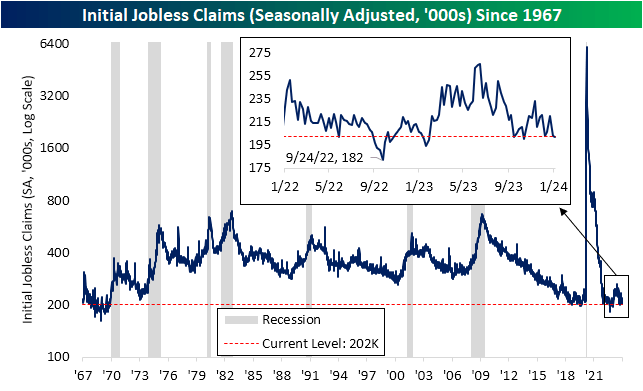

Overshadowed by the hotter than expected CPI print, initial jobless claims at least came in healthier than expected this morning. Initial claims came in at 202K, down 1K from last week’s upwardly revised level of 203K.

At current levels, initial claims are down near some of the lowest levels of the past year. Zooming out, those are also some of the lowest levels since the late 1960s, which could paint a historically rosy picture for the labor market.

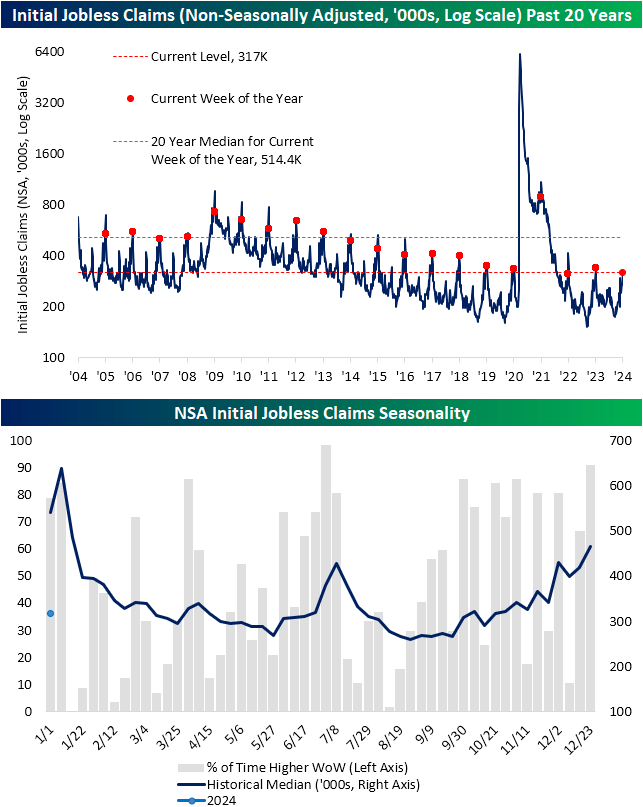

Taking a look at claims before seasonal adjustment, one of the first couple of weeks of the year have often marked the annual peak in claims.

Assuming this week does in fact mark that seasonal high, it would measure roughly inline with other years since 2018 save for 2021 when claims were working off extremely elevated pandemic levels.

Looking forward over the first half of the year, unadjusted claims face seasonal tailwinds.

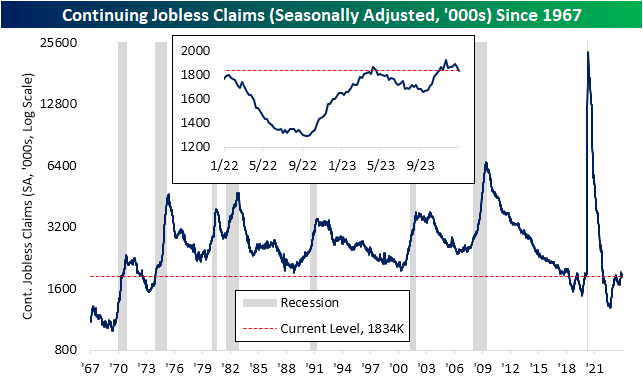

In addition to initial jobless claims posting a strong reading, continuing claims came in below expectations, falling to 1.834 million compared to expectations of an uptick to 1.87 million.

That also marks back-to-back weekly declines in continuing claims, as current levels are now down 91K versus the mid-November high of 1.925 million.

That level is also back below last spring’s highs. That means there has been at least some respite in what more generally has been an upward trend in continuing claims over the past year and a quarter.

In all, both initial and continuing claims have come off their best levels put in place in the fall of 2022, but have each seen steady improvement in recent weeks after a lackluster 2023.

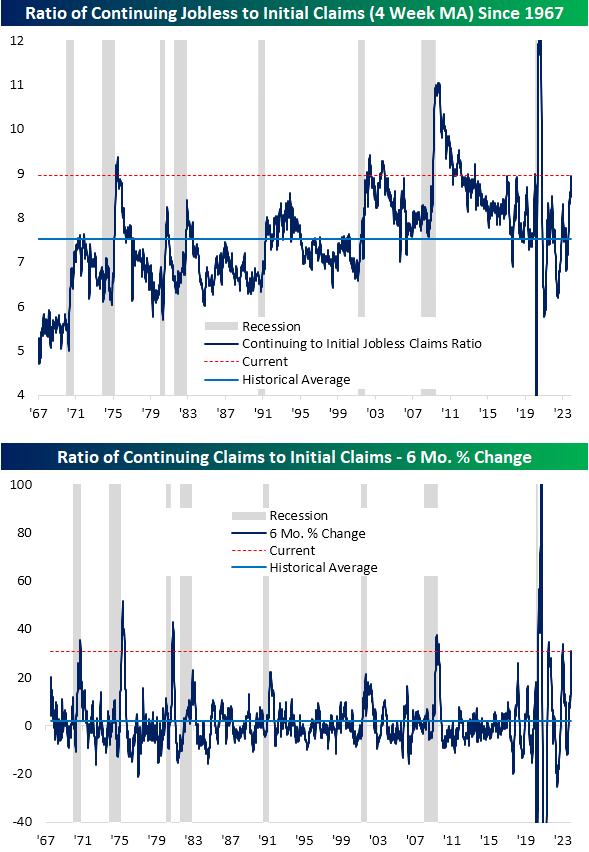

However, that does not exactly put the two in parity, and there is at least one way of chopping up the data which comes off as less optimistic than the historically strong levels.

Below, we take the ratio of the four-week moving averages of continuing claims versus initial claims. While far from a perfect recessionary indicator, it has generally spiked during, albeit particularly in the later stages of, past recessions.

Given initial claims have returned to historically low levels while the pivot lower in continuing claims has been less pronounced and more recent, this ratio has rocketed higher over the past six months.

In fact, it has risen 31% in that span. Prior to 2020, each instance of an increase of that size occurred at the tail ends of recessions, namely those of the 1970s and early 1980s.

However, in the post-pandemic period, swings of that size have greater precedence, with three other even larger increases occurring over the past few years.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here