On February 1, 2024, Ceridian HCM Holding Inc. (NYSE:CDAY) will change its ticker symbol to DAY as part of its branding change. The other piece of the rebranding is a name change to Dayforce, which is also the name of its flagship human capital management software.

Whatever the name and symbol, the company is a rebound story, recovering from a deep hit to its profitability. The financial impact of COVID-19 pushed down its net income and earnings per share, but the company is restoring profits on its bottom line and once again becoming a growth stock.

About Ceridian

It is a human capital management, or HCM, software company, according to its 10-K for 2022. Leading the way among its products and services is Dayforce, a cloud platform that provides human resource features including payroll, benefits, workforce management, and talent intelligence.

It also licenses Powerpay, a human resources and payroll platform for Canadian small businesses. Then there is North America Bureau solutions, its legacy HR platform, which is being replaced over time by Dayforce. According to its website, Dayforce covers the entire employee lifecycle, and is available to organizations of all sizes.

At the close on January 25, 2024, Ceridian’s share price was $68.60, and it had a market cap of $10.60 billion.

Competition and competitive advantages

The annual filing tells us the market for HCM technology is highly competitive with changing technology and shifting client needs. That’s the case both domestically and in its international markets.

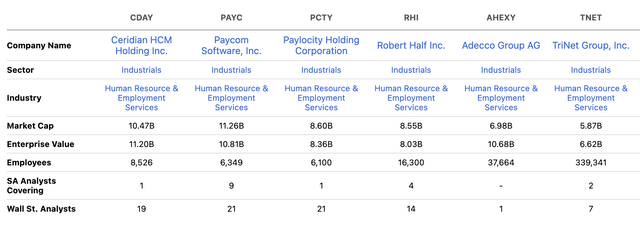

While the company doesn’t name competitors, SeekingAlpha lists five of them:

CDAY competitors table (Seeking Alpha)

Ceridian states that competition revolves around the quality of the product and service, with ease of use, accessibility of the technology, breadth of offerings, reputation, and price being key factors.

It believes it is competitive in each of those areas, and that its single application, always-on technology combined with excellent service and geographic reach give it a competitive advantage.

On a TTM basis, margins partially confirm the existence of a moat, a subject that will be examined below.

Growth

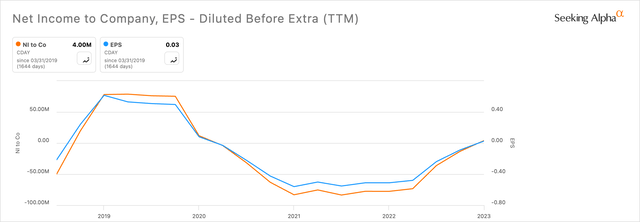

The company has grown its revenue annually for the past 10 years, increasing from $611.6 million in 2015 to $1.450 billion TTM at the end of the third quarter of 2023. Earnings per share and even net income have not grown as smoothly:

CDAY net income & EPS chart (Seeking Alpha)

Looking at the timeline at the bottom of the chart shows the company’s business plunged as COVID-19 took hold, and it needed more than a year to begin recovering. Ceridian explained in its 10-K for 2022,

“In March 2020, the World Health Organization declared the outbreak of COVID-19 to be a pandemic. The global spread of the COVID-19 pandemic created significant global volatility, uncertainty, and economic disruption. We experienced curtailed customer demand, primarily as a result of declining employment levels at our customers in certain sectors, such as retail and hospitality, as well as lower customer utilization of professional services, due to the effects of the COVID-19 pandemic.”

On the other hand, the company reported that interest rate hikes had not hurt it. In the 10-K, published early in 2022, management wrote, “the federal funds rate hikes by the U.S. Federal Reserve and the overnight rate target by the Bank of Canada in 2022 has had positive effects on our float revenue in 2022.” Since then, the company has not mentioned interest rates in any of the three quarterly reports for 2023.

Looking forward, Mordor Intelligence estimates that the human capital management software market will expand from $24.92 million in 2024 to $35.94 million in 2029. That’s a CAGR of 7.60% over the next five years. The fastest-growing market is the Asia Pacific region.

Nothing says recovery more than its projected year-over-year EBITDA growth: 2,501.23%, while at the same time, revenue increased by 21.63%. In 2022, Ceridian had a diluted net loss of $0.48, while the 16 analysts covering the company expect a profit of $1.32 for 2023. Further, they expect EPS to hit $1.70 in 2025, and the 10 analysts making 2026 estimates expect EPS of $2.16.

How will it get that growth? In its 10-K, it laid out what it called “five strategic growth levers”: finding new customers in markets where it has had previous successes; extending the Dayforce platform to generate more revenue from existing customers; growing within the Enterprise segment; speeding up its global expansion; and innovating in adjacent markets.

Ceridian is also an aggressive acquisitor, with five buys in the year and a half before December 2021.

