I gave Carrier Global (NYSE:CARR) a ‘Strong Buy’ rating in my previous article published in February 2024. Since then, the stock price has surged by more than 24%, outperforming the overall S&P 500 Index (SPX). The company released its Q2 result on July 25th, reaffirming their full-year guidance. Carrier has made significant progress in their business portfolio transformation. I think the company’s focus on climate change, energy efficiency and aftermarket will accelerate the topline growth in the future. I reiterate a ‘Strong Buy’ rating with a fair value of $88 per share.

Portfolio Transformation In Progress

As discussed in my previous article, Carrier has been transforming their business portfolio into a pure play in climate and energy solution company. They have made significant progress over the past year.

- On December 8th, 2023, Carrier sold their Global Access Solution business to Honeywell (HON) for $4.95 billion.

- On January 2nd, 2024, Carrier completed the acquisition of Viessmann Climate Solutions (VCS), and has made solid progress in integrating VCS’s sales, products and operations.

- On March 5th, 2024, Carrier announced agreement to sell their Industrial Fire business to Sentinel Capital Partners for $1.425 Billion.

- Over the earnings call, the management indicated they expect to close the Commercial Refrigeration transaction by the end of Q3. Additionally, the company has made progress in divesting their Residential and Commercial Fire business.

I favor these divestitures and acquisition of VCS for the following reasons:

- Carrier plans to use the proceeds from divestitures for debt repayment and shares buyback. In Q2, they have reduced their total debts by $5 billion. Additionally, they initiated a multi-billion-dollar shares buyback plan, with $1 billion targeted for the second half of FY24.

- The Industrial Fire Solutions and Global Access Solutions are low-growth businesses, and lack the structural growth driver provided by energy efficiency and climate solutions. I view these business as non-core and low growth units; therefore, the divestiture could accelerate Carrier’s overall organic revenue growth.

- Lastly, heat pump is a structural growth area, as they can lower gas consumption and reduce CO2 emissions. Market US forecasts that global heat pump market will grow at a CAGR of 8.8% from 2023 to 2032. VCS is a leading player in the heat pump market, with strong distribution network in Europe. I trust Carrier can help VCS expand their business in North America leveraging Carrier’s strong sales team and distribution channels.

Aftermarket Focus

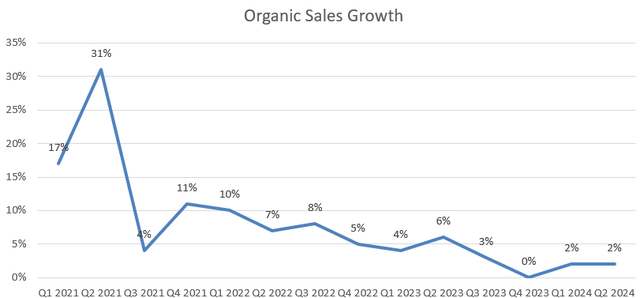

Carrier delivered 2% organic revenue growth with 200bps margin expansion in Q2, as detailed in the chart below:

Carrier Global Quarterly Results

The current low growth was caused by the following factors:

- VCS has been experiencing a weak heat pump market in Europe, declining 30% year-over-year during the quarter. The management is guiding for 15% revenue decline for their heat pump business for FY24. While I remain confident in heat pump’s long-term growth prospects, the near-term market demands could be influenced by government grant policies. Due to the tight budgetary situation in Germany, the government suspended their heat pump grant program earlier this year, with plans to restart from October. As reported by the media, the Germany government wants to cut billions in subsidies for heat pumps in 2025. The change in grant policy definitely will impact heat pump’s market growth in the near term, in my view.

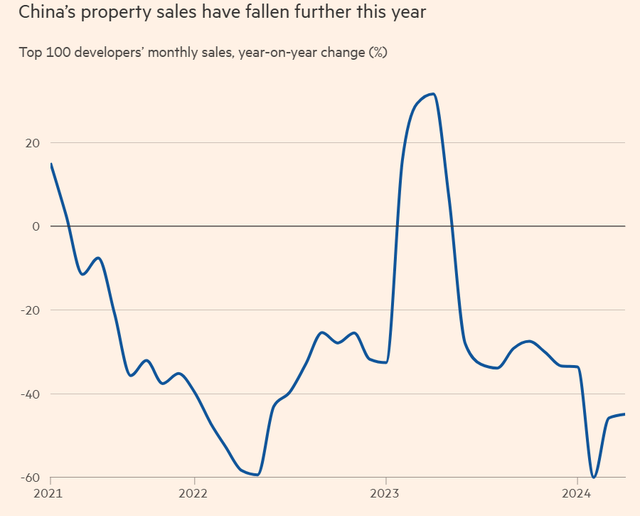

- Carrier’s Asia-Pacific revenue declined by 8% during the quarter, because of the weak market in China. During the earnings call, the management lacks any insights into the timing of market recovery. Due to the sluggish property market in China, it is unlikely for the market to recover anytime soon. As shown in the chart below, China’s property sales have fallen further this year due to the weak consumer sentiment.

