demand fundamentals driven by poor workplace attendance post-COVID. The knock-on effects presage weak flows of debt capital available to refinance maturities.

For their part, banks are already overexposed to the sector, and investors remain concerned about the long-term viability of the office market.

Fortunately, weaknesses should remain confined to the office sector as others are better positioned from a fundamental and liquidity standpoint to remain attractive to lenders and investors.

Indeed, growing investor interest in emerging growth sectors such as data centers, infrastructure, and single-family rentals has meant that the office sector now accounts for just 6% of global publicly listed real estate investment trusts (REITs).

Although the office sector accounts for a greater percentage of private equity real estate, its share among private equity real estate investors is a relatively small 17.8%, having fallen from 34.6% just five years ago1.

As such, permitted other real estate sectors show limited signs of distress, office sector weakness should remain confined.

Total maturities by property sector

$billions

Source: Mortgage Bankers Association, Loan Maturity Report, Principal Real Estate. Data as of December 31, 2023.

Attractive valuations amid a soft landing

Investing in the real estate sector in 2024 is not devoid of risk, however, the risk associated with the refinancing wall is likely less pertinent than the markets and the Fed have suggested.

Furthermore, the troubles faced by the office sector are not a proxy for the broader real estate sector. In fact, this disconnect can create opportunities for investors who can benefit when the overly pessimistic sentiment shifts.

Certainly, with extremely attractive valuations compared to prior years, the main determinant of CRE performance in 2024 will be economic performance and the durability of economic expansion.

If the Fed can pivot to an easing cycle against the backdrop of ample liquidity and positive economic growth, 2024 could provide a transition point for the CRE market.

Refinancing risk in 2024 poses minimal threat to commercial real estate, given its sector- and asset-specific nature. While the office sector may remain a vulnerable area, it is unlikely to hinder what is anticipated to be a transformative year for the real estate asset class.

1 According to the NCREIF NFI-ODCE index as of Q3 2023.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here