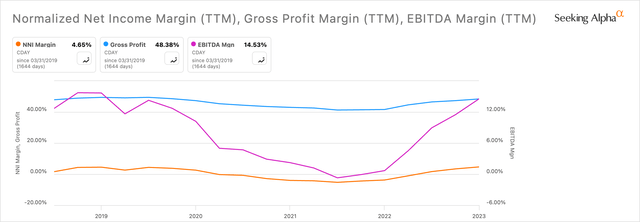

Margins

The following five-year chart shows the gross margin remaining steady, the EBITDA margin slumping during COVID-19 and then recovering, while the net margin has struggled along at less than 5.00%:

CDAY margins chart (Seeking Alpha)

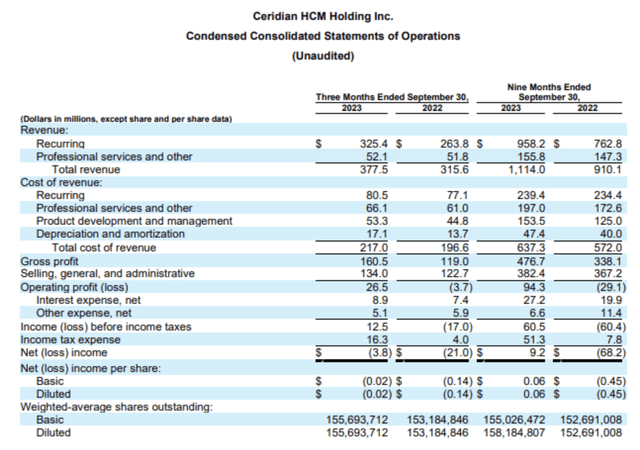

The income statement taken from the Q3-2023 earnings release shows why a strong gross profit turns into a weak net profit:

CDAY income statement (10-K)

Note the Selling, General, and Administrative [SGA] line totals $134 million and eliminates most of the gross profit. Indeed, it leaves just $26.5 million out of $377.5 in revenue. It doesn’t take many reasonable expenses to push the bottom line into the red. Nor, is EPS helped by the issuance of an additional 2.5 million shares.

Ceridian does not explain the SGA specifics, but in the 10-K for 2022, it pointed to share-based compensation and employee taxes, severance, amortization of acquisition-related assets, other non-recurring items, and sales and marketing expenses.

It’s also worth noting that the firm holds customer funds for a period before remitting them to taxing authorities, thus creating a float. Think of it as comparable to an insurance company’s float, where premiums are always collected before claims are paid.

The float is invested, and in the quarterly report, it shows a loss of $14.9 million from investing activities.

Management and strategy

Chair and CEO David Ossip was the founder and CEO of Dayforce, which Ceridian acquired in 2012. According to his profile on the firm’s website, he has more than 30 years of experience in building and leading successful HCM companies.

Jeff Jacobs is Head of Accounting and Financial Reporting at Ceridian. Before joining Ceridian in 2015 he held senior financial roles at General Mills, Inc. (GIS) and KPMG LLP. He is a certified public accountant with a master’s degree in accountancy.

The company has what it calls an “aggressive growth strategy,” and earlier, we reviewed its five strategic growth levers.

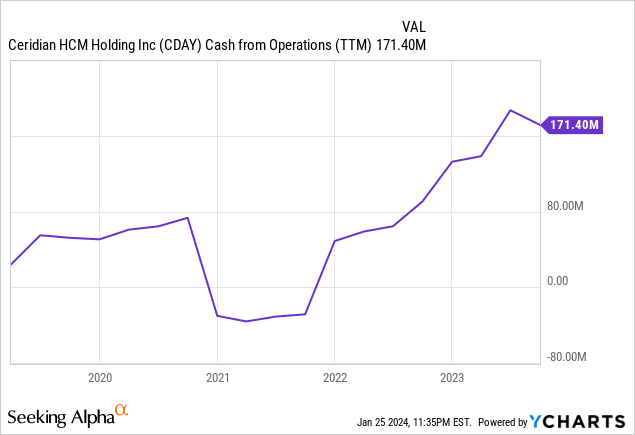

To implement its aggressive growth strategy, it will need ample cash flow. As the following five-year chart shows, that, too, is making a recovery:

Valuation

If you evaluate Ceridian based on just its P/E ratio, you’ll declare it overvalued: the non-GAAP forward ratio is a hefty 55.83, far above the Industrials sector median of 18.41. Similar high valuations come from EV/EBITDA forward, P/S, and P/B.

However, when you add the firm’s growth to the valuation mix, it is fairly valued. The PEG non-GAAP forward ratio is 1.17, compared to 1.76 for the sector median; or, put another way, Ceridian is at the low end of the fair-value range while the sector is closer to the high end.

Further, I believe a growth perspective is essential to assessing where the share price will go in the next several years. The Wall Street analysts who cover the company expect several major increases in earnings per share:

CDAY EPS estimates (Seeking Alpha)

Is that price target reliable? This chart compares price targets (in orange) with actual prices (in blue):

CDAY price targets and actual prices (Seeking Alpha)

Over the past couple of years, estimates have tended to outrun actual prices, and so perhaps our target should be the lowest estimate, which is $62.00 and below the current price. On the other hand, with the expected increases in earnings, the high estimate of $95.00 seems more likely.

Put the two together and we’re back to the average of $76.94, a 12.16% increase. I consider that the most likely and will rate Ceridian a Buy.

The quants rate it a Hold, while Wall Street analysts have issued seven Strong Buys, four Buys, and eight Holds.

Risks

The company’s payroll and tax processing services handle the movement of “significant funds from the account of a customer to its employees and to relevant taxing authorities.” Any disruption could lead to significant losses.

An information security breach could have a material, adverse effect on the company.

Ceridian received 23% of its revenue from Canada in 2022, and while exchange rates tend between Canada and the U.S. tend to be stable, it is possible that net income could be challenged by significant changes.

Its business plan calls for aggressive growth, and rapid growth could put many different types of strains on the firm.

As a technology company, it is always exposed to potentially disruptive new technologies.

Conclusion

Ceridian HCM, or Dayforce, as it’s soon to be named, is rediscovering profitability. Estimates from Wall Street analysts see its EPS expanding dramatically as it benefits from both growth in the industry and its own initiatives.

I believe all the essential elements are coming together to see the firm deliver steady capital gains in the next few years, and thus rank it a Buy.

Read the full article here