Clear Secure (NYSE:YOU) provides an identity validation platform. The company’s offering is mostly used for airport security, where customers can easily validate their identity for a more rapid airport experience with a CLEAR Plus personal subscription. The company also has offerings for businesses, including customer verification, healthcare applications, and digital KYC.

The company went public in June of 2021. Since then, the stock has lost over half of its value, as many growth stocks have taken a large hit in the period. Despite being a highly growing company, Clear Secure has paid out dividends and is expected to have a forward dividend yield of 0.81%.

Stock Chart From IPO (Seeking Alpha)

Great Growth & Runway For More

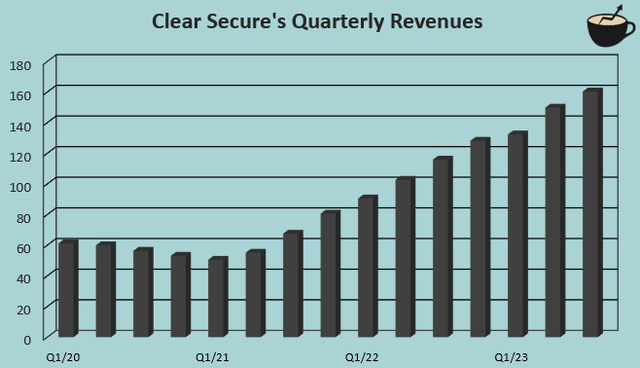

Clear Secure has been able to consistently grow its quarterly revenues after the Covid pandemic’s negative effect started to subside. From Q1/2020 to Q3/2023, the company has had a great revenue CAGR of 31.6%.

Author’s Calculation Using TIKR Data

The company has been able to drive great growth through constant increases in CLEAR Plus members. Year-over-year, members of the service increased by 17.0% into almost 6.4 million. Clear Secure constantly widens the company’s footprints with an expansion in Pittsburgh International Airport in December, an expansion in a Rhode Island airport in November, and an expansion in Buffalo Niagara International Airport in September, to name a few recent growth avenues.

Clear Secure also quite recently acquired Sora ID. While insignificant in the acquisition’s sum, the acquisition positions Clear Secure to grow in the digital KYC vertical. Clear Secure plans to grow revenues in the future by adding financial institutions as KYC platform clients. The company is clearly expanding its client base from airports into healthcare and other industries – I believe that the company still has a long runway of growth ahead.

Profitability Could Surprise the Market

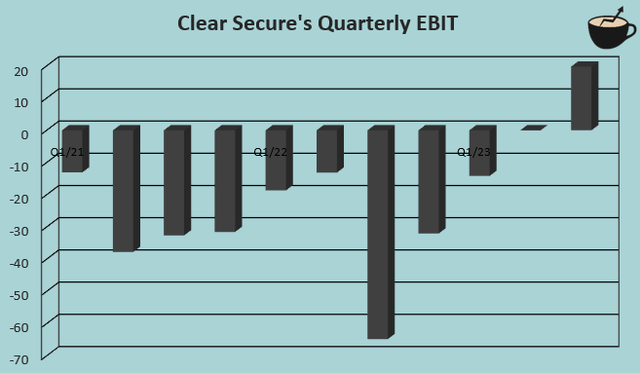

While Clear Secure’s earnings have mostly been negative in past years, the company’s great revenue growth and organizational restructuring are starting to show – in Q3, the company achieved a clearly positive operating income of $19.7 million, indicating an operating margin of 12.3%.

Author’s Calculation Using TIKR Data

I believe that Clear Secure has potential to scale its margins very significantly with operating leverage. The company has a very healthy gross margin of 62.7% with trailing figures, providing clear room for operating margin improvement with scaling revenues. The company is also going through organizational changes and has communicated around $20 million in annualized savings from the program as of Q3. Demonstratively, Clear Secure’s SG&A has decreased by $33.9 million in the first three quarters of 2023 compared to the same period in 2022. The company’s operating expenses aren’t currently scaling at all with revenues, making Clear Secure’s margin potential significant. Clear Secure targets a long-term adjusted EBITDA margin of 35%, compared to a Q3 performance of 18.5%.