Financial Times

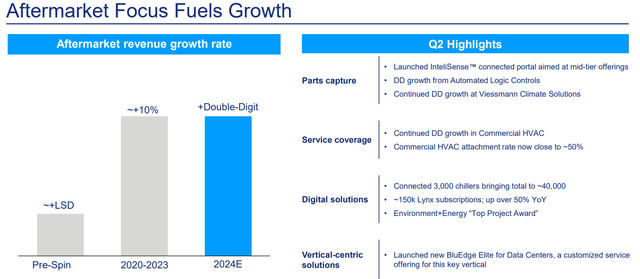

In Q2, my biggest takeaway is Carrier’s focus on aftermarket business, which grew by 9% year-over-year. As illustrated in the slide below, Carrier is guiding for double-digit revenue growth in FY24, and has launched several programs to connect with partners and support digital solutions.

Carrier Global Investor Presentation

The aftermarket growth could potentially reduce the volatility of Carrier’s overall business growth in the future. Compared to equipment sales, parts and services are less sensitive to price increases. When a HAVC is not functioning, consumers or commercial customers have to rely on service team to replace parts or make repairs, with less focus on service fees.

Growth Projection and DCF Valuation

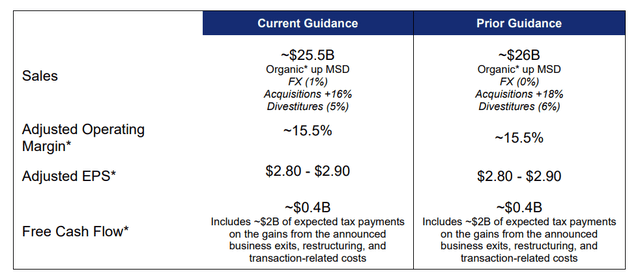

Carrier has not made too many changes for FY24’s guidance, aiming to deliver mid-single-digit organic revenue growth.

Carrier Global Investor Presentation

For the near-term growth, I am considering the following factors:

- HVAC: Due to the weakness in China and European heat pump markets, I estimate Carrier will achieve 5.5% organic revenue growth for FY24, driven by 3% volume growth and 2.5% price growth. From FY25 onwards, I assume a normalized growth model, forecasting 7% organic revenue growth, consisting of 5% volume growth and 2% price growth.

- Refrigeration: I assume the business will grow by 4% annually, aligned with their historical average. It’s worth noting that the growth may be volatile in the future, as it is driven by the capital expenditure cycles of truck and trailers.

As such, I calculate Carrier will deliver 5.1% organic revenue growth, 11% acquisition/divestiture growth and 1% decline from FX, resulting in a total revenue growth of 15.1% in FY24, as per my estimates. From FY25 onwards, I calculate Carrier’s organic revenue will grow by 7% annually, with an additional 2.7% growth from tuck-in acquisitions.

Due to the divestiture of non-core and low margin businesses, I forecast Carrier’s margin will be expanded by 40bps annually, driven by: 20bps from gross profits due to better business mix and price increases; 10bps from operating leverage of SG&A; and 10bps from R&D leverage.

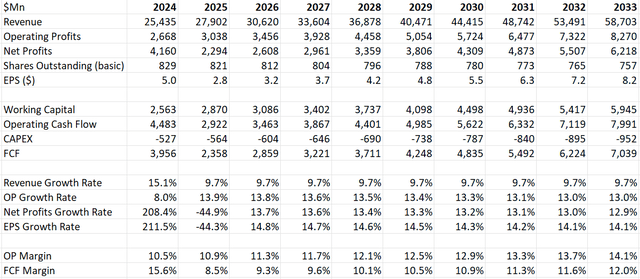

The DCF summary can be found as follows:

Carrier Global DCF

The WACC is calculated to be 12% assuming: risk free rate 3.7%; beta 1.47; equity risk premium 7%; cost of debt 7%: tax rate 25%; equity balance $63 billion; debt $14.3 billion. The fair value of Carrier’s stock price is calculated to be $88 per share, based on my DCF model.

Downside Risks

Carrier targets to achieve $200 million in cost synergies from VCS in the next three years. As a result, Carrier has been implementing strict cost management across VCS’s various divisions including supply chain, logistics, and value engineering. While I think these cost saving plans make sense for generating cost synergies, these efforts could potentially disrupt VCS’s regular business operations.

End Notes

I am encouraged by their business transformation and focus on aftermarket. Despite some near-term weakness in heat pump business and China property market, I believe their business transformation could accelerate the organic revenue growth in the future. I reiterate a ‘Strong Buy’ rating with a fair value of $88 per share.

Read the full article here