Analysts currently expect an EBIT margin of 5.1% for 2024, a margin that’s already 7.2 percentage points below Clear Secure’s Q3 margin. As Clear Secure seems to be likely achieving continued growth in revenues, the EBIT margin should theoretically improve quite well from Q3 instead of going down as the company enters 2024. With some of the organizational improvements yet to be seen in Q3, the short-term profitability could have quite good upside from analysts’ expectations.

Strong Balance Sheet

Clear Secure has an incredibly strong balance sheet. The company has $63.5 million in cash, and a staggering $673.0 million in short-term investments, bringing $7.7 million in interest income in Q3. Compared to the current market capitalization of around $3.0 billion at the time of writing, the amount is very high. While Clear Secure already paid a special $0.55 dividend in November, the company’s amount of capital is very significant. The company also currently doesn’t hold any interest-bearing debt, further strengthening the financial position.

Security Concerns

The offering hasn’t come without problems. In August of 2023, CBS released news about TSA’s plans to require CLEAR Plus users to still show an ID in airports due to security concerns, based on Bloomberg’s previous article about the topic. As Clear Secure’s offering has been based on the service’s effortlessness, the additional step could be a significant threat to Clear Secure’s demand. Clear Secure issued a response to Bloomberg’s article about the security concerns on the 28th of July, stating that the technology isn’t a security risk and an issue involving a passenger with ammunition was caused by a human error. Recently in January, Clear Secure has allowed renewals for TSA Precheck and CLEAR Plus in a bundle, providing a more expedited security screening experience for customers.

Valuation

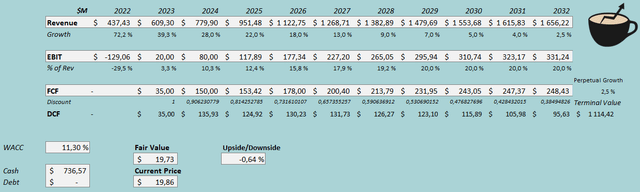

To estimate a rough fair value for the stock, I constructed a discounted cash flow model. In the DCF model, I estimate Clear Secure’s growth to continue well with a 2024 growth estimate of 28%. Afterwards, I estimate the growth to slow down in steps, representing a total revenue CAGR of 14.2% from 2022 to 2032. As Clear Secure’s operating model positions the company for great operating leverage, I estimate the EBIT margin to rise into an eventually achieved level of 20.0%. Clear Secure’s large amount of stock-based compensation and rising unearned revenues make the company’s cash flow conversion very good, although I estimate the conversion to start worsening slightly as time goes on.

With the mentioned estimates along with a cost of capital of 11.30%, the DCF model estimates Clear Secure’s fair value at $19.73, very near the stock price at the time of writing. The company’s growth story doesn’t seem to have upside for shareholders at the moment, unless greater growth or margin leverage is demonstrated.

DCF Model (Author’s Calculation)

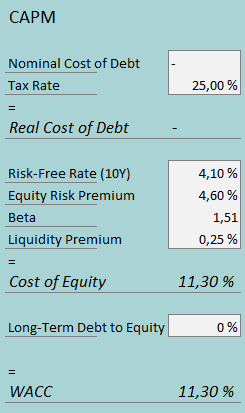

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Clear Secure doesn’t currently leverage interest-bearing debt in the company’s financing. Although the improving earnings could create good space for Clear Secure to use debt, I don’t believe that the company is likely to due to its very strong balance sheet – I estimate the long-term debt-to-equity ratio to stay at 0%. For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.10%. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, made on the 5th of January. Yahoo Finance estimates Clear Secure’s beta at a figure of 1.51. Finally, I add a small liquidity premium of 0.25%, crafting a cost of equity and WACC of 11.30%.

Takeaway

Clear Secure is turning profitable through growth coupled with immense operating leverage. The company is cutting its operating expenses while the gross profit is growing rapidly, as Clear Secure’s operations scale. Despite the great growth prospects and a very hefty balance sheet, I am not buying the stock at the moment – security concerns about Clear Secure have come up, potentially threatening the company’s main operations. The valuation also doesn’t currently provide sufficient upside for a clearly favorable risk-to-reward. For the time being, I have a hold rating for the stock.

Read the full article here